On July 2, 2025, the Luxe.CO seminar titled “New Opportunities and Challenges in China’s Sports and Outdoor Market” was successfully held at the Shangri-La Hotel in Shanghai.

The event welcomed a diverse audience from private equity funds, venture capital firms, securities companies, industrial investment institutions, international sports organizations, domestic and international sports and outdoor brands, commercial real estate enterprises, e-commerce platforms, third-party operators, PR and marketing agencies, market research firms, international certification bodies, materials suppliers, sports and outdoor clubs, and industry associations.

Lively and in-depth discussions were held on a range of topics, including market trends, investment opportunities, brand building, product and technology innovation, and consumer insights in the sports and outdoor sector.

Elisa Wang, Senior Vice President of Luxe.CO and Director of Luxe.CO Intelligence gave an in-depth interpretation of the latest edition of the “Luxe.CO Sports & Outdoor Brands China Power Ranking” and shared Luxe.CO Intelligence’s most recent observations on the development of Chinese sports and outdoor brands.

Alicia Yu, Founder and CEO of Luxe.CO provided a comprehensive review of global investment trends across various sub-segments in the sports and outdoor sectors over the past five years, highlighting several representative investment cases from the past year.

Elisa Wang, Senior Vice President of Luxe.CO and Director of Luxe.CO Intelligence

Following the launch of the “Luxury Brands in China Power Ranking” in 2021, Luxe.CO introduced its first “Sports & Outdoor Brands China Power Ranking” in 2023, sharing its latest research findings on brand development and channel strategies with industry stakeholders.

The latest edition of the Luxe.CO Sports & Outdoor Brands China Power Ranking has expanded its evaluation dimensions beyond retail stores and marketing communication to include experiential scenarios, innovative design, and women-focused business.

Drawing on the ranking, Elisa Wang shared four key development trends in the sports and outdoor market: the evolution toward premiumization, the urgency of design innovation, the surge in women’s market activity, and how children’s wear is feeding back into the adult market. Based on the latest influx of international brands into the Chinese market, she also identified three trending entry categories: backpacks, cycling, and running/trail running.

Premiumization Trend

“In the commercial landscape, sports and outdoor brands are undergoing a shift toward premiumization. Leading shopping malls are now offering prime locations to high-end sports and outdoor brands. This is an irreversible trend. In the future, we will see more sports and outdoor brands co-locating and integrating into upscale commercial properties. Some leading premium brands have already entered luxury shopping malls and are aligning their VIP services with luxury standards. We look forward to more collaborations and co-creations between brands and shopping centers.”

“The professionalism of sports and outdoor brands is no longer confined to their products; it is increasingly reflected in how they convey their brand heritage and archives, including store locations and design.”

Urgency of Design Innovation

“Right now, many feel that the products of sportswear brands are becoming increasingly homogenized. As the sports and outdoor trend has gone mainstream, brands from other sectors are also pivoting toward this space, which has only reinforced the phenomenon.”

“Chinese consumers are highly open-minded and eager for new and quality offerings. In this regard, they may have even outpaced the understanding of local preferences by design teams from global headquarters in the US, Japan, or South Korea.”

Momentum in the Women’s Market

“Women are an unparalleled driving force in consumer spending. Although the sports and outdoor market has historically been male-dominated, female consumers generally have a stronger desire for self-expression and greater influence on brand traction.”

“We are seeing a number of sports and outdoor brands actively investing in R&D from a female perspective, aiming to lead in this segment.”

Children’s Wear Feeding Back into the Adult Market

“In recent years, children’s wear in the sports and outdoor sector has experienced rapid growth. Some brands have started launching adult versions simultaneously, with excellent sales performance.”

“On one hand, children’s outdoor apparel is replacing traditional kidswear brands in malls. On the other, it is also inspiring innovation in design across the broader sports and outdoor category.”

Alicia Yu, Founder and CEO of Luxe.CO

Alicia Yu, Founder and CEO of Luxe.CO, remarked, “The world will always need the ‘next’ brand. Especially in the emerging sports and outdoor sector, both established and new brands have opportunities of their own.”

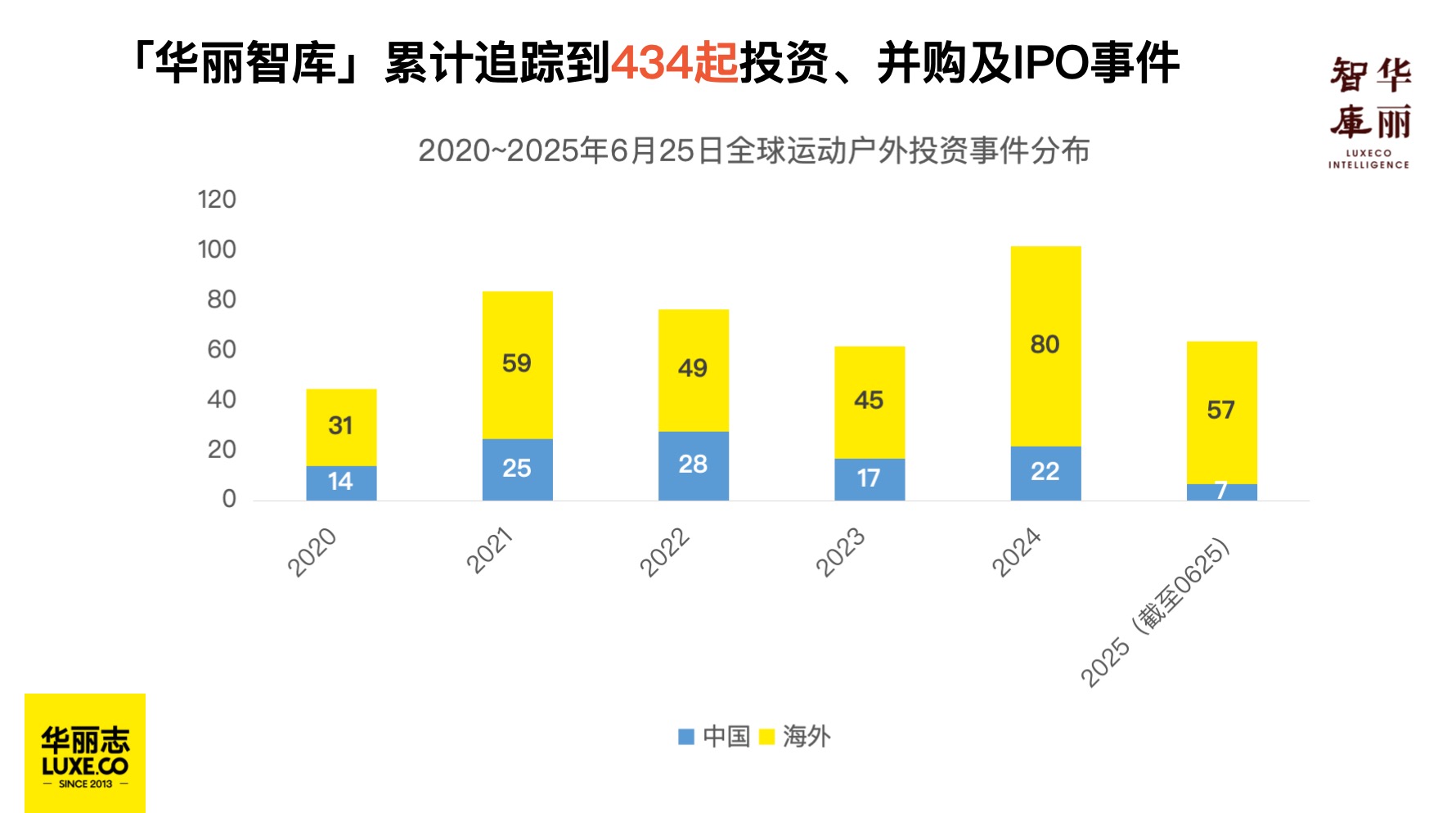

Between 2020 and June 2025, Luxe.CO Intelligence tracked a total of 434 global investment, M&A, and IPO events in the sports and outdoor sector.

From a timeline perspective, 2021 saw a mini boom following the pandemic, while 2024 hit a new peak, and 2025 is on track to surpass the previous year.

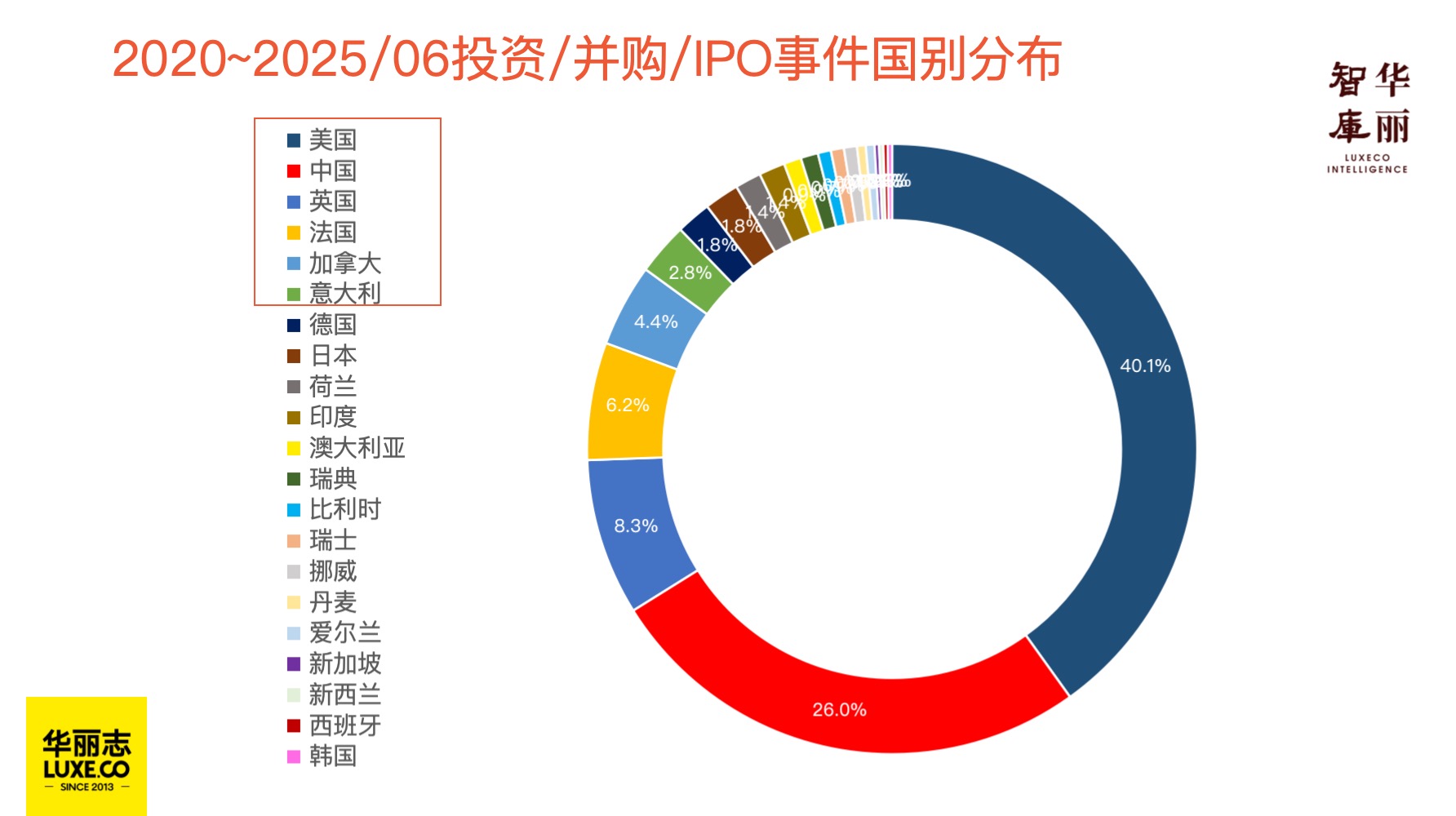

Geographically, the United States, as a major sports nation, accounted for approximately 40.1% of these cases, followed by China (26%), the UK (8.3%), France (6.2%), Canada (4.4%), and Italy (2.8%).

As for exit strategies, IPOs were extremely rare, with only four tracked in the past five years. In contrast, there were as many as 150 M&A cases. This suggests that most investments in the sports and outdoor space are still in early or growth stages and highlights the sector’s fierce competition and dynamic activity, where startups and mid-sized companies are frequently acquired and consolidated by major industry players.

In recent years, investment hotspots in the global sports and outdoor sector have continued to evolve:

-

In 2020, driven by stay-at-home demand during the pandemic, fitness equipment and service-related projects dominated;

-

After 2021, evergreen categories like sneakers and athletic footwear saw a rise, involving not just brands but also retailers and e-commerce platforms;

-

From 2022 to 2023, the outdoor sector grew increasingly popular, with niche categories like camping and cycling gaining traction among investors;

-

In 2024, cycling became the most invested sub-segment, and the long-dormant golf category also experienced a surge in investments;

-

In 2025, fitness equipment and services have bounced back from their slump to become a new hotspot for startups, innovation, and investment, particularly in Western markets.

Yu emphasized that in the sports and outdoor industry, an increasing number of high-net-worth individuals and celebrities are becoming investors driven by passion. Examples include tennis star Maria Sharapova investing in the muscle recovery brand Therabody, Oscar-winning actor Leonardo DiCaprio backing the sustainable sneaker brand LØCI, and supermodel Cindy Crawford and her family investing in and becoming strategic partners with the yoga apparel brand Vuori. As shareholders, these celebrities can more proactively leverage their networks and social media influence to speak out for the brands they support.

Moreover, many companies from other industries are also eyeing the rapidly growing sports and outdoor sector, seeking to transform across sectors through investment and acquisition.

From the perspective of supply chain and market depth, consumer enthusiasm, and startup investment activity, China is both a key driver and major beneficiary of the global sports and outdoor market. However, Europe and the United States, with their deep-rooted and widespread sports culture, remain the birthplace and innovation hubs for many sports and outdoor disciplines. We can expect to see a wave of international brands entering the Chinese market, while more Chinese companies and investors will also venture globally in search of differentiated and high-quality investment opportunities.

| Image Credit: Luxe.CO Photography

| Editor: LeZhi