On August 1, Luxe.CO held an online report briefing via video conference to present the “Luxury Brands in China Power Ranking 2025 H1.”

The briefing attracted professionals from a wide range of sectors, including luxury brands, international and domestic fashion and home furnishing brands, commercial real estate companies, securities firms, private equity funds, leading internet companies, global public relations agencies, and e-commerce platforms.

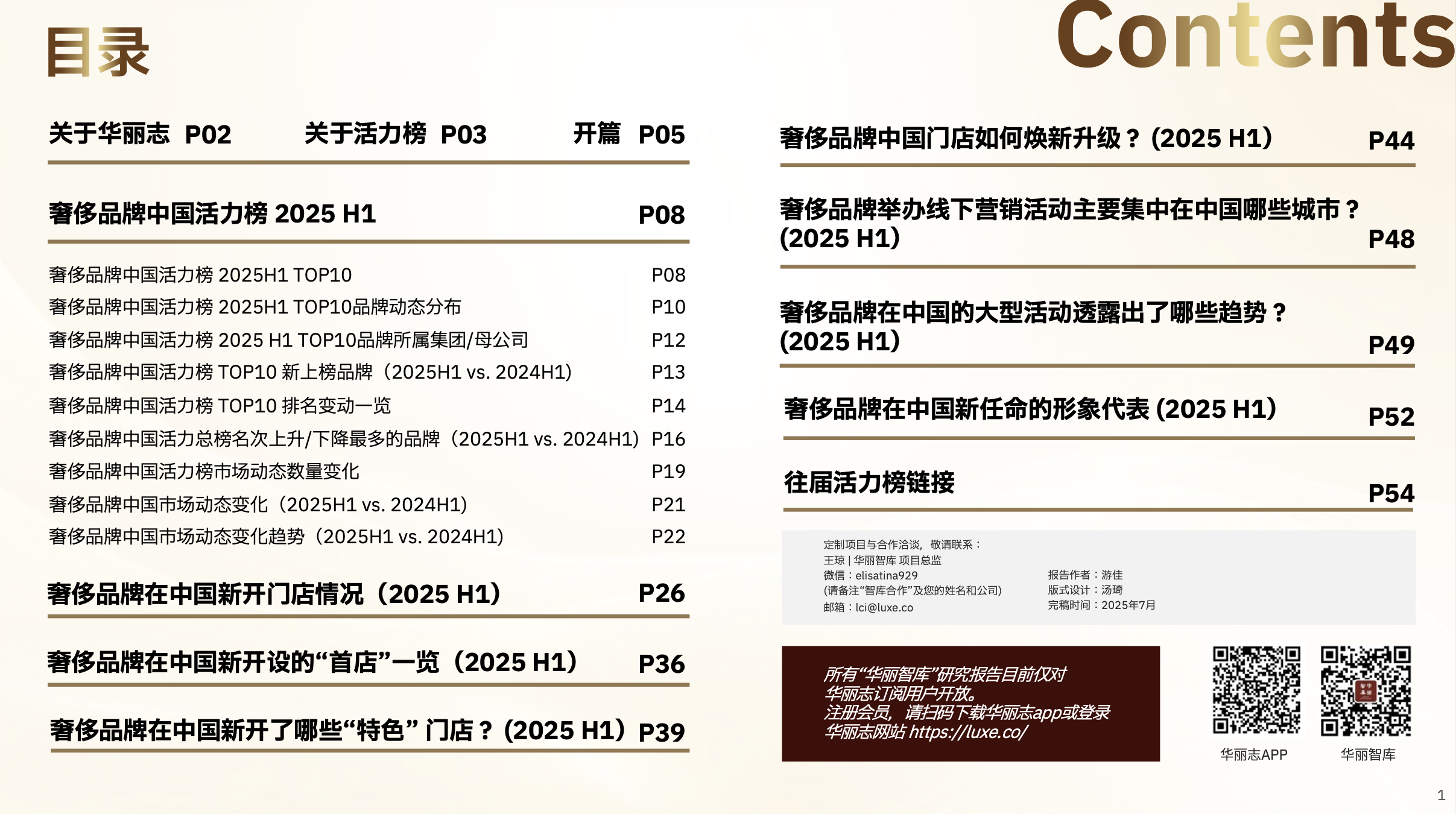

During the session, Elisa Wang, Senior Vice President of Luxe.CO and Director of Luxe.CO Intelligence, delivered an in-depth interpretation of the “Luxury Brands in China Power Ranking 2025 H1” report, revealing deeper data and exclusive insights.

Following this, Alicia Yu, Founder and CEO of Luxe.CO, analyzed the current state and trends of China’s luxury market. She compared key data and brand case studies compiled by Luxe.CO Intelligence over the past four years and integrated her recent observations and reflections into the discussion.

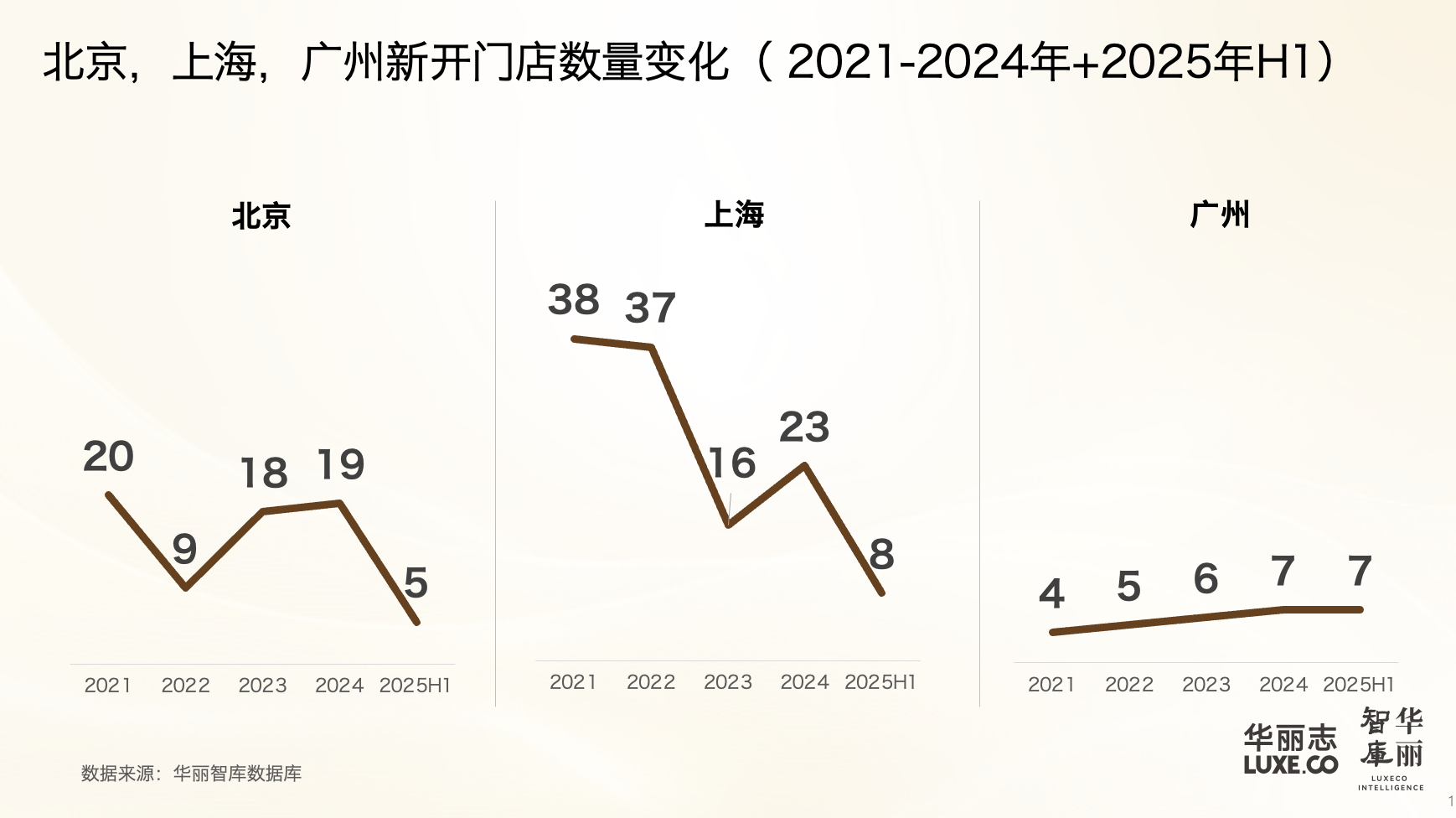

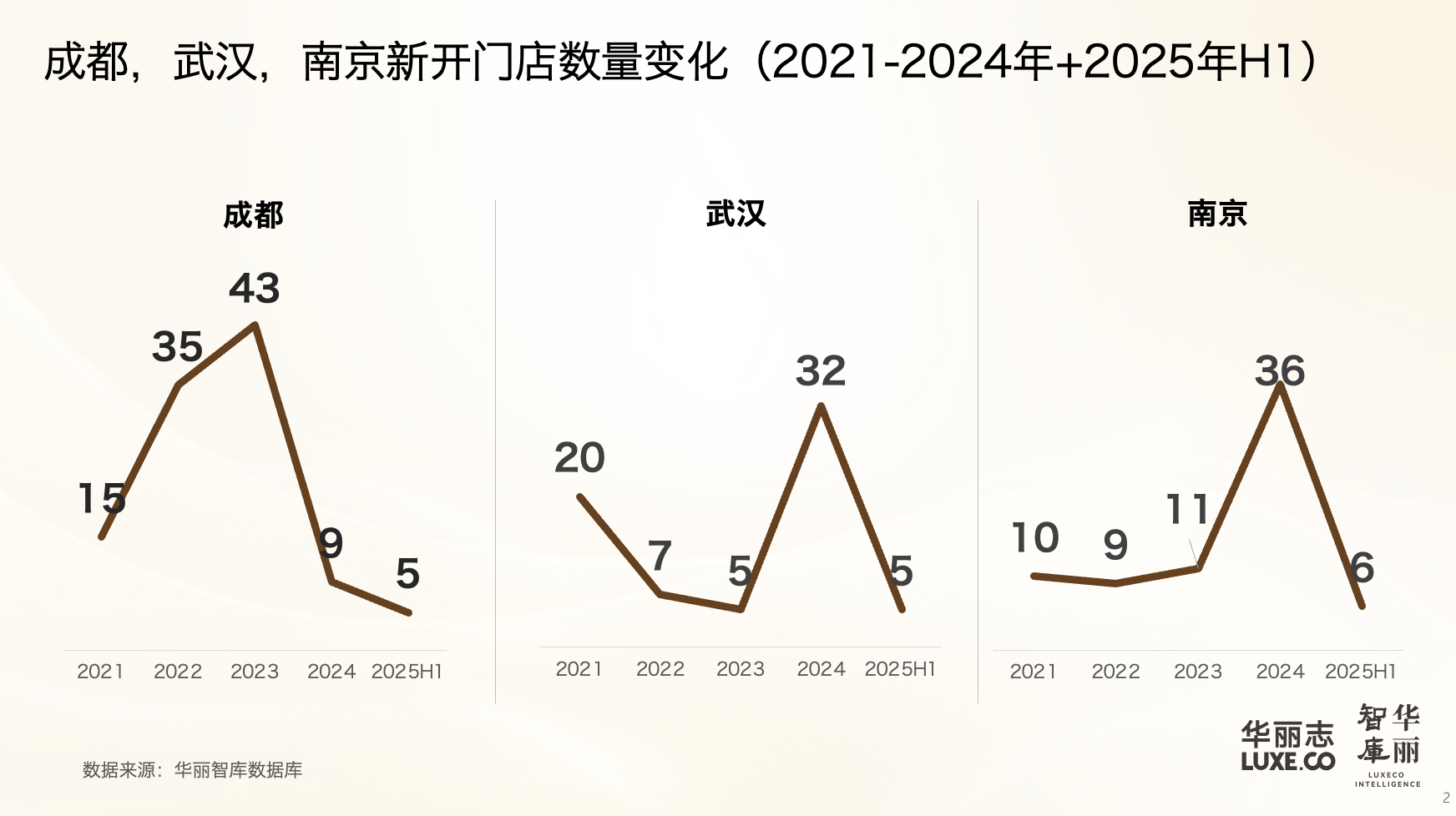

Elisa Wang focused on changes in rankings and market performance of the Top 10 brands on the Power Ranking from 2023 through H1 2025. She also provided a detailed analysis of market trends and evolutions across key marketing dimensions, as well as updates on luxury brands’ store expansion and renovation efforts in the Chinese Mainland during the first half of the year. In addition, she examined the strategic implications and market signals reflected in large-scale luxury brand events.

Wang pointed out that despite some pessimism in the Chinese local market due to macroeconomic shifts, luxury brand executives at global headquarters conveyed a more balanced and long-term view in their conversations with Luxe.CO. They remain confident in the market and the prospects for their brands in China.

She added that during previous years of rapid growth in the luxury sector, brands benefited significantly from the market boom. However, this also led to an influx of non-target customers and a broad-brush approach to marketing investments. In the current climate, only a more focused strategy centered on activities that truly reflect brand DNA can help luxury brands return to their core competitive strengths.

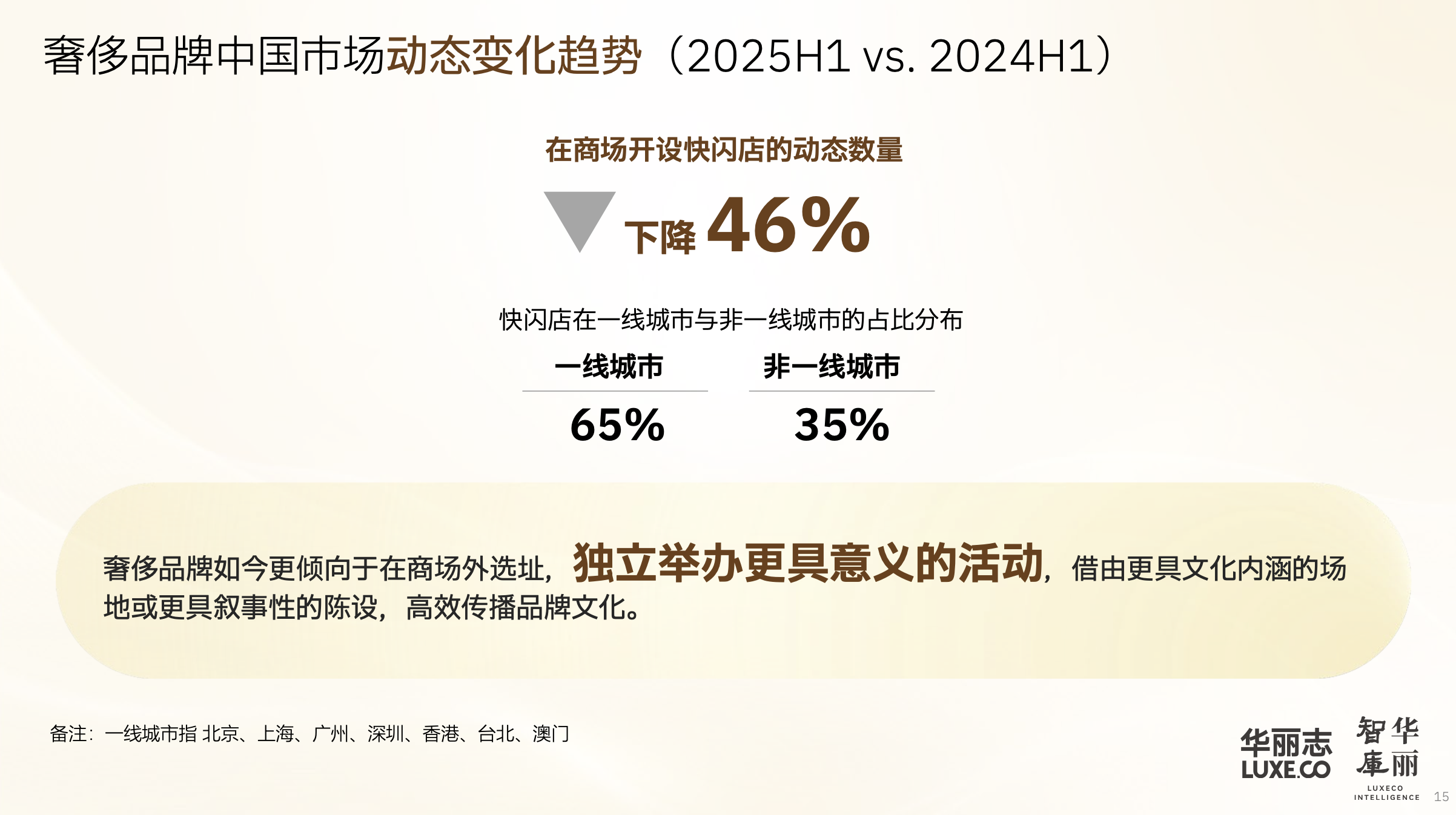

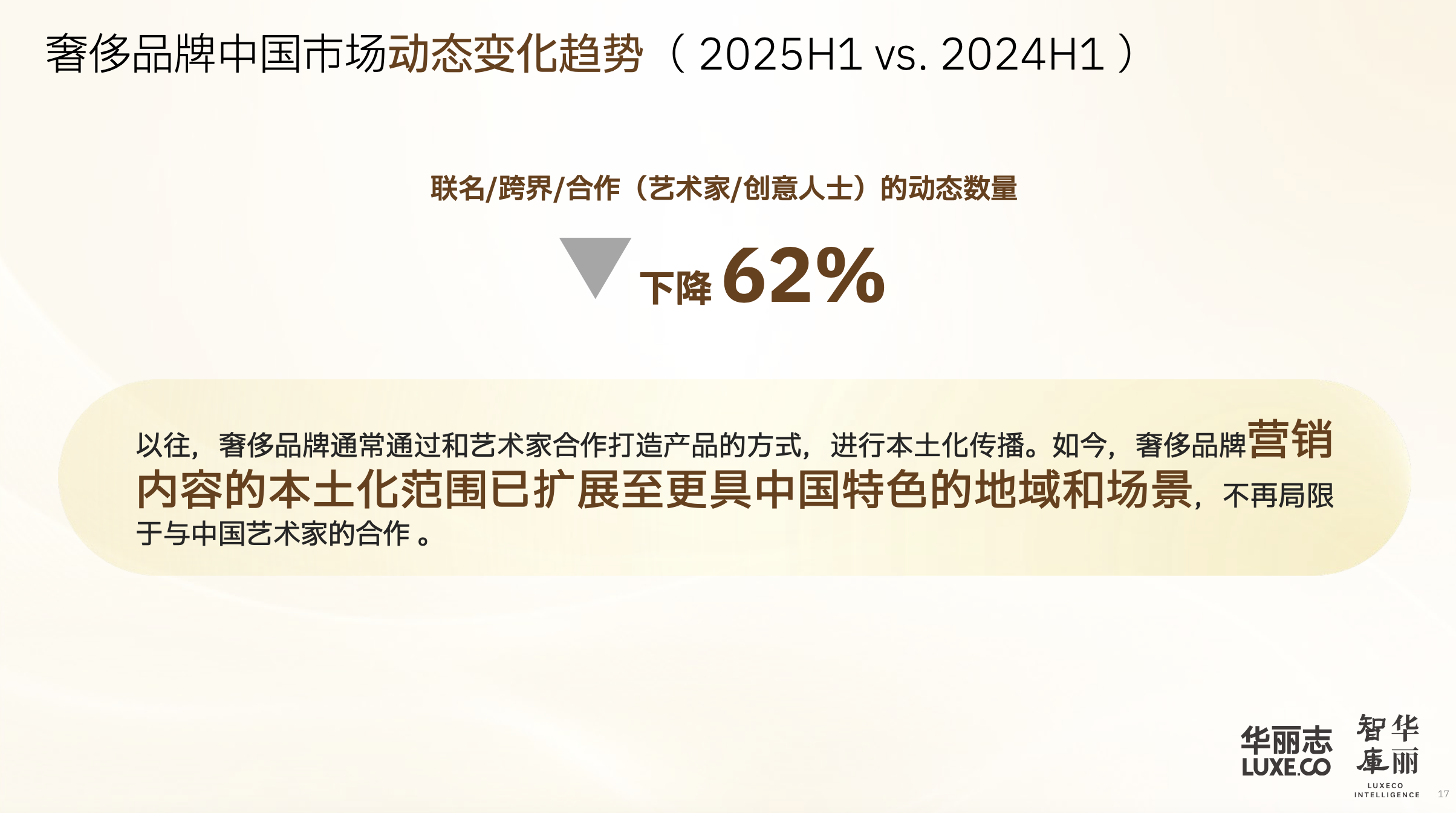

Alicia Yu offered insights into the underlying reasons behind luxury brands’ reduced use of pop-up stores and cross-industry collaborations. Drawing on historical data curated by Luxe.CO Intelligence, she examined the patterns and pace of store network expansion among key luxury brands in China. Through case studies of localization efforts over the past four years, she highlighted the strategic importance of cultural integration in building long-term brand value.

Yu emphasized that in recent years, China’s luxury market has experienced rapid expansion. However, since the second half of 2024, the industry has entered a period of historic slowdown—an opportune moment for reflection and strategic recalibration.

“In the high-growth years, luxury brand events tended to become homogeneous. When every brand is doing similar things, audience fatigue is inevitable, and the return on investment declines. This round of adjustments is likely to prompt brands to reconsider which creative initiatives truly align with their brand DNA, rather than simply following trends. At the same time, when a brand delves into its own archives to ask ‘Who am I?’, it can better communicate its value to Chinese consumers—often without having to overspend on ineffective campaigns.”

“In the past, most luxury brands’ China headquarters were based in Shanghai or Hong Kong, which inevitably led to a limited and sometimes skewed understanding of the Chinese market. Given the vast diversity of China, each key city—from south to north, from east to west—has unique characteristics and consumer potential that brands must study in depth. Moreover, the consumption structure and preferences in each city are constantly evolving and require ongoing tracking and analysis.”

Without a doubt, Luxe. CO’s platforms, especially its website and app, along with the data and case studies compiled by Luxe.CO Intelligence and its series of research reports have become invaluable resources for brand and business leaders. They help industry professionals gain fresh perspectives, stay abreast of market developments, understand their competitive position, and adapt their strategies and execution accordingly.

Luxe.CO has released the full version of the “Luxury Brands in China Power Ranking 2025 H1.”

For full access, please refer to the article: Full Version of the “Luxury Brands in China Power Ranking 2025 H1” Now Available! (Exclusive to Luxe.CO subscribers)

| Image Credit: Luxe.CO

| Editor: LeZhi