On October 28, Bama Tea Co. Ltd. (stock code: 6980.HK) was officially listed on the Main Board of the Hong Kong Stock Exchange, becoming the “first high-end Chinese tea stock.”

Bama Tea is a well-known tea supplier in China, offering a full range of the country’s six major tea categories, as well as teaware, tea snacks, and other non-tea products. The company issued 9 million shares globally in this IPO, with the offering price set at HKD 50 per share—the upper limit of the pricing range—raising a total of approximately HKD 450 million (USD 57.5 million), with net proceeds of around HKD 390 million (USD 49.9 million). On its first day of trading, Bama Tea opened at HKD 80.1 per share, surging 60.2% above its IPO price, and closed at HKD 92, up 84% from the offering price. The company’s total market capitalization reached HKD 7.9 billion (USD 1.01 billion).

After reviewing its prospectus, Luxe.CO has summarized several key highlights:

—— Revenue: Steady Growth in Recent Years, Surpassing RMB 2.1 Billion in 2024

According to the prospectus, Bama Tea’s revenue grew from RMB 1.818 billion (USD 249.8 million) in 2022 to RMB 2.122 billion (USD 291.6 million) in 2023, and further increased slightly to RMB 2.143 billion (USD 294.5 million) in 2024. For the first half of this year, revenue was RMB 1.063 billion (USD 146.2 million), slightly down from RMB 1.110 billion (USD 152.7 million) in the same period last year, primarily due to a reduction in the number of self-operated offline stores, which led to a decline in offline sales.

Citing a Frost & Sullivan report, the prospectus notes that based on 2024 sales revenue, Bama Tea ranks first in the high-end tea market in the Chinese Mainland, with a market share of approximately 1.7%. Additionally, based on the number of tea retail chain stores as of December 31, 2024, Bama Tea also ranks first among tea suppliers in the country.

In terms of profitability, the company’s net profit rose from RMB 166 million (USD 22.8 million) in 2022 to RMB 206 million (USD 28.3 million) in 2023, and further to RMB 224 million (USD 30.8 million) in 2024. For the first half of this year, net profit stood at RMB 120 million (USD 16.5 million), compared to RMB 146 million (USD 20 million) in the same period last year. The net profit margin improved during the reporting period, increasing from 9.1% in 2022 to 9.7% in 2023 and to 10.5% in 2024. However, it declined slightly in the first half of this year to 11.3%, down from 13.2% in the same period last year.

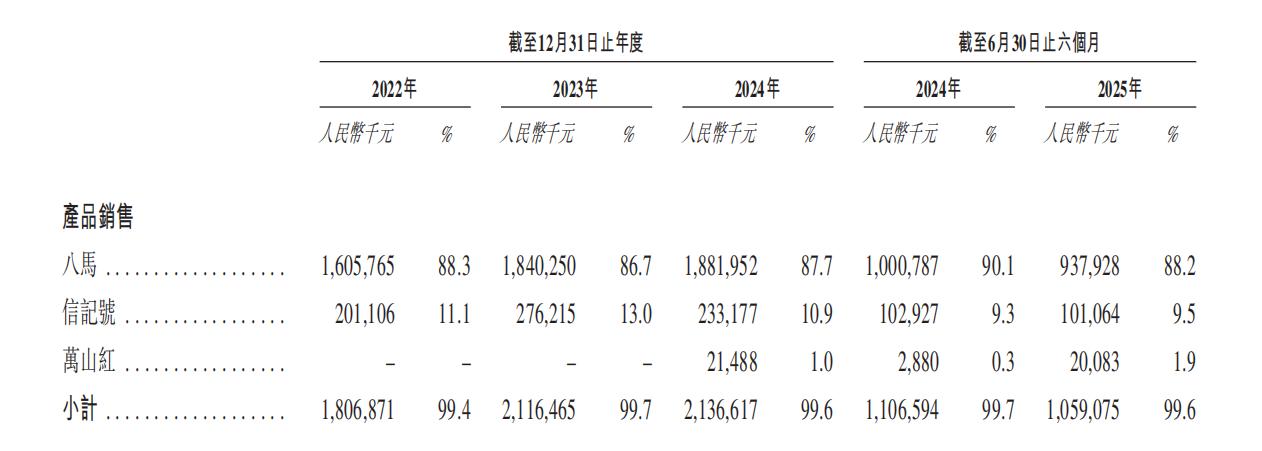

—— Products and Brands: Covering All Six Major Tea Categories with a Multi-Brand Strategy

Bama Tea’s product portfolio mainly includes tea products (such as oolong tea, black tea, dark tea, white tea, green tea, and yellow tea), teaware, and tea snacks. The company operates under its core brand “Bama” and two sub-brands: “Xinjihao” (focused on premium aged Pu’er tea) and “Wanshanhong” (targeted at younger and female consumers with a variety of flavored teas).

- Bama brand: Focuses on a full range of whole-leaf teas, teaware, and tea snacks, with business professionals and high-spending consumers as its target audience. Tea product prices range from approximately RMB 727/kg (USD 99.9/kg) to RMB 240,000/kg (USD 33,000/kg); teaware ranges from RMB 98 (USD 13.5) to RMB 60,000 (USD 8,250); tea snacks range from RMB 88 (USD 12) to RMB 499 (USD 69). Key product lines include the “Sai Zhenzhu” series of Tieguanyin and the “Niu Yi” series of Wuyi rock tea.

- Xinjihao brand: Launched in 2019, it specializes in premium aged Pu’er tea for seasoned tea drinkers and Pu’er enthusiasts. Product prices range from approximately RMB 807/kg (USD 111/kg) to RMB 224,000/kg (USD 30,800/kg). The brand holds procurement rights for finished tea products from the “King Tea Tree” in Banzhang Village, Lao Banzhang (2021–2025), and from the “King Tea Tree” in Bingdao Five Villages, Bingdao Village (2020–2025).

- Wanshanhong brand: Launched in 2024, it focuses on a variety of flavored black teas, blended teas, and herbal substitute teas, targeting young and female consumers who value diverse flavors and cost-effectiveness. It primarily sells through online channels. Product prices range from approximately RMB 840/kg (USD 115/kg) to RMB 2,200/kg (USD 302/kg).

In terms of revenue composition, tea products are the company’s core business, contributing 88.6% of total revenue in 2024. Within this category, oolong tea accounted for the highest proportion (29.9%), followed by black tea (19.4%), white tea (10.4%), and dark tea (10.8%). Among non-tea products, teaware accounted for 6.1%, and tea snacks for 3.8%.

As of the end of September, Bama Tea operated two refined tea production bases located in Anxi and Wuyi Mountain, Fujian Province, primarily focusing on processing Tieguanyin/blended teas and Wuyi rock tea/black tea, respectively. These facilities feature intelligent production lines.

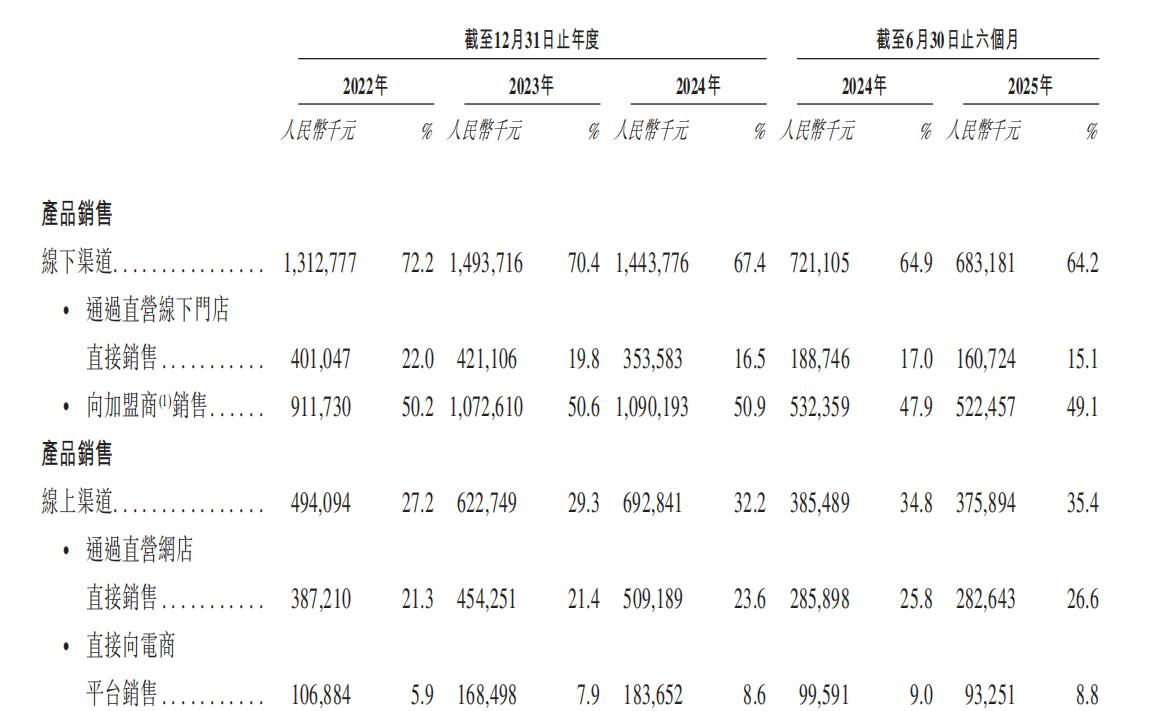

—— Channels: Online-Offline Integration, with Franchising as the Main Offline Model

Bama Tea adopts an omnichannel sales strategy that includes offline channels (self-operated and franchised stores) and online channels (self-operated online stores and third-party e-commerce platforms).

- Offline channels remain the primary revenue driver, contributing 67.4% of total revenue in 2024. As of June 30, 2025, the company operated 3,585 offline stores, including 244 directly operated stores and 3,341 franchised stores, covering all provinces across the Chinese Mainland. The franchise model is the cornerstone of its offline business, accounting for 50.9% of total revenue in 2024.

- Online channels have grown rapidly in recent years, with their revenue contribution increasing from 27.2% in 2022 to 32.2% in 2024, and further to 35.4% in the first half of this year. The company has established a presence on major e-commerce platforms, including Tmall, JD.com, and Douyin. As of the end of September, Bama Tea had a total of 40.9 million online followers and over 26 million registered members.

—— Shareholding Structure: Founding Family as Controlling Shareholders

Prior to the listing, the controlling shareholders—Mr. Wang Wenbin, Mr. Wang Wenli, Ms. Chen Yajing, Ms. Wu Xiaoning, Mr. Wang Wenchao, and Ms. Wang Xiaoping (all family members acting in concert) jointly held approximately 55.90% of the company’s voting rights. Following the completion of the global offering, this concerted group controls approximately 49.98% of the voting rights.

| Source: Bama Tea Co. Ltd. IPO Prospectus

| Image Credit: Bama Tea Co. Ltd. IPO Prospectus, Official Website

| Editor: LeZhi