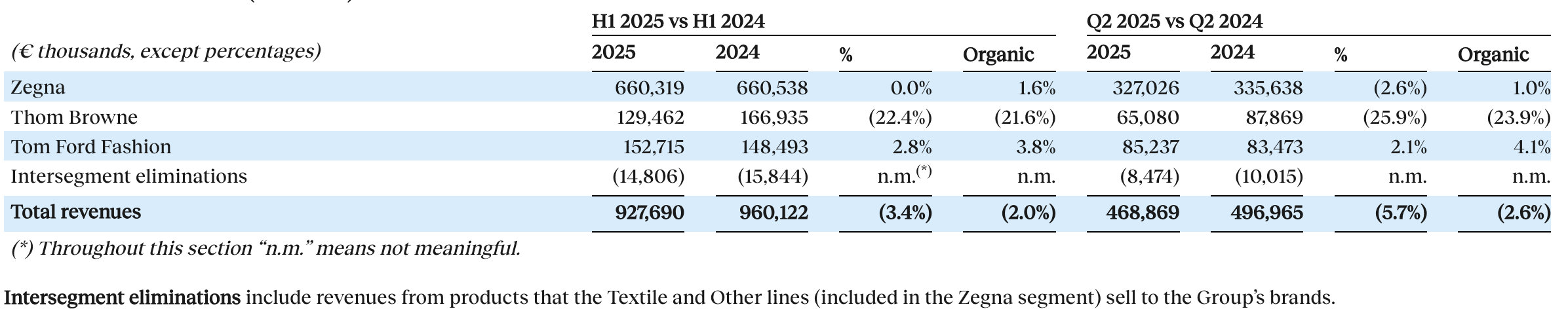

Before the opening bell on July 30 (ET), Italian luxury group Ermenegildo Zegna released key financial data for the first half and second quarter of fiscal year 2025, ending June 30: Total revenue declined 3% year-on-year to €927.7 million (organic basis: -2%). In the second quarter, group revenue fell 6% year-on-year to €468.9 million (organic basis: -3%).

During the reporting period, revenue from the Greater China region dropped 16.2% year-on-year to €223.1 million, accounting for 24% of the group’s total revenue. In the second quarter alone, Greater China revenue declined 21.3% year-on-year to €99.8 million, continuing to be affected by weak consumer sentiment in the region. Organic performance slightly worsened compared to the first quarter, primarily due to underperformance in the wholesale channel, particularly from the Thom Browne brand.

Group Chairman and CEO Ermenegildo “Gildo” Zegna stated:

“The strong organic DTC channel performance of +8% in Q2 2025 for the Group demonstrates our strategic initiatives and actions taken are yielding results, even though the sector navigates a continuously challenging environment.

ZEGNA and Thom Browne each grew by +7% in the DTC channel while TOM FORD FASHION increased by +11%. In terms of regions, the Americas and the Middle East continued to sustain robust momentum.

The recent months were also marked by several pivotal milestones for the Group and our brands, starting with our first ZEGNA fashion show outside Milan in June, along with Villa Zegna Dubai.

Looking at Thom Browne, I welcome Sam Lobban as the brand’s new CEO. With his extensive background in merchandising and customer-first mindset, Sam is exceptionally well-suited to lead this brand in capturing its unexpressed potential. Moreover, I am pleased that Temasek has chosen to invest in our Group, recognizing the strength of our vision and our Group’s long-term growth potential. With Temasek by our side, I am even more confident in our ability to realize our ambitions.”

This week, Singapore’s sovereign wealth fund, Temasek, announced that it will acquire a 10% stake in the Zegna Group through its wholly owned subsidiary, Venezio Investments Pte. Ltd., in a deal valued at approximately USD 220 million.

Following the release of the earnings report, as of the close on July 30, Zegna Group’s share price declined 3.78% from the previous trading day to USD 8.41 per share, with a current market capitalization of approximately USD 2.124 billion.

As of June 30, the Zegna Group reported the following key financial data for the first half of fiscal 2025:

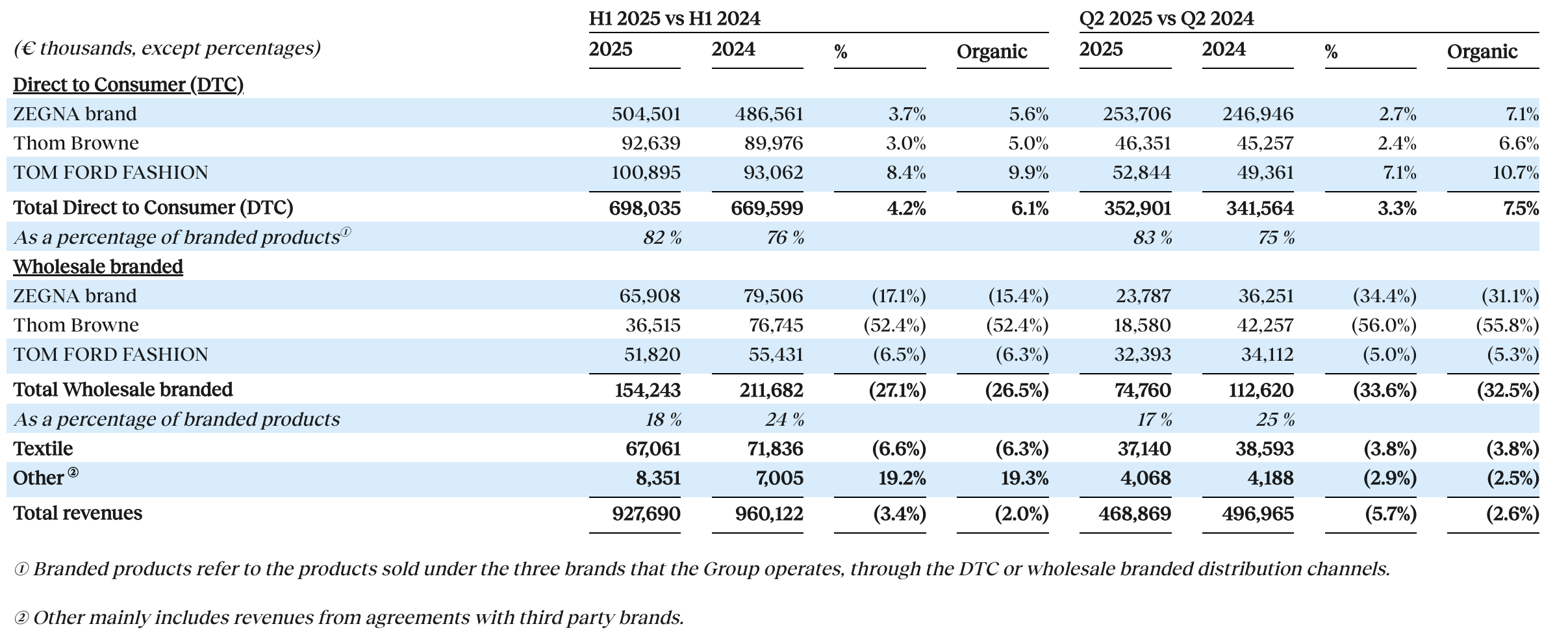

Segment Performance and Second-quarter data:

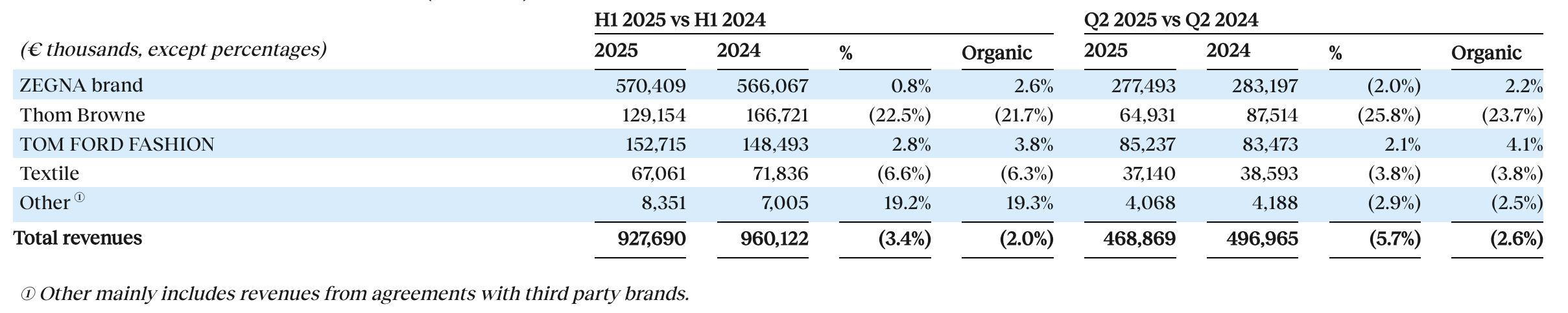

Business line performance and Second-quarter data:

— Zegna Brand (including ZEGNA brand, textiles, and others):

In the first half of fiscal 2025, the Zegna brand division recorded revenue of €660.3 million, remaining essentially flat compared to €660.5 million in the first half of 2024. Second-quarter revenue totaled €327.0 million, representing a 2.6% year-on-year decline; however, on an organic basis, it grew 1.0%, reflecting the positive organic performance of the ZEGNA brand and weaker results in the textile business.

Specifically, the ZEGNA brand generated €570.4 million in revenue in the first half of 2025, up 0.8% year-on-year. In the second quarter, revenue decreased by 2.0% year-on-year to €277.5 million, primarily driven by solid growth in the direct-to-consumer (DTC) channel, especially in the Americas, where growth accelerated compared to the first quarter of 2025. The EMEA region (Europe, Middle East, and Africa) also recorded strong double-digit organic growth, with the Middle East showing particularly robust performance.

The textile business reported revenue of €67.1 million in the first half of 2025, down 6.6% from €71.8 million in the first half of 2024, mainly due to reduced orders from third-party brands. The segment saw a slight improvement in the second quarter, with revenue down 3.8% year-on-year.

— Thom Browne Brand:

In the first half of 2025, the Thom Browne division posted revenue of €129.5 million, down 22.4% from €166.9 million in the first half of 2024. Second-quarter revenue came in at €65.1 million, representing a 25.9% year-on-year decline. The downward trend was significantly affected by the underperformance of the wholesale channel, which entirely offset growth in the DTC channel. Since 2024, the brand has been streamlining its wholesale distribution network to focus more on DTC operations.

The Thom Browne brand’s performance was largely aligned with the division, achieving revenue of €129.2 million in the first half of 2025, down 22.5% from €166.7 million in the same period last year.

— Tom Ford Fashion:

In the first half of 2025, the Tom Ford Fashion division recorded revenue of €152.7 million, up 2.8% from €148.5 million in the first half of 2024. Second-quarter revenue rose 2.1% year-on-year to €85.2 million, mainly driven by strong double-digit organic growth in the DTC channel.

Channel Performance and Second-quarter breakdown:

Direct-to-Consumer (DTC):

The ZEGNA brand’s DTC revenue reached €504.5 million in the first half of 2025, up 3.7% from €486.6 million in the same period in 2024. In the second quarter, DTC revenue increased 2.7% year-on-year to €253.7 million, driven primarily by robust double-digit growth in the Americas, where performance accelerated compared to the first quarter. The EMEA region also achieved steady double-digit organic growth, with the Middle East standing out. In contrast, Greater China continued to post negative DTC growth in the second quarter of 2025, consistent with the first quarter. As of June 30, 2025, ZEGNA operated 286 directly operated stores (DOS), with a net addition of 3 in the second quarter, including new stores in Dubai Mall’s Level Shoes and Porto Cervo, Italy.

Thom Browne’s DTC revenue increased 3.0% year-on-year to €92.6 million in the first half of 2025. In the second quarter, DTC revenue rose 2.4% to €46.4 million, driven mainly by solid performance in the Americas, where the brand opened several important stores during the quarter. As of June 30, Thom Browne operated 120 DOS, with a net increase of 3 in the second quarter, located on Melrose Avenue in Los Angeles, Madison Avenue in New York, and Ginza in Tokyo.

Tom Ford Fashion’s DTC revenue grew 8.4% year-on-year to €100.9 million in the first half of 2025. In the second quarter, revenue rose 7.1% to €52.8 million, with all regions achieving organic growth, particularly EMEA. As of June 30, 2025, TOM FORD FASHION operated 66 DOS, with one net new store added in the second quarter, located in Pacific Place, Hong Kong.

Wholesale:

ZEGNA brand wholesale revenue dropped 17.1% year-on-year to €65.9 million in the first half of 2025. In the second quarter, wholesale revenue declined 34.4% to €23.8 million. According to management, this decline reflects the impact of converting some stores into directly operated counters in the second half of 2024, as well as stricter control measures over signature products. Wholesale revenue in the second quarter of 2025 was also affected by delivery timing adjustments.

Thom Browne’s wholesale revenue stood at €36.5 million in the first half of 2025, down 52.4% both year-on-year and organically. Second-quarter revenue from the channel dropped 56.0% to €18.6 million, reflecting the brand’s previously announced strategy to streamline its wholesale presence in favor of a DTC-focused approach.

Tom Ford Fashion’s wholesale revenue declined 6.5% year-on-year to €51.8 million in the first half of 2025. In the second quarter, wholesale revenue fell 5.0% to €32.4 million, mainly due to the conversion of some stores into directly operated counters.

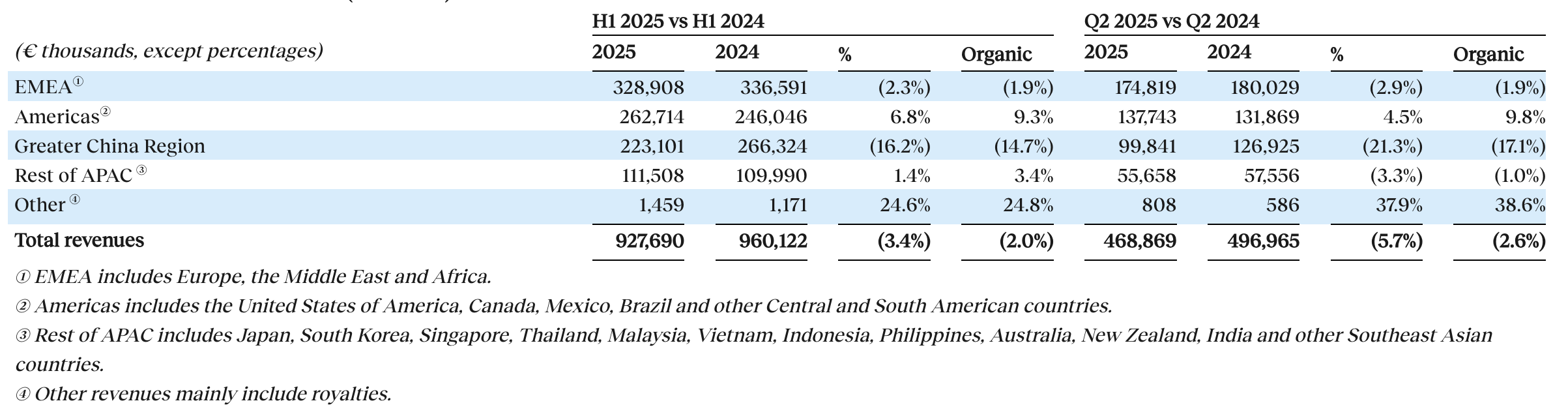

Regional Market Performance and Second-quarter breakdown:

EMEA:

In the first half of 2025, the group’s revenue in the EMEA region declined 2.3% year-on-year to €328.9 million, accounting for 35% of total revenue. In the second quarter, revenue in the region decreased by 2.9% to €174.8 million. Performance during the quarter was impacted by negative results in the wholesale channel across all three brands. Although the DTC channels for ZEGNA and TOM FORD FASHION showed solid positive growth, they were not enough to fully offset the decline in wholesale.

Americas:

Revenue in the Americas rose 6.8% year-on-year to €262.7 million in the first half of 2025, accounting for 28% of total revenue. In the second quarter, revenue increased by 4.5% to €137.7 million, primarily driven by strong DTC performance from ZEGNA and Thom Browne.

Greater China:

Revenue in Greater China declined 16.2% year-on-year to €223.1 million in the first half of 2025, accounting for 24% of total revenue. In the second quarter, revenue fell 21.3% to €99.8 million, as the region continued to be affected by weak consumer sentiment. Organic performance slightly worsened compared to the first quarter, mainly due to underperformance in the wholesale channel, particularly from the Thom Browne brand.

Rest of Asia Pacific (excluding Greater China):

Revenue in the rest of the Asia Pacific region grew 1.4% year-on-year to €111.5 million in the first half of 2025, accounting for 12% of total revenue. In the second quarter, revenue declined 3.3% to €55.7 million. Performance was impacted by high comparison base in Japan and weakening consumer confidence in South Korea.

|Source: Official earnings report

|Image Credit: Group official website

|Editor: LeZhi