On November 12, Japanese sportswear group ASICS released key financial figures for the nine months ended September 30, 2025: revenue rose 19% year-on-year to JPY 625 billion (approx. USD 4.06 billion) at current exchange rates, and 20.4% on a constant currency basis—marking the first time the Group’s nine-month revenue has surpassed JPY 600 billion. Revenue in the Greater China market increased 18.8% year-on-year to JPY 92.9 billion (approx. USD 604 million).

All product categories and regional markets reported net sales growth, with particularly strong performance from Sports Style and Onitsuka Tiger.

In the first nine months of 2025, ASICS Group’s operating profit surged 39.4% year-on-year to JPY 127.6 billion (approx. USD 829 million), while net profit attributable to owners of the parent increased 32.9% to JPY 86.3 billion (approx. USD 561 million), both reaching record highs.

ASICS noted that global events such as the 2025 World Athletics Championships in Tokyo, the 2025 World Para Athletics Championships in New Delhi, as well as the Sydney Marathon and Berlin Marathon, have further enhanced the brand’s visibility in the running category.

Meanwhile, the ASICS brand has also gained strong recognition in tennis. During international tournaments held in the UK this summer, it achieved a 22.7% market share in men’s singles footwear, ranking first. In similar tournaments in the US, ASICS also led with a 21.9% share.

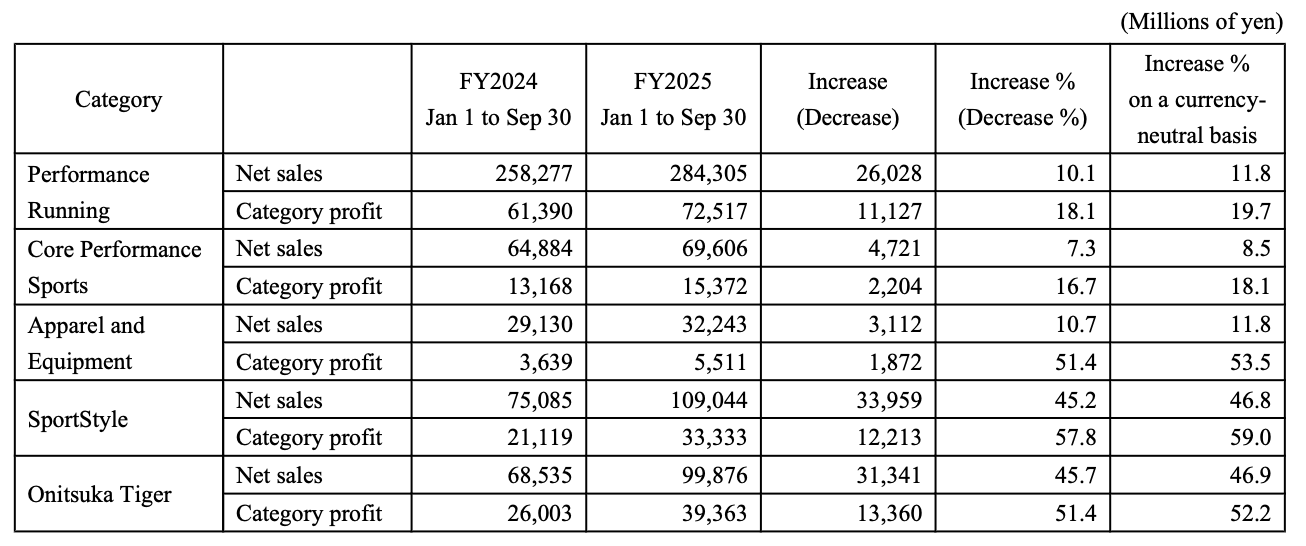

— By Product Category

Performance Running: Focused on driving both revenue and profit growth through high value-added products, particularly in Japan, Europe, Southeast Asia, and South Asia. Operating profit rose 18.1% year-on-year to JPY 72.5 billion (approx. USD 471 million).

Core Performance Sports: Despite a reduction in school-related business, categories such as tennis, indoor sports, and volleyball achieved growth. Operating profit increased 16.7% year-on-year to JPY 15.3 billion (approx. USD 99 million).

Apparel & Equipment: Strong performance in running products. Markets including Europe, Greater China, Southeast Asia, and South Asia recorded growth. Operating profit climbed 51.4% year-on-year to JPY 5.5 billion (approx. USD 36 million).

Sports Style: Revenue grew significantly across all regions, especially in the Americas, Europe, and Greater China. Cumulative revenue for the first nine months surpassed JPY 100 billion for the first time. Operating profit soared 57.8% year-on-year to JPY 33.3 billion (approx. USD 217 million).

Onitsuka Tiger: Revenue rose sharply in all regional markets, particularly in Europe and Greater China. Inbound tourist demand also significantly boosted performance in Japan. Operating profit increased 51.4% year-on-year to JPY 39.3 billion (approx. USD 255 million).

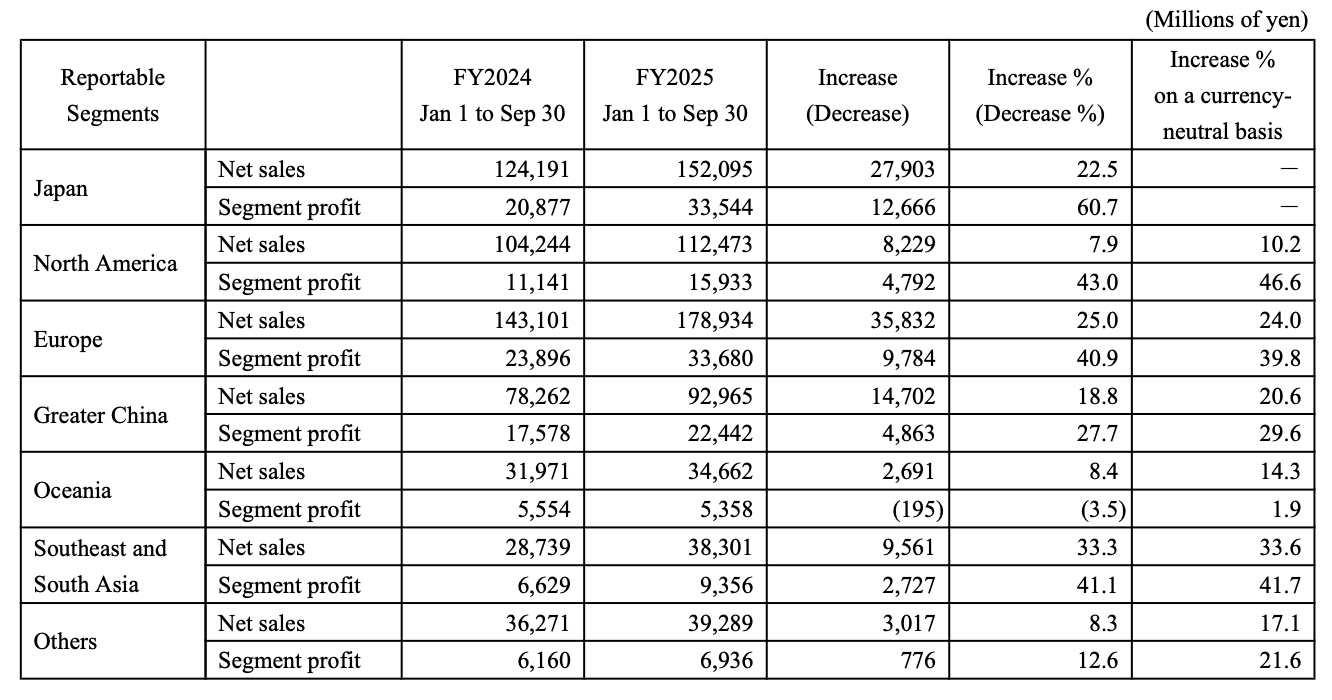

— By Regional Market

-

Japan: Operating profit rose 60.7% year-on-year to JPY 33.5 billion (approx. USD 218 million)

-

North America: Operating profit increased 43% to JPY 15.9 billion (approx. USD 103 million)

-

Europe: Operating profit up 40.9% to JPY 33.6 billion (approx. USD 219 million)

-

Greater China: Operating profit grew 27.7% to JPY 22.4 billion (approx. USD 146 million)

-

Australia: Operating profit declined 3.5% to JPY 5.3 billion (approx. USD 34 million)

-

Southeast and South Asia: Operating profit rose 41.1% to JPY 9.3 billion (approx. USD 61 million)

-

Other Regions: Operating profit grew 12.6% to JPY 6.9 billion (approx. USD 45 million)

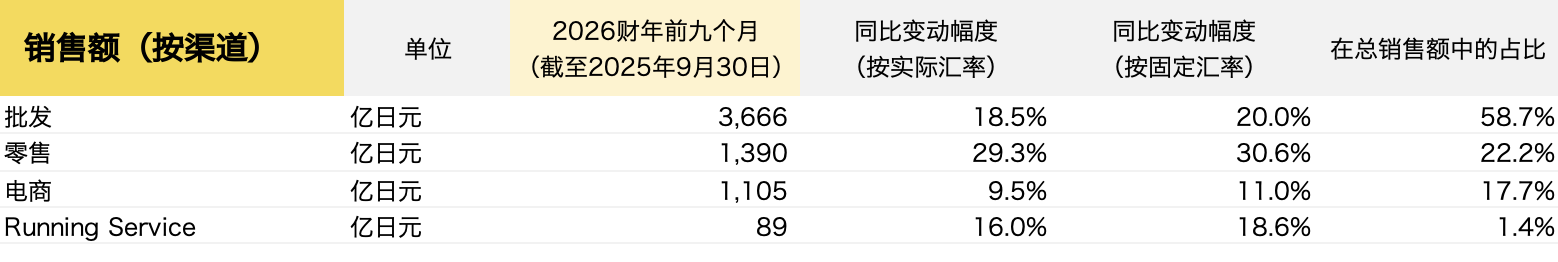

— By Sales Channel

Wholesale, Retail, Online Sales

Full-Year Outlook:

-

Revenue expected to increase 17.9% year-on-year to JPY 800 billion (approx. USD 5.20 billion)

-

Operating profit forecast to rise 45% to JPY 135 billion (approx. USD 876 million), slightly adjusted from the previous projection of JPY 136 billion

-

Net profit expected to grow 41.1% to JPY 90 billion (approx. USD 584 million), revised up from the previous estimate of JPY 87 billion

|Source: Official Financial Report

|Image Credit: Official Financial Report, Official Website

|Editor: LeZhi