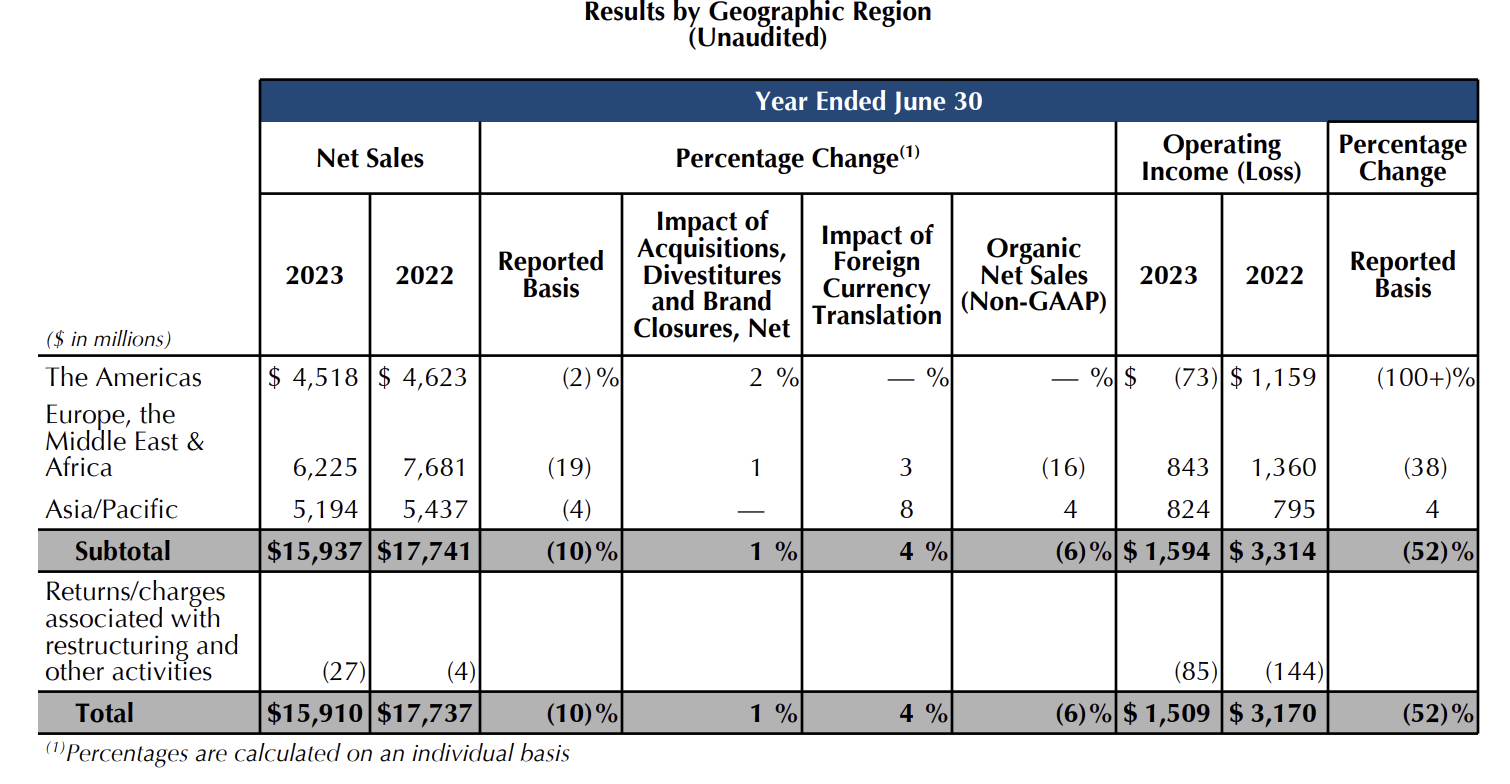

On November 1st, the American luxury beauty giant Estée Lauder Companies Inc released key financial data for the first quarter of the 2024 fiscal year, ending on September 30, 2023. The net sales dropped by 10% year-on-year to $3.52 billion, with an organic decline of 11%. This decline was primarily attributed to anticipated pressure from the softness in the Asian travel retail business and resistance from the slower-than-expected overall recovery in the high-end beauty business in mainland China.

However, many other markets in Asia, especially the Hong Kong Special Administrative Region of China and the Japanese market, performed exceptionally well, achieving organic positive growth in sales. Compared to the same period last year, almost all product categories in the Hong Kong region of China saw net sales increase by over twice, mainly benefiting from the post-pandemic reopening, tourism recovery, and increased foot traffic in physical stores.

Net sales in the Americas market increased by 8% year-on-year, with strong performance in both North America and Latin America. In the EMEA (Europe, Middle East, and Africa) region, almost all markets achieved organic sales growth, with significant growth in the UK and Germany.

In terms of product categories, the fragrance and cosmetics division of the group performed well in the first quarter of the 2024 fiscal year, partially offsetting the decline in the skincare department.

During this quarter, the group’s net profit was $31 million, a 94% decrease compared to the same period last year when it was $489 million. The adjusted diluted net earnings per share (excluding restructuring and other expenses) decreased from $1.37 in the same period last year to $0.11 but exceeded analyst’s loss expectations.

Fabrizio Freda, the President and CEO of the group, stated, “In this challenging quarter as expected, we still managed to exceed profit expectations. Strong organic growth in sales was achieved in many developed and emerging markets globally, and our market share in the high-end beauty sector continues to increase. Sales in the U.S. market rebounded this quarter, driven by fragrances, cosmetics, and skincare categories, partially offsetting the negative impacts of weak Asia travel retail and the slow recovery of the high-end beauty business in mainland China.”

During the earnings conference call, Freda revealed that the group anticipates a re-adjustment of Asian travel retail inventory by the end of the third quarter to address the challenges in this market.

Chief Financial Officer Tracey Thomas Travis also noted that the source of Asian travel retail may undergo changes in the future, saying, “A significant portion of sales has now shifted to the domestic market, so there may be a rebalancing, especially concerning Chinese customer consumption. We do not expect travel retail to return to its previous levels, although that would be great if it did. However, our profit recovery plans, including some growth initiatives we have set for markets and brands, do not rely on this to restore profitability.”

As of November 1st, at the close of the U.S. stock market, Estée Lauder Companies Inc’s stock price was $104.51, down nearly 19% from the previous trading day, with a current market value of approximately $37.4 billion.

Asia/Pacific

- Net sales increased 4%, with growth increasing to 36% in the fiscal 2023 fourth quarter from 7% in the third quarter, and reflecting double-digit growth in most markets and increases in every product category as markets recovered from eased COVID-related restrictions compared to the prior year. Also contributing to the rise in net sales were successful brand activations, new product launches and the strategic focus on luxury Fragrance and Skin Care. Hong Kong SAR and Macau SAR, mainland China, Australia and Japan led net sales growth.

- Net sales in mainland China increased, returning to strong growth in the second half of fiscal 2023 after low retail traffic as a result of COVID-related restrictions and the rise in COVID cases challenged the business primarily in the first half of fiscal 2023.

- Double-digit net sales growth from La Mer, M·A·C, Jo Malone London and TOM FORD, drove net sales growth in the region, as did strong growth from Le Labo.

- Operating income increased, primarily due to the year-over-year decrease in other intangible asset impairment of $130 million relating to Dr.Jart+, partially offset by the unfavorable impact from foreign currency translation.

- The slower-than-expected recovery of the high-end beauty business in mainland China has been partly offset by growth in many other markets, led by China Hong Kong, Japan, and Australia.

- The growth in net sales of fragrances in the mainland China market partially compensated for the decline in skincare business. The growth in the fragrance business was primarily attributed to the opening of the first Le Labo store in mainland China (Shanghai) in the fourth quarter of the 2023 fiscal year.

| Source: Official Financial Report; Official Conference Call Transcript

| Image Credit: Estée Lauder Official Website

| Editor: Wang Jiaqi