The competition between natural diamonds and lab-grown diamonds is reaching a crucial point.

What is the attitude of Chinese consumers in this intense competition between natural and lab-grown diamonds?

Natural diamond (left) and lab-grown diamond (right)

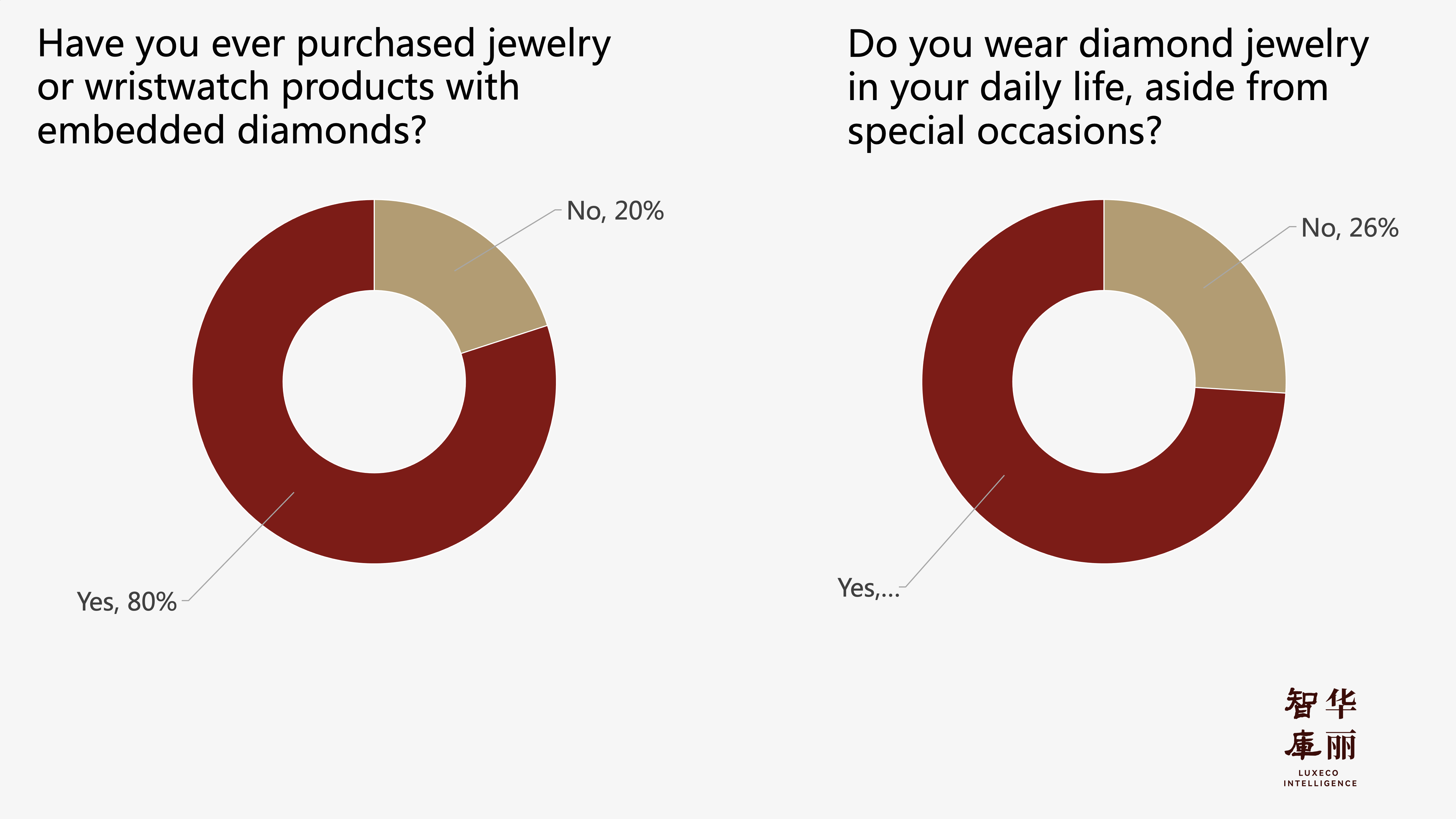

In mid-October, Luxeplace.com launched a survey through its WeChat official account, inviting our reader friends to answer eight questions about natural and lab-grown diamonds. Among the Luxeplace.com readers who filled out the survey, 80% had previously purchased diamond-set jewelry/watches, and 74% wear diamond jewelry in their daily life. This survey accurately reflects the portrait of high-end Chinese consumers and diamond buyers.

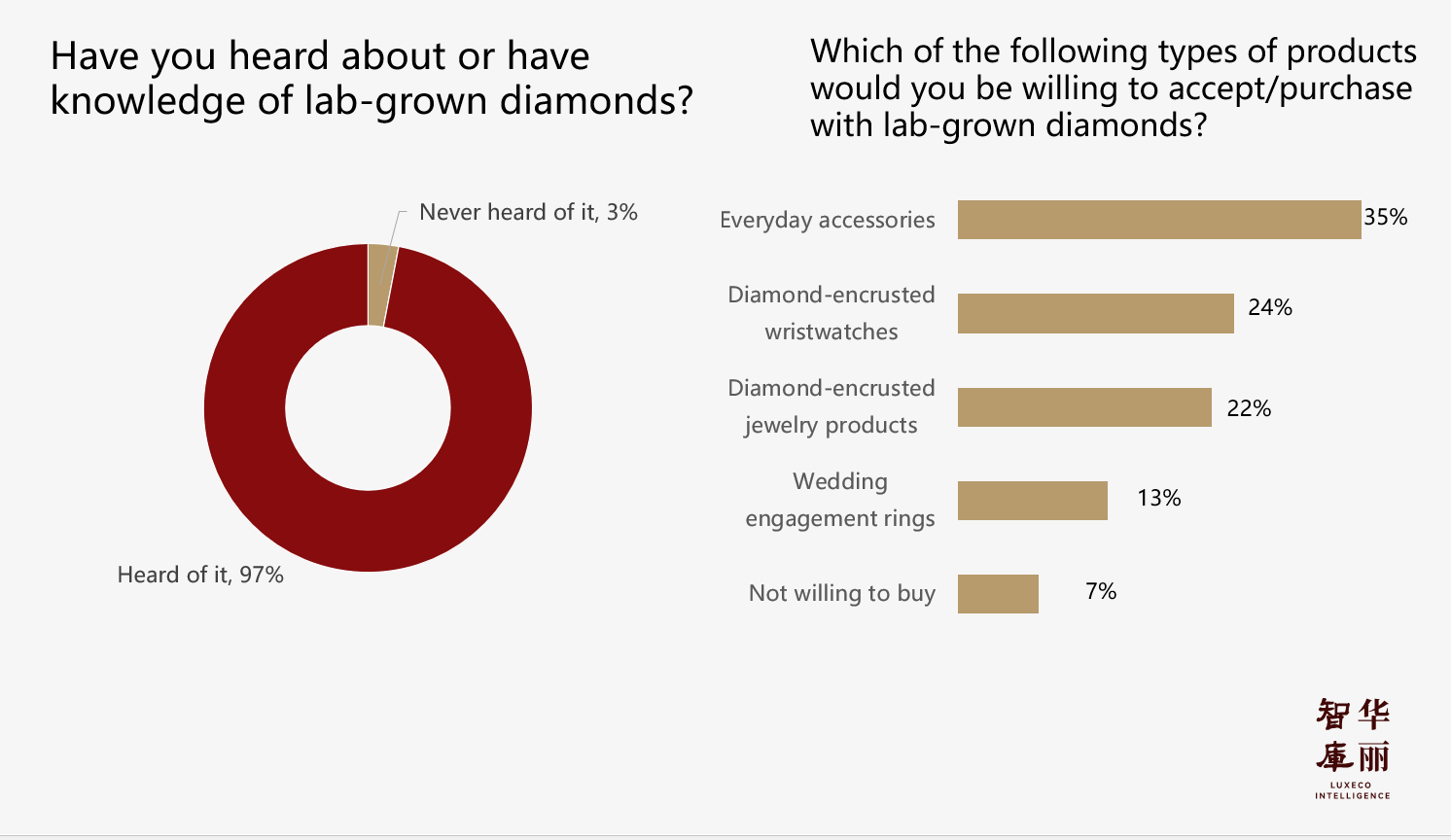

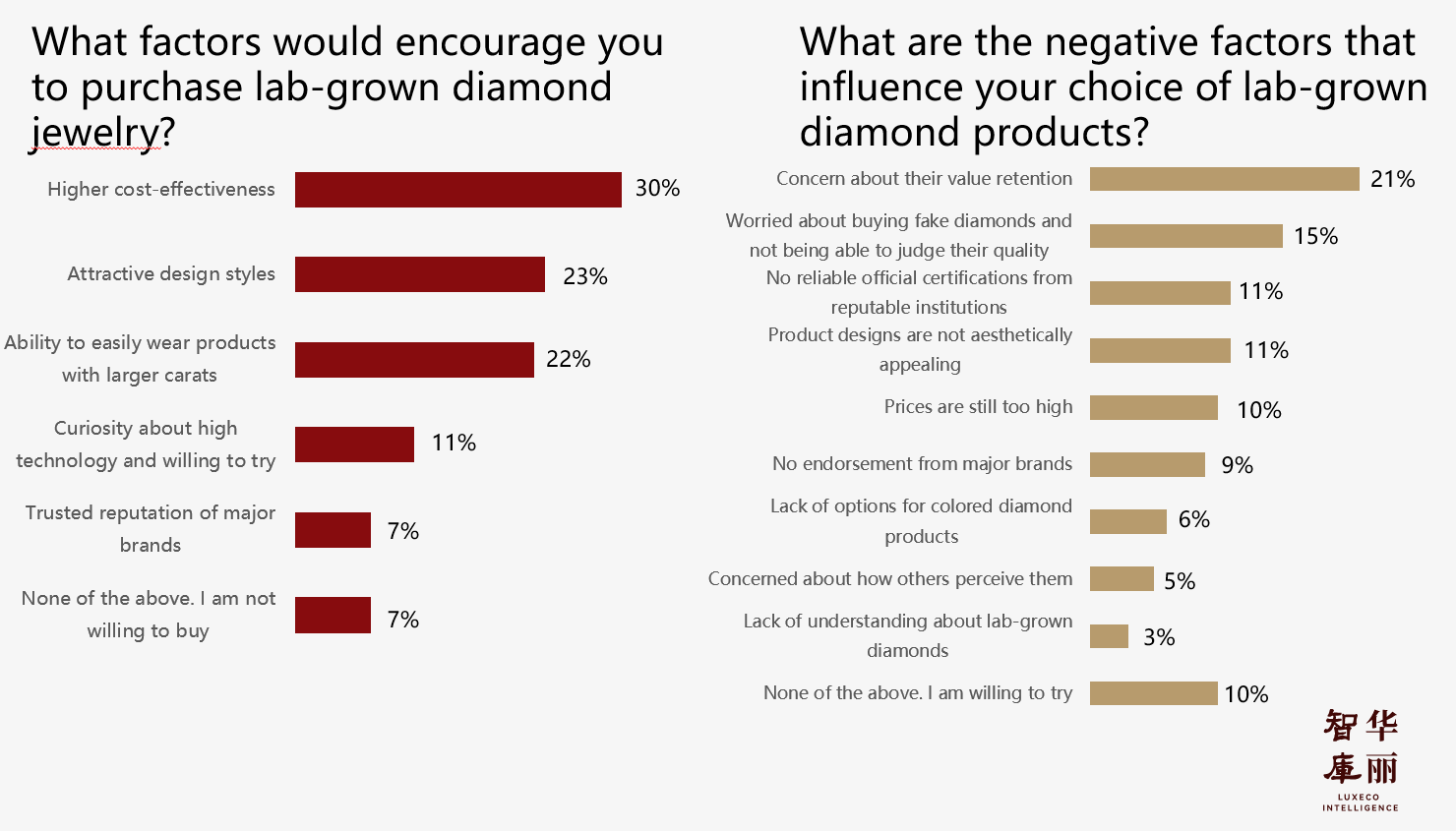

Based on 152 valid questionnaires collected first-hand, Luxe.CO Intelligence has specially produced four charts to present the current real opinions of high-end Chinese consumers on natural and lab-grown diamonds:

- Have you ever purchased jewelry or wristwatch products with embedded diamonds? Do you wear diamond jewelry in your daily life, aside from special occasions?

- Have you heard about or have knowledge of lab-grown diamonds? Which of the following types of products would you be willing to accept/purchase with lab-grown diamonds?

- What factors would encourage you to purchase lab-grown diamond jewelry? What are the negative factors that influence your choice of lab-grown diamond products?

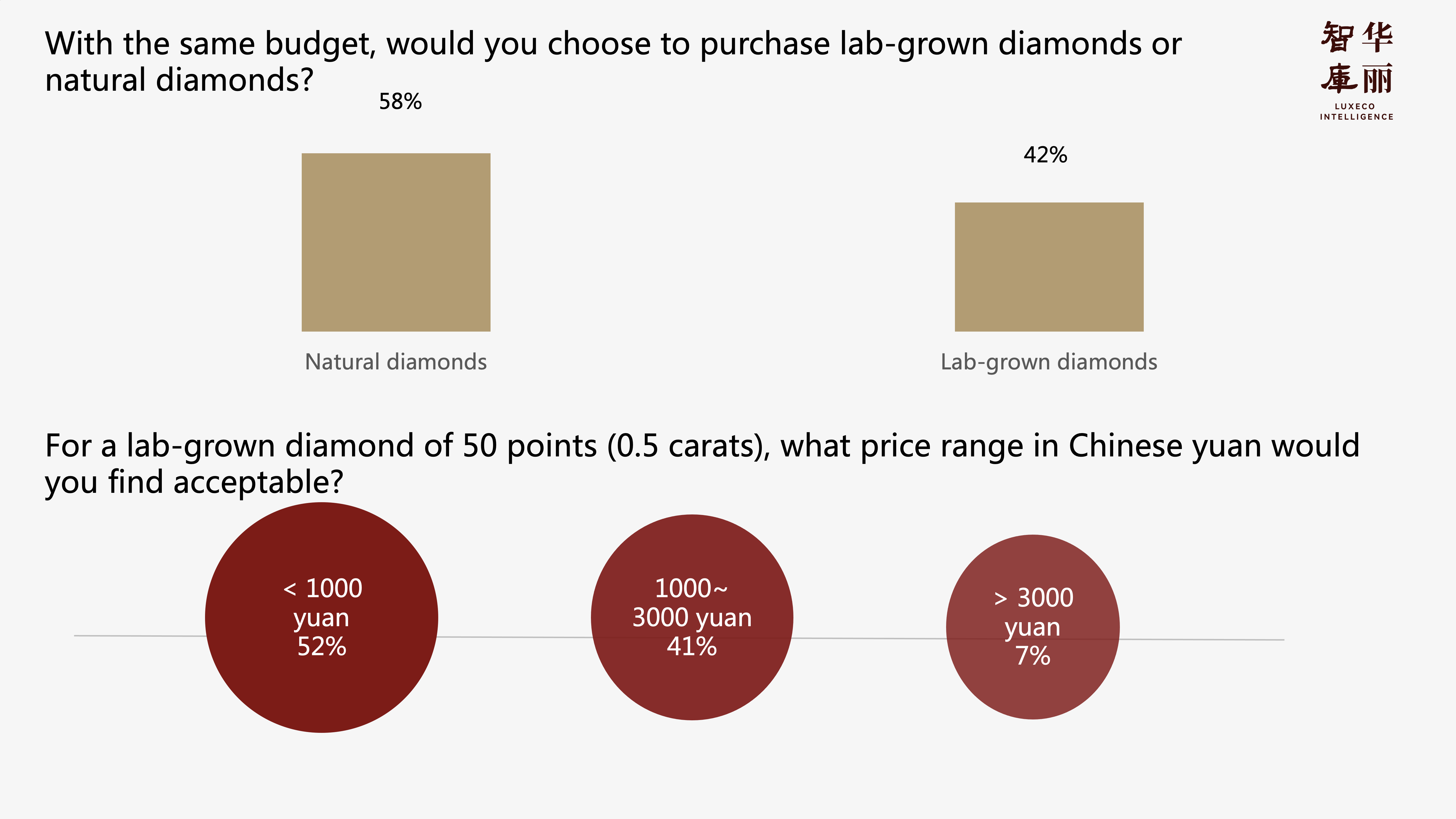

- With the same budget, would you choose to purchase lab-grown diamonds or natural diamonds?

Currently, the global diamond production giant De Beers‘ sales of natural diamonds have hit the lowest point since the pandemic, and the industry is facing challenges such as weak demand and excessive inventory. Moreover, the price of natural diamonds has fallen, spreading from larger to smaller carats.

Meanwhile, lab-grown diamonds, which emerged around 2015, continue to grow in production and market size. However, the jewelry industry has mixed attitudes towards lab-grown diamonds:

De Beers Group announced that its lab-grown diamond brand Lightbox will abandon the wedding ring business, stating that lab-grown diamonds are not a sustainable market. Chow Tai Fook Jewelry Group also stated that the market is still unstable and is not considering the lab-grown diamond business for now.

Swarovski and Pandora are continuously increasing their investment in lab-grown diamonds; Breitling and Prada are using lab-grown diamonds in their watch and jewelry products…

Nearly 80% of respondents wear diamond products daily

Among the 152 respondents, 80% have previously purchased diamond-set jewelry/watches, while only 20% have not, indicating that diamonds still have significant appeal to high-end consumers.

Furthermore, high-end consumers’ usage scenarios for diamond products are becoming more “daily.” 74% of respondents said they wear diamond jewelry daily, while 26% said they do not. In the past, diamonds were often seen as a symbol of status and were more commonly worn on significant occasions.

“Price” and “value retention” are the main factors influencing high-end consumers’ decisions to purchase lab-grown diamonds

Emerging around 2015, “gem-grade” (non-industrial) synthetic diamonds are now commonly referred to as “lab-grown diamonds.” From the name, it is evident that lab-grown diamonds are produced in laboratories or factories, not formed naturally in the Earth’s environment.

In terms of chemical, optical, physical properties, and crystal structure, lab-grown diamonds are highly similar to natural diamonds. Moreover, like natural diamonds, lab-grown diamonds have a strict grading system and can obtain certification from gemological institutes.

In recent years, thanks to the publicity and education efforts of many jewelry brands, consumers’ awareness of lab-grown diamonds has significantly increased. Among the 152 high-end consumers who participated in the survey, 97% said they had heard of or were familiar with lab-grown diamonds, while only 3% had never heard of them.

35% of respondents are willing to buy lab-grown diamonds as “daily accessories,” while 24% and 22% are willing to buy them as inlays for watches or jewelry, respectively.

However, only 13% of respondents are willing to choose lab-grown diamonds for their wedding rings. (This perhaps explains why De Beers Group abandoned the lab-grown diamond wedding ring business)

“Price” and “value retention” are the main factors influencing high-end consumers’ choice of lab-grown diamonds. 30% of respondents said they would buy lab-grown diamonds because of their “higher cost-effectiveness,” and 21% said they would not buy lab-grown diamonds because they “do not retain value.”

Attractive design (23%) and the ease of wearing larger carat products (22%) are other major factors attracting high-end consumers to buy lab-grown diamond jewelry.

Among the negative factors influencing high-end consumers’ choice of lab-grown diamonds, besides “lack of value retention,” consumers are also concerned about buying counterfeit products, not being able to judge the quality of the diamonds (15%), lack of reliable official certification for lab-grown diamond products (11%), and unattractive product designs (11%).

Given the same budget, high-end consumers still prefer to buy natural diamonds

High-end consumers still favor natural diamonds, with 58% of respondents saying they would choose to buy “natural diamonds” given the same budget, while 42% would buy “lab-grown diamonds”.

In terms of spending, consumers are currently not very willing to pay a high premium for lab-grown diamonds. For example, for a 0.50 carat lab-grown diamond, 52% of respondents would accept a price range of below 1000 yuan, 42% would accept a price range of 1000-3000 yuan, and only 7% would buy lab-grown diamond products priced above 3000 yuan.

| Image Credit: Luxeplace.com production, GIA official website

丨Reporter:Zuo Xiaoli

| Editor: Zhu Ruoyu