Canada Goose announced its financial report for the third quarter of the fiscal year 2024, ending December 31, 2023. Boosted by the holiday season and key consumer moments, sales revenue increased by 6% year-over-year to CAD 610 million.

In the Asia-Pacific region, which stands as its largest market, revenue saw a significant surge of 62% year-over-year to CAD 270 million. The Chinese mainland market, in particular, showed strong growth with increases in sales across all channels and a doubling of store traffic compared to the same period last year.

Canada Goose shines in the Year of the Dragon, adding splendor to the New Year

Moreover, Luxeplace.com learned that Canada Goose has appointed Kuan Cheng as the President of its China region, effective immediately. He will be based in Shanghai and will oversee all business operations in mainland China, including commercial, marketing, and financial aspects.

Kuan Cheng brings over 15 years of experience in luxury brand management and more than a decade of senior leadership experience. Prior to joining Canada Goose, he served as the General Manager of Panerai, under the Richemont Group, in China, where he played a key role in driving the brand’s rapid growth, expanding its e-commerce platform, and deepening cooperation with key owners and brand purchasing partners. Before that, he worked with Zenith and TAG Heuer under the LVMH Group.

Kuan Cheng, President of Canada Goose China

Dani Reiss, Chairman and CEO of Canada Goose, stated, ““Our third quarter results were in line with our guidance, highlighted by progress across our strategic priorities, including robust growth in the Asia Pacific region, increased revenue across categories, with particular strength in apparel, the delivery of elevated experiences across all touch points, and increased efficiencies driven by our transformation initiatives.”

“While we continue to operate in a challenging consumer spending environment, we are encouraged by our holiday performance, which saw record traffic levels and strong revenue generated during key consumer moments. We remain confident in our strategy and our ability to capitalize on the unique heritage of our iconic, luxury brand to deliver long-term profitable growth.”

Following the release of the financial report, as of the close on February 1, Canada Goose’s stock price rose by 8.51% to USD 13.01 per share, with a current market value of approximately USD 1.32 billion.

Highlights of the third quarter of the fiscal year 2024 include:

– Accelerated consumer-oriented growth

- Launch of the second collaboration with BAPE, the best-selling co-branded series so far this fiscal year. Additionally, Canada Goose collaborated with Pyer Moss, Concepts, OVO, Giants of Africa, and Shoe Surgeon, continuing innovation.

- Strong Black Friday and Christmas holiday shopping, with store traffic reaching an all-time high and revenue increasing by over 40% compared to the same period in 2022.

- Further expansion of the travel retail business, extending its footprint to Seoul, South Korea.

– Expansion of the direct-to-consumer (DTC) network

- Total number of global specialty stores reached 65 by the end of the third quarter of the fiscal year 2024.

- In January, Canada Goose opened a specialty store in Nanjing IFC, China.

– Category expansion

- Non-parka outerwear revenue exceeded the previous year, further increasing its revenue share. In non-parka categories, apparel outperformed expectations across all regions: achieving double-digit growth in the United States, Canada, Europe, the Middle East, Africa, and doubling in the Asia-Pacific market.

- In December, Canada Goose acquired Paola Confectii, a high-end European knitwear factory, marking its first manufacturing facility in Europe. This acquisition supports the strategic growth plan, especially expanding existing categories and enriching seasonally appropriate products.

Canada Goose Nanjing IFC specialty store

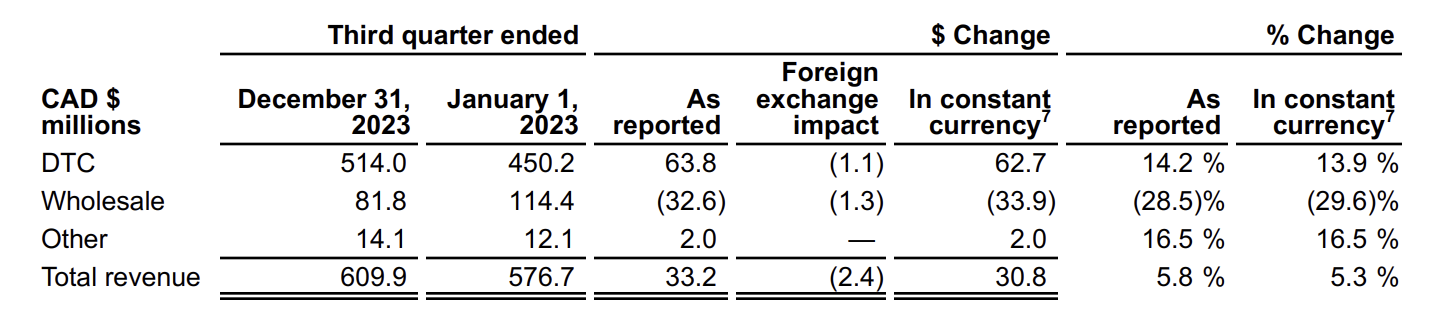

By channel:

- The increase in DTC channel revenue was mainly due to the growth in physical specialty store sales, with its revenue share rising from 78% in the same period last year to 84%.

- The decline in wholesale revenue is related to proactive adjustments in brand purchasing relationships.

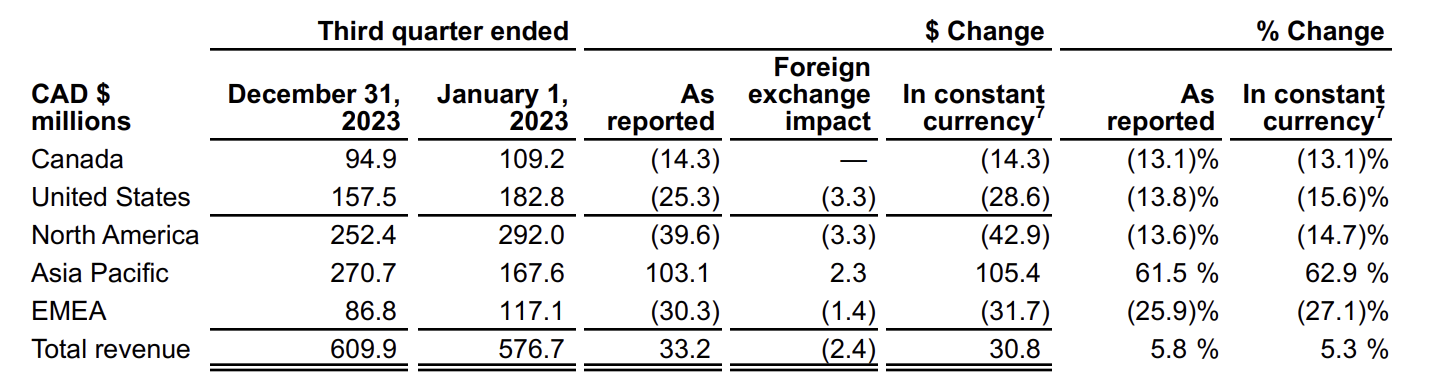

By region:

- Revenue in the Asia-Pacific region surged by 62% year-over-year, with apparel and footwear sales doubling compared to the same period last year. The Chinese mainland market showed strong growth: increases in sales across all channels, store traffic doubled compared to the same period last year, significant growth in parka sales driven by cold weather in December, and record sales during the Singles’ Day event. Additionally, the recovery of domestic tourism boosted markets in Hong Kong and Macau, China.

Based on this, Canada Goose has adjusted its full-year performance outlook for fiscal 2024:

• Total revenue between $1.285b and $1.305b, compared to previous guidance of $1.2b to $1.4b.

• Non-IFRS adjusted EBIT between $146m and $158m, representing a margin of between 11% and 12%, compared to previous guidance of non-IFRS adjusted EBIT of $135m to $225m, representing a margin of 11% to 16%.

• Non-IFRS adjusted net income per diluted share between $0.82 and $0.92, compared to previous guidance of $0.60 to $1.40.

Canada Goose also forecasts:

- The DTC channel will account for approximately 70% of total revenue, with plans to open 3 new specialty stores in the fourth quarter, bringing the total number of global specialty stores to 68 by the end of this fiscal year.

| Source: Official financial report, Luxeplace historical articles

| Image Credit: Brand official website, official WeChat public account, Luxeplace historical articles

| Editor: Wang Jiaqi