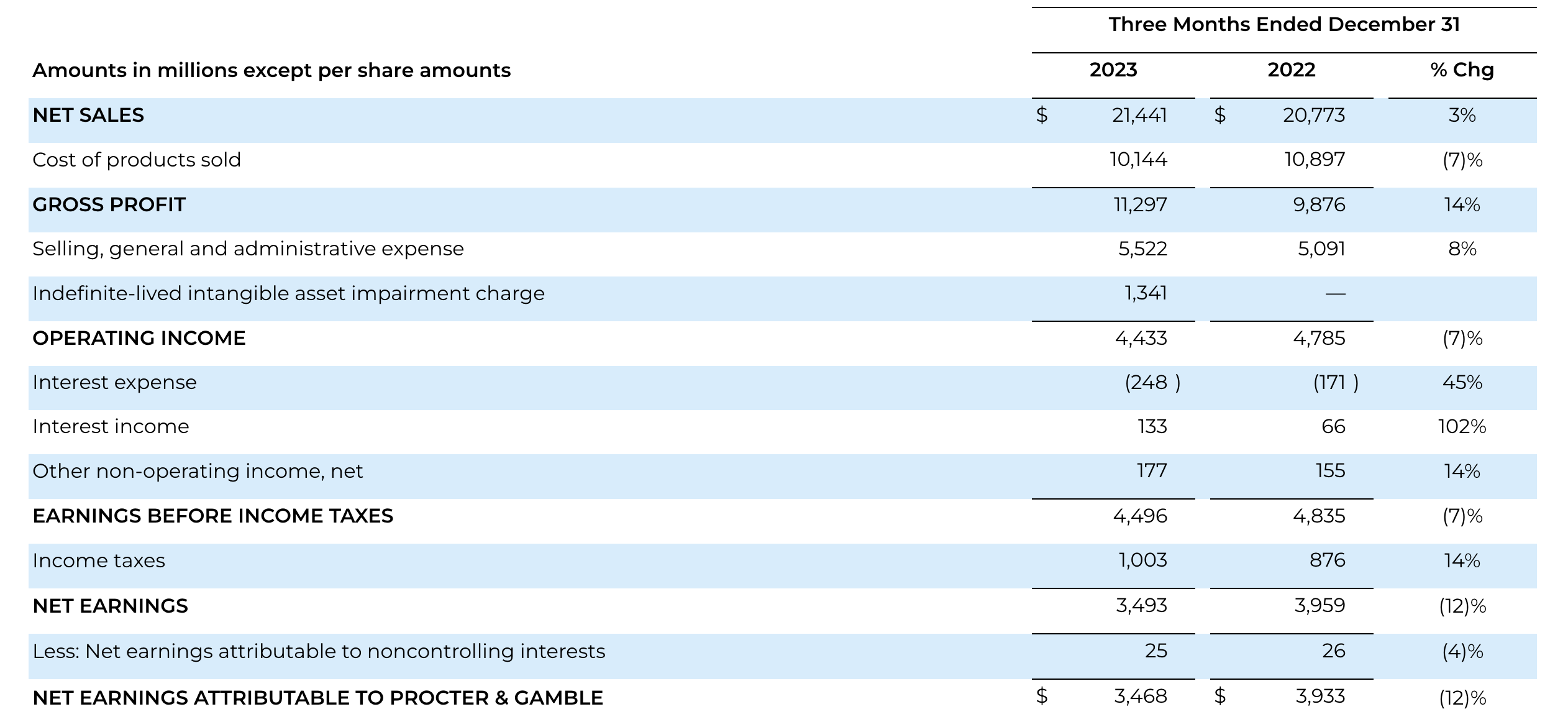

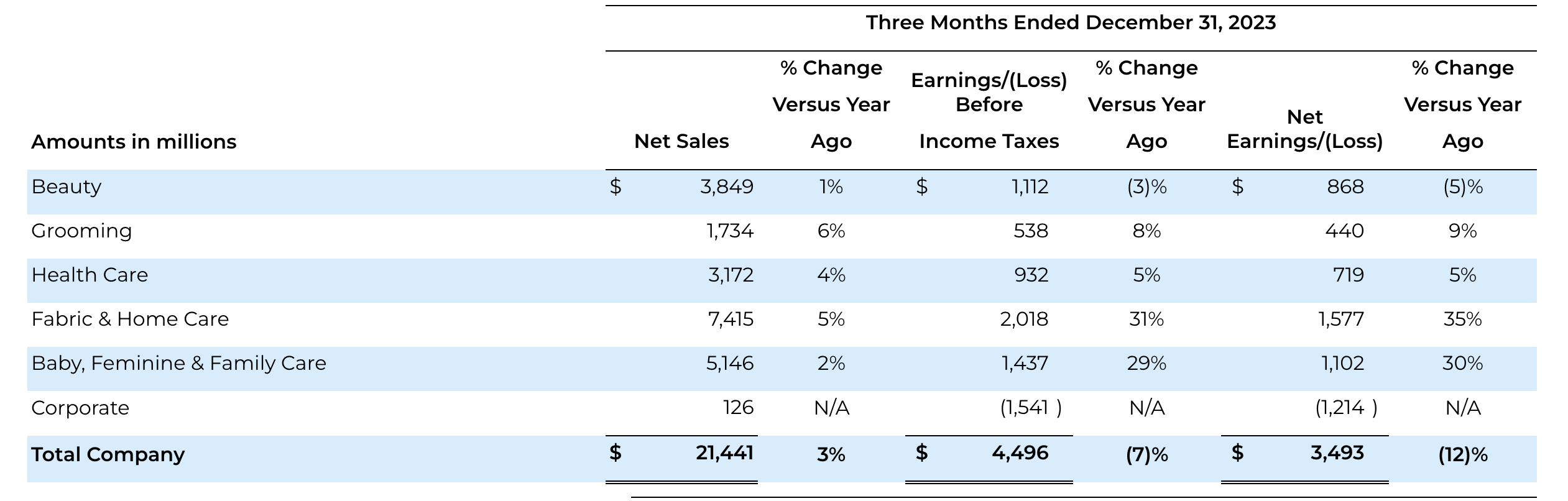

Procter & Gamble Co.released key performance data for the second quarter of the 2024 fiscal year, ending December 31, 2023. The company reported a 3% year-over-year increase in net sales to $21.44 billion, with a 4% organic growth, slightly below the analysts’ expectation of $21.48 billion. This was attributed to a slowdown in demand for beauty brands like SK-II in its second-largest market, Greater China, where sales dropped by 15% on an organic basis.

The diluted earnings per share decreased by 12% year-over-year to $1.40, impacted by the impairment of its Gillette shaving business. In December 2023, Procter & Gamble had anticipated that impairment charges and restructuring costs in certain markets related to Gillette could result in expenses up to $2.5 billion over two fiscal years.

Jon Moeller, Chairman, President, and CEO of the group, stated, “We delivered strong results in the second quarter, enabling us to raise our core EPS growth guidance and maintain our top-line outlook for the fiscal year. We remain committed to our integrated strategy of a focused product portfolio of daily use categories where performance drives brand choice, superiority — across product performance, packaging, brand communication, retail execution and consumer and customer value — productivity, constructive disruption and an agile and accountable organization. The P&G team’s execution of this strategy has enabled us to build and sustain strong momentum. We have confidence this remains the right strategy to deliver balanced growth and value creation.”

Following the earnings report, Procter & Gamble’s stock price rose by 4.14% at the close on January 23rd, bringing the company’s market value to approximately $362.9 billion.

During a conference call, executives mentioned that demand in North America and Western Europe had improved. However, other markets, like Greater China, saw weaker demand, with a 15% decline in sales on an organic basis. The slow consumer recovery was cited as one of the reasons for this downturn in Greater China. Andre Schulten, the CFO, commented during the call, “In China, we are seeing a recovery since the COVID-19 pandemic that is not linear, but rather somewhat bumpy.”

Key financial data for Procter & Gamble’s second quarter of the 2024 fiscal year, ending December 31, are as follows:

- The increase in gross margin was mainly driven by overall productivity improvements, favorable commodity costs, and pricing actions.

- The decrease in operating profit margin was primarily due to impairment charges of Gillette’s intangible assets recorded in the quarter. Excluding the impairment and non-core restructuring charges, the operating profit margin increased by 400 basis points compared to the same period last year.

By Department:

Based on this, Procter & Gamble has maintained its 2024 fiscal year guidance range, with total sales expected to grow 2% to 4% compared to the last fiscal year, and organic sales growth projected to be between 4% and 5%.

|Source: Official Earnings Report, Reuters, CNBC, Luxeplace.com Historical Articles

|Image Credit: Group Official Website

|Editor: Wang Jiaqi