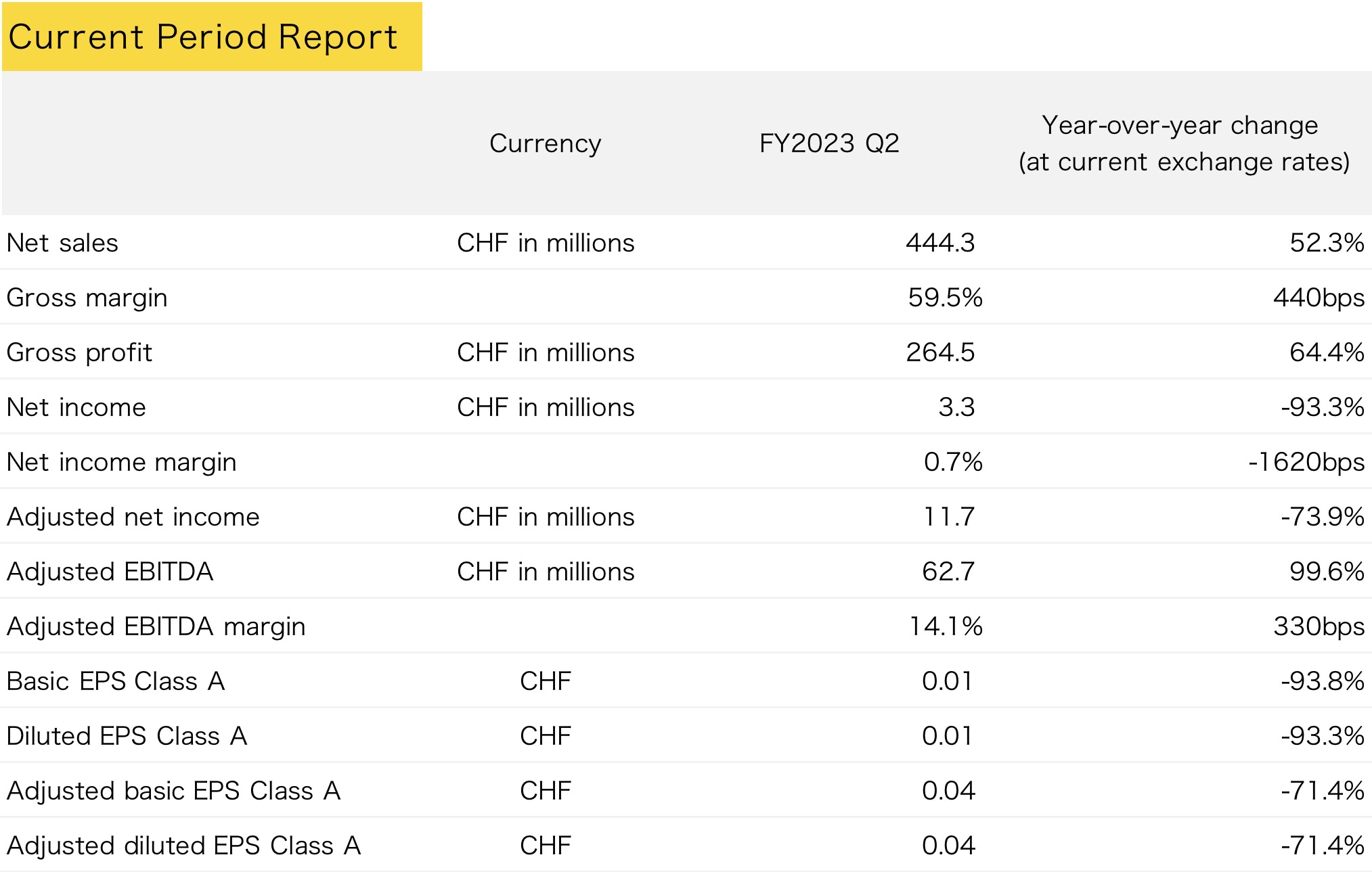

On August 15th, Swiss sportswear brand On announced its financial data for the second quarter of the fiscal year 2023, ending on June 30th. On achieved a record-breaking sixth consecutive quarter of revenue growth, surging by 52.3% to 444.3 million Swiss Francs.

- By channel: Net sales through the Direct-to-Consumer (DTC) sales channel increased by 54.7%, reaching 163.5 million Swiss Francs (approximately 186.18 million US Dollars); net sales through the wholesale channel grew by 51.0%, reaching 280.8 million Swiss Francs.

- By region: Net sales in Europe, Middle East, and Africa (EMEA) increased by 28.9% year-over-year to 113.6 million Swiss Francs; net sales in the Americas grew by 59.8% to 296.6 million Swiss Francs; net sales in the Asia-Pacific region surged by 90.2% to 34.1 million Swiss Francs.

- By category: Net sales of footwear rose by 52.6% to 428.2 million Swiss Francs; net sales of apparel increased by 45.9% to 13.4 million Swiss Francs; net sales of accessories grew by 45.4% to 2.7 million Swiss Francs.

Specifically, the second quarter’s revenue amounted to 444.3 million Swiss Francs, surpassing the analyst average expectation of 418 million Swiss Francs. As of August 15th, On’s stock price had risen by 73.48% year-to-date, far outpacing competitors like Nike and Puma. However, analysts anticipate that this might also bring pressure to On, with investors closely monitoring its sustained strong growth to validate its stock performance.

With On’s expanding lineup of footwear and increasing supply from retailers like Dick’s Sporting Goods Inc., the brand continues to experience rapid growth in the United States. This growth contributes to On’s market share gain from larger competitors such as Adidas, Nike, and Puma.

Martin Hoffmann, Co-CEO and CFO of On, noted the strong momentum from retailers like Dick’s and Foot Locker Inc. in the US. He mentioned, “Dick’s has 800 stores, of which we are present in just over 50. So, (On still) has a tremendous untapped market potential.”

In the second quarter of fiscal year 2023, On reported that driven by demand from high-end consumers, net sales through the DTC channel grew by 54.7%, outpacing the wholesale channel. With DTC share rising to 36.8% and strong full-price sales support, On achieved a robust gross margin of 59.5% in the second quarter, compared to 55.1% in the same period last year.

On continues to combine strong growth with increasing profitability. This quarter, On achieved a net profit of 3.3 million Swiss Francs, and adjusted EBITDA reached 62.7 million Swiss Francs, nearly doubling the 31.4 million Swiss Francs from the same period last year.

During this quarter, On continues to offer innovative and differentiated products, showcasing top-tier performance across road, track, trail, and court. In recent months, On’s tennis athlete Iga Świątek won the French Open Women’s Singles Championship, and On’s track and field athletes have stood on the podium 24 times in their respective events, further enhancing On’s recognition in the sports arena.

Hoffmann expressed, “The very strong first six months of the year and now six consecutive record quarters is a testament to the incredible work and dedication our team continues to showcase every day. The strength of the On brand and continued exceptional growth is visible across channels, regions and products. We are thrilled that we are visibly progressing further on our strategy and ambition to win credibility and market share in the performance space. In particular, we are extremely pleased with the feedback on our Cloudboom Echo 3, which was more broadly launched in Q2 and is our fastest long-distance running shoe yet.”

On’s Co-Founder and Co-Chairman David Allemann said, “We are coming closer to our two-year anniversary since our IPO. Our life as a public company has been an incredible continuation of our journey, marked by significant progress and huge achievements. Our product innovation engine has delivered six all-new performance shoes within the 24-month period, as we continue to take market share in the specialty run channel. We have opened the door for future regional growth and category expansion, while also improving our operational backbone. After a great first half of 2023, we are excited and energized for the second half of the year, starting with the upcoming World Athletics Championships in Budapest, where numerous On athletes will be participating.”

Based on the achievements of the first half of the year, the exciting product lineup, sustained strong momentum into the beginning of the third quarter, and continuous positive feedback from wholesale and retail partners, On has once again raised its financial guidance for the fiscal year ending December 31, 2023. The annual net sales are projected to grow by at least 44% year-on-year to 1.76 billion Swiss Francs, indicating a growth rate of nearly 30% for the second half of the year. At fixed exchange rates, the growth rate for the second half of the year is projected to be 44%.

Additionally, On maintains its previous expectations for gross margin and adjusted EBITDA profit margin at 58.5% and 15.0%, respectively. On also believes that if the US dollar remains weak against the Swiss Franc and no significant offsetting currency movements occur, the gross margin could exceed 58.5%. The strong gross margin of 58.9% in the first half of the year and the anticipation of sustained high full-price sales in the remaining time of the year further support this expectation.

However, analysts initially expected On to revise its revenue forecast to 1.78 billion Swiss Francs. Due to the updated performance guidance falling short of expectations, On’s stock price fell by 13.98% on the New York Stock Exchange, leading to a market capitalization of less than 10 billion US Dollars. Hoffmann noted that the desire for strong growth is still present in the guidance, but it has been negatively impacted by foreign exchange factors.

Over the past 12 months, the Swiss Franc has appreciated by 7.9% against the US Dollar. Economists anticipate that the Swiss National Bank will make its final interest rate hike in September, providing support to the currency. The Swiss Franc to Euro exchange rate is also near historic highs. The strength of the Swiss Franc will likely undermine On’s sales in the United States, Europe, and other regions later this year.

As of the close on August 15th, On Holdings AG’s stock price on the New York Stock Exchange dropped by 13.98% to $29.77 per share, resulting in a new market capitalization of $9.448 billion. The stock has experienced a 73.48% increase in value year-to-date.

|Source: On’s official website and official financial report, Bloomberg

|Image Credit: On’s official website

|Editor: Wang Jiaqi