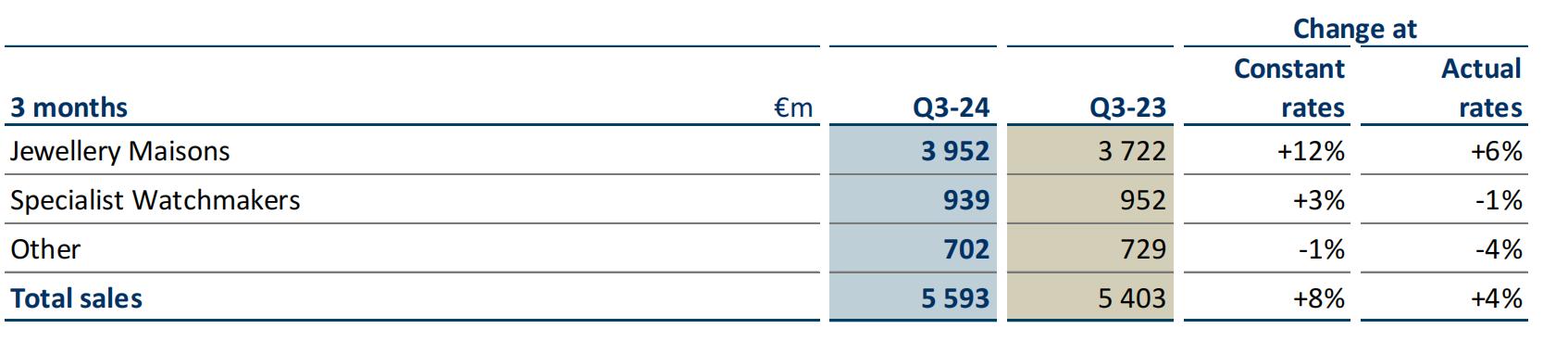

On January 18th, Richemont, the Swiss luxury giant and parent company of brands like Cartier and Van Cleef & Arpels, reported its financial results for the third quarter of the 2024 fiscal year, ending December 31, 2023. Sales increased by 8% to €5.6 billion at fixed exchange rates. Chinese Mainland, Hong Kong, and Macau saw a 25% increase, making them among the best-performing markets.

In a subsequent conference call, the Chinese market was a focal point, especially with the upcoming Chinese New Year. Burkhart Grund, the Group’s CFO, provided detailed data on the Chinese market/consumer:

- The Chinese Mainland experienced double-digit sales growth last fiscal quarter, with Hong Kong and Macau growing by 60-80% and 80-100% respectively.

- Chinese consumers, both domestically and overseas, contributed to a 42% increase in sales, compared to 88% and 22% in the previous two quarters.

- Over the last three fiscal quarters, sales from Chinese consumers grew by 47%, with a 19% and 45% increase compared to the same period in the 2022 and 2020 fiscal years, respectively.

- The annual compound growth rate of sales from Chinese consumers from the 2020 to 2024 fiscal years (the first three quarters of the 2024 fiscal year, i.e., April-December 2023) was 10%.

In contrast, over the past four years, the annual compound growth rates for sales from American and European consumers were 23% and 21%, respectively.

Grund acknowledged that the “reconstruction” of the Chinese market is still incomplete, requiring about two more years.

“From what we observed in the Japanese market (one of the best-performing markets in the third quarter), Chinese tourists contributed double-digit sales, but this number is still significantly lower than the pre-pandemic level of 30%; in Europe and the Middle East, we are only seeing sporadic Chinese tourists, not tour groups, contributing 5%-6% to the market.”

Grund commented on potential macroeconomic issues in China, such as the unrecovered real estate market, which may take years to resolve.

He also discussed the upcoming Chinese New Year. “Last year, the Chinese market had just fully reopened during the festival, resulting in a high comparison base. However, we remain confident about this year’s performance.”

Last fiscal quarter, Richemont’s three major jewelry brands – Buccellati, Cartier, and Van Cleef & Arpels – performed strongly, boosting the jewelry department’s contribution to the group to 71%. The continued strong performance of the jewelry department was another focus of the conference call.

Grund stated that the jewelry industry is attractive, driving continuous efforts from existing brands and attracting new entrants.

“Jewelry is loved across generations, which we clearly see in Generation Z,” Grund added.

However, Grund also noted that the jewelry industry has high barriers to entry. To excel, continuous and significant investment is necessary. Brand assets are key to success, especially in economically uncertain times.

“Just look at Cartier, outperforming its competitors.”

| Source: Richemont’s Conference Call

| Image Credit: Richemont’s Website

丨Reporter:Wang Jiaqi

| Editor: LeZhi