Recently, CapitaLand announced its data for the Chinese market during the New Year’s holiday in 2024. The group’s shopping centers in Beijing experienced a customer flow increase of over 40% compared to the same period last year, with CapitaLand Mall Xizhimen witnessing nearly an 80% increase, and CapitaLand Mall Daxing (formerly CapitaLand Mall Tiangongyuan) seeing an 85% rise in sales.

The success wasn’t limited to Beijing. During the New Year’s holiday, CapitaLand’s shopping centers across different regions in China had effective marketing campaigns:

- In East China: Suzhou Center saw over 630,000 visitors on December 31, North Bund Raffles City’s customer flow increased 1.5 times compared to last year, and Ningbo Raffles City’s customer flow more than doubled compared to last year;

- In North China: Harbin CapitaMall Xuefu and Hohhot CapitaMall Nuohemule’s customer flow both increased by over 100% on average;

- In West and South China: Chongqing Raffles City’s customer flow increased by 113%, Chengdu CapitaMall Xinnan’s customer flow more than 2.5 times, and Guangzhou CapitaMall Yunshang’s customer flow nearly 1.5 times;

- In Central China: Wuhan CapitaMall Wusheng’s customer flow increased by 1.5 times.

To enhance the immersive experience for members, CapitaLand launched various themed social check-in scenes in 2023, offering consumers unique experiences.

According to data released by CapitaLand on December 27, 2023, the sales of CapitaLand Star members have increased by 33% compared to the previous year.

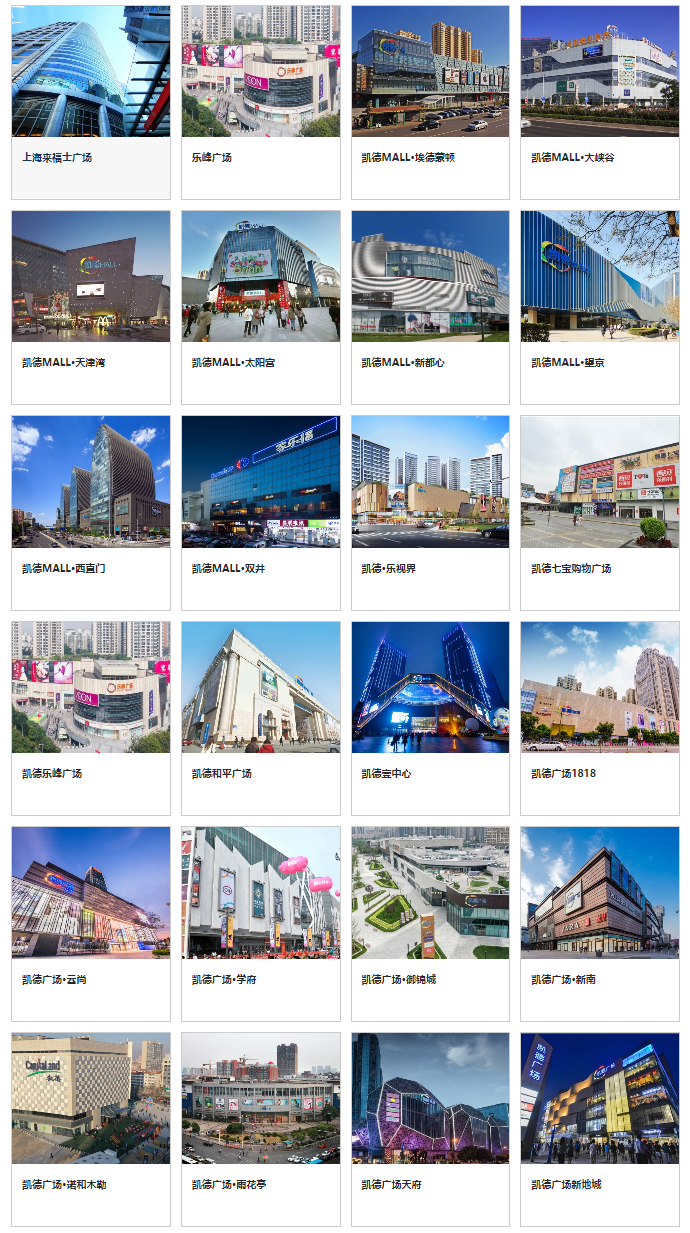

CapitaLand is a well-known, large-scale diversified real estate group in Asia. Headquartered in Singapore, the company focuses on real estate investment management and development, with an investment portfolio spanning over 260 cities in more than 40 countries. CapitaLand entered China in 1994, which is one of its core markets. Currently, CapitaLand manages over 300 projects in more than 40 cities in China, including 45 retail projects (as shown in the figure below). In addition, CapitaLand also operates retail projects in Singapore (20), Vietnam (1), and Malaysia (7).

Looking back at 2023, CapitaLand Group has been increasing its investment in the Chinese market. For instance, in January 2023, CapitaLand established three RMB funds, increasing its asset management scale by nearly 9 billion yuan and acquiring three high-quality mature assets in core cities, further expanding domestic capital cooperation to drive business growth in China. CapitaLand also established the CapitaLand China Opportunistic Partners Programme with a total committed equity of 1.1 billion Singapore dollars, investing in special opportunity projects in China, and acquired the first two assets in Beijing and Foshan at the same time as the announcement.

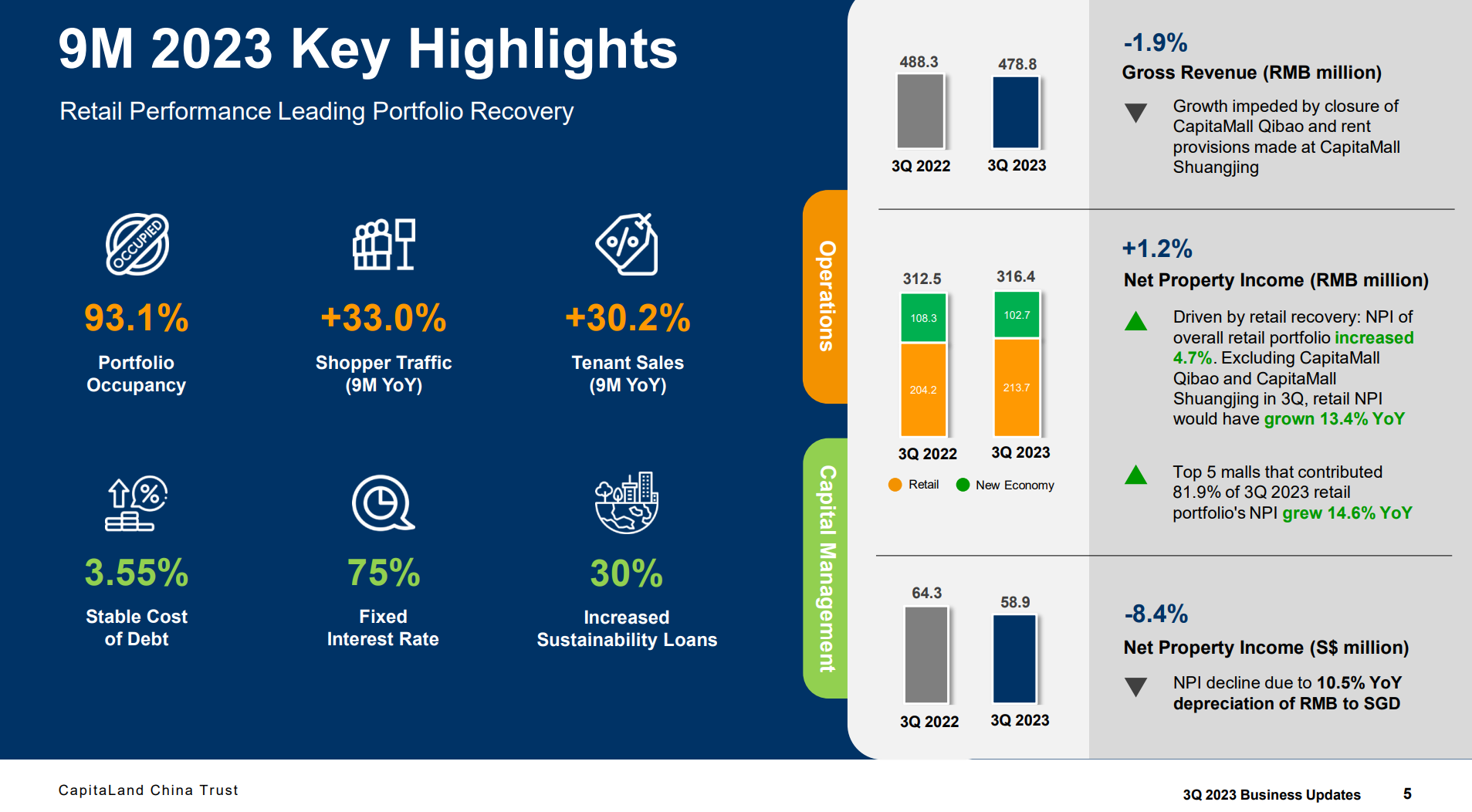

According to the data for the first nine months of the 2023 fiscal year (as of October 27) released by CapitaLand China Trust, its retail shopping centers had a rental rate of 93.1%, with customer flow increasing by 33% and tenant sales by 30.2% compared to the previous year. It owns 11 shopping centers in Beijing, Shanghai, Harbin, Hohhot, Guangzhou, Chengdu, and Changsha (CapitaMall Shuangjing is counted as unsold), valued at 18 billion yuan.

In December 2023, CapitaLand China Trust Management Limited announced the sale of all shares of CapitaLand Commercial Beijing Shuangjing Real Estate Co., Ltd., the parent company of CapitaMall Shuangjing, to an unrelated third party for 842 million yuan. The transaction is expected to be completed in the first quarter of 2024 and is expected to generate a net profit of approximately 690.7 million yuan. After the divestment, CapitaLand China Trust Management Limited will own a property portfolio consisting of 10 shopping centers, 5 business parks, and 4 logistics parks, spread across 12 cities in mainland China.

Chee Koon Lee, CEO of CapitaLand Group/CapitaLand Investment Group, stated in his New Year’s message for 2024: “Three weeks ago, CLI announced a profit warning to caution investors that there will be asset valuation losses for FY2023 across various markets that we are operating in. Even though these losses may be non-cash in nature, they will still impact CLI’s full year results. This is despite the fact that our underlying operating performance continues to be resilient and our business units continue to position strongly for the future. Our operating profit also remains strong, driven by our fee income, and we are moving in the right direction.”

| Source: CapitaLand Group’s official website and press release

| Image Credit: CapitaLand Group’s official website

| Editor: LeZhi