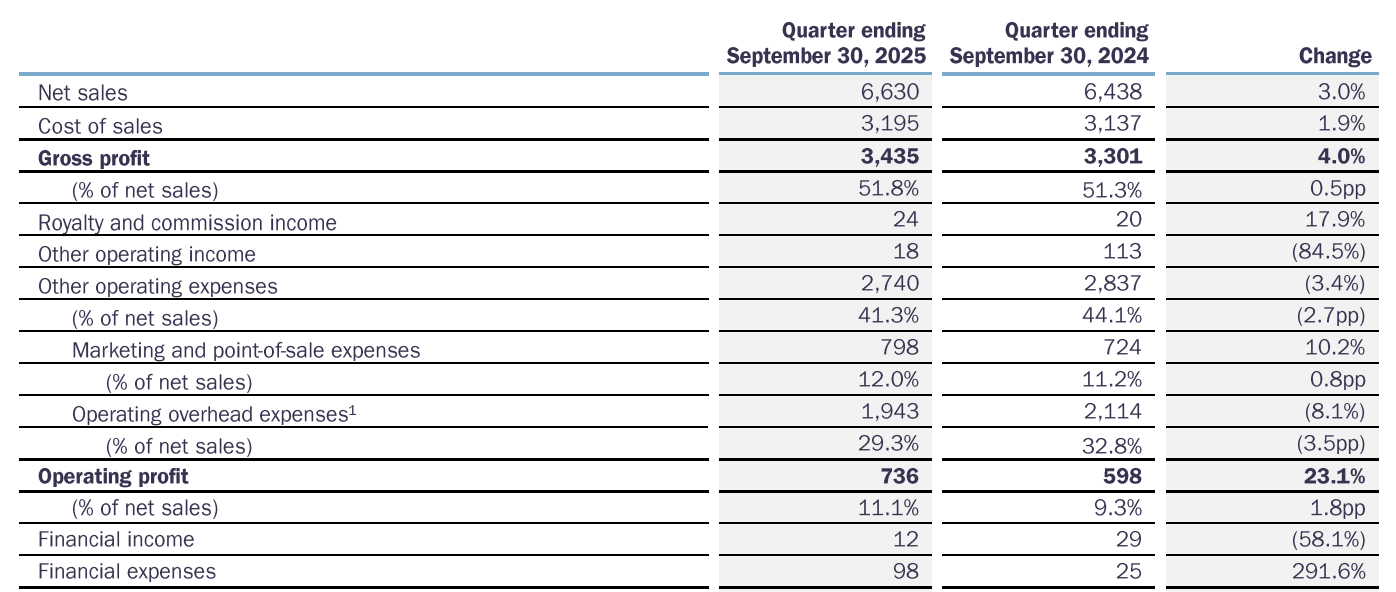

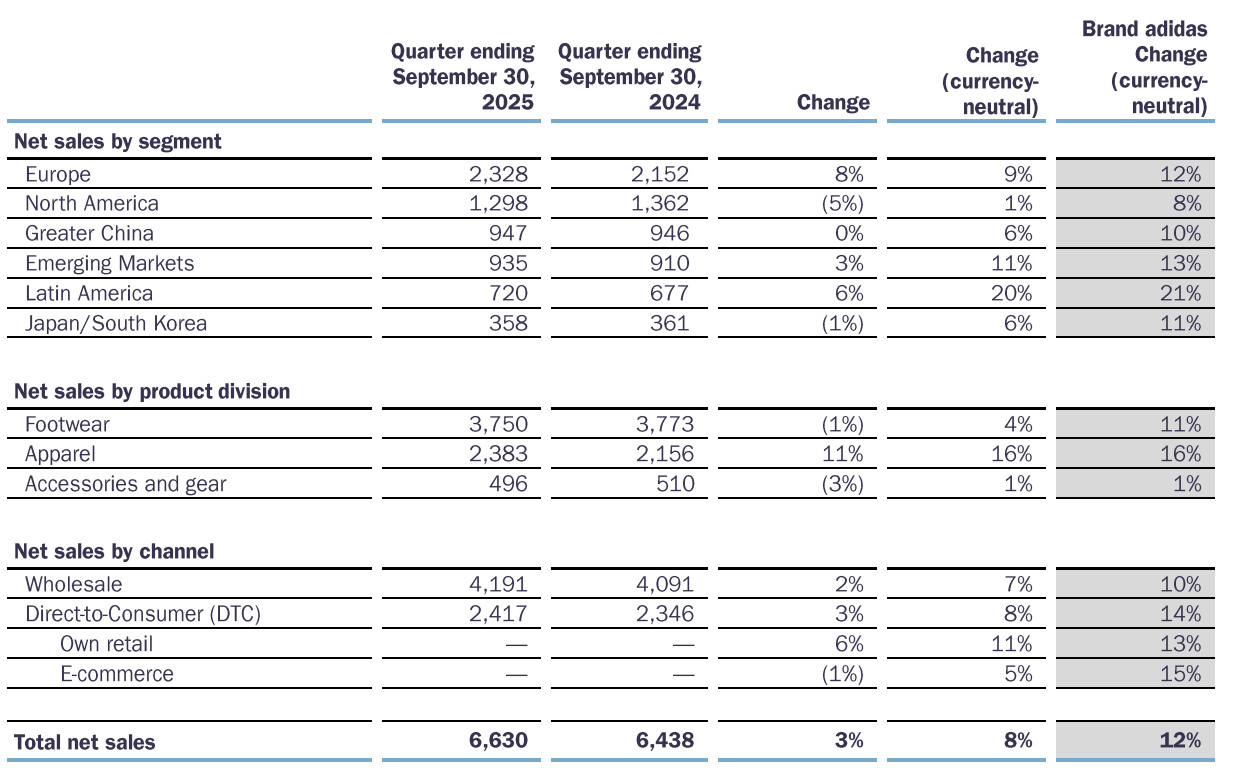

On October 29, German sportswear giant Adidas released key financial data for the third quarter of its 2025 fiscal year, ending September 30. The Adidas brand achieved a year-on-year revenue increase of 12%, reaching a record €6.63 billion (approximately USD 7.02 billion). However, since sales of the Yeezy product line contributed to revenue in the same period last year but were completely discontinued this year, the Group’s total quarterly revenue (also €6.63 billion) grew by only 3% year-on-year (+8% at constant currency). Operating profit rose 23% year-on-year to €736 million (approximately USD 779 million).

Adidas CEO Bjørn Gulden stated, “I am extremely proud of what our teams achieved in the third quarter with actually record revenues. 12% growth for the adidas brand leading to total revenue of € 6.63 billion is the highest we have ever achieved as a company in a quarter. I am especially happy to see that our performance business is growing strongly across categories and in all regions.”

By region, sales in North America declined 5% year-on-year, making it the company’s worst-performing market, largely due to a weaker U.S. dollar.

In a call with reporters, Gulden remarked, “(U.S.) retailers are very cautious… so it’s quite obvious that they want to pre-buy less.” He added that retailers are also “very flexible” with their discounting strategies, as they need to clear out excess inventory from other major brands.

Gulden later told investors that this discounting trend is affecting Adidas’ full-price sales. “If your €100 shoe sells at full price, but a competitor’s €200 shoe is 50% off, of course, you’re going to sell less.”

As a result, following the release of the financial report, Adidas shares fell more than 10% by the close of trading on October 29 compared to the previous trading day—the biggest single-day drop since the end of July.

As of September 30, key financial figures for Adidas’ Q3 FY2025 are as follows:

— By Product Line

Footwear: A broader and deeper product portfolio drove double-digit growth in footwear revenue across key performance categories, including running, football, training, and specialist sports. Strong growth in Originals and Sportswear also contributed to increased footwear sales.

Apparel: Momentum in brand and product growth continued to expand. Differentiated and locally relevant apparel collections drove double-digit growth in Originals, football, running, specialist sports, and U.S. sports categories.

— By Region

From a regional perspective, in the third quarter, Adidas brand net sales at constant currency rose 12% in Europe, primarily driven by double-digit growth in both the wholesale and branded DTC businesses. Revenue in the Chinese Mainland increased 10% year-on-year, emerging markets grew by 13%, Latin America by 21%, and Japan/Korea by 11%, with particularly strong year-on-year growth in DTC channels across all regions. North America saw an 8% year-on-year increase, with both footwear and apparel achieving double-digit growth, while accessories sales declined in the quarter.

— By Channel

Brand net sales recorded double-digit year-on-year growth across all channels. High sales conversion in retail partner stores and expanded shelf space continued to drive wholesale revenue, which grew 10% at constant currency. Own-retail revenue rose 13% year-on-year, supported by strong global same-store sales and continued investment in retail locations. E-commerce sales increased 15% year-on-year, with a continued focus on full-price products and more than 25% growth compared to the same period last year. As a result, the brand’s net sales through DTC channels rose 14% year-on-year in the third quarter.

“Given the positive developments in the third quarter, we have narrowed our revenue guidance range and raised our full-year operating profit forecast from €1.7–1.8 billion to around €2 billion (approximately USD 2.12 billion).

2025 is already proving to be a successful year for us. Year to date, the Adidas brand has grown 14%, with an EBIT margin exceeding 10%, demonstrating the strength of our brand. As a global brand, we operate with a local mindset, empowering each market to win over local consumers. This is the right strategy for achieving global success and has driven these strong results,” said Bjørn Gulden.

Based on this, Adidas Group has raised its full-year 2025 outlook:

-

Total revenue at constant currency is expected to grow at a double-digit rate. If including the Yeezy inventory sales in the 2024 comparison base (approximately €650 million), revenue is projected to grow about 9% at constant currency;

-

Operating profit is expected to rise to around €2 billion (previous forecast: €1.7–1.8 billion).

The company noted that the profit forecast upgrade reflects continued brand momentum, better-than-expected business performance, and the company’s success in partially offsetting the additional costs from higher U.S. tariffs.

|Source: Official Financial Report, Reuters

|Image Credit: Company Website

|Editor: LeZhi