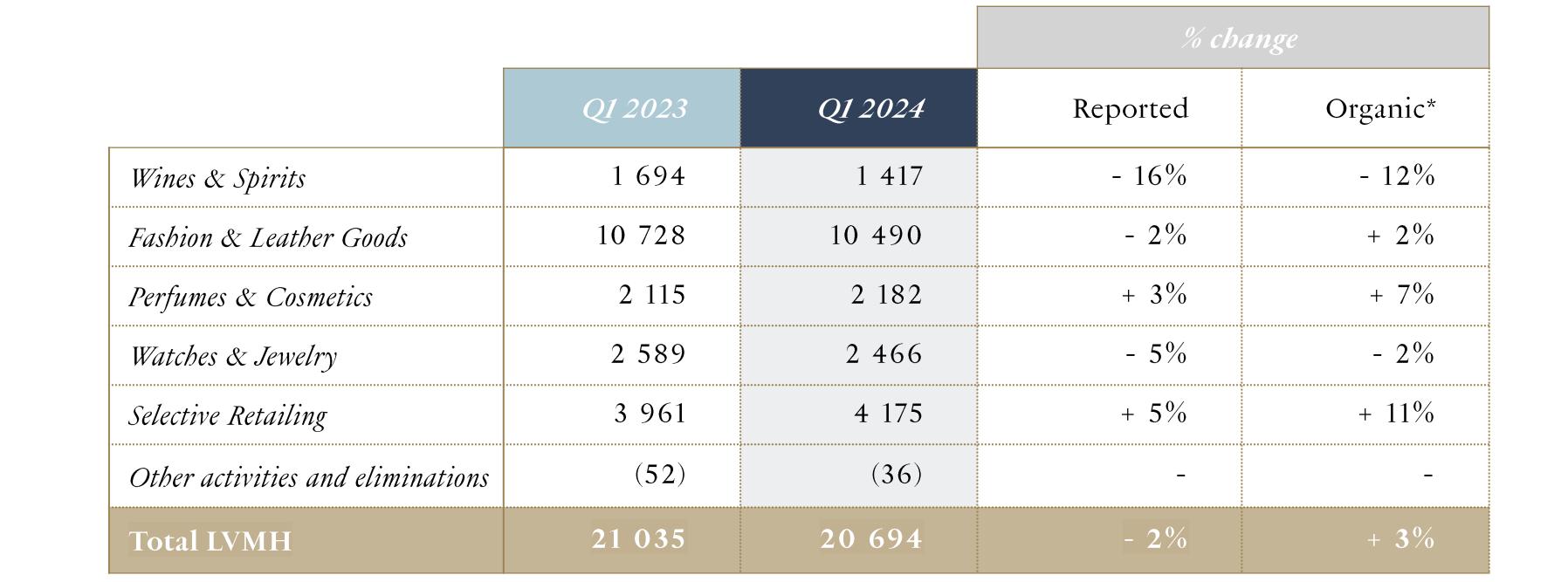

On April 16th, local time, after the close of trading, French luxury giant LVMH (Moët Hennessy Louis Vuitton) Group announced its performance for the first quarter of 2024: a 2% year-over-year decrease in sales revenue to 20.7 billion euros, with an organic growth of 3%.

“Organic basis” refers to the fixed integration scope and currency basis. For LVMH, the sale of the cruise shopping company Starboard caused structural and currency exchange changes that impacted the Group’s sales revenue by -1% and -4%, respectively.

LVMH Group stated that despite the ongoing geopolitical and economic uncertainties, LVMH had a good start to the year.

“LVMH continues to benefit from the diversity of its brands and its carefully crafted regional balance. They’ve served us well in recent years and still do in the complex and economic geopolitical environment, which continues to prevail. Finally, we will continue to invest selectively in our store network, the breadth and quality of which also proved a differentiating factor in recent years, whilst we will also endeavor to protect profitability.”

During the subsequent conference call, Rodolphe Ozun, Director of Financial Communication, stated that the organic growth achieved in the first quarter brings the Group’s average growth rate over the past five years to 10%, with the Fashion and Leather Goods sector at 16%, indicating a significant increase in market share.

Regarding the slight slowdown in revenue growth (13% organic growth in 2023, 10% in the fourth quarter), Chief Financial Officer Jean-Jacques Guiony frankly stated that compared to the high growth of the past few years, today’s “normalization” seems abnormal, but my crystal ball is in the office (there is no way to predict the future), and the connection between macro and micro in our business is extraordinarily complex.

However, Jean-Jacques Guiony expressed encouragement during the conference call that globally, the number of Chinese customers increased by 10% year-over-year.

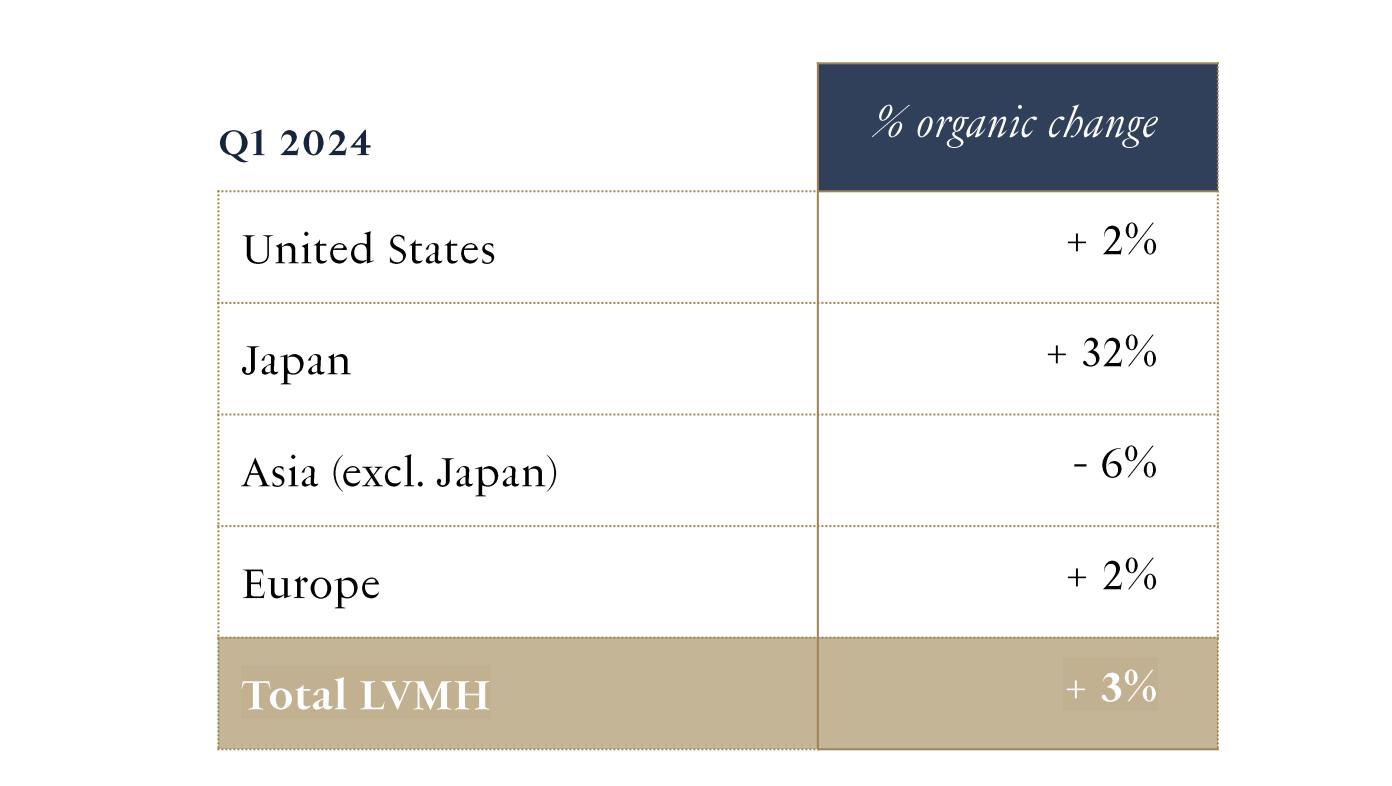

——Regional Performance——

Regionally, the Japanese market saw a significant increase in sales revenue by 32% year-over-year, raising its contribution to the Group from 7% to 9%, mainly due to Chinese consumers in the region, with Japan remaining one of the fastest-growing travel destinations for Chinese tourists. Asia (excluding Japan) experienced a 6% year-over-year decline in sales revenue, becoming the only major region to decline, with its contribution to the Group decreasing from 36% to 33%, still representing the Group’s largest market.

——Sector Performance——

——Wines and Spirits Sector

First quarter sales revenue decreased by 16% year-over-year, with a 12% decrease on an organic basis.

LVMH Group stated that the drop in champagne prices reflects the normalization of post-pandemic demand. Additionally, compared to the strong growth in the first quarter of 2023, this quarter was also affected by distributors adjusting inventory levels.

Hennessy cognac again faced cautious attitudes from retailers, further limiting orders for the brand, while the environment in the United States remains unstable.

Furthermore, the renowned rosé wine producer Château Minuty was included in the financial report for the first time, with LVMH Group announcing this acquisition in February 2023.

——Fashion and Leather Goods Sector

First quarter sales revenue decreased by 2% year-over-year, with a 2% growth on an organic basis.

Louis Vuitton had a strong start to the year, inspired by the high creativity and quality of its products. Women’s Creative Director Nicolas Ghesquière celebrated his tenth anniversary designing for Louis Vuitton at the latest women’s fashion show held in the Cour Carrée courtyard of the Louvre Palace in Paris; Men’s Creative Director Pharrell Williams showcased his new men’s collection, inspired by classic American Western wear, with his design of the Speedy P9 handbag achieving significant success.

Additionally, to highlight Louis Vuitton’s support for the 2024 Paris Olympics and its long history as a trunk maker, the brand launched a unique suitcase designed specifically to hold the 2024 Paris Olympics and Paralympics medals and torch.

Christian Dior continues to display extraordinary creative momentum. Creative Director Maria Grazia Chiuri and Men’s Creative Director Kim Jones continue to pay tribute to Dior’s iconic designs, elevating Dior’s visibility to record levels: the viewership of its 2024 Fall/Winter women’s ready-to-wear collection release show reached 3.9 billion times, while the drama series “The New Look” traced the founding and rise of the Dior brand.

Additionally, a new boutique designed by renowned architect Christian de Portzamparc opened in Geneva, marking a highlight of the quarter.

Celine, designed by Creative Director Hedi Slimane, continued to enhance the brand’s appeal with the new Arc de Triomphe series. Curated by Creative Director Jonathan Anderson, Loewe held its first major exhibition in Shanghai, China, paying homage to the brand’s Spanish heritage. Fendi expanded its Selleria leather goods series. Loro Piana again achieved excellent results across all product categories. Rimowa and Berluti had a good start to the year.

——Perfumes and Cosmetics Sector

First quarter sales revenue increased by 3% year-over-year, with a 7% growth on an organic basis, mainly driven by strong innovation momentum and selective distribution strategies.

Under the continuous success of iconic perfumes Sauvage, J’adore, and Miss Dior, Christian Dior performed exceptionally. The relaunch of Rouge Dior makeup and the Capture skincare line also contributed to the brand’s rapid growth.

Guerlain was boosted by strong demand for Aqua Allegoria perfumes, as well as the new Abeille Royale cream and Terracotta makeup. The expansion of Parfums Givenchy‘s L’Interdit promoted the development of the perfume. Maison Francis Kurkdjian achieved robust growth, especially driven by its iconic Baccarat Rouge 540. Fenty Beauty expanded its regional footprint by entering China through a partnership with Sephora.

——Watches and Jewelry Sector

First quarter sales revenue decreased by 5% year-over-year, with a 2% decrease on an organic basis.

In the jewelry sector, Tiffany continued to roll out new store concepts inspired by The Landmark (Fifth Avenue flagship store) globally and hosted the first exhibition “Culture of Creativity” at this iconic flagship store, celebrating the brand’s long-term commitment to excellence in art. Additionally, a comprehensive campaign aimed at showcasing its iconic products just launched globally and achieved tremendous success.

Bulgari continued to showcase its iconic Serpenti series and relaunched its B.zero1 series. The brand announced the appointment of Greek fashion designer Mary Katrantzou as the first creative director for its leather goods and accessories series and established the Bulgari Foundation, dedicated to protecting cultural and craft heritage and passing on Italian craftsmanship.

Chaumet unveiled the 2024 Paris Olympics and Paralympics medals crafted by the studio. Fred launched the new “Sunshine Jeweler” communication campaign.

The creative momentum in the watchmaking industry remains strong, with TAG Heuer, Hublot, and Zenith showcasing a range of innovations at the fifth LVMH Watch Week held in Miami.

——Selective Retailing Sector

First quarter sales revenue increased by 5% year-over-year, with an 11% growth on an organic basis.

Sephora achieved significant growth again, continuing to expand market share. Growth in North America, Europe, and the Middle East was particularly strong. The store network continued to expand, especially in North America.

DFS‘s business activities are still below the pre-pandemic levels of 2019, with international tourism in Europe and the flagship destinations of Hong Kong and Macau only partially recovering. Additionally, DFS recently held a signing ceremony in Sanya, with the DFS Yalong Bay project expected to open in 2026.

|Source: Official financial report, conference call

|Image Credit: Group official website

|Editor: LeZhi