After the close of trading on the Paris Stock Exchange on July 24, French luxury giant LVMH released key financial figures for the first half of 2025: total revenue declined 4% year-on-year to €39.8 billion, with a 3% year-on-year decline on an organic basis; profit from recurring operations fell 15% year-on-year to €9.015 billion.

In the second quarter, total revenue reached €19.499 billion, a 4% organic decline (compared to a 3% organic decline in the first quarter).

Regarding the Chinese market, the Group’s Chief Financial Officer, Cécile Cabanis, revealed during a conference call that the decline had narrowed by several percentage points, improving to “high single-digit negative growth,” showing notable progress.

“Demand in the Chinese Mainland saw a significant and continuous improvement in the second quarter,” she said. “This improvement was partly driven by certain initiatives, as well as by the effect of the ‘repatriated consumption’ previously observed in Japan, which is now starting to translate into actual local demand in China.“

LVMH Chairman and Chief Executive Officer Bernard Arnault stated, “LVMH showed solidity in the current context. We owe this to the power of our iconic brands and their boundless capacity for innovation while remaining true to their culture of incomparable artisanal craftsmanship. Beyond the prevailing uncertainties, we remain focused thanks to the long-term vision that has always guided our family group. We are driven by our steadfast pursuit of quality and desirability in everything we create, combined with the modernity of our historic brands. We enter the second half of the year with great vigilance. I am confident in LVMH’s tremendous long-term potential and the commitment of our teams to further strengthen the Group’s leadership position in luxury goods. Our main shared priority is about offering our customers the most exceptional products.“

Cécile Cabanis added, “In China, we’ve found that whenever we proactively design and implement certain innovative projects, we’re able to spark consumer interest and drive brand development.”

This month, Louis Vuitton unveiled its new concept space “LV The Place” at HKRI Taikoo Hui in Shanghai (see image below). Cabanis described the project as “a very unexpected initiative. This space is truly unique, blending brand storytelling and cultural exhibitions, retail space, and lifestyle experiences—something only Louis Vuitton can achieve.”

“This approach generated heavy foot traffic, with many visitors entering the retail space, and the launch itself was powerful. Overall, it truly brought strong brand visibility and engagement.“

Highlights of LVMH Group in the First Half of 2025

At the Group Level:

- LVMH demonstrated solid resilience amid a challenging environment.

- Operating free cash flow grew significantly to €4 billion (approx. USD 4.35 billion).

At the Regional Level:

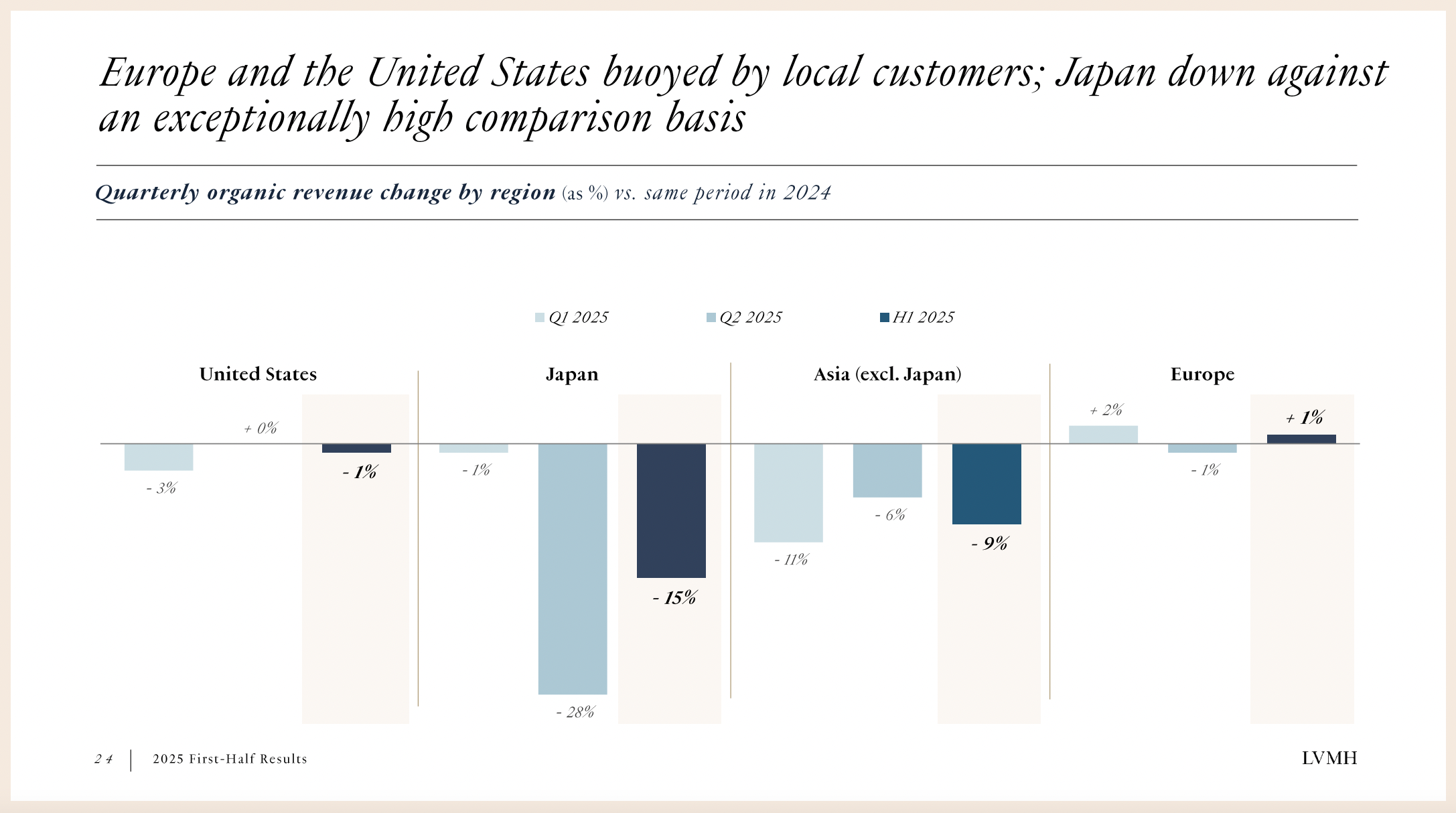

- Local demand in Europe and the United States remained strong.

- The Japanese market saw a decline compared to the first half of 2024, when tourist spending was robust.

At the Business Segment Level:

- Champagne trends improved in the second quarter, while demand for cognac remained sluggish.

- Local demand in fashion and leather goods remained stable, and the business continued to maintain very high operating margins.

- The perfumes and cosmetics segment performed strongly in terms of innovation and continued to implement a selective retail strategy.

- Iconic collections from watch and jewelry brands delivered standout results, and Tiffany & Co.’s renovated stores were a success.

- Sephora performed well, with continued growth in both revenue and profit.

As of June 30, LVMH Group’s key financial figures for the first half of fiscal year 2025 are as follows:

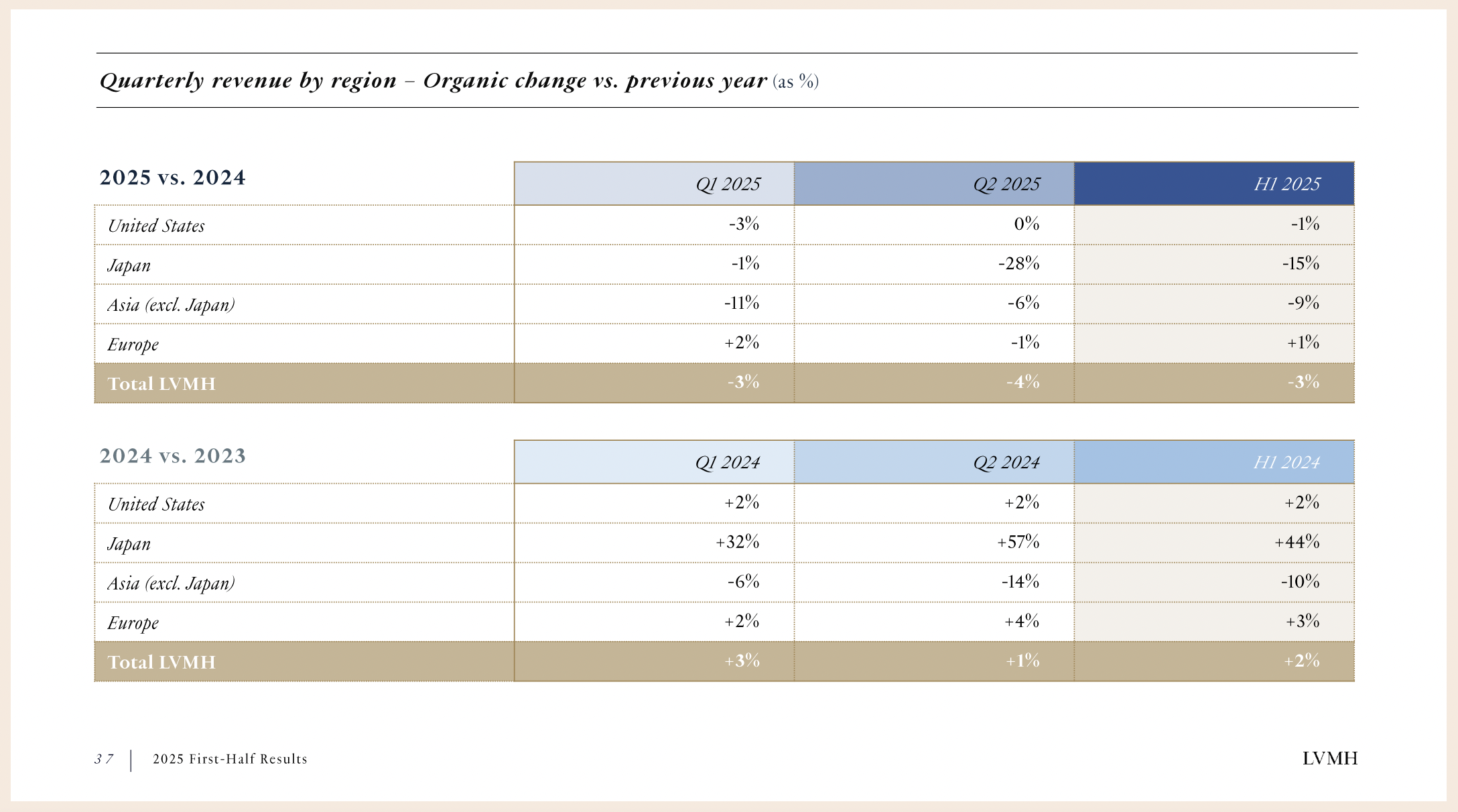

Regional Performance

In terms of regions, Europe recorded a 1% year-on-year increase in revenue during the first half, making it the best-performing market. The Japanese market declined 15% year-on-year in the first half and 28% in the second quarter, reflecting a drop in tourist spending. Asia, excluding Japan, declined 9% year-over-year in the first half, with a narrower decline in the second quarter.

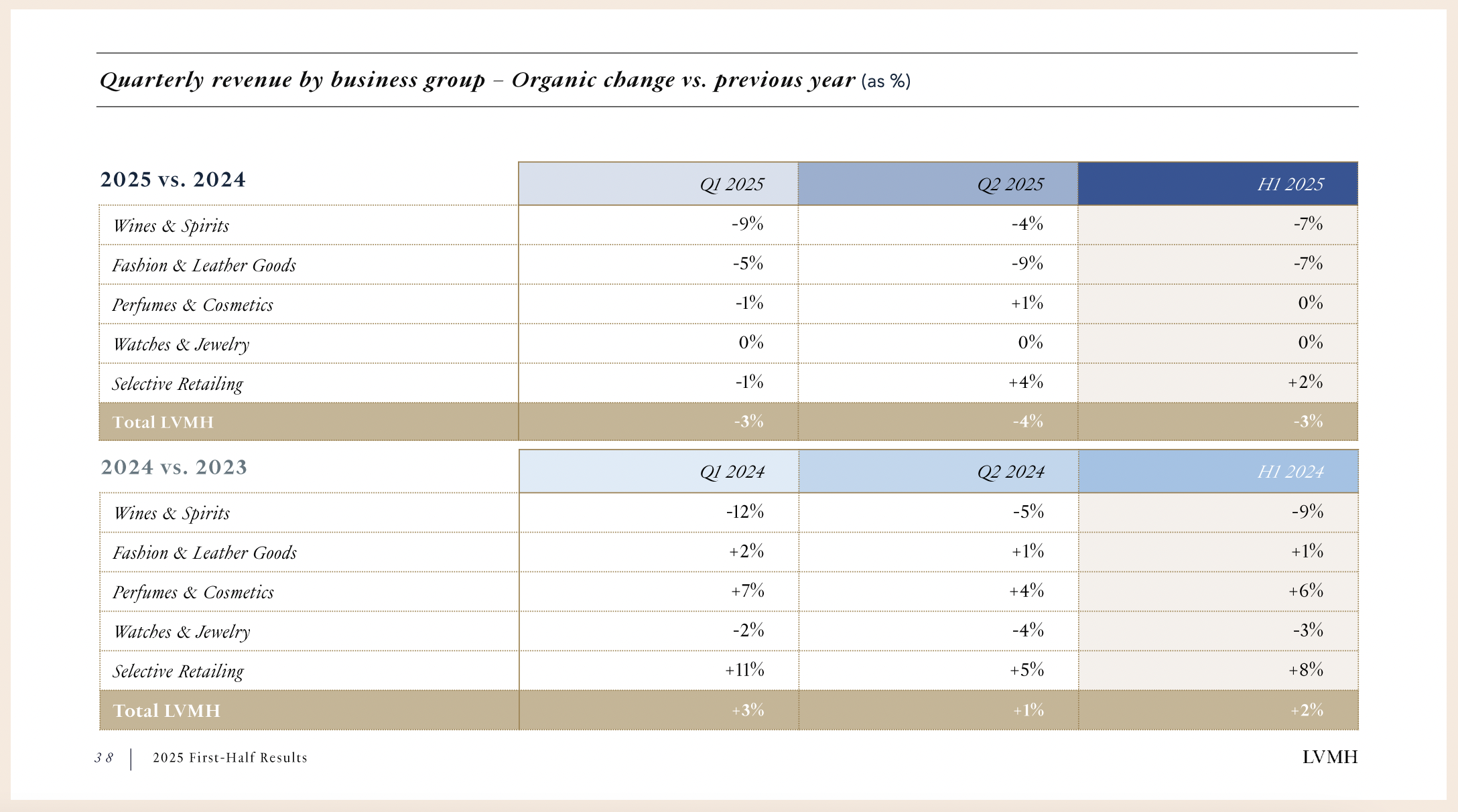

Business Segment Performance

— Wines & Spirits

The Wines & Spirits business group recorded year-on-year declines in both revenue and profit in the first half of 2025.

The segment continued the trends seen in 2024, mainly impacted by the effect of US-China trade tensions on consumer behavior in these two key markets.

In this context, the overall performance of Wines & Spirits declined. However, sales trends for champagne improved, and rosé wines from Provence performed well. To maintain market demand and strengthen brand appeal, major brands launched large-scale promotional initiatives during the first half, while actively managing costs.

— Fashion & Leather Goods

Despite declines in revenue and profit in the first half of 2025, the segment saw resilient demand from local customers. In contrast, the first half of 2024 experienced rapid growth, driven by strong tourist spending, particularly in Japan. Operating margins remained at very high levels.

Louis Vuitton continued to showcase strong creativity by innovating on its signature products and brand experiences. A notable example is “LV The Place,” a cruise-ship-like space in the heart of Shanghai resembling a museum, embodying the brand’s travel spirit since its founding by Louis Vuitton in 1854. Other highlights included Nicolas Ghesquière’s latest fashion show at the Palais des Papes in Avignon and Pharrell Williams’ runway presentation in Paris.

Dior appointed Jonathan Anderson as its new Creative Director for Haute Couture, Menswear, Women’s Ready-to-Wear, and Accessories (see link). His debut menswear collection, unveiled in June at the Hôtel des Invalides in Paris, was a major success. Victoire de Castellane launched the new high jewelry collection Diorexquis, paying tribute to Mr. Dior’s love of nature.

Loro Piana celebrated its centenary with its first-ever exhibition, held at a contemporary art museum in Shanghai. It’s 2025 Resort Collection and Maison Icons line performed well. Fendi kicked off its centenary celebrations with a joint runway show at its new “Solari” headquarters in Milan, led by Silvia Fendi.

Celine presented Michael Rider’s debut collection, and Givenchy launched the first collection designed by Sarah Burton—both were well received by the market. Loewe announced the appointment of Jack McCollough and Lazaro Hernandez as its new Creative Directors.

— Perfumes & Cosmetics

Perfumes and cosmetics maintained stable development in the first half of 2025, continuing to execute a strong innovation strategy and a highly selective retail approach.

Christian Dior advanced its iconic fragrance lines, including the globally best-selling Sauvage, J’adore, and the launch of the new Dior Homme, as well as Bois Talisman, a new addition to its luxury fragrance collection La Collection Privée. Success in makeup lines such as Forever and Dior Addict, and in skincare, also contributed to the brand’s strong performance.

Guerlain’s strong results were driven by new additions to its Aqua Allegoria and L’Art & La Matière fragrance collections and the global relaunch of its Abeille Royale Royal Jelly Serum. Parfums Givenchy benefited from growth in L’Interdit and strong sales of its Prisme Libre makeup line. Maison Francis Kurkdjian launched its new fragrance, Kurky.

— Watches & Jewelry

Watches and jewelry maintained stable development in the first half of 2025. A decline in recurring operating profit was due primarily to continued investment in store renovations and brand communication campaigns.

Tiffany & Co. continued to expand its iconic collections and rolled out its new concept stores globally, inspired by its landmark flagship in New York.

Bulgari celebrated the Year of the Snake with immersive art exhibitions in Shanghai and Seoul, showcasing its signature Serpenti collection. The brand also unveiled its new high jewelry collection, Polychroma, in Taormina. Chaumet actively developed its iconic Bee de Chaumet collection.

In timepieces, TAG Heuer began implementing its 2024 partnership with Formula 1, becoming an official event partner during the Monaco Grand Prix. Hublot celebrated the 20th anniversary of its Big Bang collection, while Zenith marked its 160th anniversary.

— Selective Retailing

The Selective Retailing segment saw growth in both revenue and profit.

Despite facing a high comparison base, Sephora continued its upward momentum with a robust strategy, further consolidating its global leadership. The brand continued to expand market share in multiple countries and grew its loyal customer base through differentiated product offerings and omnichannel innovation.

DFS improved profitability despite a still-constrained global environment by cutting costs and streamlining operations, including the closure of its Galleria in Venice (see link).

Le Bon Marché achieved revenue growth once again, thanks to the department store’s continually refreshed product selection and distinctive cultural programming. The Group further strengthened the organizational structure of its department stores, implementing shared governance across La Samaritaine and Le Bon Marché.

Looking ahead, amid ongoing geopolitical and economic uncertainty, the Group remains confident and will continue to implement its strategy focused on enhancing brand desirability, underpinned by exceptional product quality and outstanding retail performance.

Appendix:

Changes in LVMH Group’s revenue in the first half of fiscal 2025 by quarter (by business group and region):

|Source: Official financial report, conference call

|Image Credit: LVMH Group official website

|Editor: Wang Jiaqi