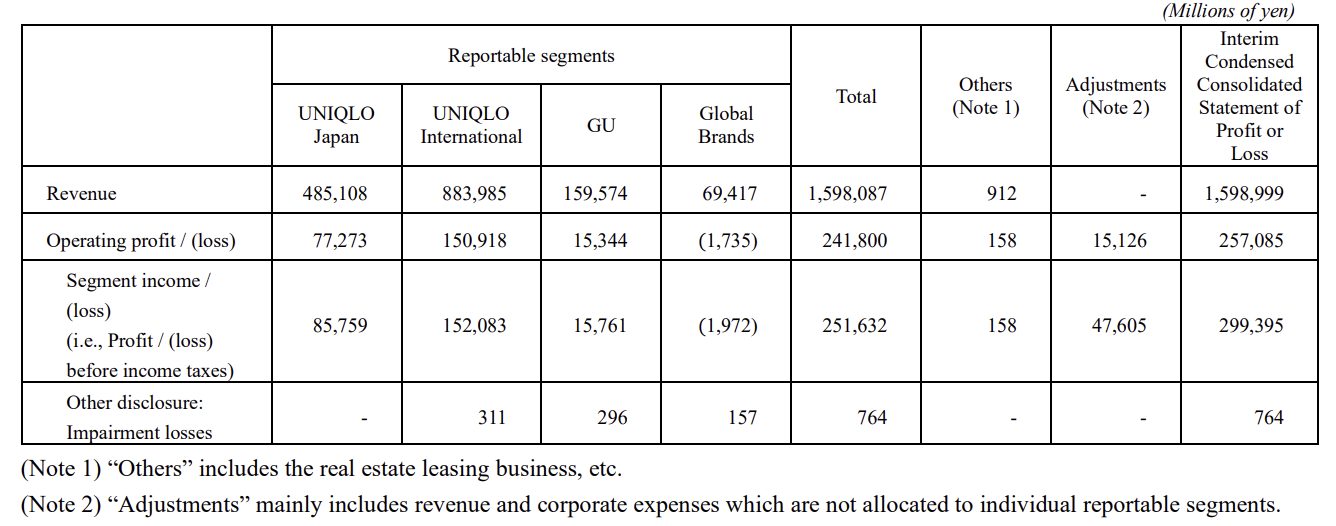

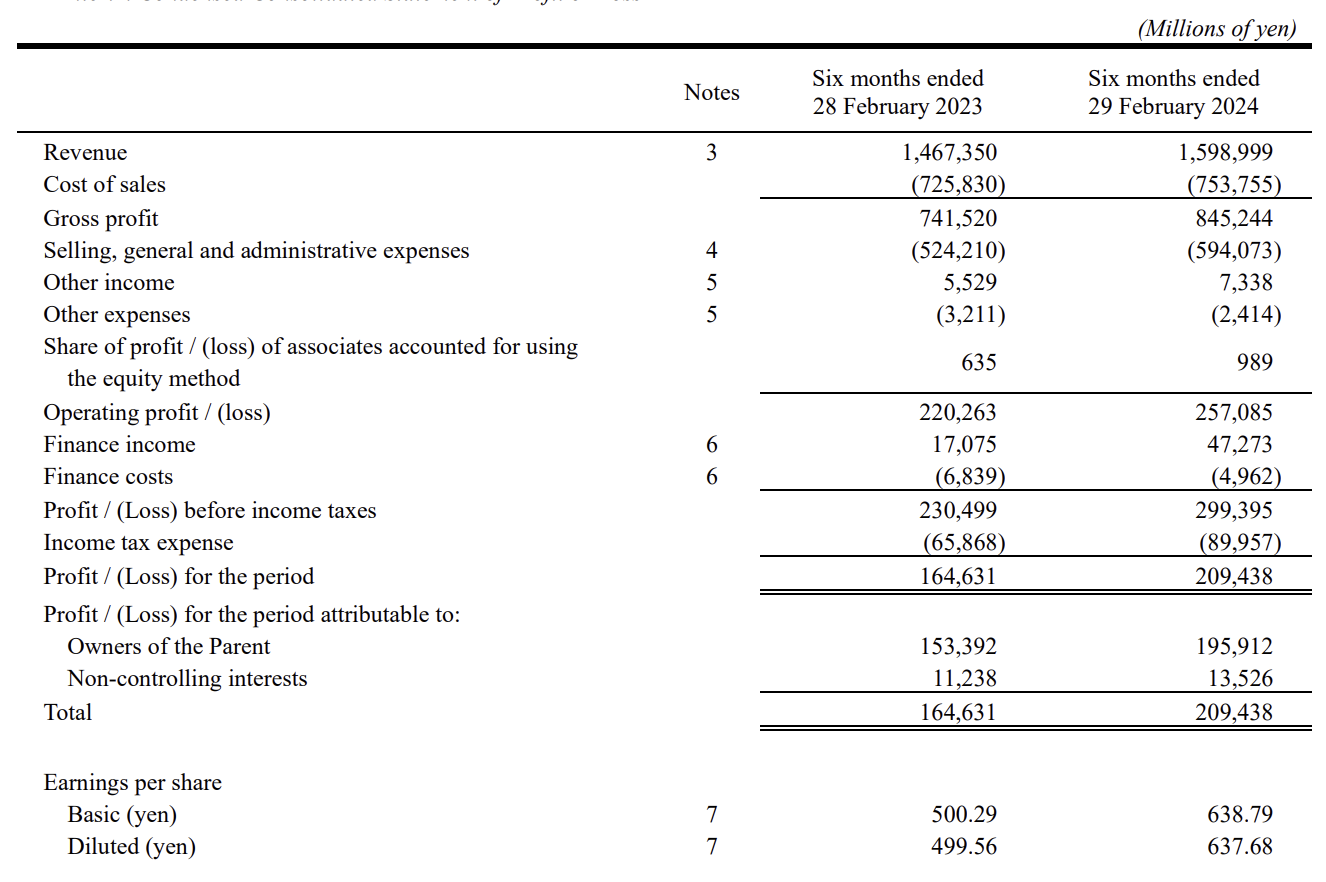

On April 11, Fast Retailing, the parent company of the UNIQLO brand, announced its consolidated financial results for the first half of fiscal year 2024 ending February 29, 2024. During this period, consolidated revenue increased by 9.0% year-over-year to 1.5989 trillion yen, and operating profit increased by 16.7% to 257 billion yen, both reaching historical highs.

During the reporting period, UNIQLO’s operations in Europe, Southeast Asia, and the GU business division performed strongly, driving overall group growth. In the first half of the fiscal year, UNIQLO saw revenue growth in mainland China, although profits slightly declined. In the first fiscal quarter, net sales in comparable stores increased by about 20% due to strong sales of winter clothing, which boosted revenue for the first half of the fiscal year. However, in the second quarter, net sales in comparable stores slightly declined due to a mild winter, unstable temperatures, and low consumer sentiment.

To accelerate the diversification of the group’s revenue pillars, Fast Retailing plans to focus on the following five key areas in the second half of the fiscal year:

1. Develop products best suited for global markets to further enhance brand value.

2. Strengthen the opening of high-quality stores.

3. Implement a focus on inventory units and the management of each store.

4. Enhance the GU and global brands.

5. Transition to a management style with a global perspective.

As of the close on April 11, Fast Retailing’s stock price fell by 0.59% to 44,100 yen per share, with a cumulative increase of 48.01% over the past 12 months. As of this writing (April 12), the latest market value was approximately 12.931 trillion yen.

By division:

Japanese UNIQLO: Revenue Declines But Gross Margin Improves, Profits Surge

During the reporting period, UNIQLO’s Japanese division experienced a revenue decline but a substantial increase in profits: revenues amounted to 485.1 billion yen (a 2.0% year-over-year decrease), while operating profits reached 77.2 billion yen (a 14.7% increase). Comparable store sales net revenue fell by 3.4%, due in part to higher temperatures in early autumn and winter (September, October, and the peak sales month of December), which reduced the demand for winter clothing. Additionally, the inability to fully develop a product lineup suitable for a mild winter and to release information in a timely manner contributed to the decline. However, improvements in cost ratios led to a significant 3.6 percentage point increase in gross margin compared to the previous year.

Overseas UNIQLO: Revenue and Profits Both Increase Significantly, Western Markets Enter a Healthy Growth Cycle

During the reporting period, UNIQLO’s overseas division saw significant increases in both revenue and profits: revenue was 883.9 billion yen (a 17.0% increase year-over-year), and total operating profit was 150.9 billion yen (a 23.0% increase).

Specifically, in the first half of fiscal 2024, mainland China’s market achieved revenue growth and a slight decline in profits. In the first quarter, strong sales of winter clothing led to a 20% increase in comparable store sales net revenue, driving revenue growth for the first half of the fiscal year. However, in the second quarter, due to a mild winter and unstable temperatures, along with low consumer desire, comparable store sales net revenue slightly declined. Meanwhile, both revenue and profits grew in Hong Kong, and Taiwan saw an increase in revenue with profits remaining at the level of the previous fiscal year.

The Korean market saw growth in both revenue and profits as winter clothing was timely shelved during falling temperatures. Southeast Asia, India, and Australia also saw significant increases in both revenue and profits due to strong sales of winter clothing and early shelved spring and summer items. North American and European operations were particularly impressive as the brand’s “LifeWear” concept gradually gained consumer understanding, expanded the customer base, and accelerated the pace of store openings, resulting in a virtuous cycle of performance growth.

GU Brand: Revenue and Profits Significantly Increase

During the reporting period, the GU division achieved growth in revenue and a significant increase in profits: revenue was 159.5 billion yen (a 9.6% increase year-over-year), and operating profit was 15.3 billion yen (a 17.5% increase). The popularity of mainstream trends, adequate inventory preparation, and strengthened sales contributed to strong sales of heavyweight sweatshirts, HEAT PADDED coats, cargo pants, and wide-leg jeans, resulting in an increase in comparable store sales net revenue. Additionally, improvements in production efficiency and cost ratios, as well as an improved gross margin, led to a 0.6 percentage point increase in the operating profit margin year-over-year.

Global Brand Division: Revenue Declines, Operating Loss Recorded

During the reporting period, the Global Brand division’s revenue was 69.4 billion yen (a 1.2% decrease year-over-year), and it recorded an operating loss of 1.7 billion yen (compared to an operating profit of 0.1 billion yen in the same period last year). The Theory brand saw strong sales in Japan and Asia, leading to revenue growth, but increased personnel costs due to higher salary levels and an increase in sales, general, and administrative expenses as a percentage of revenue led to a decline in operating profit. The PLST brand underwent business restructuring, resulting in approximately 60% fewer stores year-over-year, leading to decreased revenue and a slight operating loss, which was in line with the previous fiscal year’s level. The French brand Comptoir des Cotonniers also underwent business restructuring, with approximately 10% fewer stores year-over-year. A lack of inventory in key winter products made it difficult to attract customers, leading to a decline in revenue and maintaining the operating loss at the same level as the previous year.

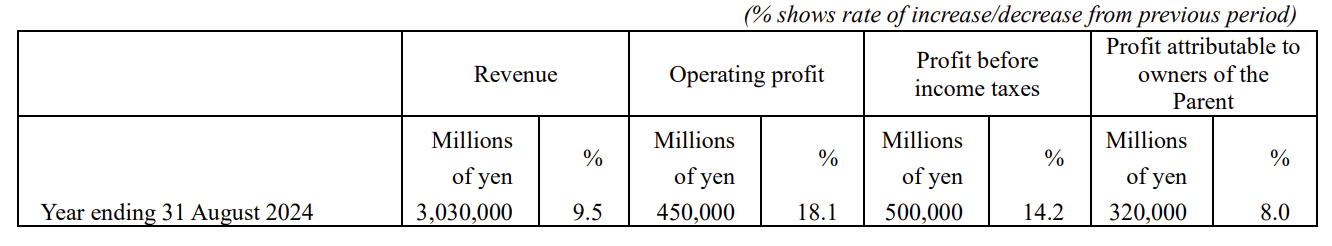

Looking ahead to the full year of fiscal 2024, Fast Retailing has revised its total annual revenue forecast downward by 20 billion yen to 3.03 trillion yen due to lower-than-expected revenue in the first half of the fiscal year, a 9.5% increase over the previous fiscal year. The forecast for consolidated operating profit remains unchanged from the previous projection, expected to reach 450 billion yen, a year-over-year increase of 18.1%. Net profit attributable to the parent company is revised upward by 10 billion yen to 320 billion yen, an 8.0% increase year-over-year, and is expected to achieve a record high performance.

By Division:

- It is anticipated that the overseas UNIQLO division will see significant increases in both revenue and profits in the second half and the entire fiscal year, particularly in the Southeast Asian, Indian, and Australian markets, as well as in North America and Europe, continuing to drive overall group growth. Additionally, for the second half and the entire fiscal year, the Greater China market is expected to experience revenue growth and a slight increase in profits. The Korean market is also projected to achieve growth in both revenue and profits.

- For the Japanese UNIQLO division, revenue growth is expected in the second half of the fiscal year, and, thanks to slight improvements in gross margin and the ratio of sales, general, and administrative expenses to revenue, a significant increase in operating profits is also anticipated; for the entire fiscal year, a slight increase in revenue and a significant increase in profits are expected.

- The GU division is expected to achieve revenue growth and a significant increase in operating profits in both the second half and the entire fiscal year. The Global Brand division is also expected to see a slight increase in revenue and to turn a profit in terms of operating profit in both the second half and the entire fiscal year.

In this regard, the group forecasts a dividend per share of 350 yen for the fiscal year 2024 (including an interim dividend of 175 yen and a final dividend of 175 yen), an increase of 20 yen from the previous guidance and an increase of 60 yen from fiscal year 2023.

Attached: Fast Retailing’s Consolidated Financial Results for the First Half of Fiscal Year 2024, as of February 29, 2024.

| Source: Fast Retailing official website and the original financial report.

| Image Credit: Fast Retailing official website.

| Editor: Wang Jiaqi