On November 14 this year, due to objections from the U.S. Federal Trade Commission (FTC), the $8.5 billion merger agreement between U.S. affordable luxury group Tapestry (brands: Coach, Kate Spade, Stuart Weitzman) and U.S. luxury group Capri (brands: Michael Kors, Versace, Jimmy Choo) was unexpectedly terminated. The deal, which included Capri’s $6.8 billion equity valuation and $1.7 billion in net debt, had been agreed upon 16 months earlier and was poised to be the largest post-pandemic acquisition in the luxury sector.

As of yesterday, Capri announced that it had enlisted investment banks to find buyers for its Versace and Jimmy Choo brands. The company intends to focus on its core affordable luxury brand, Michael Kors.

The decision to sell comes amid Capri’s plummeting performance and stock price following the deal’s collapse. Capri’s market capitalization has dropped to $2.6 billion, over 60% lower than its $6.8 billion equity valuation at the time of the deal announcement. Shockingly, Capri’s current market value is less than the amounts it paid to acquire Jimmy Choo in 2017 ($1.35 billion) and Versace in 2018 (€1.83 billion, approximately $2.1 billion at the time).

In contrast, Tapestry’s stock price has risen since the merger was canceled. Combined with better-than-expected performance this year, its market value has surged to nearly $15 billion, nearly doubling since the merger announcement.

This article by Luxe.CO delves into the financial performance and capital strategies behind the widening market cap gap between Tapestry and Capri.

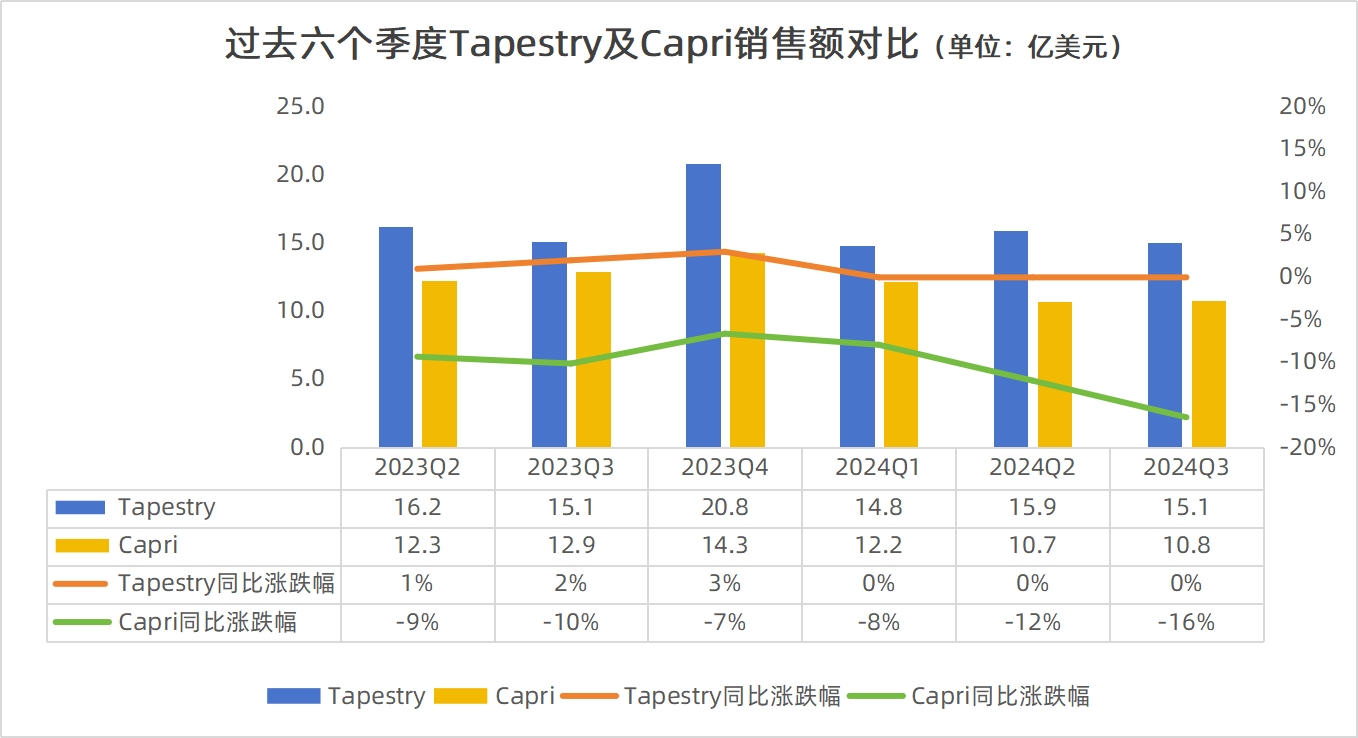

Note: Because Tapestry’s fiscal year-end dates (typically June) and Capri’s (typically March) differ, the financial data in this article have been consolidated based on the natural calendar year. It covers six quarters, from Q2 2023 to Q3 2024, with all growth rates calculated at constant exchange rates.

Sales Performance: Diverging Trends at Group and Brand Levels

Group-Level Performance

- Tapestry: Over the past six quarters, Tapestry’s sales growth ranged from 0%-3% year-on-year. This steady growth is notable given the global luxury market’s slowdown.

- Capri: In contrast, Capri’s sales have continuously declined, with drops in the high single digits to low double digits. The past two quarters saw sharper declines of 12% and 16%.

Capri’s management acknowledged their disappointing performance, attributing it to a lack of long-term planning during the merger process and underwhelming results from efforts to reposition and increase prices for Michael Kors and Versace.

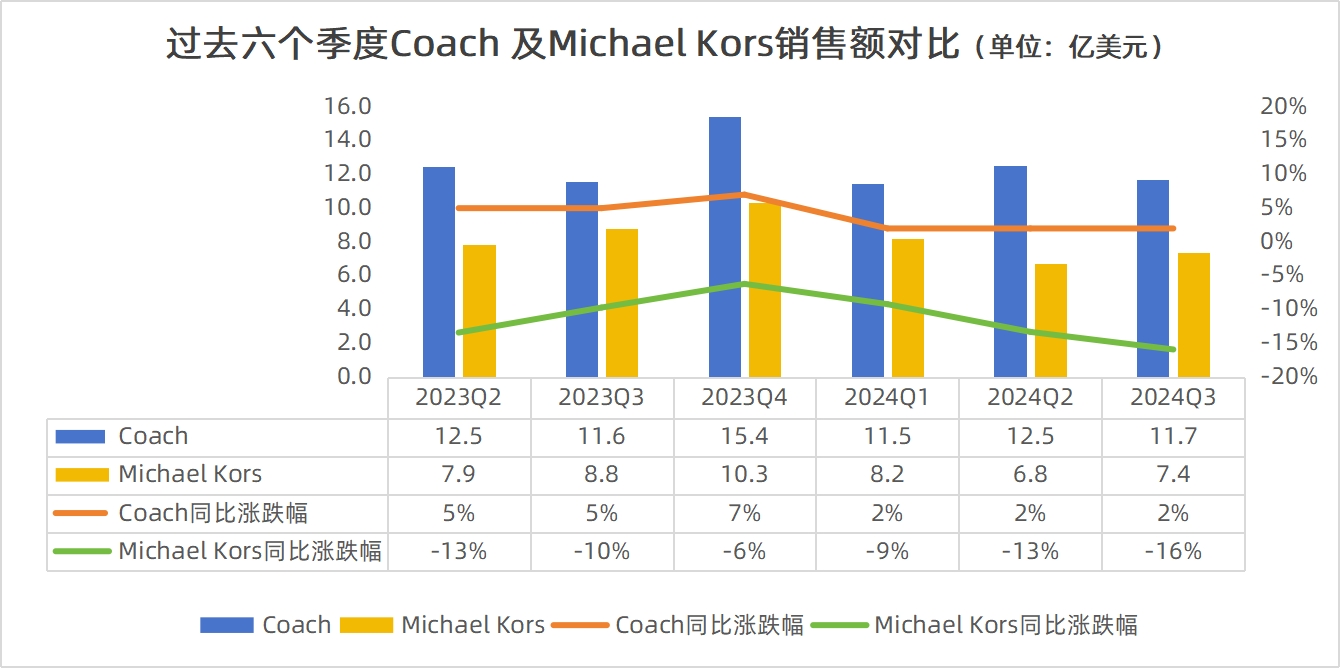

Brand-Level Performance

- Coach: Sales grew modestly over the past six quarters, demonstrating the resilience of affordable luxury amid an industry downturn.

- Michael Kors: Sales consistently declined, with drops ranging from high single digits to mid-double digits, and the pace of decline accelerated in the past two quarters.

The performance gap between Coach and Michael Kors is widening. In the last 12 months, Coach’s sales surpassed $5.1 billion, while Michael Kors fell to $3.27 billion, creating a nearly $2 billion gap. Before the pandemic, Michael Kors slightly outperformed Coach with a $300 million sales advantage.

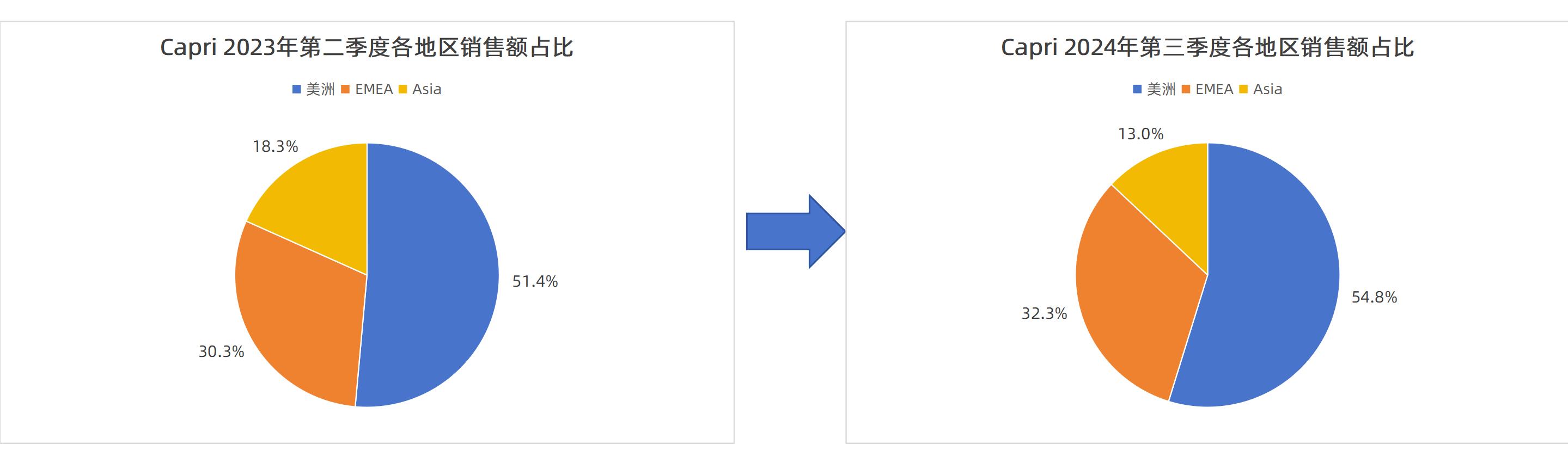

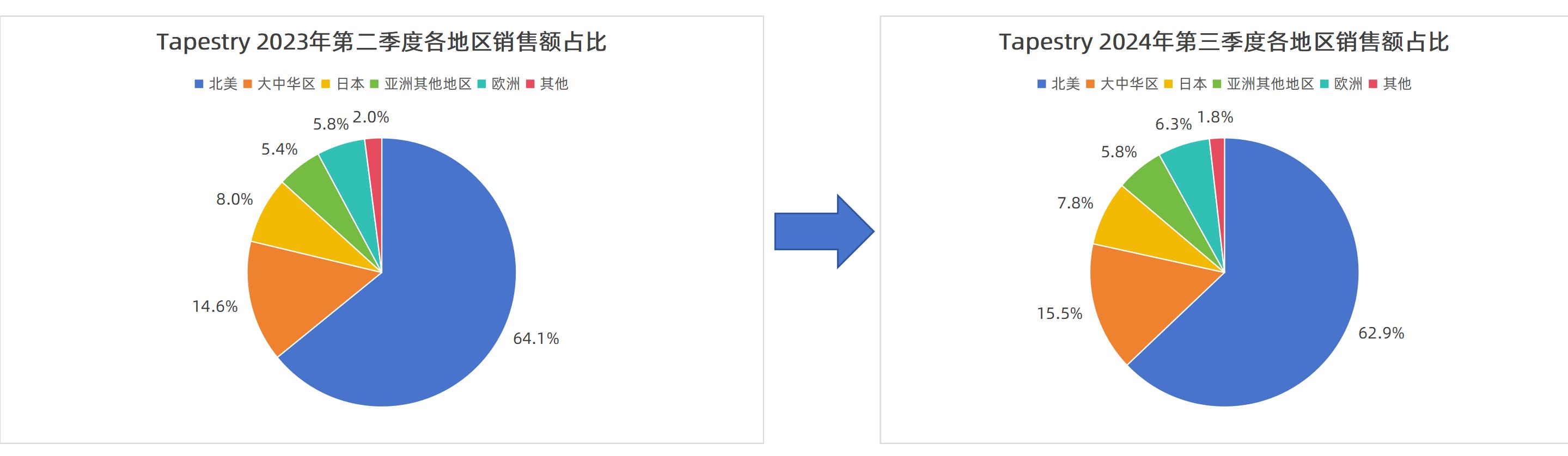

Regional Performance

- Tapestry: Sales distribution across regions remained stable over six quarters. North America’s share slightly decreased, while Greater China and Europe saw growth, indicating stronger international market performance.

- Capri: Asia’s share dropped by 5.3 percentage points, while the Americas and EMEA gained. This reflects weaker performance in Asian markets, including Greater China, compared to the U.S. and Europe.

Profitability: Tapestry Gains Ground, Capri Struggles to Break Even

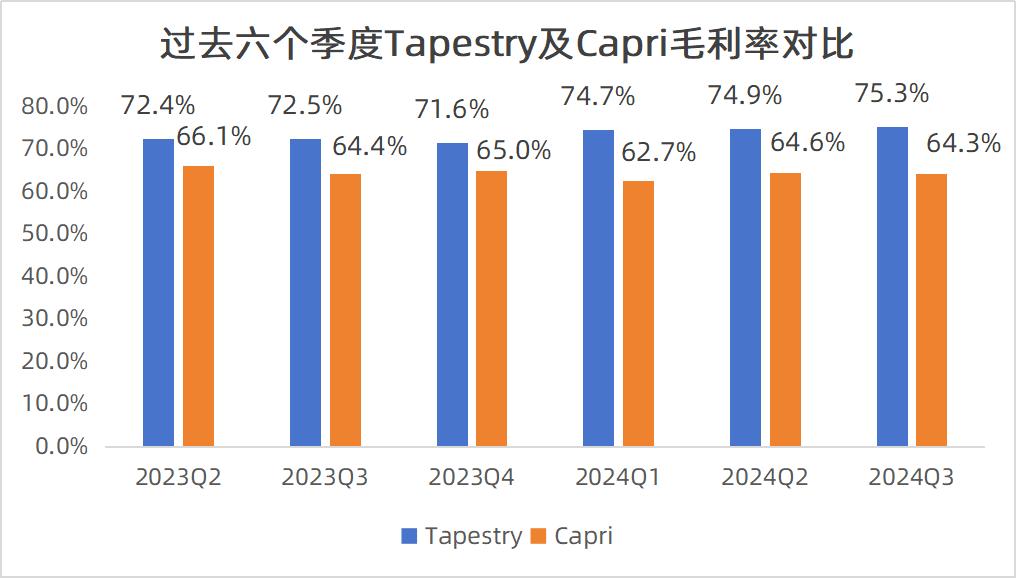

Gross Margin

- Tapestry: Improved from 72.4% to 75.3% over the six quarters, consistently outperforming Capri.

- Capri: Declined from 66.1% to 64.3%.

- The gap between the two groups widened from 6.3% to 11%.

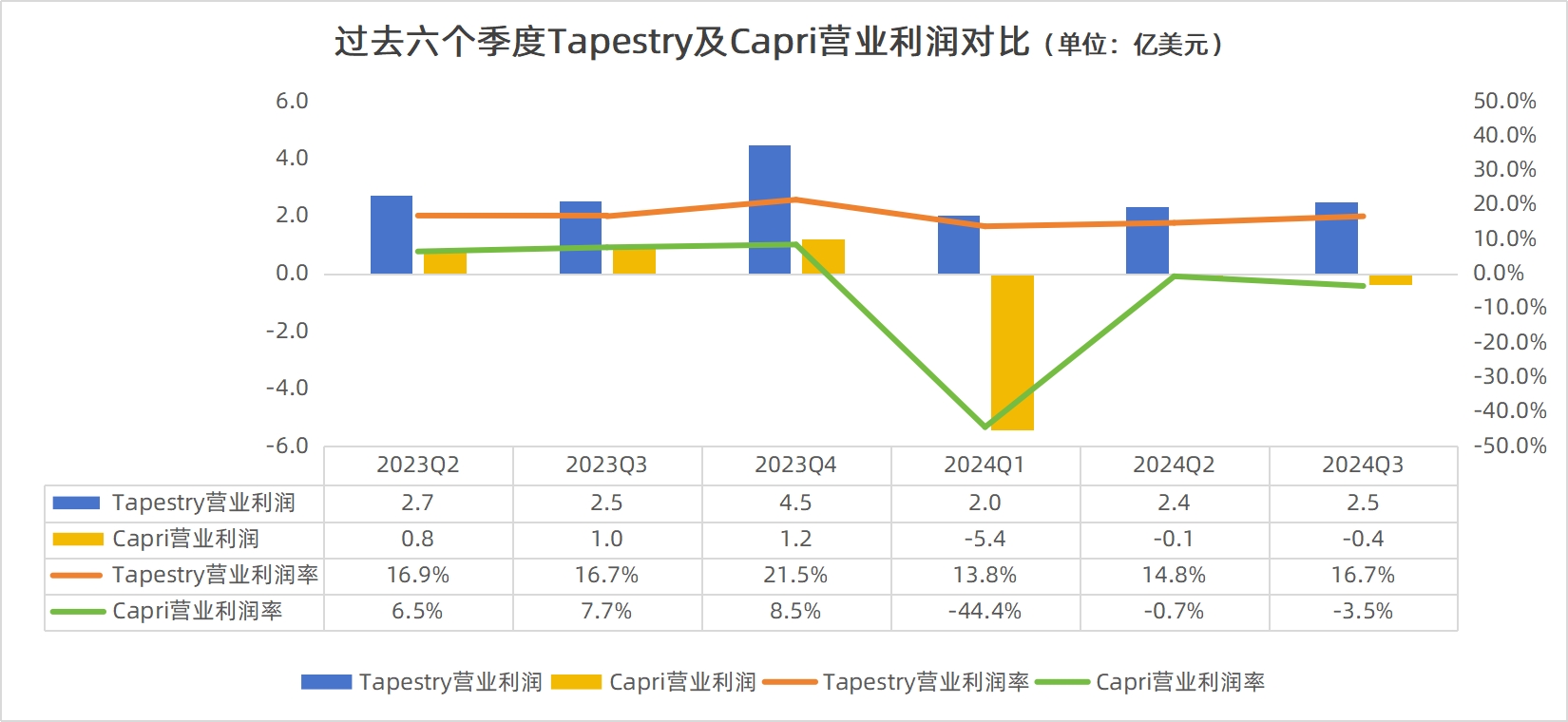

Operating Profit

- Tapestry: Maintained profitability, with operating margins in the mid-double digits.

- Capri: Entered a loss position in Q1 2024, reporting a $540 million operating loss and a -44.4% margin, largely due to $549 million in impairment charges for Jimmy Choo goodwill, Versace and Jimmy Choo intangible assets, and certain lease rights. Excluding these charges, Capri would have posted a modest $6 million operating profit, with a 0.5% margin.

Capital Structure: Impact of the Acquisition on Tapestry’s Balance Sheet

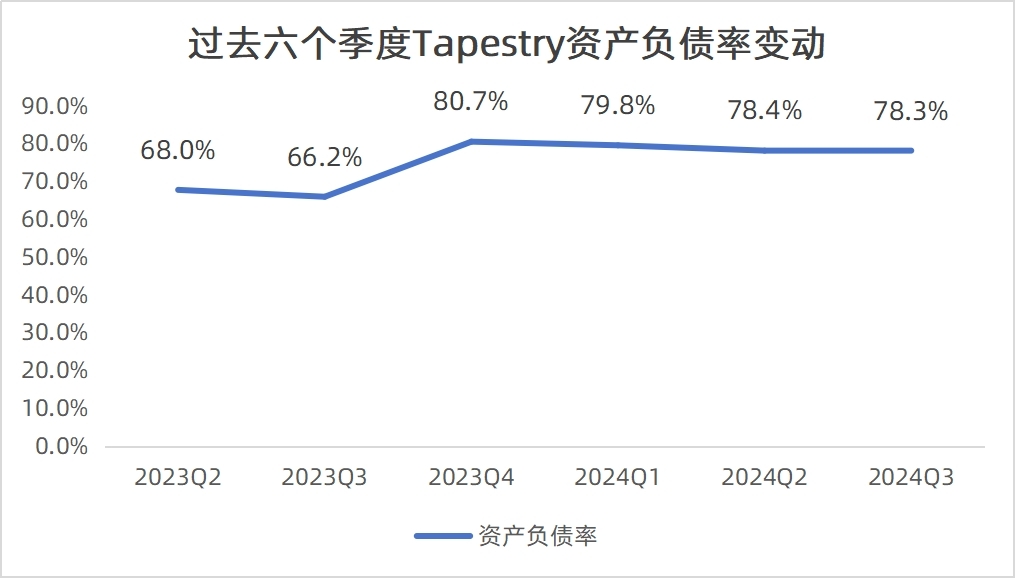

To finance the acquisition of Capri, Tapestry issued $4.5 billion in senior unsecured USD bonds and €1.5 billion in senior unsecured EUR bonds on November 27, 2023. The bonds have maturities ranging from 2 to 10 years.

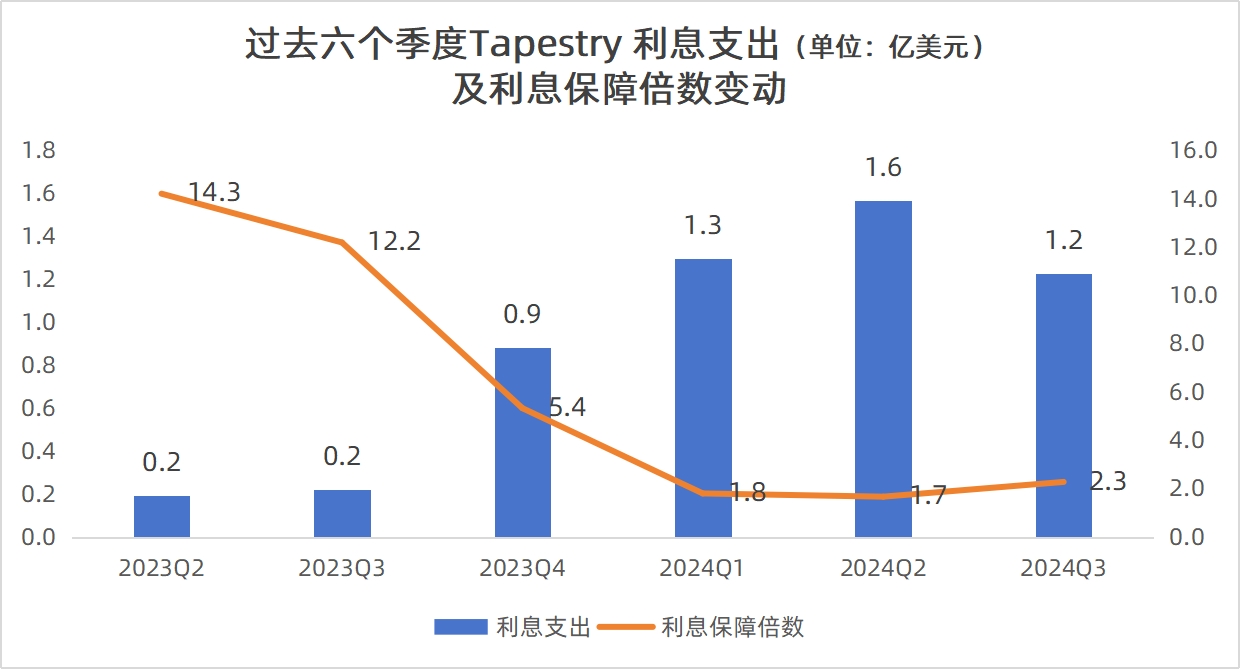

As a result, Tapestry’s debt-to-equity ratio surged from 66.2% in Q4 2023 to 80.7% and currently stands at 78.3%. Its quarterly interest expenses also rose significantly, from $22 million in early 2023 to $89 million, with over $100 million in quarterly interest payments still required.

The increase in debt caused Tapestry’s Interest Coverage Ratio to drop from 12.2 in Q4 2023 to 5.4, and further to approximately 2.

*The Interest Coverage Ratio, calculated as EBIT divided by interest expenses, measures a company’s ability to meet its interest obligations. Ratios above 3, or at least not lower than 2, are generally considered ideal.

Behind the Acquisition and Share Buybacks: Shareholder Value as the Driver

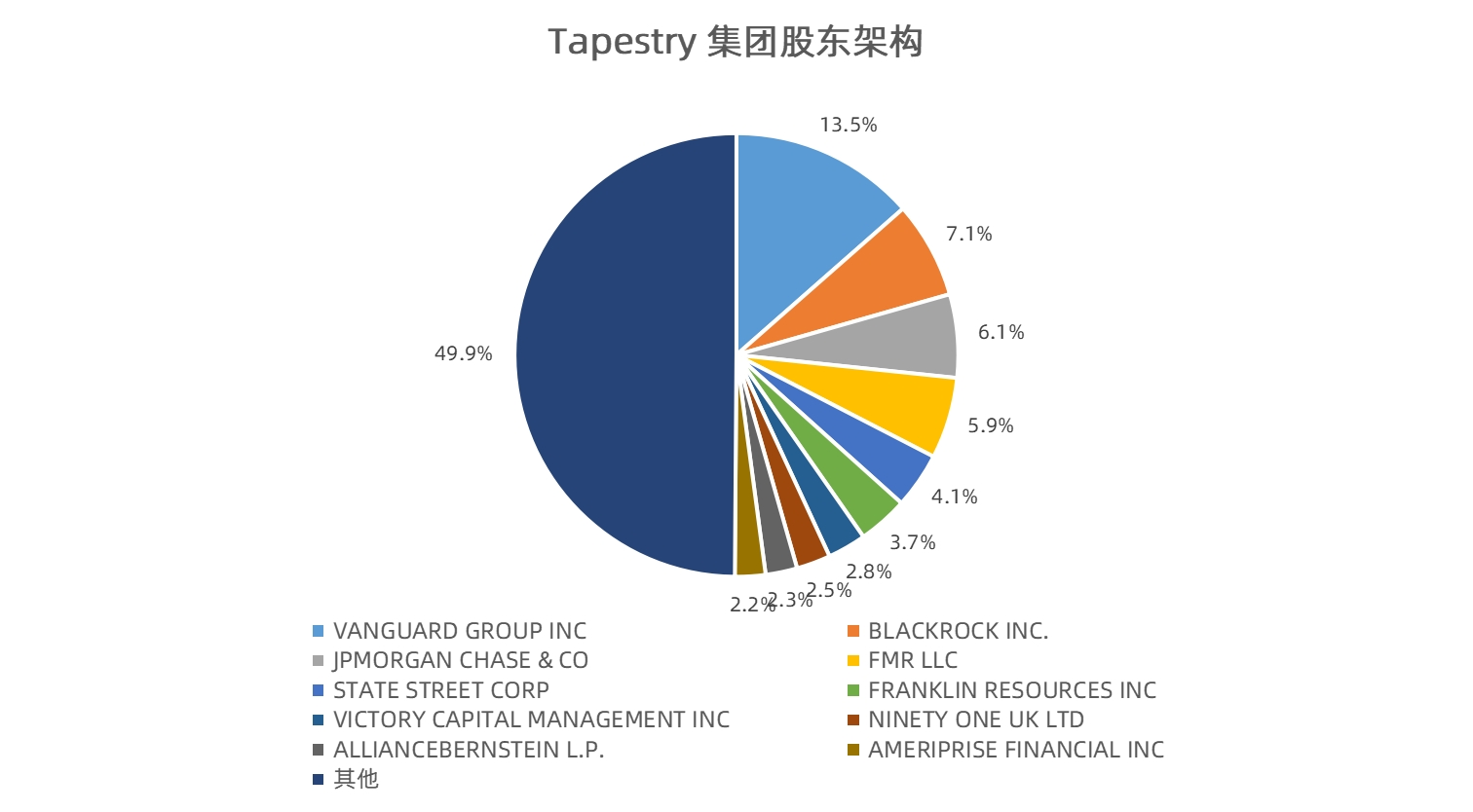

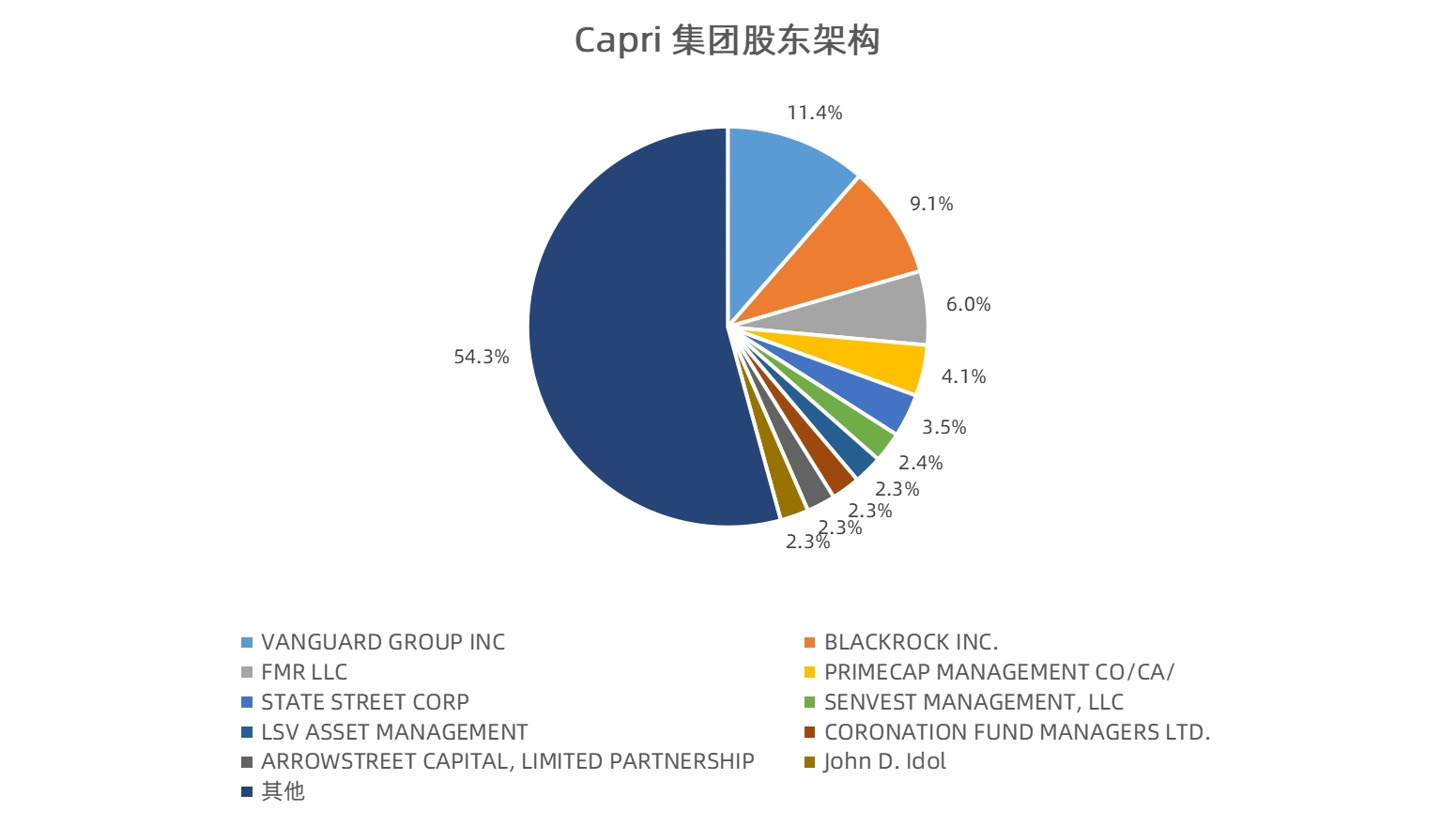

Luxe.CO’s analysis of shareholder structures for Tapestry and Capri reveals significant overlap between the two companies’ major institutional investors. Key asset management firms such as Vanguard Group, State Street Corp, BlackRock Inc., and FMR LLC were common stakeholders prior to the merger announcement.

It is reasonable to infer that these institutional investors originally intended to achieve higher returns on capital by facilitating the merger and optimizing operations post-acquisition. With the merger now terminated, both Tapestry and Capri are pursuing alternative strategies to enhance shareholder value, including stock buybacks and brand asset sales.

In mid-November, alongside the merger cancellation announcement, Tapestry’s board approved an additional $2 billion stock repurchase plan, part of which will be executed through an accelerated share repurchase program (ASR). Together with $800 million in previously approved but unused debt, the company now has $2.8 billion available for stock buybacks in fiscal 2025 and beyond.

To further optimize its debt structure, Tapestry announced in December the issuance of $750 million in 5.1% senior unsecured notes due 2030, and $750 million in 5.5% senior unsecured notes due 2035. The proceeds from these notes, along with cash reserves, will partially repay borrowings under its revolving credit facility, which were used to fund the ASR program.

At the same time, Capri is reportedly working with Barclays to explore potential buyers for its Versace and Jimmy Choo brands, signaling a strategic shift to prioritize its core Michael Kors brand.

| Data Source: NASDAQ, as of June 30, 2023

| Information Sources: Group annual reports, transaction announcements

| Image Credit: Official company websites

| Editor: LeZhi