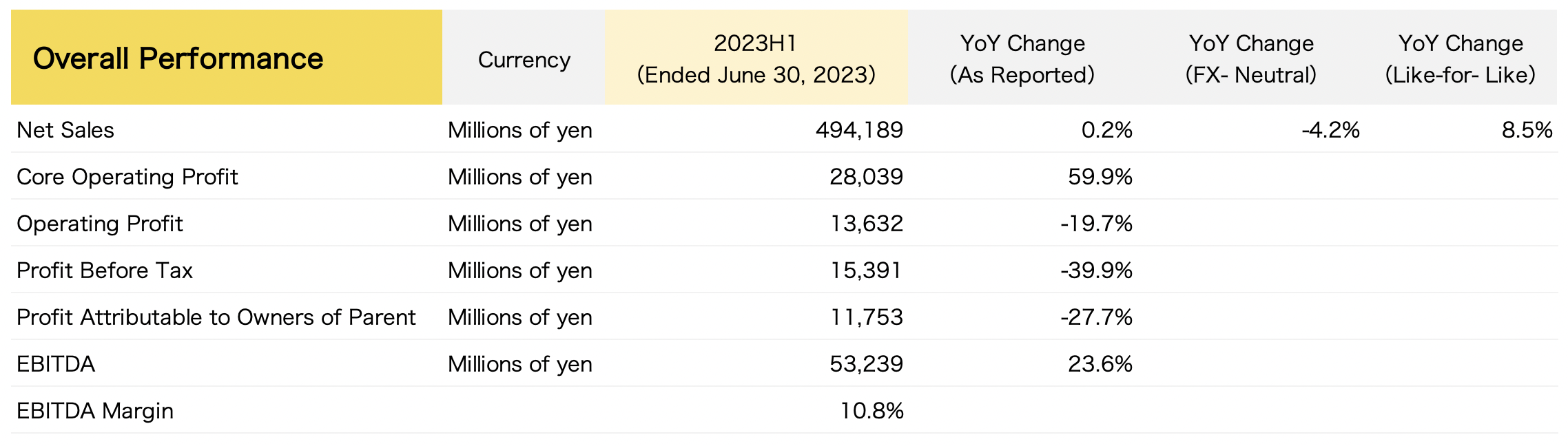

On August 8th, Japanese beauty giant Shiseido Company Limited announced its key performance data for the first half of the fiscal year ending on June 30, 2023. Net sales increased by 0.2% year-on-year to ¥494.2 billion, showing a 4.2% decrease when excluding the impact of exchange rates, and an 8.5% increase on a comparable basis after excluding the effects of business transfers.

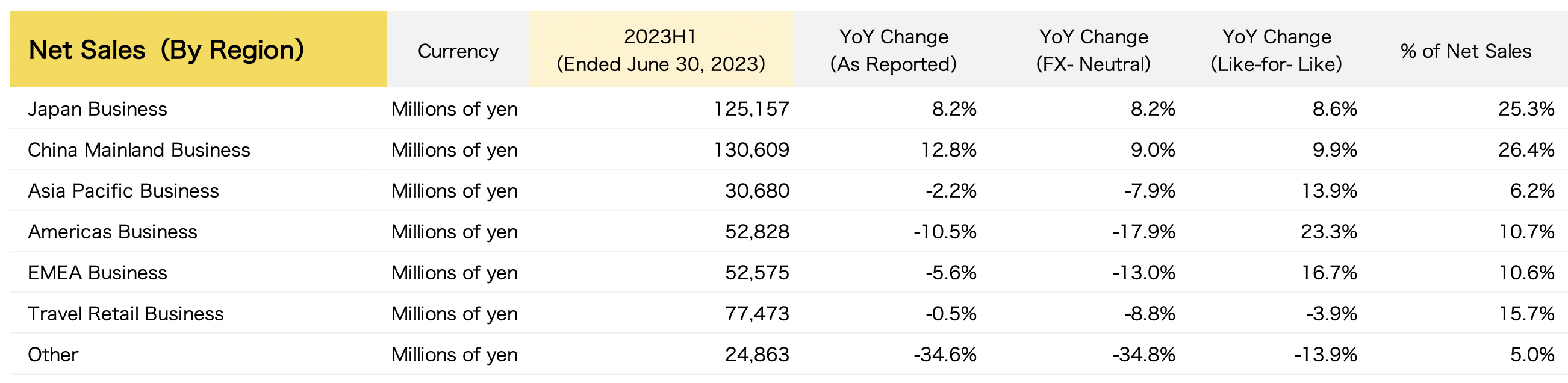

Regarding the performance in the mainland China market, the group stated that despite the challenges faced at the beginning of the year, the mainland China market rebounded in February and demonstrated stable growth throughout the first six months. Net sales increased by 12.8% year-on-year to ¥130.6 billion, making it the best-performing major market. This growth can be attributed in part to a lower base caused by pandemic-related control measures during the same period last year.

Following the introduction of the “WIN 2023 and Beyond” long-term strategy in 2021, Shiseido Group launched a new mid-term strategy called “SHIFT 2025 and Beyond” this year. Under this strategy, the group aims to achieve a core operating profit margin of 12% by 2025 and a 15% target by 2027. This will be accomplished through increased investments in key areas such as branding, innovation, and talent, along with the establishment of a value-driven management model to provide unparalleled unique value.

*Note: The “WIN 2023 and Beyond” long-term strategy aims to focus on the skincare and beauty sector, restructure the group’s business portfolio, enhance profitability and cash flow, particularly in the Americas and EMEA (Europe, Middle East, and Africa) regions.

The financial report highlighted that the focus in 2023 is on implementing the new strategy, with strategic marketing investments aimed at strengthening brand assets to surpass market growth and increase market share in each region.

On the second day after the financial report was released, Shiseido Group’s stock price increased by 2.3%, resulting in a current market value of approximately ¥26 trillion.

As of June 30, 2023, the main financial data for the first half of the fiscal year 2023 for Shiseido Group is as follows:

- The growth in core operating profit is mainly attributed to sales growth driven by strategic marketing investments and ongoing flexible cost management.

- The decrease in net profit attributable to shareholders is primarily due to non-recurring items, including impairment losses, structural reform costs, and losses related to the business transfer agreement for personal care product production, offsetting the growth in core operating profit.

Performance in Various Markets

Japanese and mainland China businesses capitalized on market recovery opportunities through strategic product launches and enhanced marketing activities, resulting in steady growth in year-on-year net sales. Travel retail business net sales declined due to retail inventory adjustments and market normalization, impacted by a shift in their business model from tourist-focused to a more diversified approach. Strong sales growth was achieved in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific regions.

Japanese Business:

Net sales increased by 8.2% year-on-year to ¥125.2 billion, and after excluding the impact of business transfers, it increased by 8.6% on a comparable basis. Core operating loss narrowed down to ¥3.4 billion, a ¥4 billion improvement from the previous year, attributed to increased gross profit related to sales growth and cost management efforts.

In the Japanese business segment, the group introduced innovative new products under various brands to meet post-pandemic consumer demand. These efforts resulted in strong sales growth for brands like Clé de Peau Beauté and SHISEIDO. The updated version of the ELIXIR product, utilizing the latest technology, continued to perform well. MAQuillAGE experienced robust growth, capitalizing on the resurgence in demand for makeup.

Mainland China Business:

Net sales increased by 12.8% year-on-year to ¥130.6 billion, showing a 9.0% increase when excluding the impact of exchange rates, and a 9.9% growth on a comparable basis after excluding the effects of business transfers. Core operating profit reached ¥5.5 billion, a ¥7.5 billion increase year-on-year, primarily due to increased gross profit related to sales growth and overall profitability recovery.

In the mainland China business, the group is transitioning from a growth model primarily driven by large-scale promotions to a more sustainable growth model focused on value-based branding and consumer-oriented product communication. SHISEIDO’s growth is primarily driven by offline channels, enhancing brand experiences through distinctive in-store activities. On the other hand, Clé de Peau Beauté’s growth is driven by e-commerce channels. Both brands have achieved remarkable growth.

Asia-Pacific Business:

Net sales decreased by 2.2% year-on-year to ¥30.7 billion, with a 7.9% decrease when excluding the impact of exchange rates, but showing a 13.9% growth on a comparable basis after excluding the effects of business transfers. Core operating profit decreased by ¥2.2 billion to ¥200 million, attributed to increased marketing investments exceeding the increase in gross profit related to sales growth.

Within this segment, Taiwan shifted towards growth in the second quarter, while South Korea and Southeast Asia continued to exhibit strong growth. NARS maintained its strong performance, driving overall growth.

Americas Business:

Net sales decreased by 10.5% year-on-year to ¥52.8 billion, showing a 17.9% decrease when excluding the impact of exchange rates, but indicating a 23.3% growth on a comparable basis after excluding the effects of business transfers. Core operating profit increased by ¥400 million to ¥4.1 billion, primarily due to increased gross profit related to sales growth.

In the Americas business segment, strategic marketing activities allowed the group to capture an expanding market. Drunk Elephant achieved over 100% year-on-year growth through enhanced social media marketing. NARS and SHISEIDO also experienced steady growth.

EMEA (Europe, Middle East, and Africa) Business:

Net sales decreased by 5.6% year-on-year to ¥52.6 billion, with a 5.6% decrease when excluding the impact of exchange rates, but showing a 16.7% growth on a comparable basis after excluding the effects of business transfers. Core operating profit decreased by ¥1.3 billion to ¥1.3 billion, primarily due to business transfers.

In the EMEA business segment, NARS continued to drive overall sales through digital marketing and new product launches. SHISEIDO achieved stable growth with BIO-PERFORMANCE Skin Filler, which uses advanced hyaluronic acid research technology. Drunk Elephant and Clé de Peau Beauté achieved steady growth with an increase in the number of stores.

Travel Retail Business:

Net sales decreased by 0.5% year-on-year to ¥77.5 billion, with an 8.8% decrease when excluding the impact of exchange rates, but indicating a 3.9% decrease on a comparable basis after excluding the effects of business transfers. Core operating profit reached ¥15.4 billion, a ¥1.5 billion decrease year-on-year, primarily due to reduced gross profit resulting from the decline in sales.

In the travel retail business segment (primarily selling cosmetics and perfumes through airport and downtown duty-free stores), the impact of the pandemic-related challenges lessened due to an increase in tourist traffic, resulting in strong recovery in Japan. Meanwhile, in Korea and Hainan Island, China, sales were lower than the previous year due to retail inventory adjustments and market normalization, reflecting changes in their business model from tourist-centric approaches.

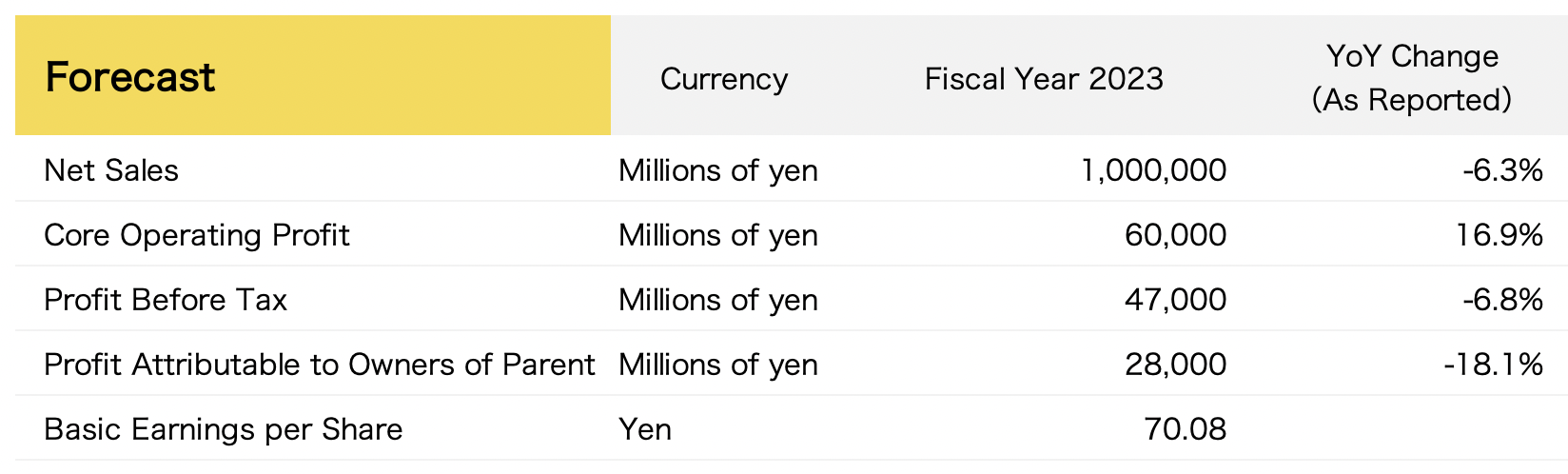

Based on these results, Shiseido Group announced its full-year performance expectations for fiscal year 2023:

Note: At time of writing, 100 JPY = 0.69 USD

| Source: Official financial report

| Image Credit: Group’s official website

| Editor: Wang Jiaqi