The latest data from the Federation of the Swiss Watch Industry (FHS) indicates that in November 2024, Swiss watch exports fell by 3.8% year-on-year to CHF 2.406 billion, marking a slight expansion compared to the 2.2% decline in October. This figure is largely in line with the average trend observed over the preceding ten months.

From January to November 2024, Swiss watch exports totaled approximately CHF 23.9 billion, reflecting a year-on-year decline of 2.7%. Exports to the Chinese Mainland and Hong Kong during this period decreased by 26.3% and 19.7%, respectively.

Swiss Watch Export Performance in Major Markets (November 2024):

- Chinese Mainland: Down 27% year-on-year to CHF 152 million, improving from October’s 38.8% decline.

- Hong Kong: Down 18.8% year-on-year to CHF 170 million.

- United States: Up 4.7% year-on-year to CHF 421 million.

- Japan: Down 2.5% year-on-year to CHF 172 million.

- Singapore: Down 6.1% year-on-year to CHF 149 million.

- United Kingdom: Down 8.3% year-on-year to CHF 169 million.

- Germany: Down 11.3% year-on-year to CHF 115 million.

- Italy: Down 2.9% year-on-year to CHF 101 million.

- France: Down 2.9% year-on-year to CHF 115 million.

- United Arab Emirates: Down 4.9% year-on-year to CHF 118 million.

In November, exports of Swiss watches to the six major markets of the United States, Japan, Hong Kong, the United Kingdom, the Chinese Mainland, and Singapore collectively fell by 7.9% year-on-year to CHF 1.233 billion, contributing 51.2% of the global market’s export total.

Also in November, exports to the top 30 global markets fell by 4.0% year-on-year to CHF 2.243 billion, accounting for 93.2% of the total export value.

Beyond the 10 markets listed above, South Korea (+21.7%), Spain (+33.5%), Mexico (+6.9%), the Netherlands (+7.1%), India (+59.7%), Canada (+7.4%), Saudi Arabia (+8.7%), Turkey (+6.8%), Austria (+12.2%), the Kingdom of Bahrain (+19.3%), Kuwait (+26.8%), Belgium (+10.6%), and the Czech Republic (+37.3%) showed growth.

Meanwhile, Taiwan (-16.8%), Thailand (-14.2%), Ireland (-20.1%), Portugal (-24.2%), and Greece (-37.4%) experienced double-digit declines.

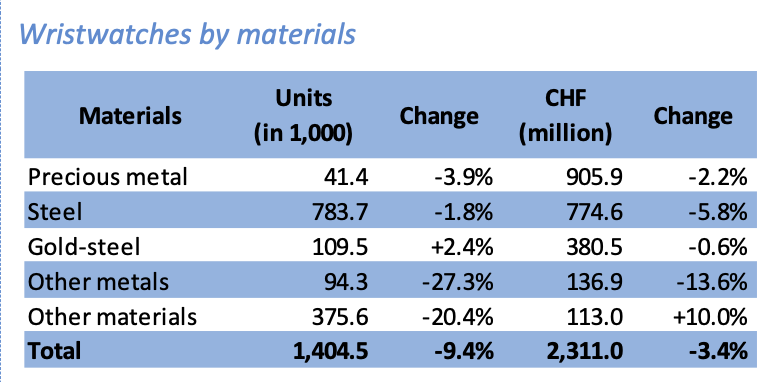

In November, the export performance of Swiss watches by material was as follows:

- Watches made of precious metals saw export volumes fall by 3.9% and export values fall by 2.2%

- Steel watch exports saw volumes fall by 1.8% and values fall by 5.8%

- Steel and gold watches saw export volumes rise by 2.4% but export values fall by 0.6%

- Watches made of other metals saw export volumes fall by 27.3% and values fall by 13.6%

- Watches made of other materials saw export volumes fall by 20.4% but values rise by 10%

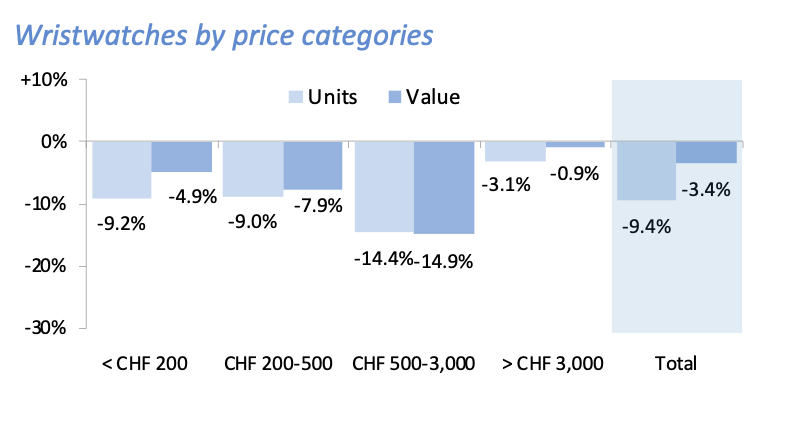

In November, the export performance of Swiss watches by price range was as follows:

- Watches priced below CHF 200 saw export volumes fall by 9.2% and values fall by 4.9%

- Watches priced between CHF 200 and CHF 500 saw export volumes fall by 9% and values fall by 7.9%

- Watches priced between CHF 500 and CHF 3,000 saw export volumes fall by 14.4% and values fall by 14.9%

- Watches priced above CHF 3,000 saw export volumes fall by 3.1% and values fall by 0.9%

Detailed report on Swiss watch exports in November 2024

(Charts source: Federation of the Swiss Watch Industry official website)

By watch material

By watch price range (Currency: Swiss Franc)

12-month moving average changes

|Source: Federation of the Swiss Watch Industry official website

|Image Credit: Federation of the Swiss Watch Industry official website

|Editor: LeZhi