On February 14, Japanese sportswear giant ASICS released its financial report for the fiscal year ending December 31, 2024. Driven primarily by strong sales across all categories and the impact of exchange rate fluctuations, net sales increased by 18.9% year-over-year to JPY 678.5 billion.

Fueled by net sales growth and improved gross profit margins across all categories and regions, operating profit surged 84.7% year-over-year to JPY 100.1 billion, marking the first time the group has reached this milestone. The operating profit margin stood at 14.8%, ranking among the top in the industry. ASICS stated that this signifies the group has entered a new stage of development.

Additionally, driven by the aforementioned net sales growth, annual gross profit rose 27.6% year-over-year to JPY 378.9 billion, while net profit attributable to shareholders increased by 80.9% to JPY 63.8 billion. This was primarily due to gains from the sale of cross-shareholdings and the overall growth in net sales and profits.

Reflecting on 2024, ASICS noted that the year was marked by a series of major international sporting events, including the 2024 World Athletics Championships, the Paris Olympics, and the Paralympics. These events provided significant opportunities for the brand to gain exposure through the achievements of numerous athletes, potentially serving as a catalyst for increased brand awareness.

In November 2024, ASICS also raised its financial targets for its mid-term plan, MTP 2026. The company now aims to achieve an operating profit of at least JPY 130 billion by 2026 (previously JPY 80 billion), with an operating profit margin of at least 17% (previously around 12%) and a return on assets (ROA) of approximately 15% (previously around 10%).

As part of the updated MTP 2026 plan, ASICS announced the establishment of ASICS Innovation Campus (tentative name) to further enhance innovation. The group will continue to focus on its long-term strategy of “Performance x Footwear,” preparing the campus as a global hub for internal and external collaborations.

As of December 2024, ASICS’ membership program OneASICS had approximately 17.6 million members. In December, the ASICS official app was launched in Japan, significantly improving user convenience by providing popular product information and allowing members to earn points by scanning their membership barcodes in ASICS-owned stores. Looking ahead, ASICS plans to enhance OneASICS by integrating unified data to provide personalized recommendations and notifications. The company will also improve brand engagement by hosting exclusive events for app members.

As of the market close on February 14, ASICS’ stock price had risen 4.98% from the previous day to JPY 3,518 per share, with a latest market capitalization of JPY 2.52 trillion. Over the past 12 months, the stock has surged by 145.5%.

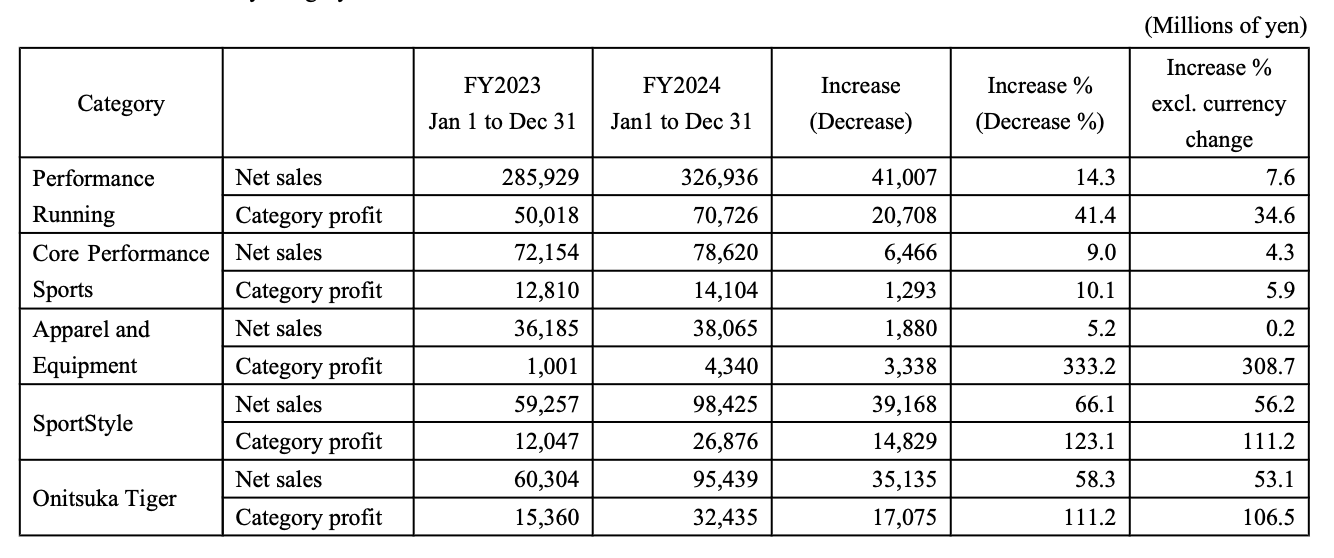

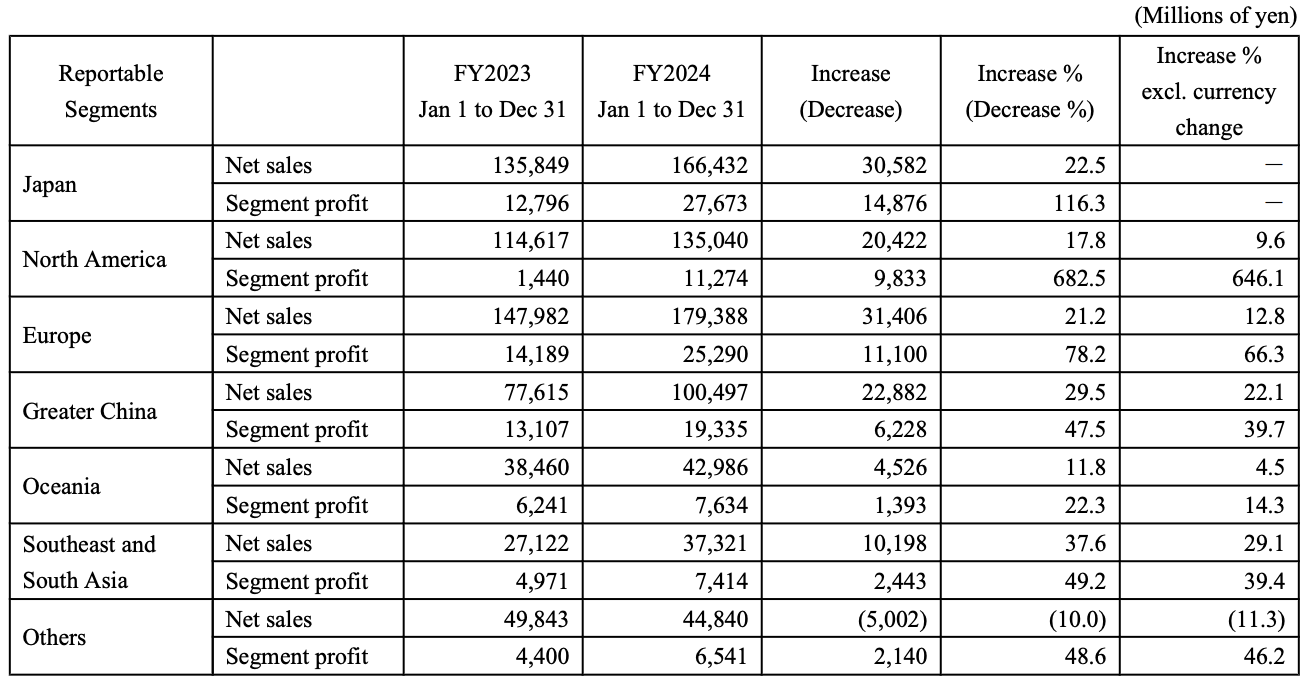

By Business Segment

Among ASICS’ key business segments, SportsStyle and Onitsuka Tiger have made significant strides, emerging as key pillars alongside the Performance Running business. Both segments recorded net sales approaching JPY 100 billion.

- SportsStyle Business: Net sales increased by 66.1% year-over-year, with a profit margin of 27.3% (up 7.0 percentage points from the previous fiscal year). As this category continues to expand, its profitability has also improved. SportsStyle products were featured in multiple fashion media outlets, including GQ, ELLE, and HYPEBEAST, while the brand’s global footprint continued to grow.

- Onitsuka Tiger Business: Net sales grew by 58.3% year-over-year, with a profit margin of 34.0% (up 8.5 percentage points from the previous fiscal year), the highest among all categories. In 2024, Onitsuka Tiger celebrated its 75th anniversary and further expanded its global presence by launching Hotel Onitsuka Tiger on Champs-Élysées in Paris, participating in Milan Fashion Week, and collaborating with other brands.

- Core Performance Sports Business: Net sales increased by 9.0%, primarily driven by strong sales in Europe, Southeast Asia, and South Asia. Profit rose by 10.1%, mainly due to higher gross profit margins and the aforementioned sales growth.

- Apparel and Equipment Business: Net sales grew by 5.2%, mainly due to strong sales in Europe. Profit surged by 333.2%, largely driven by improvements in gross profit margins.

By Market

In Japan, net sales grew by 22.5%, mainly driven by strong sales in the SportsStyle and Onitsuka Tiger businesses. Profitability improved significantly, with profit soaring by 116.3%, primarily due to higher gross profit margins and sales growth. The operating profit margin reached 23.5%, up 12.7 percentage points from the previous fiscal year. In addition to strong sales to inbound tourists, ASICS attributed this success to its “selection and concentration” strategy.

Across other key markets, net sales increased by approximately 20% year-over-year. In North America, net sales rose by 17.8%, supported by strong sales in the Performance Running and SportsStyle segments. Profit surged by 682.5%, mainly due to higher gross profit margins and sales growth. The operating profit margin improved by 7.0 percentage points to 8.3%. In Europe, net sales grew by 21.2%, driven by strong sales across all categories, while profit increased by 78.2%, mainly due to improved gross profit margins and sales growth.

In the Greater China region, net sales increased by 29.5%, supported by strong sales across all categories, with profit rising by 47.5%, primarily due to overall sales growth. In Oceania, net sales grew by 11.8%, with stable sales across all categories contributing to a 22.3% increase in profit.

Southeast Asia and South Asia saw a substantial increase in net sales, rising by 37.6%, driven by strong performance across all categories. Profit grew by 49.2%, primarily due to sales growth. Among the fastest-growing markets, Thailand, Malaysia, and Indonesia recorded a year-over-year net sales increase of over 30%, while Vietnam saw net sales surge by more than 70%. ASICS expressed optimism about the continued growth potential in these regions.

In other regions, net sales declined by 10.0%, mainly due to the sale of Haglöfs AB in December 2023, which is no longer included in ASICS’ consolidated financials. However, profit grew by 48.6%, largely driven by strong sales in Latin America.

Key Developments and Outlook for 2025

- ASICS running shoes continued to gain market share during the annual year-end and New Year’s Ekiden relay races (officially known as the Tokyo-Hakone Round-Trip College Ekiden Race), demonstrating the brand’s growing influence in athlete partnerships and brand promotion.

- In 2025, ASICS aims to become the No. 1 brand in the North American running shoe market, while maintaining its leading position in Europe and Japan. As the official partner of the Tokyo 2025 World Athletics Championships, ASICS plans to support athletes while implementing strategies to enhance brand awareness and consumer engagement.

- As part of the “T Project” (named after ASICS President & COO Mitsuyuki Tominaga) launched in May 2024, which aims to solidify ASICS’ leadership in tennis shoes, the company hosted the ASICS Tennis Summit in Australia in January 2025. The event showcased ASICS’ tennis business strategy and introduced the latest GEL-RESOLUTION X tennis shoes. In a discussion with athletes, ASICS shared insights into product development, incorporating athlete feedback. The company emphasized its commitment to growing the tennis segment by continuing to prioritize athlete-driven innovation.

- As announced in July 2024, ASICS plans to establish the ASICS Foundation in April 2025 (pending shareholder approval). This non-profit organization will support groups that assist economically or socially disadvantaged communities worldwide, aiming to improve access to sports and address social issues related to physical activity, contributing to the well-being of as many people as possible.

| Source: ASICS Group official website and financial report

| Image Credit: ASICS brand website, Onitsuka Tiger official website

| Editor: LeZhi