On July 24, Moncler Group, the Italian luxury group, released its financial results for the first half of 2024, ending June 30. The group reported a consolidated revenue increase of 8% year-over-year to €1.2302 billion (up 11% at constant exchange rates). Key figures include:

- Moncler brand: Revenue grew by 11% to €1.0413 billion (up 15% at constant exchange rates).

- Stone Island brand: Revenue decreased by 6% to €188.9 million (down 5% at constant exchange rates).

Additionally, the group’s EBIT reached €258.7 million, compared to €217.8 million in the first half of 2023. Net profit for H1 2024 was €180.7 million, up from €145.4 million in H1 2023.

In Q2, Moncler Group’s consolidated revenue was €412.2 million, a 3% increase from Q2 2023, with the following highlights:

- Moncler brand: Revenue was €336.3 million (up 5% at constant exchange rates).

- Stone Island brand: Revenue was €75.9 million (down 4% at constant exchange rates).

Moncler S.p.A. Chairman and CEO Remo Ruffini commented, “We are very pleased with the solid set of results we delivered in the first half of the year amid a generally complex operating environment for the luxury goods sector. Both our brands enjoyed strong growth in the DTC channel across all regions and the Group reached a notable operating profit, exceeding 250 million euros. The global macroeconomic context is highly volatile and unpredictable, and industry trends are seeing a continued normalisation. This requires us to maintain a vigilant mindset, focusing on our operational flexibility and responsiveness.

At the same time, I am confident that the strategic initiatives we are driving at both Moncler and Stone Island, our deep connection with our communities, the continued pursuit of product excellence as well as our focus on high-quality and selective growth, will further strengthen our brands in the coming months and in the years ahead.”

On July 25, at 2:50 PM Milan time, Moncler Group’s share price rose by 0.4% to €54.64, with a market capitalization of €15 billion, despite a nearly 13% decline over the past 12 months.

Moncler Brand Performance

For H1 2024, Moncler brand revenue reached €1.0413 billion, a 15% increase year-over-year.

In Q2, revenue was €336.3 million, a 5% increase supported by solid DTC growth across all markets.

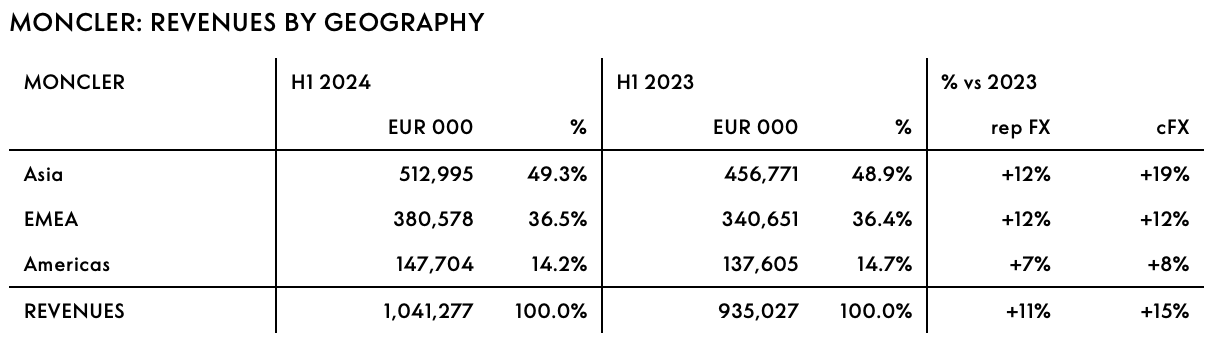

By Market:

- In Asia (which includes APAC, Japan and Korea) H1 revenues were EUR 513.0 million, up 19% cFX compared to the first half of 2023. In the second quarter, revenues in the region grew by 6% cFX YoY, driven by strong growth registered in Japan, supported mostly by tourists, as well as by the positive performance of the Chinese mainland, notwithstanding the tough comparable base and the increase in Chinese consumption abroad. Korea and the rest of APAC showed softer trends.

- EMEA recorded revenues of EUR 380.6 million in H1 2024, +12% cFX compared to H1 2023. In the second quarter, revenues in the region increased by 6% cFX YoY, supported by solid tourist purchases as well as positive local consumption. Chinese, American and Korean customers remained the strongest contributors to tourist purchases in the region.

- In the first half of 2024, revenues in the Americas increased by 8% cFX compared to H1 2023. In the second quarter revenues in the region were down 1% cFX YoY, with the positive performance registered in the DTC business offset by the decline in the wholesale channel.

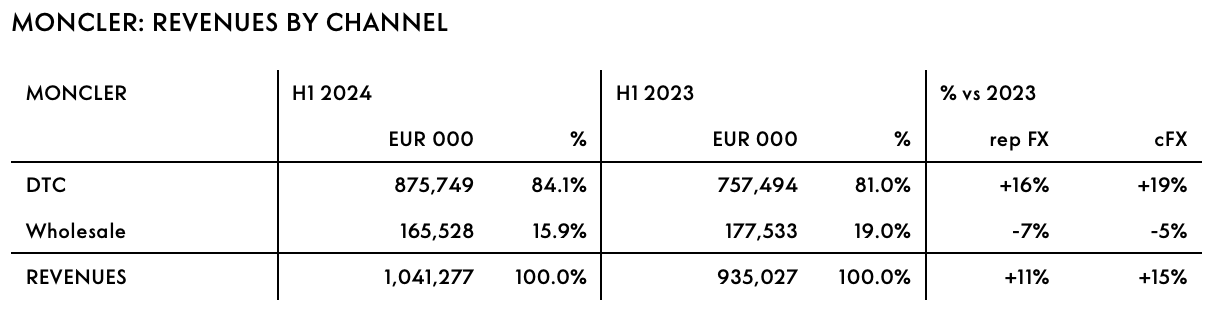

By Channel:

- In the first half of 2024, the DTC channel recorded revenues of EUR 875.7 million, up 19% cFX compared to the first half of 2023. Revenues in the second quarter of 2024 increased by 8% cFX YoY, notwithstanding a very high comparable base. All three regions recorded positive growth with EMEA outperforming largely due to the contribution from tourist consumption. The growth in the DTC channel in the second quarter was penalised by the weak performance of the direct online channel across all regions. 4 In H1 2024, revenues by stores open for at least 12 months (Comparable Store Sales Growth4) grew by 14% compared to H1 2023.

- The wholesale channel recorded revenues of EUR 165.5 million in the first half of 2024, a decline of 5% cFX compared to H1 2023. In the second quarter, revenues in this channel declined by 5% cFX YoY, mainly impacted by the ongoing efforts to upgrade the quality of the distribution network.

As of 30 June 2024, the network of Moncler mono-brand boutiques comprised 277 directly operated stores (DOS), +2 net openings compared to 31 March 2024, including the conversion of Macau Four Seasons and the opening of JiNan Mixc in China. The Moncler brand also operated 56 wholesale shopin-shops (SiS).

Stone Island Brand Performance

For H1 2024, Stone Island brand revenue reached €188.9 million, a 5% decrease year-over-year. In Q2, revenue was €75.9 million, a 4% decrease, with strong DTC growth almost offsetting the decline in wholesale channels.

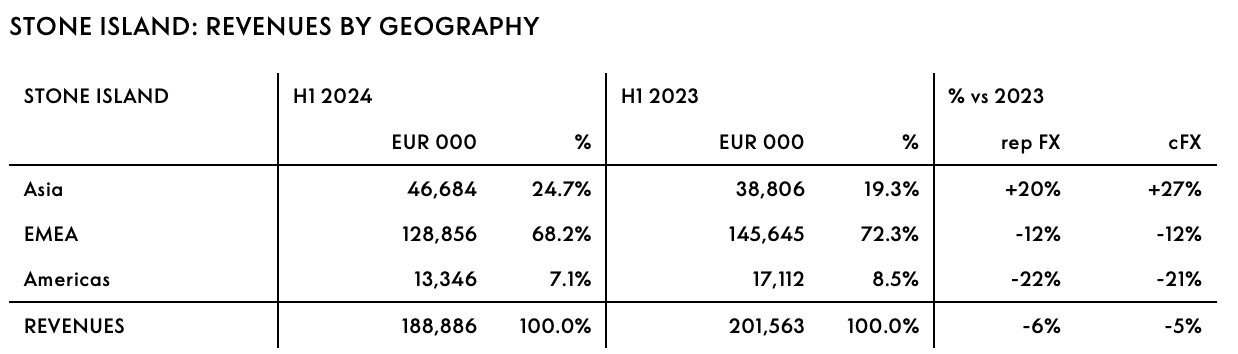

By Market:

- Asia (which includes APAC, Japan and Korea) reached EUR 46.7 million revenues in the first half of 2024, growing 27% cFX compared to H1 2023. In the second quarter, the region grew by 27% cFX, mainly driven by the strong performance of Japan and solid growth in APAC. Trends in Korea remained softer than other areas of Asia.

- In H1 2024, EMEA which continues to be the most important region for the brand, recorded revenues of EUR 128.9 million, a decrease of 12% cFX compared to H1 2023. In the second quarter, revenues were down 11% cFX YoY, with the strong double-digit performance in the DTC channel not enough to fully offset the decline in the wholesale channel.

- In the first half of 2024, revenues in the Americas region were down 21% cFX compared to the first half of 2023. In the second quarter, the region saw a decline of 15% cFX YoY. The positive performance of the DTC channel in the quarter was more than offset by the decline in the wholesale channel, which continued to be impacted by challenging trends mostly among department stores, as well as by the ongoing efforts in upgrading the quality of this channel.

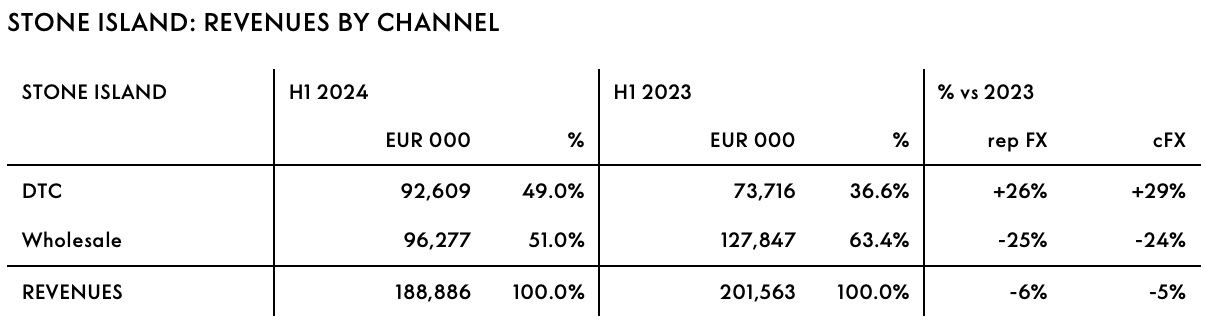

By Channel:

- In the first six months of 2024, the DTC channel revenues reached EUR 92.6 million, +29% cFX compared to H1 2023, representing 49% of total H1 2024 revenues. In the second quarter, revenues in this channel were up 27% cFX YoY, thanks to a positive contribution from all regions, with Asia and EMEA outperforming. In the first half of 2024, the wholesale channel recorded revenues of EUR 96.3 million, down 24% cFX compared to H1 2023.

- In the second quarter, revenues declined by 28% YoY, impacted by challenging 6 market trends in this channel and the strict volume control adopted to continuously improve the quality of the network.

As of 30 June 2024, the network of Stone Island mono-brand stores comprised 85 directly operated stores (DOS), a net increase of 2 units compared to 31 March 2024, including the opening of Vienna Kohlmarkt. The Stone Island brand also operated 13 mono-brand wholesale stores.

Outlook

Moncler Group noted the complex and volatile global macroeconomic environment, with the luxury sector normalizing. The group remains cautious, focusing on operational flexibility and responsiveness while continuing to invest in its organization and people to ensure sustainable growth. Key strategic initiatives include:

- STRENGTHENING OF ALL MONCLER BRAND DIMENSIONS ALL YEAR AROUND. During 2024 Moncler will further reinforce the three dimensions of the brand (Moncler Collection, Moncler Grenoble and Moncler Genius) through distinctive events and focused marketing strategies. With a new extraordinary event in Shanghai in October, Moncler Genius will continue to evolve as a co-creation and re-creation platform, playing a role of brand recruiter, based on the involvement of new talents who will embrace new forms of creativity between design, entertainment, music and sport going well beyond fashion. Moncler Collection will see the celebration in a contemporary approach of other iconic styles that have built the brand’s legacy to date through relevant collections and concepts all year around. Moncler Grenoble, the dimension of the brand closest to its mountain DNA, post the extraordinary brand experience held in February 2024 in St. Moritz, will continue to strengthen its awareness, with dedicated marketing initiatives and a wider and more complete performance-oriented collection suitable for all the seasons of the year, always mixing high technical content and style.

- DEVELOPMENT OF THE NEXT CHAPTER FOR STONE ISLAND LEVERAGING THE BRAND’S SOLID FOUNDATIONS. 2024 marked the beginning of Stone Island’s next chapter of evolution, which was officially opened in January 2024 during the Milan Fashion Week by revealing the new global advertising campaign and presenting the new brand manifesto called “The Compass Inside”. The brand will continue powering the momentum built in recent months through a highly articulated marketing and communication plan with activations scheduled for every month of the year. The new communication and brand strategy will further support Stone Island in continuing its evolution to drive worldwide resonance and strengthen its unique positioning, which has its own identity and value matrix rooted in the culture of research and experimentation. The brand will continue its international development and the progressive upgrade of its distribution network, implementing a very selective strategy in the wholesale channel, while further strengthening the DTC one, both physical and online. The planned internalisation of the brand e-commerce platform will be instrumental in unlocking the full potential of the online channel and of the brand’s omnichannel strategy.

- SUSTAINABLE AND RESPONSIBLE GROWTH. Moncler Group believes in a sustainable and responsible development according to shared values that are reflective of stakeholder expectations and consistent with the Group’s long-term strategy. An approach based on the commitment to set increasingly ambitious goals as well as on the awareness that every action has an impact on the society and the environment in which we operate. In 2024 Moncler remains committed to implement the actions and projects necessary to pursue the sustainability objectives published in the 2020-2025 Plan. The five strategic priorities of the Sustainability Plan are: climate change and biodiversity, circular economy and innovation, responsible supply chain, enhancement of diversity and support for local communities.

Notably, on March 28, Moncler Group acquired the remaining 5.06% of Moncler Japan from its Japanese shareholder Yagi Tsusho Ltd for €9.3 million, now fully owning Moncler Japan through its subsidiary Industries S.p.A.

| Source: Moncler Group official website and financial reports

| Image: Moncler Group official website

|Editor: Wang Jiaqi