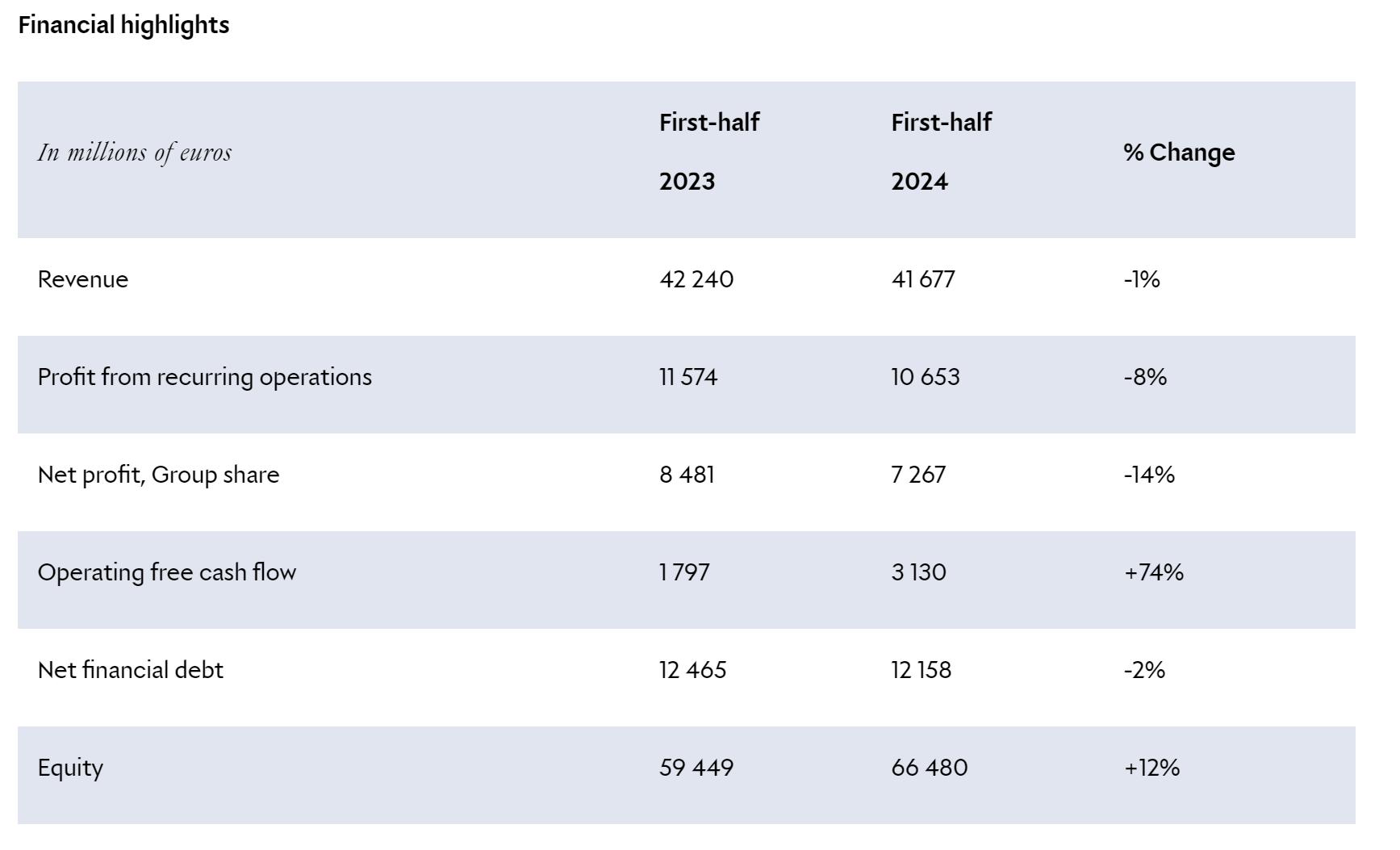

On July 23, LVMH, the French luxury giant, announced its financial results for the first half of 2024: Sales revenue decreased by 1% year-on-year to 41.7 billion euros, with a 2% growth on an organic basis. The group noted that despite the ongoing uncertainties in the geopolitical and economic landscape, it achieved sustained growth during this period.

The Asian market, led by the Chinese Mainland (excluding Japan), saw a 10% year-on-year decline in sales revenue, though the number of global Chinese customers increased by a high single-digit percentage.

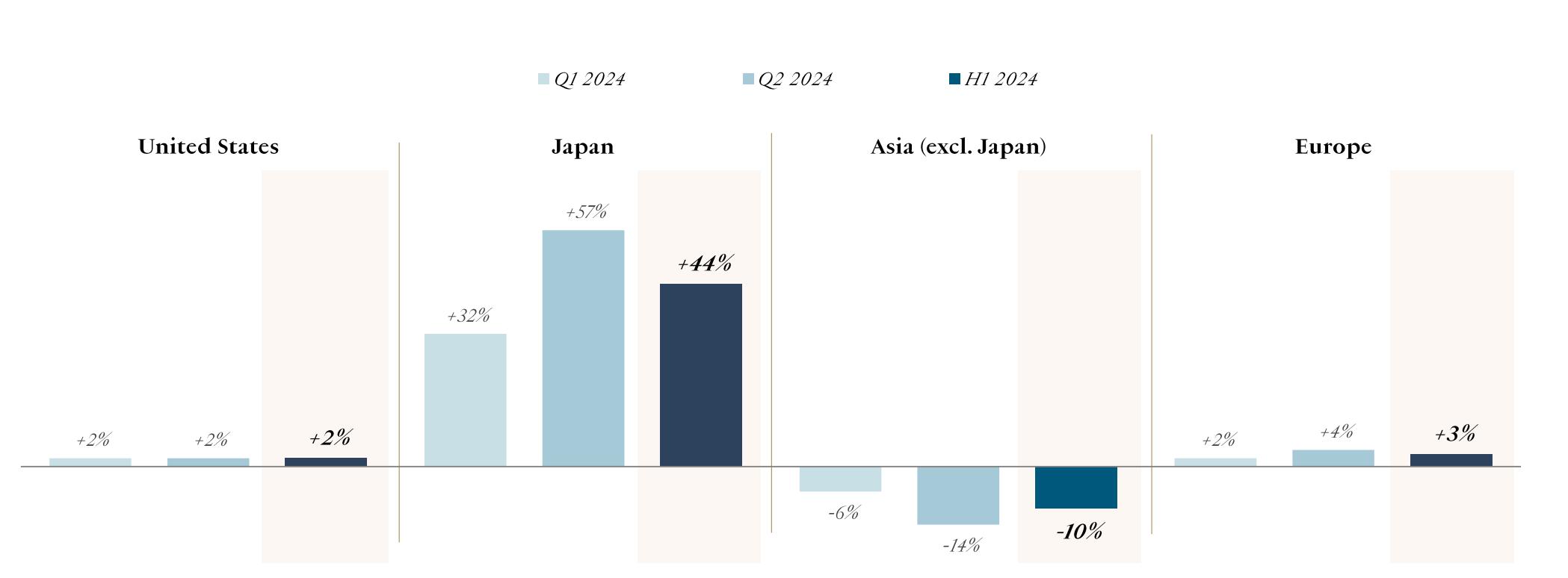

Quarterly Breakdown:

- Q1: Global sales revenue decreased by 2% year-on-year to 20.7 billion euros (3% growth on an organic basis).

- Q2: Global sales revenue decreased by 1% year-on-year to 21.0 billion euros (1% growth on an organic basis).

Organic basis refers to a fixed scope of consolidation and constant exchange rates. The impact of changes in the scope of consolidation for LVMH in the first half of the year was negligible, while exchange rate fluctuations had a -3% impact.

In the first half of 2024, the group’s recurring operating profit reached 10.7 billion euros, with an operating margin of 25.6%, significantly surpassing pre-pandemic levels. However, exchange rate fluctuations had a notable negative impact on first-half performance. Net profit for the group was 7.3 billion euros.

Bernard Arnault, Chairman and CEO of LVMH, commented: “The results for the first half of the year reflect LVMH’s remarkable resilience, backed by the strength of its Maisons and the responsiveness of its teams in a climate of economic and geopolitical uncertainty. Driven as ever by our dual focus on desirability and responsibility, we have continued to work towards achieving the targets set out in our environmental and social action programs.

In a year marked by our partnership with the Paris 2024 Olympic and Paralympic Games, we are honored to share our creativity, excellent craftsmanship and deep commitment to society to make this event a resounding success and an opportunity for France to shine on the world stage. While remaining vigilant in the current context, the Group approaches the second half of the year with confidence, and will count on the agility and talent of its teams to further strengthen its global leadership position in luxury goods in 2024.“

During the post-earnings conference call, CFO Jean-Jacques Guiony emphasized LVMH’s ability to adapt strategies in various environments, whether favorable or challenging, without losing sight of long-term goals. He noted a performance divergence among brands, with some achieving remarkable growth rates. He also highlighted the enduring appeal of flagship brands in attracting rapidly changing consumer tastes. Looking ahead to the second half, the group expects a more favorable comparison base to drive stronger growth.

Notably, during the conference call, “Chinese market” and “Chinese consumers” were mentioned 76 times, underscoring their prominence as key topics of interest.

Jean-Jacques Guiony stated that in terms of consumers, the number of American and European customers in the second quarter exceeded that of the first quarter, while the growth rate of Chinese customers in the second quarter was slightly lower than in the first quarter. Japanese customer growth was sluggish due to multiple price increases in recent quarters. In the first quarter, the number of Chinese customers grew by 10% year-on-year, although this growth rate was slightly lower for fashion and leather goods customers.

“During the first half of this year, the number of Chinese customers grew by a high single-digit percentage year-on-year. Although the second quarter was slightly lower than the first quarter, the fashion and leather goods sectors remained very healthy. However, the watch and jewelry sector declined due to a global decrease in Chinese customers.“

Jean-Jacques Guiony emphasized, “I want to point out that brands with less marketing investment in the Chinese Mainland in recent quarters were penalized more than others. Customer response to marketing stimuli in the Chinese Mainland remains very significant. That’s why we continue to invest in this market, which is clearly crucial for us.“

Nine Key Points of LVMH Group’s H1 2024 Results

1. Sales revenue achieved sustained growth on an organic basis.

2. Exchange rate fluctuations had a significant negative impact, particularly in the fashion and leather goods sector.

3. Sales revenue in Europe and the US grew, while the Japanese market saw strong growth due to shopping by Chinese tourists.

4. The wine and spirits division reflected a return to normal demand since 2023.

5. The fashion and leather goods division demonstrated strong resilience, maintaining high operating profit margins, especially for flagship brands Louis Vuitton and Christian Dior.

6. The perfume and cosmetics division grew rapidly, with classic lines from well-known brands continuing to sell well.

7. Watch and jewelry brands showcased strong creative vitality, with ongoing investments in marketing and store renovations.

8. Sephora’s performance was outstanding, further solidifying its leadership in the global beauty retail sector.

9. Operating free cash flow increased significantly, exceeding 3 billion euros.

Regional Performance

- Japan: Sales revenue surged by 44% year-on-year, increasing its contribution to the group from 7% to 9%. The yen is at its lowest point against the euro in 34 years, making Japan the most attractive shopping destination in Asia, particularly for Chinese consumers.

- Asia (excluding Japan): Sales revenue declined by 10% year-on-year, reducing its contribution to the group from 34% to 30%, but it remains the largest market for the group.

- US and Europe: Sales revenue grew by 2% and 3%, respectively.

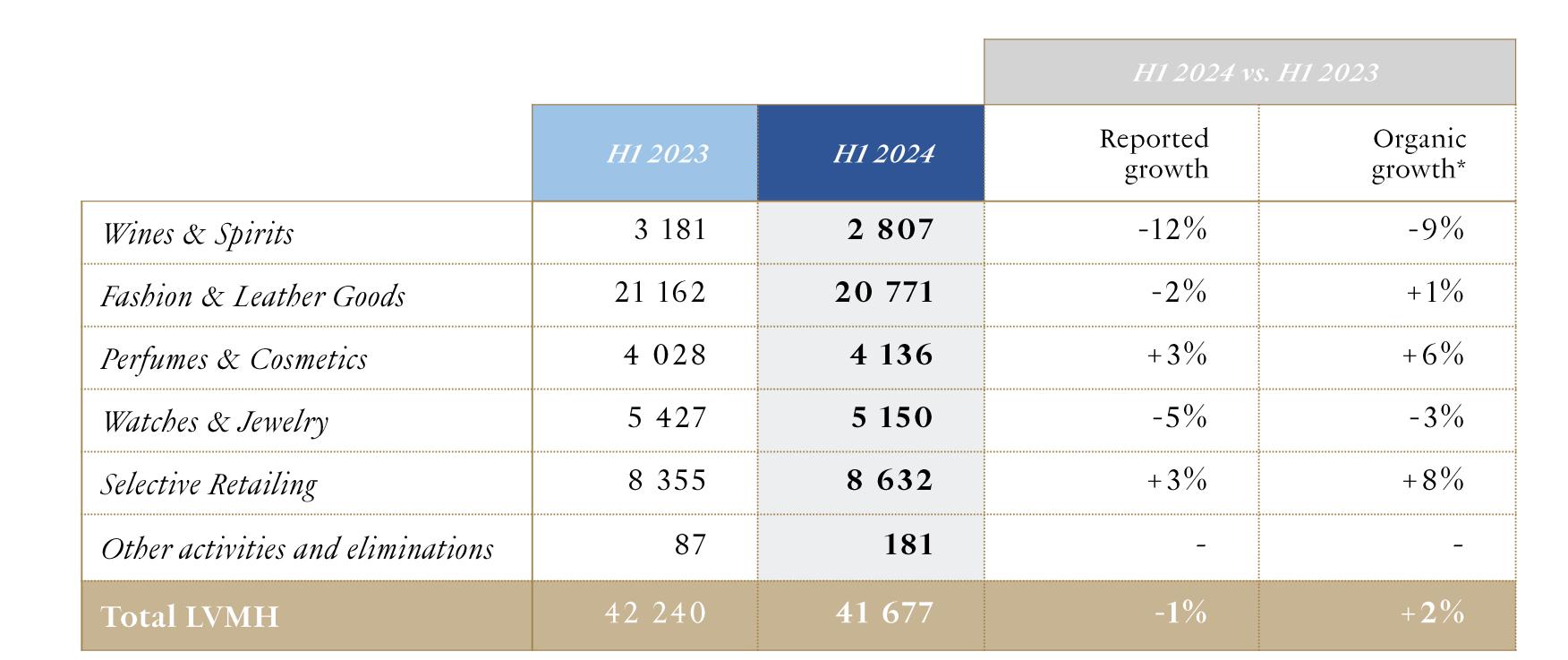

Division Performance

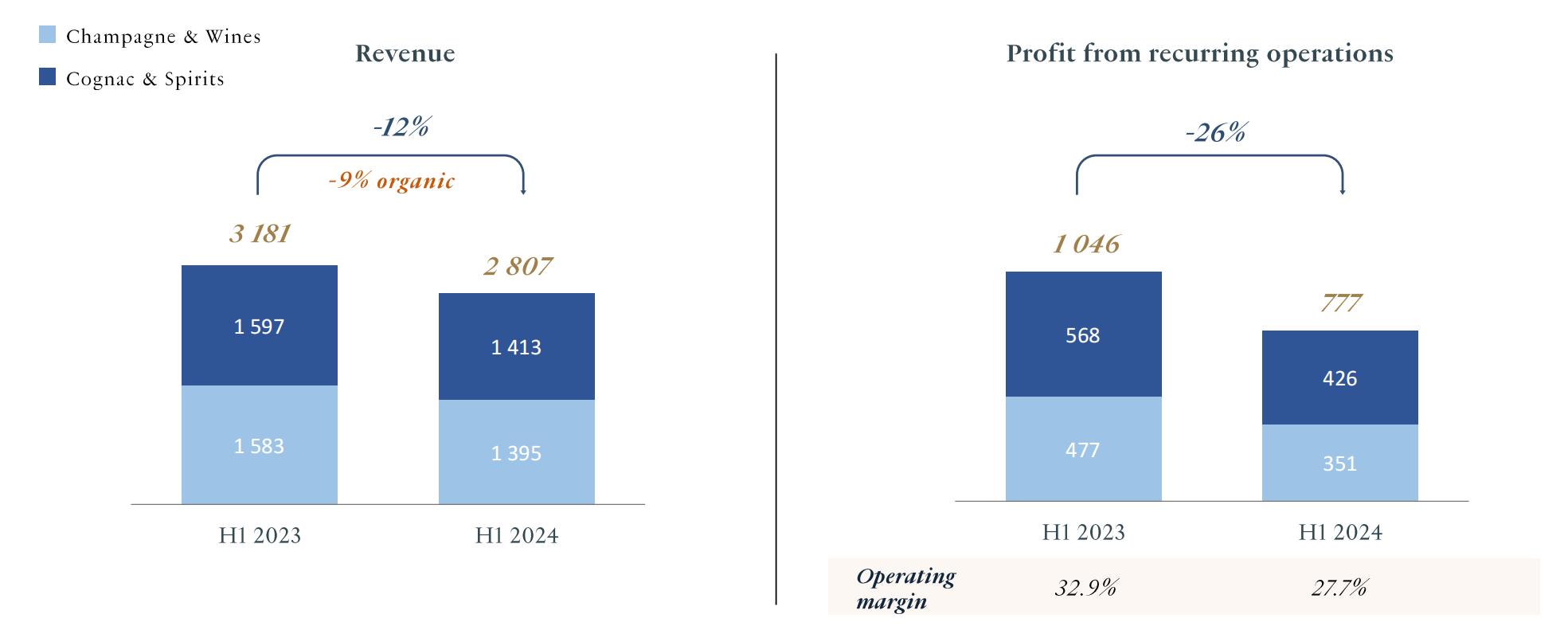

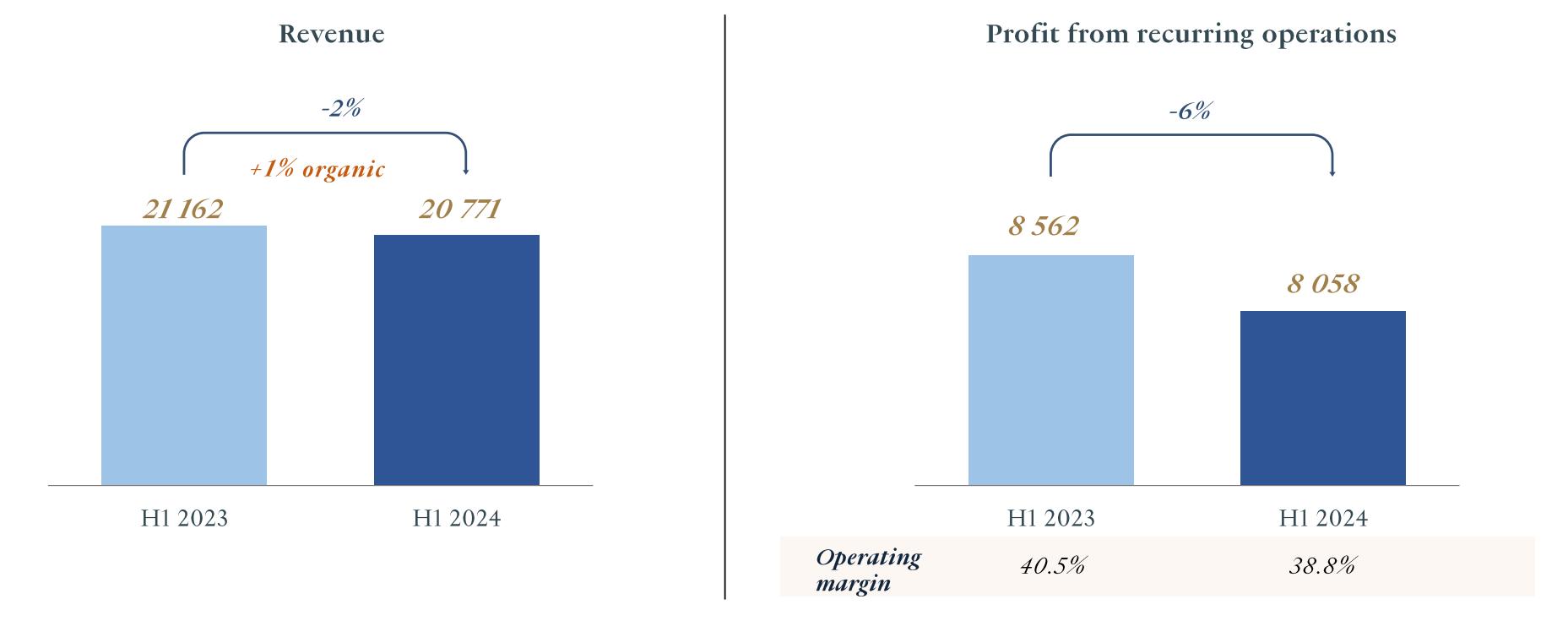

- Wines and Spirits: Sales revenue decreased by 9% year-on-year on an organic basis, with recurring operating profit down 26%.

The group commented that champagne sales declined but remained significantly above 2019 levels, reflecting a post-pandemic normalization of demand.

- Hennessy cognac was impacted by weak local demand in the Chinese Mainland, but saw growth in the US market in the second quarter despite a cautious overall environment.

- In the Provence rosé wine sector, Château d’Esclans accelerated its international expansion, while the prestigious Château Minuty was consolidated into the financial report for the first time, strengthening the group’s overall capabilities.

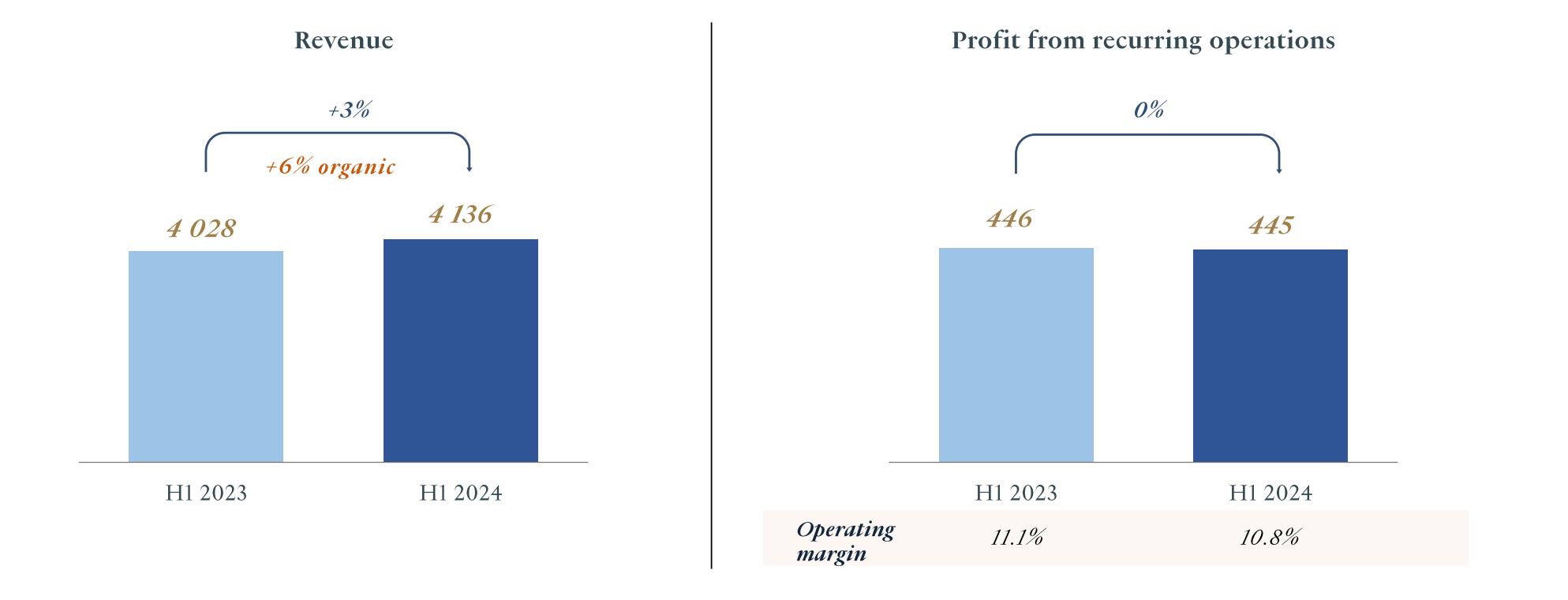

- Fashion and Leather Goods: Sales revenue grew by 1% year-on-year on an organic basis, with recurring operating profit down 6%, yet operating profit margin remained at historically high levels.

At the beginning of the year, Louis Vuitton had a strong start, attributed once again to its successful high-quality strategy. Women’s Creative Director Nicolas Ghesquière celebrated his tenth anniversary designing for Louis Vuitton with the latest women’s fashion show held in the Cour Carrée courtyard of the Louvre in Paris. Men’s Creative Director Pharrell Williams celebrated the spirit of Louis Vuitton with his latest fashion show, “The World is Yours,” at UNESCO headquarters in Paris.

The brand also unveiled its latest chapter of its iconic core value—movement, featuring tennis champions Roger Federer and Rafael Nadal.

Christian Dior continued to demonstrate extraordinary creative momentum, thanks to the appeal of collections designed by Creative Director Maria Grazia Chiuri and Men’s Creative Director Kim Jones. Their fashion shows attracted record audiences. The 2025 women’s cruise collection showcased at Drummond Castle in Scotland highlighted traditional Scottish craftsmanship, receiving high praise. The Diorama high jewelry collection exhibited in Florence showcased the exquisite craftsmanship of the brand’s Chief Fine Jewelry Designer, Victoire de Castellane. The opening of a new store in Geneva, designed by architect Christian de Portzamparc, was a highlight of the first half of the year.

Following the success of the leather goods Triomphe collection designed by Creative Director Hedi Slimane, Celine benefited from growing demand for accessories. Loewe held its first major exhibition in Shanghai, curated by Creative Director Jonathan Anderson, paying tribute to the brand’s Spanish heritage and commitment to craftsmanship. Fendi launched the Pequin collection, reinterpreting the brand’s iconic stripes. Loro Piana and Rimowa continued to perform strongly, while Berluti also had a solid start.

Perfumes and Cosmetics Division

Sales revenue grew by 6% year-on-year on an organic basis in the first half, driven by the continued success of flagship lines, strong innovation, and a selective distribution strategy. Recurring operating profit remained stable.

Christian Dior excelled in all product categories, consolidating its leadership in strategic markets. Sauvage continued to rank among the world’s top fragrances, and the iconic women’s fragrance J’adore remained popular. The new Miss Dior Parfum saw a significant increase in sales. Makeup and skincare also contributed to the brand’s excellent performance, particularly Rouge Dior lipstick and Capture Totale skincare line.

Guerlain‘s fragrance innovations performed well, especially Néroli Plein Sud from the extraordinary fragrance collection L’Art et la Matière. Parfums Givenchy continued to grow with its L’Interdit fragrance.

Benefit added new brow products to its Precisely, My Brow line.

Fenty Beauty launched a new haircare line and expanded its retail presence in the Chinese Mainland.

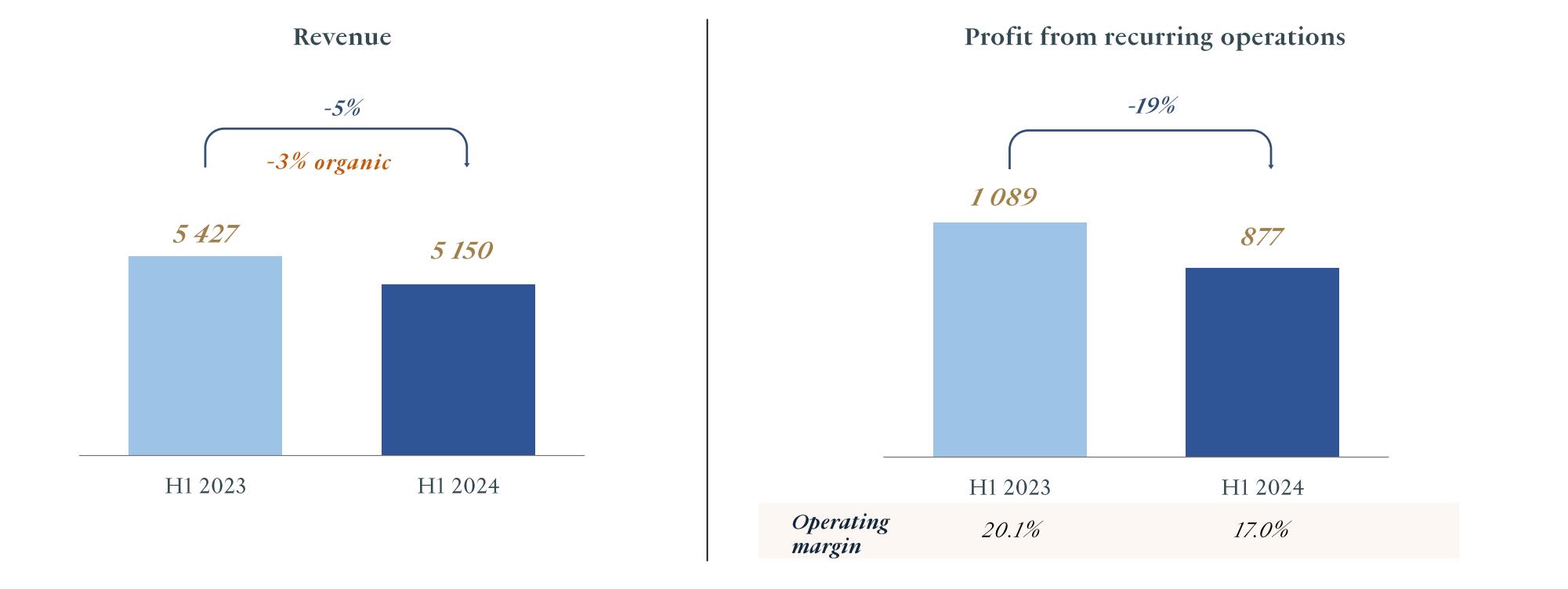

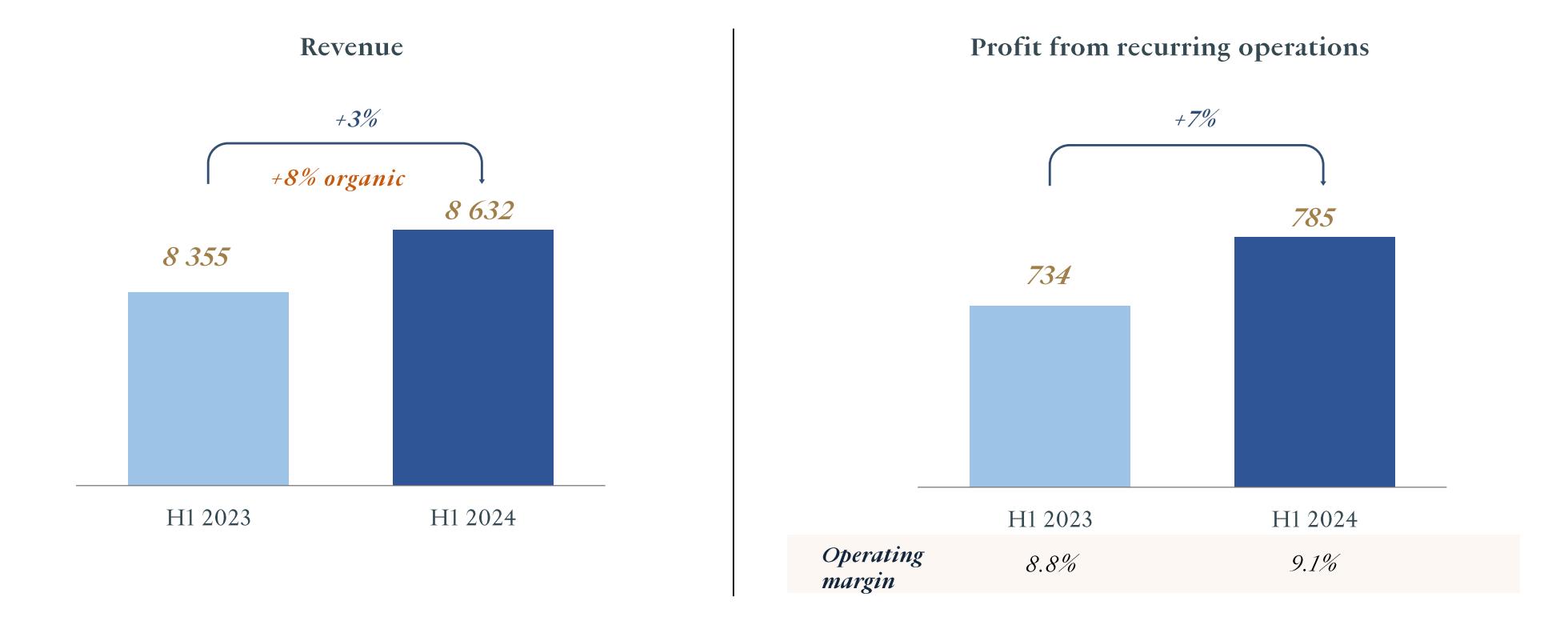

Watches and Jewelry Division

Sales revenue decreased by 3% year-on-year on an organic basis in the first half, with recurring operating profit down 19%, mainly due to exchange rate fluctuations.

Tiffany continued to showcase its iconic collections through various initiatives, including a highly anticipated new campaign. The Tiffany Titan collection, designed by Louis Vuitton Men’s Creative Director Pharrell Williams, garnered significant attention. The 2024 Blue Book high jewelry collection, Céleste, launched in Beverly Hills in May, drew inspiration from the limitless imagination of the brand’s legendary designer Jean Schlumberger.

BVLGARI celebrated its 140th anniversary with the Eternally Reborn campaign and achieved record sales with the new Aeterna high jewelry collection launched in Rome.

Chaumet unveiled the medals for the 2024 Paris Olympic and Paralympic Games, created by its design studio.

In the watch sector, TAG Heuer strengthened its connection with sports, particularly with motorsport, successfully relaunching its classic F1 series. Hublot reaffirmed its pioneering position in the art world with a pocket watch designed in collaboration with American contemporary artist Daniel Arsham.

LVMH Watch Week has become a major event in the international watch industry, achieving great success. In the first half of the year, LVMH announced the acquisition of renowned high-end Swiss watchmaker L’Epée 1839.

Selective Retailing Division

Sales revenue grew by 8% year-on-year on an organic basis in the first half, with recurring operating profit up 7%.

Sephora achieved significant growth and continued to gain market share, reaffirming its strong position in the high-end beauty market and the appeal of its unique approach, solidifying its status as the world’s leading perfume and cosmetics retailer. Growth remained strong in North America, Europe, and the Middle East.

DFS‘s business activity remained below pre-pandemic 2019 levels, with significant differences in visitor flows across destinations.

Le Bon Marché continued to grow, driven by its differentiated strategy, including an ever-evolving selection of products and services and unique events.

|Source: Official Financial Report, Conference Call

|Image Credit: Group Official Website

|Editor: LeZhi