Japanese sports equipment manufacturer YONEX has released its financial results for the first half of fiscal year 2026, ending September 30. Net sales rose 18.8% year-on-year to JPY 79.532 billion (approx. USD 526 million), operating profit grew 15.0% to JPY 8.847 billion (approx. USD 58.5 million), and net profit attributable to the parent company increased 17.4% to JPY 6.371 billion (approx. USD 42.1 million).

Sales in Asia, excluding Japan, jumped 26.2% year-on-year to JPY 40.931 billion (approx. USD 270.5 million), with both the Chinese Mainland and Taiwan markets showing growth.

In the earnings report, the company stated, “Demand in the sporting goods market remains favorable. To further stimulate growth, we focused on marketing initiatives and grassroots promotion, highlighting achievements in international tournaments and by Yonex athletes. Badminton demand continues its steady rise, especially in the Chinese market. In the tennis segment, Yonex’s global brand recognition has steadily increased, with notable sales growth for new racket models. Despite negative exchange rate effects from a stronger yen, consolidated net sales for the first half reached a record high.”

Due to rising procurement and production costs, as well as quality-related losses, gross profit margin declined from 45.2% to 43.9%. However, gross profit still increased, supported by the rise in net sales. Selling and administrative expenses rose 15.4% to JPY 26.028 billion (approx. USD 172 million), mainly driven by higher advertising costs from intensified global marketing efforts and increased personnel expenses aimed at strengthening brand awareness.

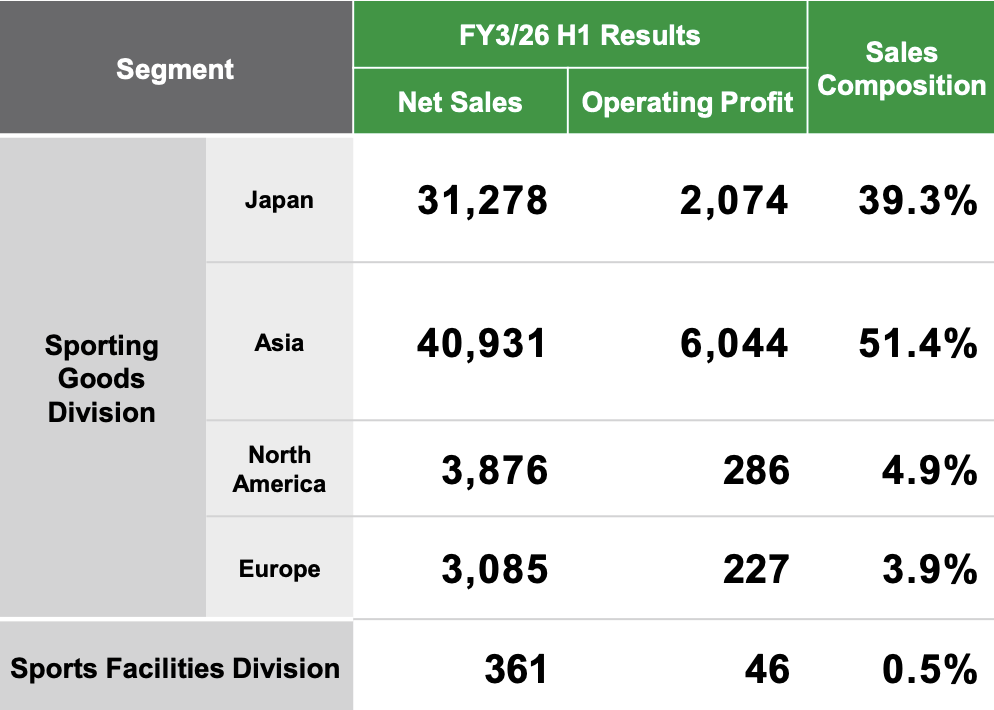

By Business Segment

Japan Market

Sales rose 11.0% year-on-year to JPY 31.278 billion (approx. USD 207 million), with operating profit up 8.0% to JPY 2.074 billion (approx. USD 13.7 million).

Badminton demand remained steady, with increased racket sales across all price points. The summer tournament season spurred greater sports participation, boosting string sales and overall revenue. In tennis, the launch of new products also supported sales growth.

Although procurement and production costs increased and quality-related losses impacted margins, gross profit grew on the back of higher sales, offsetting the rise in personnel and advertising expenses, ultimately resulting in profit growth.

Asia (Excluding Japan)

Sales surged 26.2% year-on-year to JPY 40.931 billion (approx. USD 270.5 million), while operating profit climbed 19.2% to JPY 6.044 billion (approx. USD 40 million).

In the Chinese Mainland, the badminton market continued to grow steadily. Grassroots initiatives tied to the success of the national team, coupled with a full head-to-toe product offering, drove strong sales in apparel, backpacks, and other categories.

In the tennis segment, Yonex boosted brand visibility through its role as official ball supplier for major international tournaments, contributing to category-wide growth and higher sales.

In Taiwan, a May international tournament saw strong performances from local athletes and drew a record number of spectators, sustaining high interest in badminton and driving sales growth.

Despite higher advertising and personnel expenses in the Chinese Mainland, overall sales growth boosted gross profit, which more than offset the rise in operating costs and led to an increase in profit.

North America

Sales increased 24.6% year-on-year to JPY 8.76 billion (approx. USD 58 million), but operating profit declined 13.0% to JPY 286 million (approx. USD 1.89 million).

Strong demand for the new EZONE racket series and strings drove tennis growth. In the U.S. and Canada, greater participation in badminton boosted sales of strings and shuttlecocks.

In April, Yonex launched a direct-to-consumer (DTC) e-commerce platform in the U.S. to improve product access, raise brand visibility, and promote its full head-to-toe product lineup.

While sales growth lifted gross profit, increased personnel, marketing, and DTC-related expenses drove up selling and administrative costs, ultimately reducing profit.

Europe

Sales grew 8.0% year-on-year to JPY 3.085 billion (approx. USD 20.4 million), but operating profit fell 23.3% to JPY 227 million (approx. USD 1.5 million).

In Germany, the new EZONE racket series was well-received, boosting tennis sales. An international tournament in May further enhanced brand visibility and athlete engagement, supporting continued sales growth. Badminton sales also performed well, underpinned by stable demand.

In the UK, the EZONE series supported stable tennis sales. Steady demand for rackets and strings helped boost badminton revenue.

Although sales growth led to higher gross profit, increased personnel and event-related advertising expenses raised selling and administrative costs, ultimately resulting in a profit decline.

By Product Category

- As the market continues to expand, badminton sales increased both in Japan and overseas (+20.2%).

- Tennis sales outside Japan also rose (+14.8%), with particularly strong performance in North America and Europe.

- Sales in the “Others” category climbed 20.4%, driven primarily by robust apparel and backpack sales in the Chinese market.

Backed by strong sales and a weaker yen, Yonex has revised its full-year outlook upward.

The company stated:

“In the first half, both overseas and domestic markets remained strong, supported by stable sports demand and effective marketing tied to international tournaments and the strong performances of Yonex athletes. Furthermore, the yen’s exchange rate has been lower than initially projected at the start of the fiscal year, resulting in sales and profit surpassing our May forecasts.”

For the full fiscal year ending March 2026, Yonex now forecasts:

-

Net sales to rise 17.2% year-on-year to JPY 162 billion (approx. USD 1.07 billion)

-

Operating profit to grow 14.3% to JPY 16.2 billion (approx. USD 107.2 million)

-

Net profit attributable to the parent company to increase 9.5% to JPY 11.6 billion (approx. USD 76.8 million)

Note: As at time of writing, 100 Japanese yen is approximately USD0.64

|Source: Official Earnings Report

|Image Credit: Official Earnings Report, Company Website

|Editor: LeZhi