On August 1, Italian luxury group Salvatore Ferragamo Group (Milan Euronext: SFER) released its H1 and Q2 report for the fiscal year ending June 30, 2024: total revenue decreased by 12.8% year-over-year to €523 million, a 10.9% decline at constant exchange rates. In Q2, weakened by the Asian market and wholesale environment, total revenue fell by 8.1% year-over-year to €296 million (down 6.0% at constant exchange rates).

Salvatore Ferragamo CEO and General Manager Marco Gobbetti commented, “The second quarter showed again some of the encouraging underlying operating trends that we started to see earlier in the year. Retail primary full-price sales showed a positive trend in the US, Europe, Japan and Latin America; our refreshed shoes and handbags offerings have been attracting new, younger customers, contributing to shift a higher proportion of purchases to younger demographics. In the media, the increased brand desirability was confirmed once again by the excellent resonance of our Fall-Winter 2024 Collection.”

“Despite these positive operating trends, our aggregate financial results in the second quarter were significantly impacted by the challenging consumer environment, especially in Asia Pacific, which offset the positive trends in the rest of the world. We have also continued to experience weakness in the wholesale channel, exacerbated by a more selective distribution strategy.” “In a general context of ongoing demand slowdown, we will continue to focus on top-line performance and profitability, expanding our audience and boosting engagement through a refreshed product offer, a full funnel marketing approach, an enriched customer experience with tailored CRM initiatives and a new store concept.”

As of August 2, the day after the earnings report, the group’s stock price rose by 1.56% from the previous trading day, with a market value of approximately €1.344 billion.

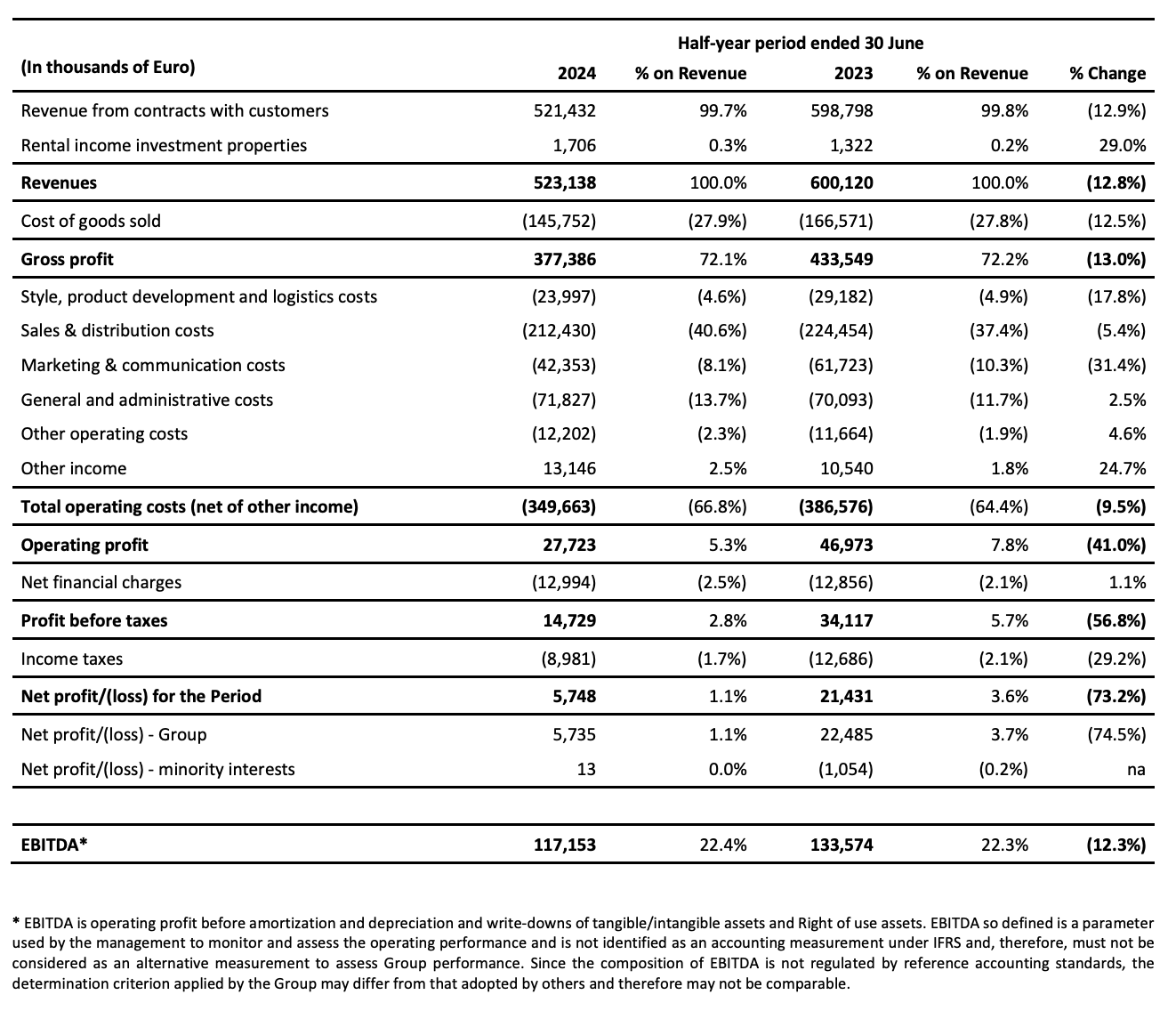

As of June 30, 2024, Salvatore Ferragamo Group’s key financial data for the first half of the fiscal year are as follows:

Gross margin remained flat year-over-year, thanks to a positive channel mix offsetting the negative exchange rate impact.

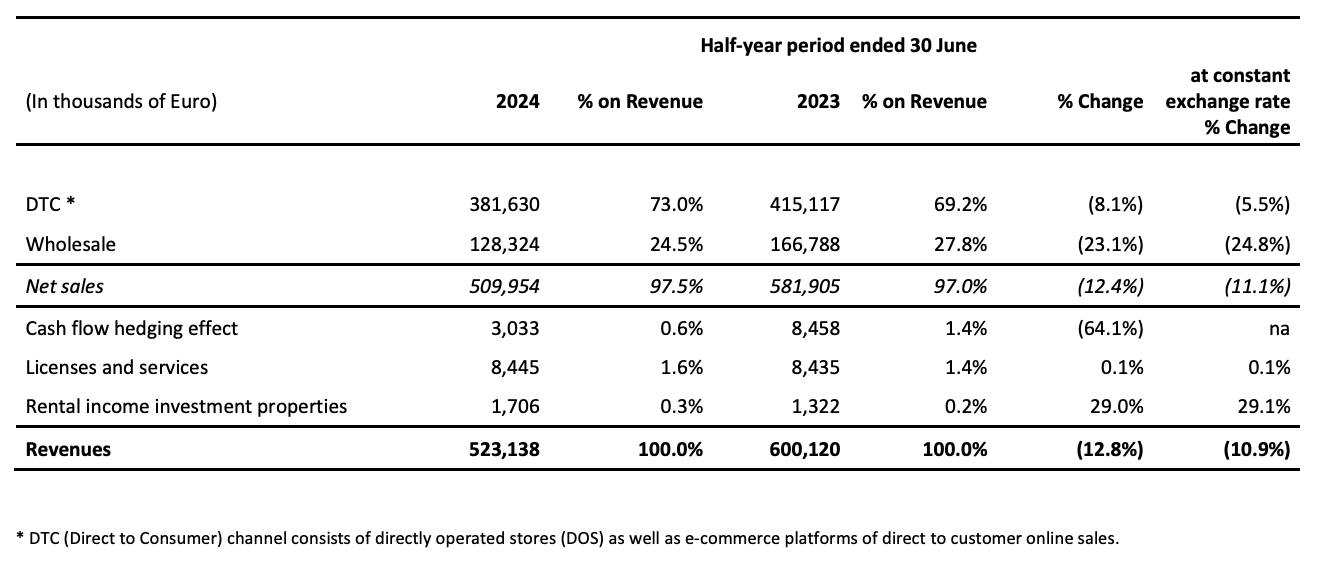

By Channel:

*Note: Direct-to-consumer (DTC) channels include Salvatore Ferragamo Group’s directly managed single-brand stores (DOS), directly managed online stores, and other e-commerce platforms through which the group sells products directly to customers.

- DTC: Q2 net sales decreased by 3.8% at constant exchange rates and by 5.5% at current exchange rates year-over-year. Europe and Japan performed well compared to Q2 2023, while North America was flat year-over-year, and Asia-Pacific weakness offset these gains. Full-price sales in primary channels were excellent, led by the top 50 stores, whereas discount channels underperformed, reflecting lower markdown inventory.

- Wholesale: Q2 net sales decreased by 12.1% at constant exchange rates and by 8.7% at current exchange rates year-over-year, reflecting a weak overall environment.

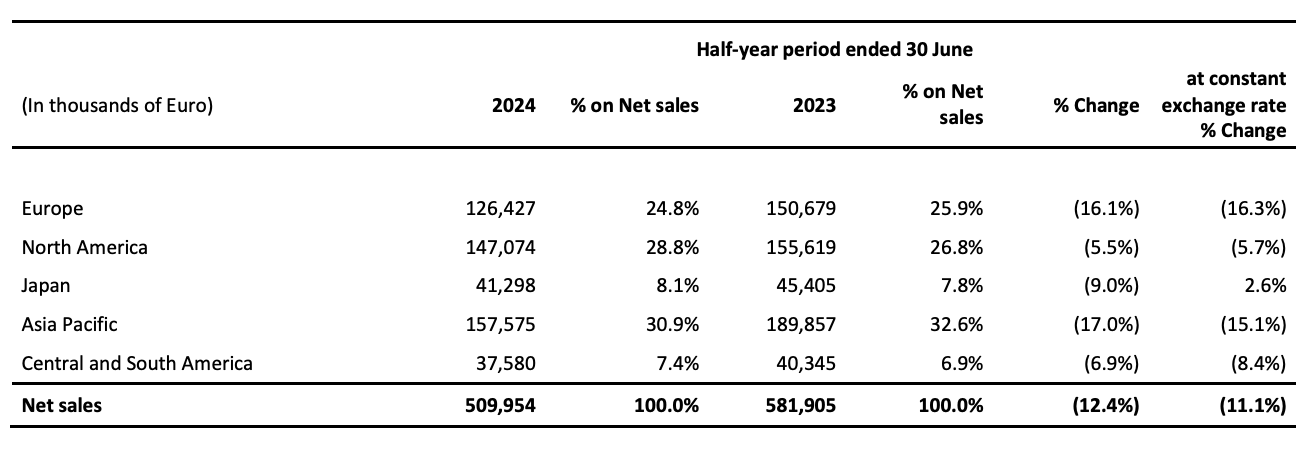

By Market:

- EMEA (Europe, Middle East, and Africa): Q2 net sales decreased by 2.9% at constant exchange rates and by 2.7% at current exchange rates year-over-year due to wholesale. DTC channels outperformed the previous year, growing by 5.4% at constant exchange rates, while wholesale channels declined by 11.3% at constant exchange rates due to a weak overall environment.

- North America: Q2 sales in this region fell by 3.2% at constant exchange rates and by 1.4% at current exchange rates year-over-year due to poor wholesale performance, while DTC was flat at constant exchange rates year-over-year.

- Latin America: Q2 net sales decreased by 6.1% at constant exchange rates and by 5.4% at current exchange rates year-over-year. DTC grew by 2.4% at constant exchange rates, while wholesale showed negative growth.

- Asia-Pacific: Q2 net sales decreased by 14.9% at current and constant exchange rates year-over-year. Improvement in the Chinese Mainland market (Q2 net sales down 3.9% at constant exchange rates, compared to a 21.1% decline in Q1) was offset by weakness in other Asian countries.

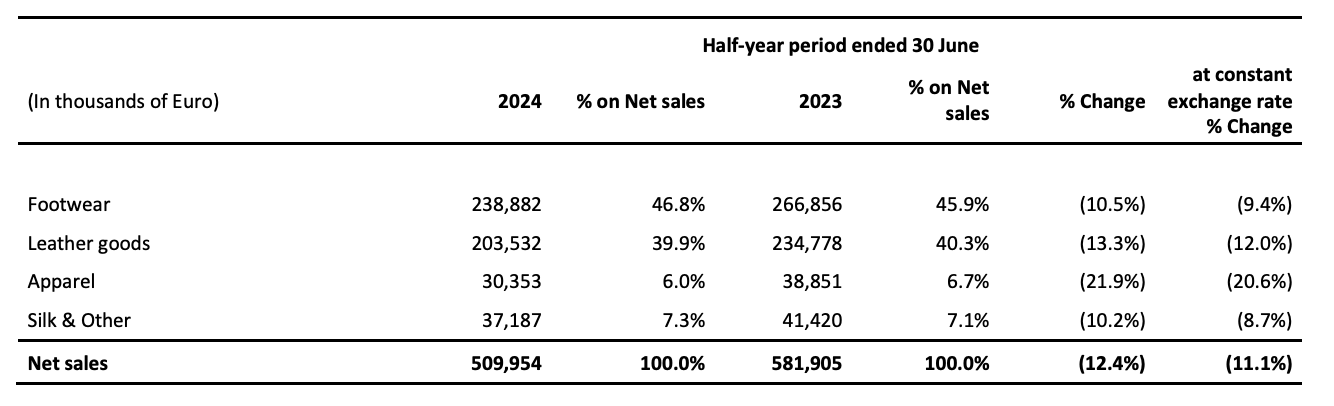

By Category:

| Source: Official Financial Report

| Image Credit: Group Website

| Editor: Liu Jun