In November and December 2024, Luxe.CO Intelligence researched and analyzed 610 brand activities across 464 sports and outdoor brands. Based on this research, Luxe.CO Intelligence has selected the most noteworthy Top 4 Brand Cases, providing exclusive commentary that reflects the direction of effort and development trends within the sports and outdoor sector.

In the increasingly competitive sports and outdoor field, this issue’s selected Top Cases excellently illustrate four key operational themes:

- Building a Lifestyle Brand: BURTON

- Refined Event Operations: NIKE

- Organizing and Exploring Brand Archives: ARC’TERYX

- Continuously Revisiting Brand DNA: DESCENTE

1. BURTON

BURTON hosted the “Ride On” themed outdoor market and multiple snowboarder meetups in Shanghai and Beijing.

Luxe.CO Insights:

Snowboarding is gradually becoming a winter fashion sports lifestyle.

Consumers who take to the slopes are not necessarily pursuing peaks or endpoints; instead, they are attracted to the sporting spirit and lifestyle that snowboarding represents. This provides professional snowboarding brands with opportunities to expand into broader markets.

This year, BURTON has opened stores in Shanghai’s Ice World, Hangzhou’s Hubin Yintai In77, and Shenzhen’s The MixC World.

As outdoor sports brands increasingly focus on snowboarding scenarios, how should professional snowboarding brands create a differentiated lifestyle and brand experience for general consumers?

Rather than strictly focusing on technical teaching, BURTON approached its outdoor market activities with a “friend-making” mentality. It invited world-class snowboarders such as Liu Jiayu, Ben Ferguson, Mark McMorris, and Zeb Powell to sit down and share their snowboarding stories with consumers.

These stories ranged from their initial nervous moments on a snowboard, to finding courage on the edge of their limits, to the moments of falling, struggling, and rising again. These authentic and personal stories reflect the aspirations of every outdoor enthusiast. They resonate with audiences far more than one-sided brand storytelling ever could.

Meanwhile, BURTON gathered over 40 lifestyle brands and communities in Beijing’s Longfu Temple, covering running, tennis, cycling, camping, hiking, climbing, food, and fashion, showcasing a variety of lifestyles.

Snowboarding is just one aspect of the consumer’s fashionable sports lifestyle. By extending beyond snowboarding into broader sports and lifestyle scenarios, BURTON has established multiple points of connection with a wider consumer base.

This year, BURTON collaborated with Erdos 1980 to launch a co-branded outdoor cashmere collection, including base layers, down jackets, hats, and scarves. It partnered with KFC to open a themed store at Beidahu Ski Resort, released a new co-branded snowboard collection with Su Yiming for the third time, and co-produced an ad campaign with NIO.

While deepening its promotion of snowboarding culture, BURTON is steadily building a unique sports lifestyle around its brand.

2. NIKE

NIKE sponsored the Shanghai Marathon for the 12th consecutive year and launched the “Winning Isn’t for Everyone” campaign.

Luxe.CO Insights:

The running boom in the Chinese Mainland continues to surge, with more sports brands increasing their investments in marathon sponsorships. Marathons have become a competitive battleground for sports brands.

How can a brand use marathon marketing to maximize its visibility, resonate with runners, and capture the minds of general consumers? These are critical questions for brands to consider.

According to statistics, NIKE led the Shanghai Marathon in apparel worn by the top 100 finishers, as well as among the top 10 male and female runners.

However, what impressed runners most were NIKE’s large on-course slogans, featuring inspiring messages such as “Here for the second half, full of anticipation,” “Isn’t this all about pain and excitement?” and “Keep pushing, even if you break.”

These motivational phrases were strategically placed at points where runners felt fatigue and faced mental struggles. This reflects not only NIKE’s deep understanding of participants’ psychology but also its precision in managing marathon events.

The heartfelt copywriting allowed runners and general consumers to experience NIKE’s dedication to running culture.

In an analyst call following its FY2025 Q1 financial report, NIKE’s CFO Matthew Friend stated: “NIKE is a running company and a running brand. Winning the support of runners is crucial for NIKE.” Going forward, NIKE plans to reinvest in the running field.

Running has always been central to NIKE’s identity.

Beyond the Shanghai Marathon, NIKE’s activities this year included focusing on running at the China International Import Expo with its Running Lab FORM, launching the “2024 Kipchoge China Tour,” and introducing new running shoes designed specifically for children, such as the Cosmic Runner.

Running is poised to become one of NIKE’s key focus areas in the Chinese Mainland market.

3. ARC’TERYX

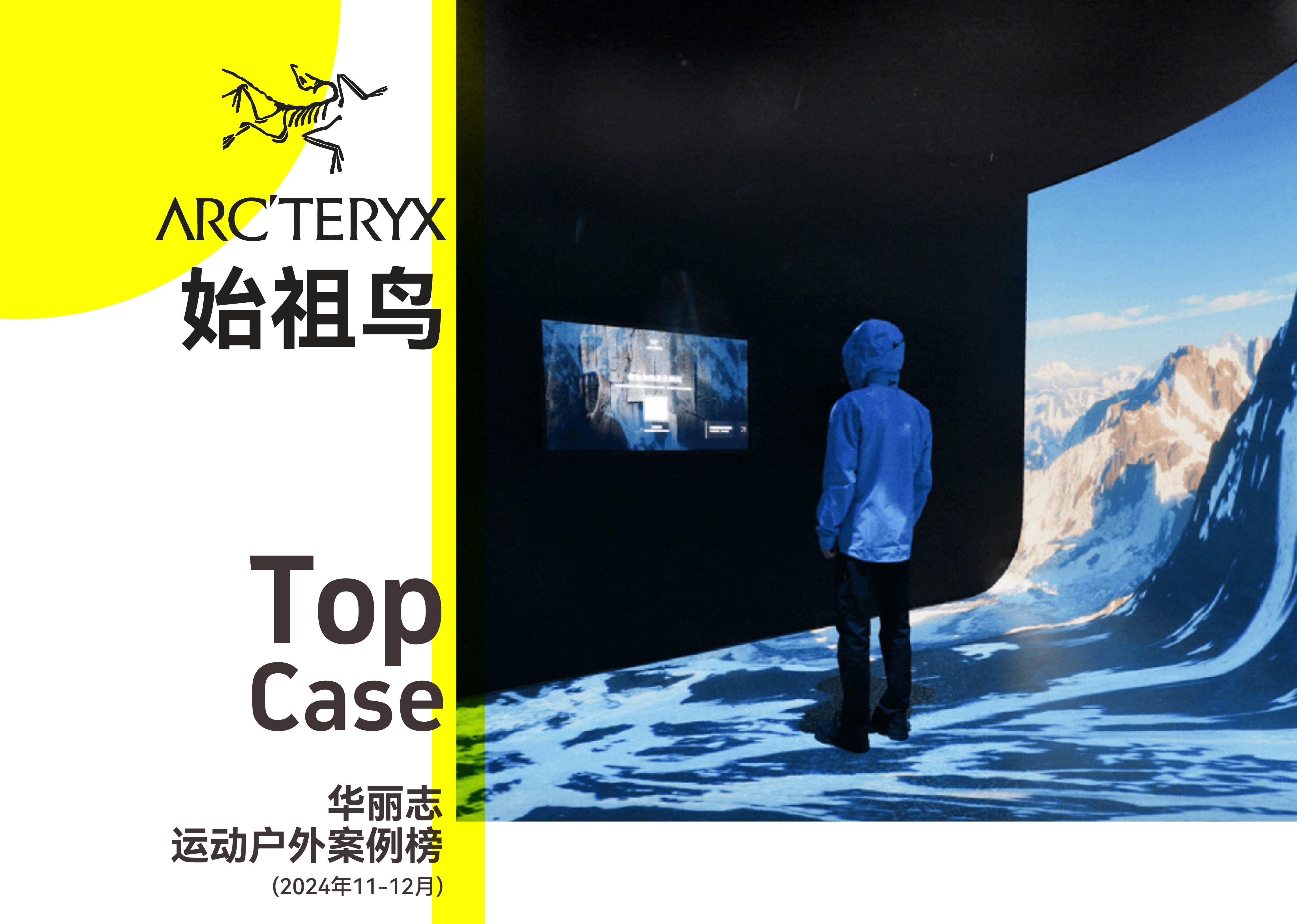

ARC’TERYX launched the “Arc’teryx Genesis and Evolution Exhibition” at its ARC’TERYX Museum in Shanghai.

Luxe.CO Insights:

As specialized outdoor sports brands expand into broader markets, their investment in offline spaces grows, aiming to use these venues to tell their stories effectively.

Whether designing a concept store or curating an exhibition, the key is to explore the brand’s archives to identify elements that resonate deeply with consumers.

Instead of simply showcasing products, ARC’TERYX collaborated with the Chinese Academy of Sciences’ Institute of Vertebrate Paleontology and Paleoanthropology. Together, they curated an exhibition centered on fossils of the Archaeopteryx species, which existed 150 million years ago.

From the Archaeopteryx species’ ability to adapt to environmental changes for survival, to the Alpha SV jacket being repeatedly tested and refined in extreme environments over 25 years, ARC’TERYX used nature’s evolution to narrate its brand’s story of progress in the extreme outdoor field.

ARC’TERYX continues to use various formats to communicate its culture and values to general consumers.

This year, it relaunched China’s Advanced Mountaineering Training Program, published the “Observation Report on the Development of Chinese Rock Climbing,” upgraded the Yangshuo International Climbing Mountain Classroom, and unveiled its new Cliff House retail concept.

As part of Amer Sports, valued at $14 billion, ARC’TERYX remains its fastest-growing and largest brand, achieving revenue growth of 26%, 44%, 34%, and 34% year-over-year in the past four quarters.

The ability to effectively organize and leverage its archives to tell stories from diverse perspectives will be key to building ARC’TERYX’s brand strength.

4. DESCENTE

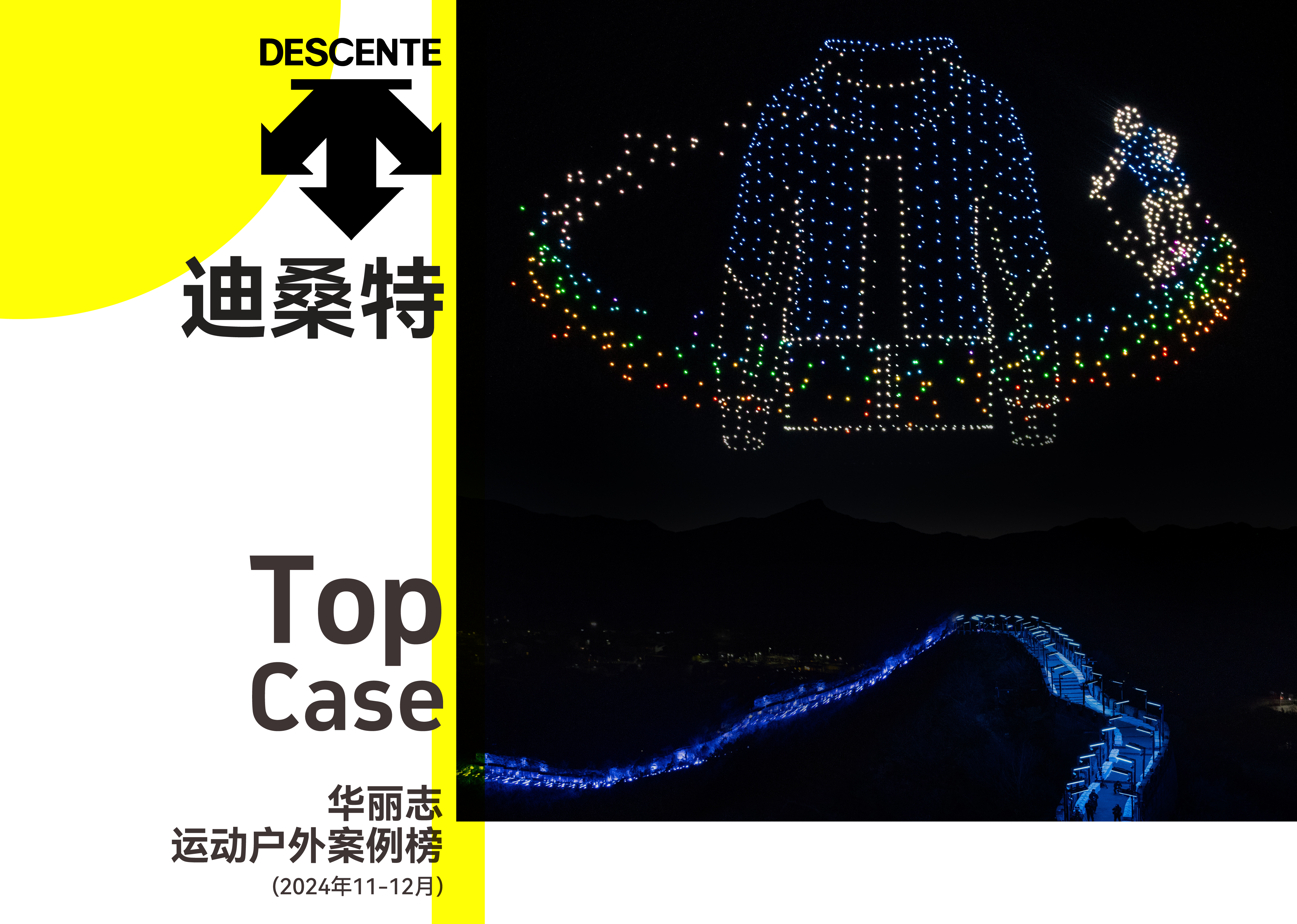

DESCENTE held “The Next Peak” brand launch event at the Great Wall and appeared as a sponsor at the 2024 Freestyle Ski and Snowboard Halfpipe World Cup.

Luxe.CO Insights:

As another snow season arrives, brands are focusing on how to effectively tell their stories in winter outdoor sports scenarios and occupy consumers’ minds.

Skiing is one of the most important outdoor sports contexts in winter.

For example, DESCENTE opened the “The Peak” ski-themed pop-up store in Beijing’s Sanlitun, held a seasonal fashion show on the Great Wall, and participated as a sponsor at the Halfpipe World Cup.

While many brands spread their efforts across various initiatives, DESCENTE used a cohesive brand launch event to connect its marketing efforts. It highlighted its development history alongside international skiing and its deeply rooted skiing DNA and “Five Peaks” spirit.

As Le Jun, President of DESCENTE China, stated, “‘The Next Peak’ is not just the theme of this event; it is also the attitude the brand wishes to convey.”

More and more consumers are not only buying products but also embracing the brand’s spirit and lifestyle values.

According to Anta Group’s financial results, DESCENTE achieved revenue of over RMB 5 billion (approximately USD 686 million) in 2023, surpassing expectations. The goal is to reach RMB 10 billion (approximately USD 1.37 billion) by 2026, becoming Anta’s third billion-dollar brand.

In addition to upgrading products and consumer experiences, DESCENTE’s sustained growth is closely tied to its focus on brand storytelling and consumer engagement.

| Image Credit: Official brand accounts

| Editor: Elisa