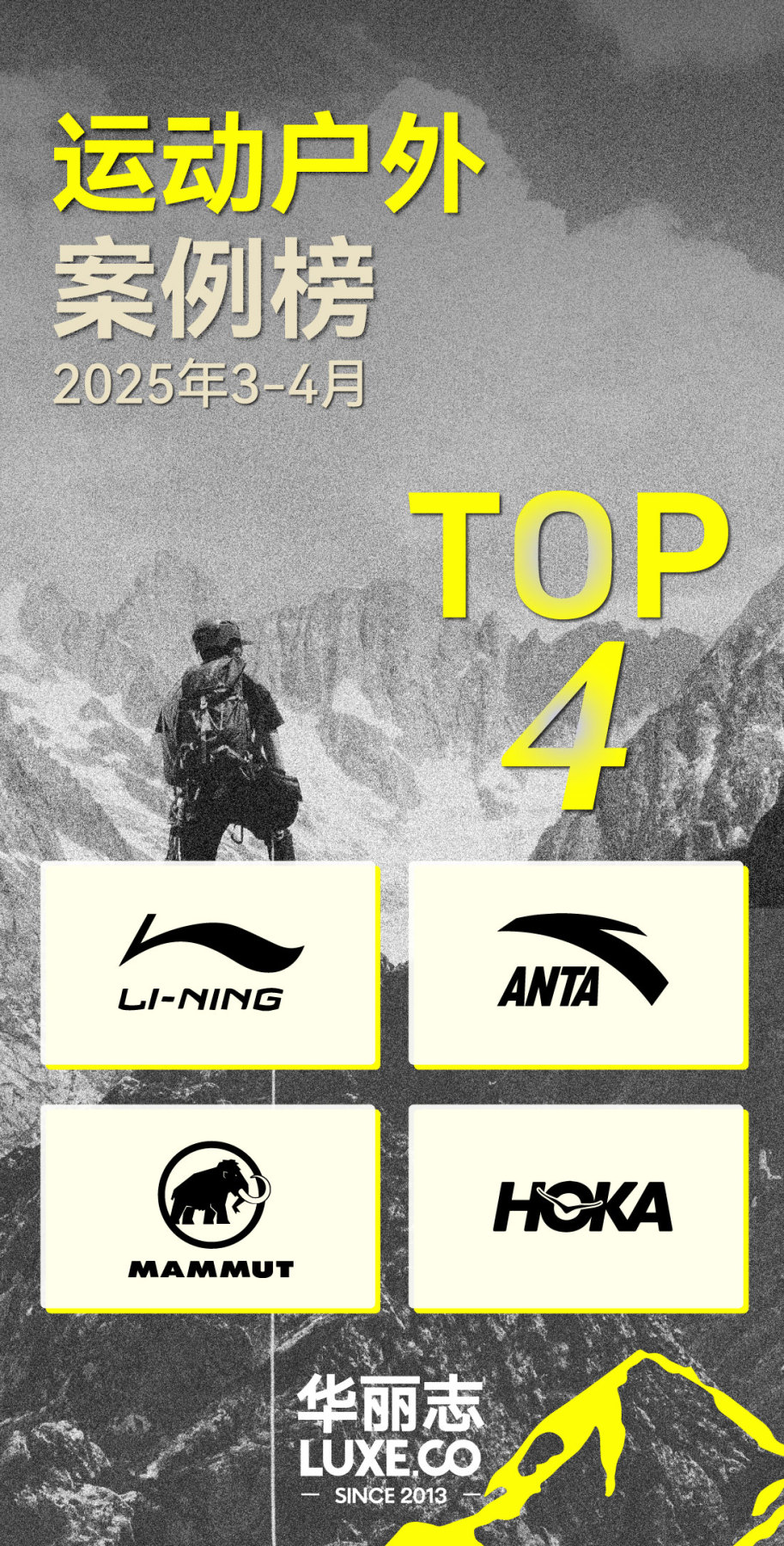

Between March and April 2025, Luxe.CO Intelligence tracked and analyzed 606 brand activities from a total of 464 sports and outdoor brands.

Based on these findings, Luxe.CO Intelligence selected the most noteworthy TOP 4 brand cases, offering exclusive commentary to reflect the current direction and emerging trends in the sports and outdoor industry.

In an increasingly competitive sports and outdoor market, the selected cases represent four key industry development themes (in no particular order):

-

Li-Ning: Building brand equity through 20 years of sustainable practice

-

Anta: Advancing proprietary material R&D to drive independent manufacturing

-

Mammut: Expanding reach with celebrity endorsements in the Chinese outdoor market

-

HOKA: Differentiating through collaborations with niche high-end brands

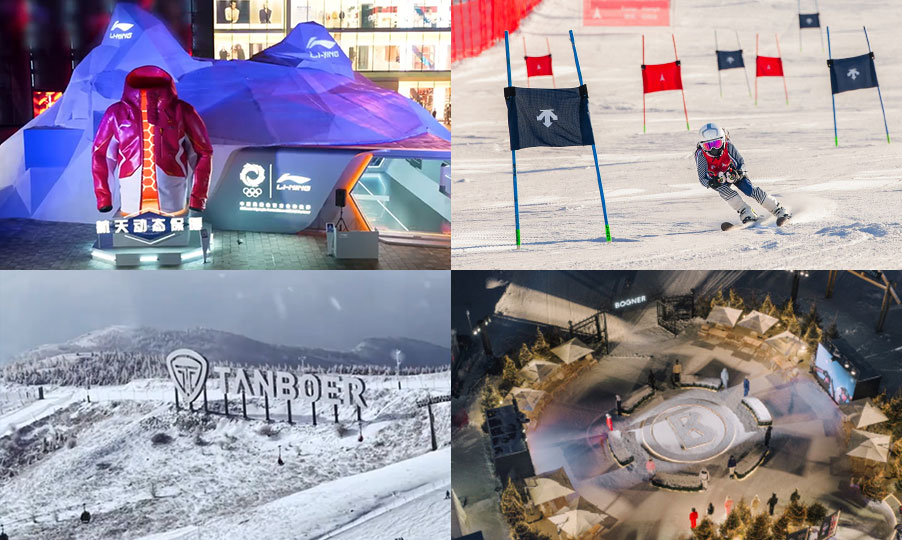

1. Li-Ning launched a limited-time “Li-Ning NATURE” pop-up at Yinshi Plaza on Chunxi Road, Chengdu.

According to the WTO Economic Guide, a business journal under the Ministry of Commerce, 2006 marked the inaugural year of Chinese Corporate Social Responsibility reports, with 71 companies releasing sustainability-related documents—nearly triple the number from the previous year. Li-Ning was among these early adopters.

On April 29, Li-Ning officially released its 2024 Environmental, Social and Governance (ESG) Report, marking the 19th consecutive year the company has published a sustainability report.

These reports clearly reflect Li-Ning’s long-term commitment to and investment in sustainability. The company has achieved notable progress in multiple areas, including degradable technology, bio-based materials, eco-friendly dyeing techniques, and recycling.

For example, fully degradable sports shoes are widely considered a formidable industry challenge. A single sports shoe comprises over 30 components, each needing to meet environmental standards while maintaining performance. Since 2020, with strong support from the group, Li-Ning’s R&D team has tackled this challenge. Last year, in collaboration with an academician-led team, they successfully developed China’s first fully degradable sports shoe.

In 2024, Li-Ning also co-drafted and published the national group standard “Footwear – Biodegradability Performance Evaluation”, collaborating with relevant national associations.

Li-Ning’s signature Boom Fiber upper is made using castor oil extracts, reducing reliance on petroleum-based resources. The Boom Fiber is lightweight, breathable, flexible, durable, and sustainable. To date, over 10 million pairs of Li-Ning’s bio-based running shoes have been produced.

In celebration of Earth Day, Li-Ning highlighted its full-spectrum sustainability practices through immersive environmental science exhibitions, retrospectives on eco-product development, and both online and offline engagement campaigns.

Leveraging Earth Day as a global awareness platform, Li-Ning showcased its long-standing sustainability R&D efforts in a single offline event, reinforcing consumers’ understanding of the brand’s “sustainable” identity.

2. Anta held a technical innovation exchange event to showcase its high-performance proprietary fabric “Anta Membrane” AEROVENT ZERO.

According to Anta’s head of apparel promotion, “The debut of ‘Anta Membrane’ broke the technological monopoly of international brands, reshaping the premium outerwear market. It also democratized access to high-performance outdoor gear, enabling more consumers to enjoy quality at fair prices.”

As environmental awareness grows among consumers and research increasingly highlights the potential hazards of PFAS, demand for eco-friendly outdoor apparel has surged in the domestic market.

In April 2024, China officially implemented a new national standard for outdoor jackets that includes PFOS and PFOA testing. In September, the EU also restricted PFHxA and related substances under REACH regulations to further reduce PFAS emissions.

This push for sustainability is prompting sports and outdoor brands to upgrade their technologies. Amid these challenges, how can brands seize new growth opportunities?

Innovative fabric development not only supports sustainable strategies but also offers a competitive edge in a saturated market. High-tech and innovative materials boost product value, elevate performance, and aid in brand upgrading.

For years, key technologies in outdoor gear were dominated by foreign brands, creating a closed ecosystem around materials, technology, patents, and supply chains. For instance, the core waterproof-breathable materials used in performance outerwear were almost entirely dependent on global suppliers, leaving domestic brands with little influence.

In September 2023, Anta partnered with Donghua University to develop China’s first domestically produced high-performance waterproof-breathable material, “Anta Membrane,” breaking the monopoly and filling a critical gap in the market.

At the event, Anta showcased several iconic products equipped with the “Anta Membrane” technology. Among them, the Storm Armor Series, worn by the Chinese national team, received high praise from outdoor enthusiasts and consumers, with total sales reaching the million-unit mark.

Moreover, with global outerwear brands shifting away from fluorinated materials, the performance of traditional waterproof-breathable membranes has declined. Anta’s second-generation bio-based membrane, AEROVENT ZERO, circumvents the fluorine issue entirely, while maintaining performance parity with the first-generation Anta Membrane. Independent lab tests from both domestic and international institutions confirm that the second-generation membrane matches leading ePE membranes, positioning Anta at the forefront of the industry.

The AEROVENT ZERO membrane, made from bio-based waterproof breathable materials, is scheduled for official release in the second half of 2025.

3. Mammut appoints Zhang Ruoyun as its first-ever global brand ambassador in the brand’s 163-year history.

With the rapid growth of the Chinese outdoor market, consumer awareness and expectations have significantly evolved. For sports and outdoor brands looking to strengthen their presence in China, understanding current consumer demands and achieving market differentiation are top priorities.

Mammut, known as the “pioneer of softshells,” is a key name in high-intensity outdoor activities such as alpine climbing, skiing, and rock climbing.

As the line between outdoor sports and daily life continues to blur, consumers are increasingly seeking outdoor products that cater to diverse settings while offering a degree of fashion appeal. In response, Mammut is actively positioning its softshell offerings to capture consumer mindshare.

Back in the 1980s, Mammut revolutionized outdoor apparel with a single pair of softshell pants, redefining industry standards and creating the now-established division between “hardshell” and “softshell” gear. This legacy cemented Mammut’s status as the originator of softshell technology.

Recently, Mammut officially announced actor Zhang Ruoyun as its global brand ambassador, featured in the brand’s promotional video wearing the Ultimate VII Softshell Jacket.

First launched in 2000 for hiking and climbing, the Ultimate series has undergone seven generations of upgrades and remains one of Mammut’s flagship product lines.

Mammut is now increasing investment to secure a larger share of China’s premium professional outdoor market. The ambassador strategy represents a deeper form of communication with consumers, aiming to resonate with younger demographics and expand brand visibility. This move marks the first time in Mammut’s 163-year history that it has employed a brand ambassador as part of its communications strategy.

According to exclusive information obtained by Luxe.CO, Mammut China entered a phase of strategic restructuring between 2021 and 2023, achieving three consecutive years of growth. In 2023, the brand saw an 85% year-on-year increase, and in 2024, that growth climbed to 97%. The company opened 26 new stores in 2024, including locations in Tianjin MixC and Taiyuan MixC. Looking ahead, Mammut plans to continue focusing on premium department stores and high-end malls in China’s tier-one and tier-two cities to further solidify its upscale brand image.

4. HOKA collaborates with Italian luxury fashion brand Marni to launch a co-branded Bondi B3LS sneaker.

The competition in China’s sports and outdoor footwear sector is intensifying rapidly.

From a market perspective, international sports brands have long dominated the high-end segment in China, leveraging their strong brand equity, robust R&D capabilities, and extensive market experience. Meanwhile, Chinese brands are steadily gaining ground in the mass market by improving product quality, elevating design, and investing in innovation. Specialized brands targeting niche sectors have also emerged swiftly, further intensifying the competitive landscape.

From the consumer angle, the demand for athletic footwear has evolved beyond functionality to include fashion appeal and everyday wearability. As younger consumers become the market’s dominant force, they are increasingly willing to pay a premium for high-quality, well-designed products.

In such a fiercely competitive environment, how can brands craft differentiated strategies? How can they balance professional performance with fashion trends, while preserving their unique product identities and broadening their reach?

As a professional running shoe brand, HOKA has traditionally been known for performance-driven products, with a core user base focused on marathons and trail running. The recent collaboration with Italian fashion label Marni marks HOKA’s foray beyond the performance niche into the world of fashion and lifestyle.

The co-branded shoe takes HOKA’s classic Bondi running model and fuses it with Marni’s bold color aesthetics. The Bondi B3LS comes in four saturated tones—flamboyant red, fern brown, tourmaline blue, and straw yellow—and includes multiple interchangeable laces, offering greater styling versatility and appealing to young, fashion-forward consumers seeking personalization.

In addition, HOKA recently signed Chinese swimming world champion Wang Shun as a brand ambassador. The current roster of HOKA ambassadors and brand representatives spans athletes, celebrities, and influencers across various sectors, helping the brand extend from its professional roots to a broader audience.

According to Deckers Brands’ FY2025 Q3 earnings report, HOKA® net sales rose 23.7% year-on-year, reaching $530.9 million, up from $429.3 million. President and CEO Stefano Caroti commented, “HOKA delivered impressive results aligned with our strategic goals. The brand remains focused on expanding through innovative, high-performance products.”

In May, HOKA is set to open its largest global flagship store in Shanghai Xintiandi, covering approximately 370 square meters. The store is positioned as a “brand culture landmark” and signals HOKA’s intensified push into the Chinese market.

| Image Credit: Brand official, Luxe.CO Design

| Editor: Elisa