On October 23, after the market closed, French luxury giant Kering released its financial data for the third quarter and the first nine months of fiscal year 2024, ending September 30. In the third quarter, Kering’s revenue fell by 15% year-on-year to €3.786 billion, representing a 16% drop on a comparable basis (the reported revenue change includes a 1% negative exchange rate effect and a 2% positive effect due to the consolidation of Creed). Over the first nine months of this year, Kering generated total revenue of €12.8 billion, with a 12% year-on-year decrease on both a reported and comparable basis.

On a comparable basis, the flagship brand Gucci’s revenue decline over the past three quarters has exceeded the group’s overall decline:

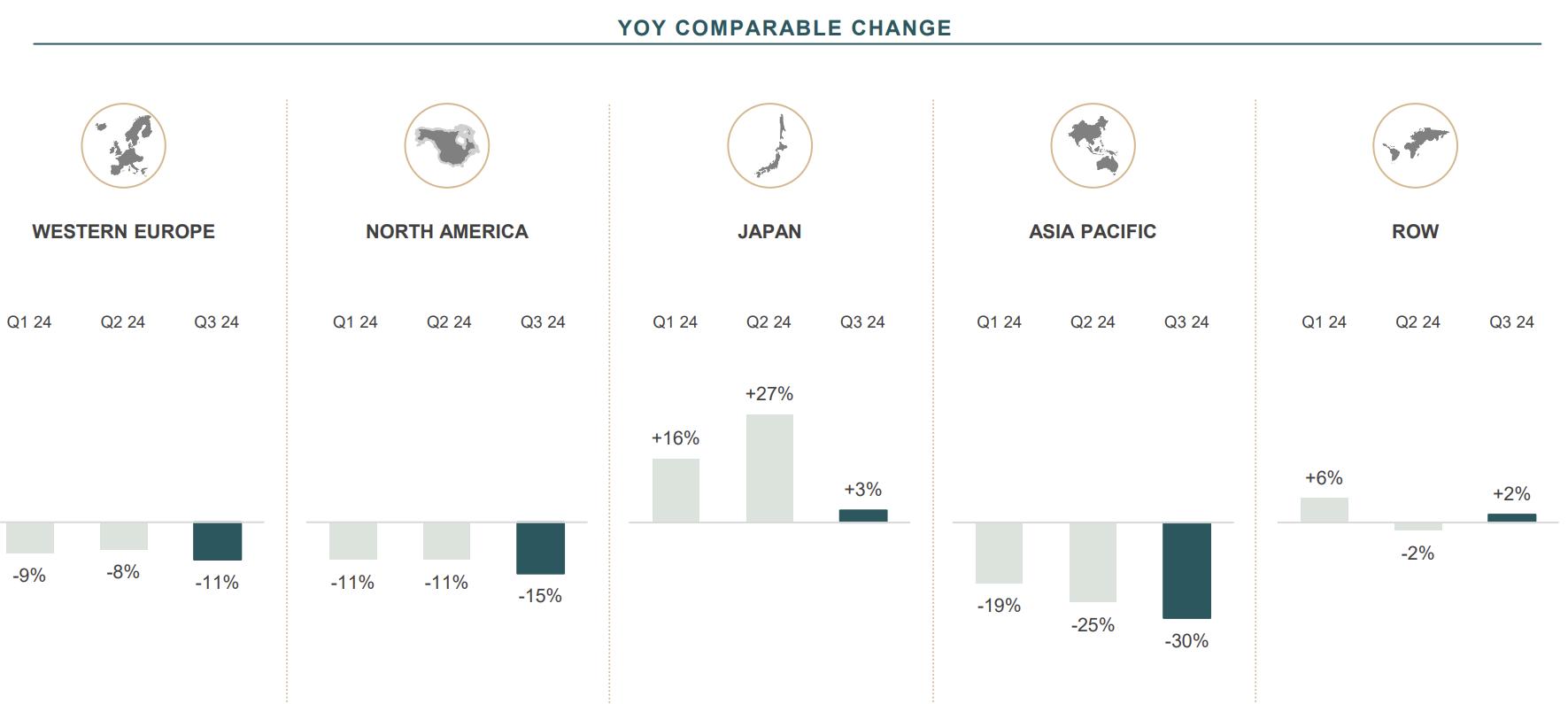

By distribution channel, in the third quarter, revenue from direct retail network sales dropped 17% year-on-year on a comparable basis, again impacted by declining store traffic. Compared to the second quarter, market trends weakened across all regions, particularly in the Asia-Pacific and Japan regions, where Japan saw a noticeable slowdown. In North America and Western Europe, performance varied across the group’s brands (details in the chart below). Revenue from wholesale and other channels fell 12% on a comparable basis.

Regarding these results, François-Henri Pinault, Chairman and CEO of Kering, stated, “With discipline and determination, we are executing a far-reaching transformation of the Group, and at Gucci in particular, at a time when the whole luxury sector faces unfavorable market conditions. This severely impacts our performances in the short term. Our absolute priority is to build the conditions for a return to sound, sustainable growth, while further tightening control over our costs and the selectivity of our investments. We have the right strategy, organization, and talents to achieve these goals.”

Looking ahead, Kering said that to achieve its long-term vision, the group will continue to invest in the development of its brands, ensuring their appeal and uniqueness continue to grow, finding the perfect balance between creative innovation and timeless classics, and maintaining the highest standards in quality, sustainability, and customer experience.

Looking ahead, Kering said that to achieve its long-term vision, the group will continue to invest in the development of its brands, ensuring their appeal and uniqueness continue to grow, finding the perfect balance between creative innovation and timeless classics, and maintaining the highest standards in quality, sustainability, and customer experience.

Amid ongoing economic and geopolitical uncertainties, Kering will continue to execute its strategy and vision, pursuing two key goals: maintaining long-term profitable growth and reinforcing its position as one of the most influential groups in the luxury sector.

Given the significant uncertainty luxury consumers may face in the coming months, and the sharper-than-expected slowdown in the third quarter, Kering expects recurring operating income for 2024 to be approximately €2.5 billion (compared to €4.746 billion last year). The group will prioritize expenditures and initiatives that support the long-term development and growth of its brands, while remaining committed to optimizing its cost structure, organizational efficiency, and return on investment.

As of 10:30 a.m. local time on October 24, Kering’s stock price had risen 1.62% from the previous day to €234.7 per share, with a current market value of approximately €29.7 billion. Over the past 12 months, Kering’s stock price has fallen by a cumulative 42.4%.

—By Brand—

Gucci

In the third quarter, Gucci’s revenue fell 26% year-on-year to €1.6 billion, down 25% on a comparable basis. By channel:

- Sales from the direct retail network declined 25% on a comparable basis, with the brand significantly impacted by market conditions, particularly in the Asia-Pacific region. The group stated that Gucci’s leather goods category is undergoing a comprehensive overhaul, with the rollout of new products towards the end of the quarter progressing smoothly.

- Wholesale revenue fell 38% on a comparable basis, reflecting Gucci’s strategic reduction of this distribution channel and challenging market conditions.

- Licensing and other revenue grew 9% on a comparable basis.

Yves Saint Laurent

In the third quarter, Yves Saint Laurent’s revenue dropped 13% year-on-year to €670 million, down 12% on a comparable basis. By channel:

- Sales from the direct retail network fell 12% on a comparable basis. However, the group noted that Yves Saint Laurent’s fashion shows continue to receive widespread acclaim, and the brand is expanding its leather goods collection, with many new products set to launch by the end of the year.

- Wholesale revenue dropped 20% on a comparable basis.

- Licensing and other revenue grew 17% on a comparable basis.

Bottega Veneta

In the third quarter, Bottega Veneta’s revenue grew 4% year-on-year to €397 million, up 5% on a comparable basis. By channel:

- Direct retail network revenue showed especially strong growth, increasing 9% on a comparable basis, largely driven by double-digit growth in North America and Western Europe. The group stated that the brand’s excellent performance continues to be fueled by the tremendous success of its leather goods collections, with its recent fashion show receiving widespread acclaim once again.

- Wholesale revenue fell 10% on a comparable basis.

Other Brands (Other Houses) Division

Other Brands (Other Houses) Division

In the third quarter, revenue from the group’s other brands dropped 15% year-on-year to €686 million, down 14% on a comparable basis. By channel:

- Due to complex market conditions, direct retail network revenue fell 10% on a comparable basis. However, the group noted that Balenciaga’s leather goods collections performed exceptionally well; Alexander McQueen has gradually introduced new collections in-store since July, and the second show under its new creative director was met with enthusiastic praise; Brioni continued to achieve growth. Furthermore, Kering’s jewelry brands showed resilience.

- Wholesale revenue for the other brands division fell 28% on a comparable basis.

Kering Eyewear and Corporate Business

In the third quarter, Kering Eyewear and corporate business revenue reached €440 million, growing 32% on a reported basis.

- Kering Eyewear’s revenue grew 4% on a comparable basis.

- In addition, the recently acquired luxury fragrance brand Creed significantly boosted growth in the Kering Beauté division.

|Source: Kering official website and financial reports

|Image Credit Kering official website

|Editor: Wang Jiaqi