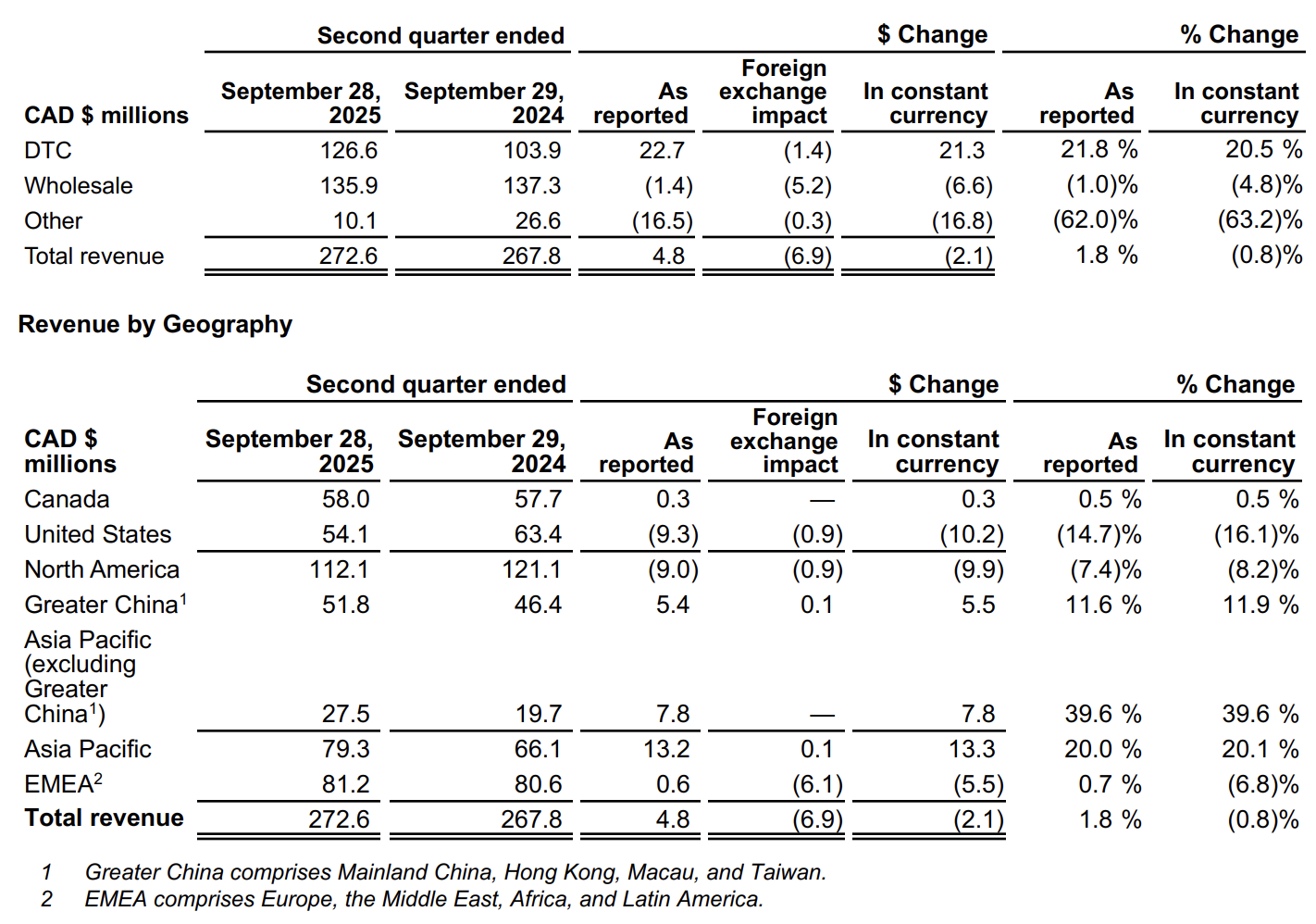

Before the market opened on November 6 local time, Canada Goose released its financial results for the second quarter of fiscal year 2026, ending September 28, 2025. Global revenue rose 1.8% year-on-year to CAD 272.6 million (down 0.8% at constant currency).

Driven by effective strategy execution, the Direct-to-Consumer (DTC) channel delivered strong results, with revenue up 21.8% year-on-year to CAD 126.6 million. Comparable sales increased 10.2% year-on-year, marking the third consecutive quarter of positive growth for the channel.

By region, revenue in Greater China grew 11.6% year-on-year to CAD 51.8 million, helping drive a 20% year-on-year increase in the Asia-Pacific region to CAD 79.3 million, making it the company’s primary growth engine for the quarter.

Dani Reiss, Chairman and CEO of Canada Goose, commented, “Our second quarter results reflect strong DTC performance and positive comparable sales growth – clear proof our strategy is working. We’re exactly where we planned to be, investing with intention, elevating our product offering, brand and consumer experiences, and entering peak season with confidence.“

Greater China Continues to Lead Among Global Core Markets

As a key strategic region for Canada Goose, Greater China delivered outstanding performance this quarter. Revenue in the region increased 11.6% year-on-year to CAD 51.8 million (up 11.9% at constant currency), continuing to lead among the company’s core global markets.

The Chinese Mainland, backed by strong consumer demand and deep brand penetration, drove robust growth in the DTC channel. This momentum not only reinforced Canada Goose’s market position in the Mainland but also had a spillover effect, helping push comparable sales growth in the broader Asia-Pacific region to high single digits.

During the earnings call, Neil Bowden, CFO of Canada Goose, added, “Despite mixed consumer sentiment in China, our performance in the market remains solid.“

The company attributed the growth in Greater China and the Asia-Pacific region to several key factors:

-

E-commerce breakthroughs: Online sales saw impressive growth, particularly through Douyin, which accelerated the brand’s digital expansion and became a significant contributor to regional growth.

-

Brand ambassador impact: The appointment of actor Greg Hsu as a global brand ambassador boosted brand relevance and market reach, especially in the Chinese Mainland, while further enhancing consumer engagement.

-

Retail network expansion: The opening of new stores further elevated brand visibility in key consumption scenes and enhanced customer experience.

Coordinated Progress Across Four Strategic Pillars

Canada Goose’s stable revenue growth in the second quarter of fiscal 2026 was underpinned by rigorous execution across four core operational strategies:

— Expanding product categories to boost year-round relevance

The brand officially launched its Fall/Winter 2025 collection, which presents a modern urban design narrative, refining product style, function, and use-case scenarios to enhance the appeal of signature items and expand seasonless wearability.

Apparel remains the fastest-growing segment. Driven by new down and non-down products, revenue from new arrivals more than doubled year-on-year.

The highly anticipated Snow Goose by Canada Goose line is set to return at the end of this month.

— Strengthening brand heat through purpose-driven partnerships

Canada Goose collaborated with NBA MVP and champion Shai Gilgeous-Alexander, blending athletic flair, fashion aesthetics, and brand heritage.

The appointment of actor Greg Hsu as global brand ambassador, whose personal image aligns well with the brand’s identity, added brand momentum and supported business growth.

— Enhancing retail operations through strategic store expansion and targeted efficiency improvements

The brand continued reinforcing its presence in key markets, increasing its number of global standalone stores to 77.

Internationally, store upgrades also advanced, with the Paris location officially relocating to the renowned Avenue des Champs-Élysées. The new store adopts an updated design concept, featuring designated spaces for signature products and curated brand art pieces, creating a space that blends retail functionality with cultural experience.

— Efficient operations with stronger accountability and agility

Inventory levels declined 3% year-on-year, marking the eighth consecutive quarter of year-on-year reductions—an encouraging trend in inventory management that lays a solid operational foundation for future strategic initiatives.

Organizational and Capital Updates

To further optimize corporate governance and capital efficiency, Canada Goose recently announced two key updates:

-

Board changes: Stephen Gunn, who served as a director and Audit Committee member since 2017, has retired and stepped down from the Board. As of October 1, 2025, independent director Belinda Wong has been designated as the “Audit Committee Financial Expert” and appointed as a member of the Audit Committee.

-

Early renewal of Normal Course Issuer Bid (NCIB): The company announced it would terminate its current NCIB on November 9, 2025, and launch a new one the following day, November 10, 2025, valid through November 9, 2026. (The NCIB is a stock repurchase program, meaning Canada Goose is ending its current buyback plan and immediately starting a new one for another 12 months.)

Appendix:

Fiscal Q2 2026 performance data:

|Source: Official financial report

|Image Credit: Official website, official Weibo

|Editor: LeZhi