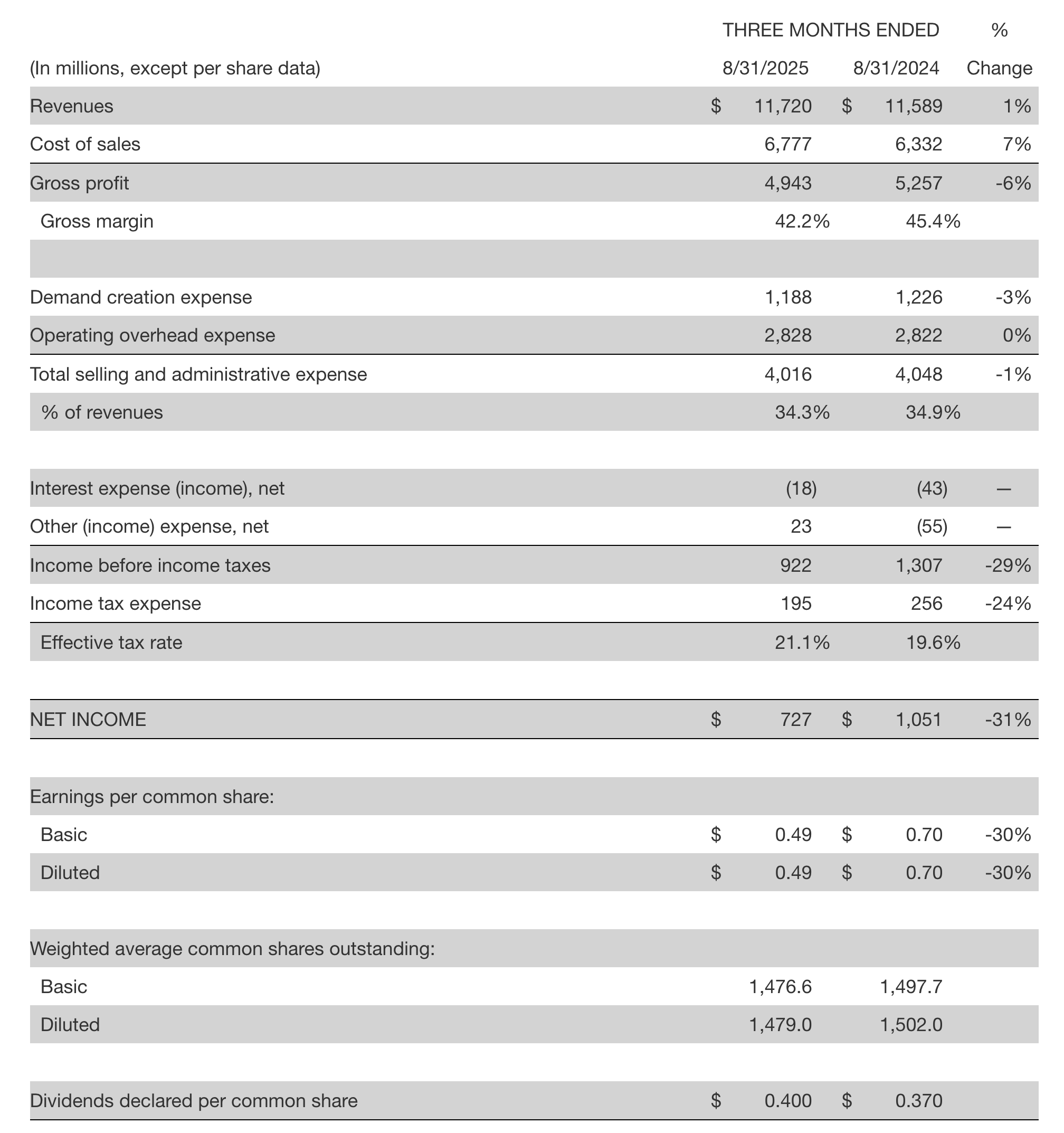

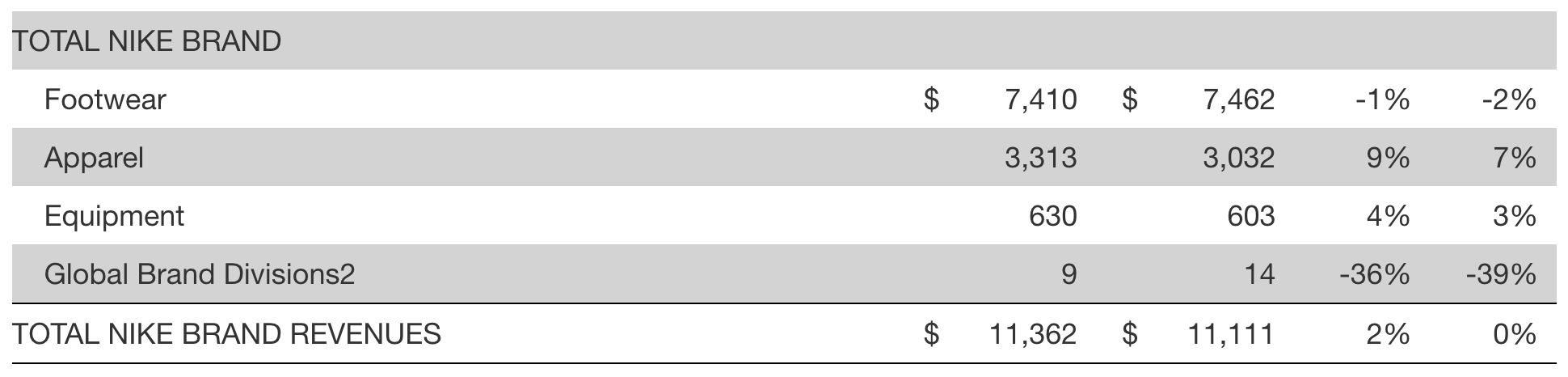

After the market closed on September 30 Pacific Time, American sportswear giant Nike released its financial results for the first quarter of fiscal year 2026, ending August 31, 2025. Benefiting from a 7% increase in its wholesale business, total revenue rose 1% year-on-year to USD 11.7 billion (on a constant currency basis: -1%), exceeding the market consensus estimate of USD 11.0 billion. Net profit fell 31% year-on-year to USD 700 million, but still came in at nearly double the average analyst estimate from Visible Alpha.

Management emphasized that Nike’s current strategic focus is on strengthening its core areas, including North America, wholesale, and running, through the “Win Now actions,” while relying on the new “Sport Offense” organizational structure to maximize long-term portfolio potential. In the face of external headwinds and uneven business recovery across markets, the company will focus on controllable factors to steadily drive growth.

Nike President and CEO Elliott Hill stated, “This quarter NIKE drove progress through our Win Now actions in our priority areas of North America, Wholesale, and Running. While we’re getting wins under our belt, we still have work ahead to get all sports, geographies, and channels on a similar path as we manage a dynamic operating environment. I’m confident that we have the right focus in Win Now and that our new alignment in the Sport Offense will be the key to maximizing NIKE, Inc.’s complete portfolio over the long-term.”

Nike Executive Vice President and CFO Matthew Friend added, “I’m encouraged by the momentum we generated in the quarter, but progress will not be linear as dimensions of our business recover on different timelines. While we navigate several external headwinds, our teams are focused on executing against what we can control.”

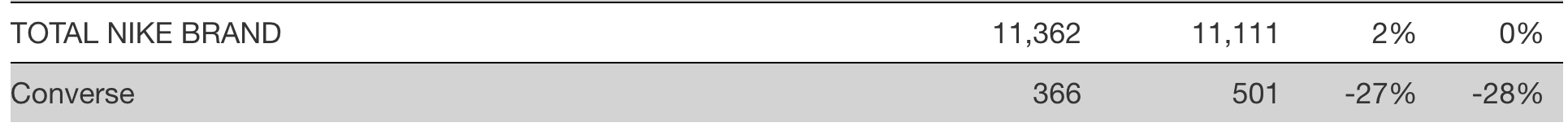

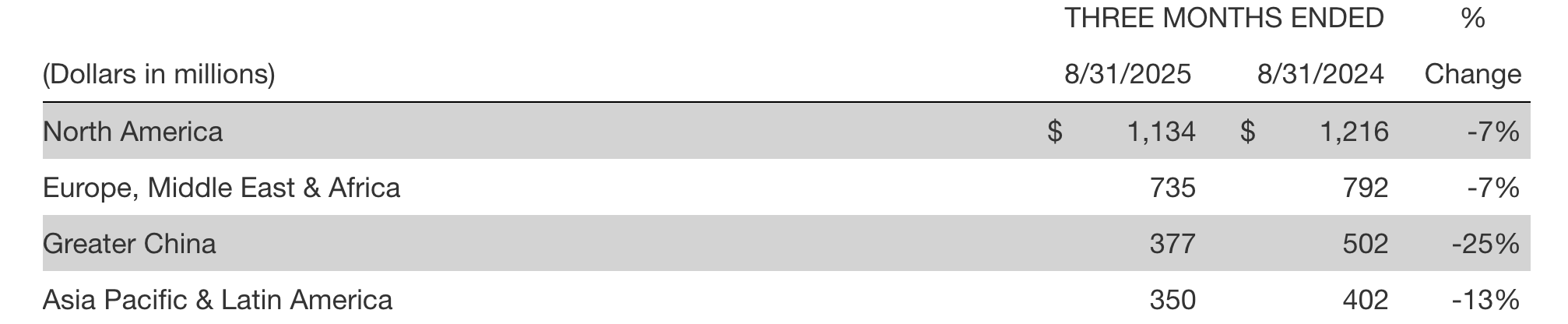

By region, Nike Brand revenue grew in all markets except Greater China. In the Greater China region, revenue fell 10% to USD 1.5 billion.

Elliott Hill noted that the market is facing “structural challenges,” but added, “We remain confident in the long-term opportunity in China, particularly in footwear and apparel for running, training, basketball, and football.”

Based on the latest tariff developments, Matthew Friend raised the company’s full-year tariff cost estimate to USD 1.5 billion, up 50% from USD 1.0 billion three months ago, equivalent to about 3% of Nike’s USD 46.3 billion in revenue last year. The company has been relocating production to help manage tariff-related costs.

Following the earnings release, Nike’s share price rose 3.4% in after-hours trading to USD 72.10 per share, bringing its current market capitalization to approximately USD 102.364 billion.

As of August 31, key financial data for Nike’s first quarter of fiscal year 2026 are as follows:

|Source: Nike official financial report, Financial Times

|Image Credit: Nike official website

|Editor: LeZhi