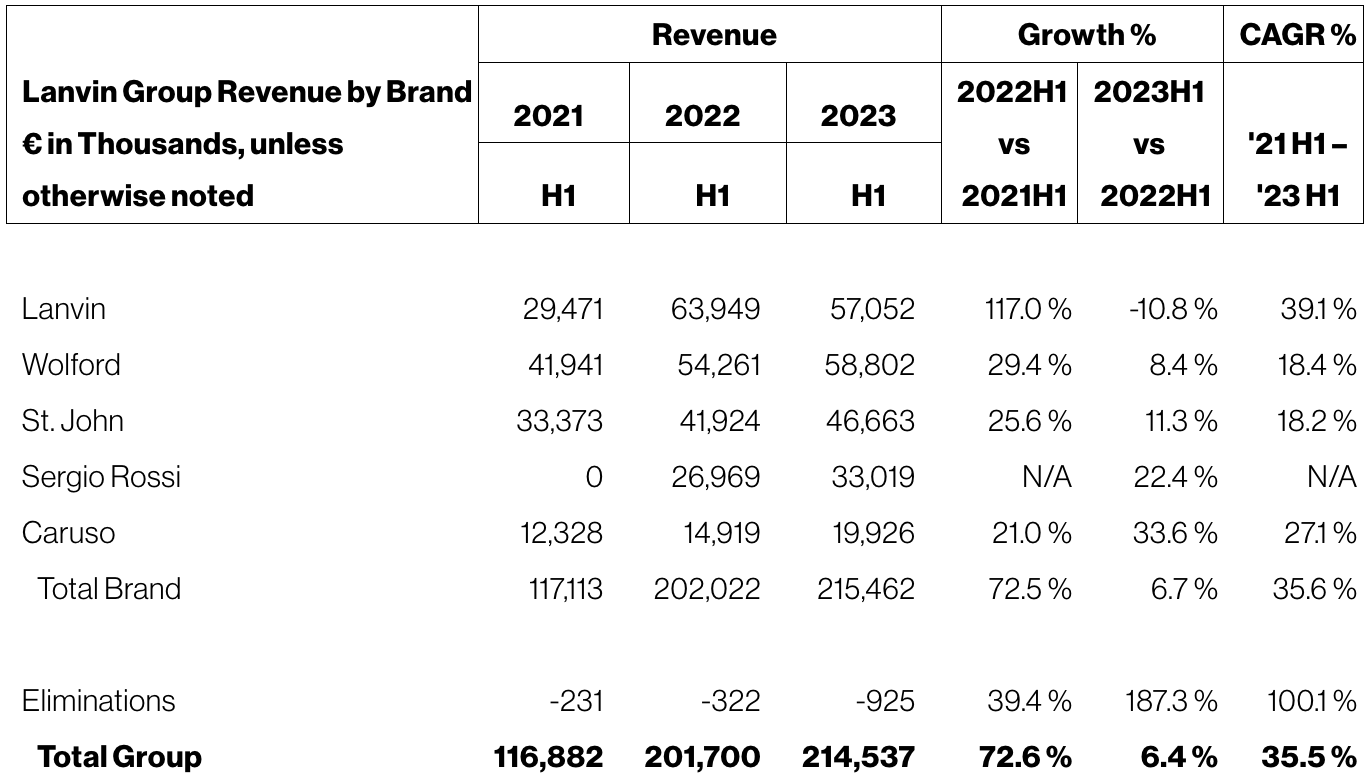

On August 30th, Lanvin Group (Ticker: LANV), a global fashion and luxury conglomerate, released its financial report for the first half of 2023. The group reported a total revenue of €215 million, marking a 6.4% year-on-year growth compared to 2022. The gross profit reached €125 million, with a gross profit margin of 58.5%, a further increase from the 2022 figures of €113 million and 55.9% respectively.

Lanvin Group encompasses several brands, including Lanvin, Wolford, Sergio Rossi, St. John, and Caruso.

Joann Cheng, Chairman and CEO of Lanvin Group, stated, “We continue our track record of global growth while we make progress on our path to profitability. Our improvement in gross profit and contribution profit are evidence of our commitment to securing profitable growth. We have done the groundwork for our brands to accelerate their growth and are excited about our prospects for the remainder of 2023.”

Cheng added, “At the top line, we grew group revenues across all our key markets with Sergio Rossi growing sales by 22.4% and Wolford growing 8.4%, especially after the hiring of Nao Takekoshi as its Creative Director. We also made several strategic reorganization decisions with respect to Lanvin which had an expected short-term impact in the first half of 2023. We believe we have now placed Lanvin in a much stronger position and look forward to seeing the results of these decisions, such as a new collection from our first Lanvin Lab guest designer, the Grammy-winning artist, Future.“

As of the closing of the market on August 29th, Lanvin Group’s stock price on the New York Stock Exchange declined by 2.63% to $4.45 per share, with a current market capitalization of approximately $583 million. In after-hours trading on the same day, the stock price increased by 1.12% to $4.5 per share.

During this period, Lanvin Group achieved growth across various regions and channels. The Greater China region saw strong growth of 13.9%, EMEA region grew by 5.3%, the North American market grew by 2.6%, and other Asian markets outside of Greater China grew by 27.1%. At the brand level, while creative strategy adjustments influenced Lanvin’s performance in the first half, the overall brands under the group grew by 14.7% compared to the first half of 2022.

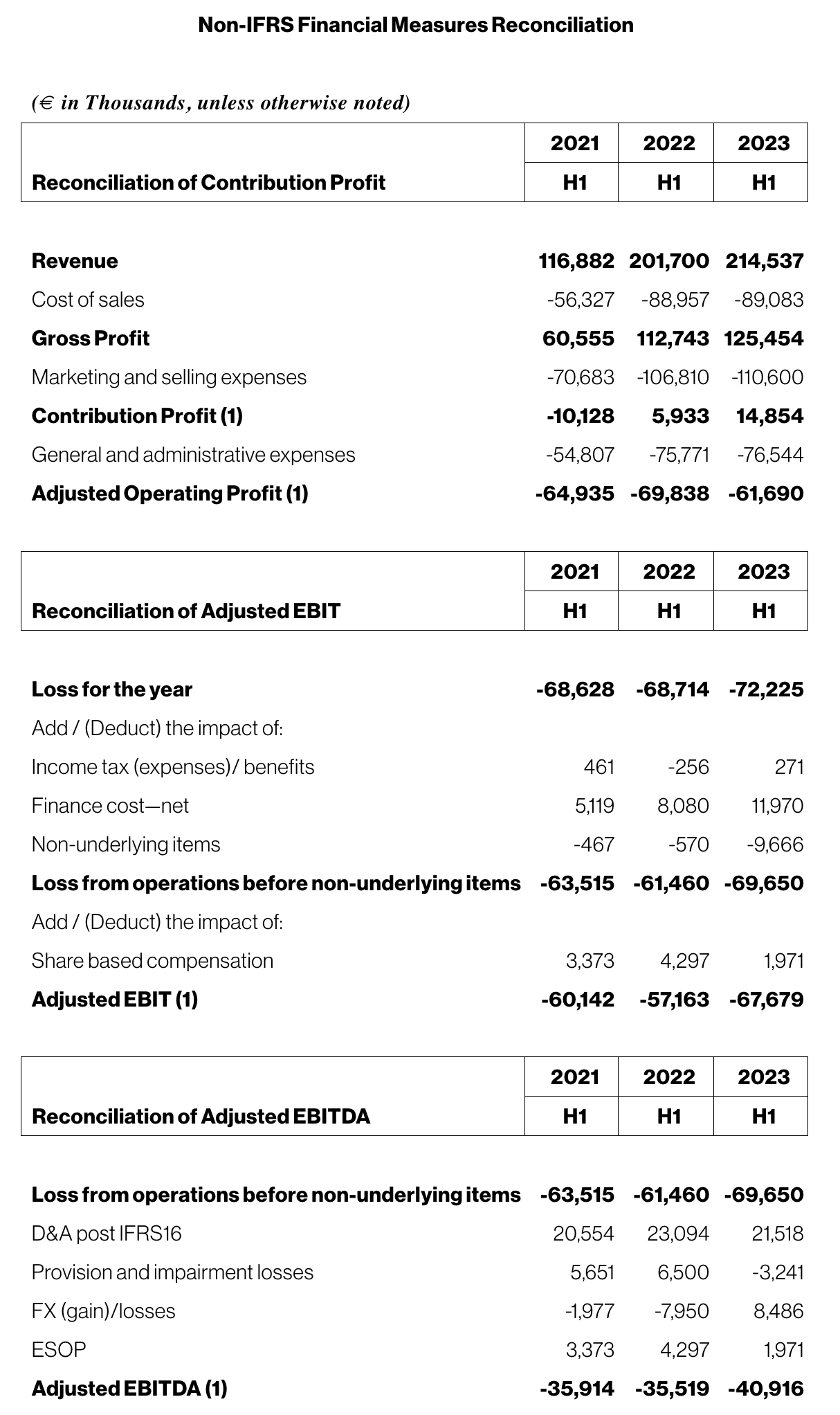

Simultaneously, the group’s profitability continued to improve, with the gross profit margin rising to 58.5%. The increased margin income reached a new high of €14.85 million, with a margin income rate of 6.9%. The effects of operational improvements are gradually being realized and are expected to continue driving profitability enhancements in the second half of the year, leading the group to achieve its adjusted EBITDA turnaround target by 2024.

Other highlights of the first half of the fiscal year include:

Flagship brand Lanvin successfully regained its trademark rights in Japan. In March of this year, Lanvin successfully repurchased the trademark rights in Japan from strategic partner ITOCHU Corporation, further solidifying the brand’s global intellectual property and management integrity. Over the past 20 years, ITOCHU Corporation has established a highly successful brand licensing business for Lanvin in the Japanese market and will continue to serve as Lanvin’s exclusive authorized distributor in Japan after the trademark repurchase, providing strong support for Lanvin’s further development in the Japanese market.

New organizational structure and personnel appointments: Lanvin announced strategic adjustments to its creative system in April of this year following the departure of former Creative Director Bruno Sialelli. Lanvin introduced two new creative branches, the Leather Goods & Accessories Division, and Lanvin Lab, as part of the continuous strengthening of its mainline clothing collection. As an innovative project venturing into cutting-edge design, Lanvin Lab aims to invite globally influential interdisciplinary artists and creative talents as creative partners to interpret and express the brand’s inherent culture, driving the brand’s continuous transformation in a contemporary context. Its first guest creative director, Grammy Award winner, and renowned rapper Future, will launch a new collection in the second half of 2023.

In February of this year, Wolford announced its new Creative Director, Nao Takekoshi. With extensive experience in the fashion industry, Takekoshi began his early career at Issey Miyake and has worked for well-known brands such as Cerruti, Gucci, Donna Karan, Jil Sander, and Calvin Klein. His appointment marks a key step in Wolford’s development strategy, signifying the brand’s commitment to enhancing its classic style and further shaping a global brand image.

Profitability of Each Brand

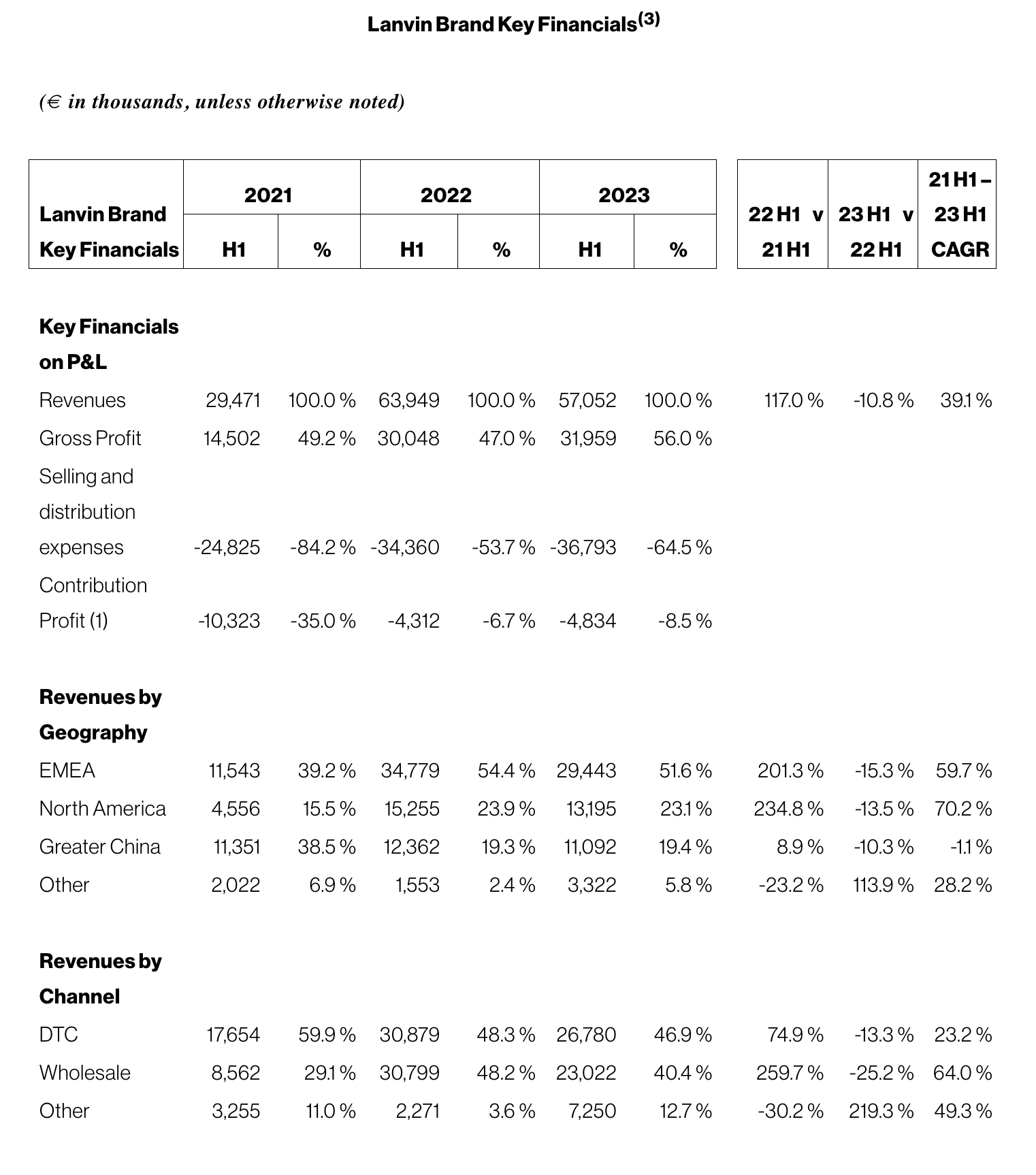

—— Lanvin

Lanvin’s revenue for the first half of the year decreased from 63.95 million euros in the same period of 2022 to 57.05 million euros. This decrease was mainly due to the brand’s implementation of creative system adjustments in the first half of the year, as well as the impact of annual product and marketing activities. As part of the brand’s creative system upgrade, Lanvin established Lanvin Lab and a dedicated Leather Goods & Accessories Division in the first half of 2023, preparing for key product releases and marketing activities in the second half of the year.

Outside of Lanvin Lab, the brand plans to announce a new Creative Director in the coming months. The new Creative Director will work together with Lanvin Lab to build a unified and diverse creative system for the brand, constantly creating surprises and excitement. These upgraded adjustments lay the foundation for the brand’s next stage of development.

Lanvin’s gross profit increased from 30.05 million euros in the first half of 2022 to 31.96 million euros, mainly benefiting from higher sales through direct channels and accessories. Lanvin’s margin remained stable, decreasing slightly from a loss of 4.31 million euros in the first half of 2022 to a loss of 4.83 million euros in the first half of 2023.

In the second half of this year, Lanvin expects to achieve accelerated growth through a series of key product releases and marketing activities, opening a new flagship store on Madison Avenue in New York, and expansion into new growth markets such as the Middle East.

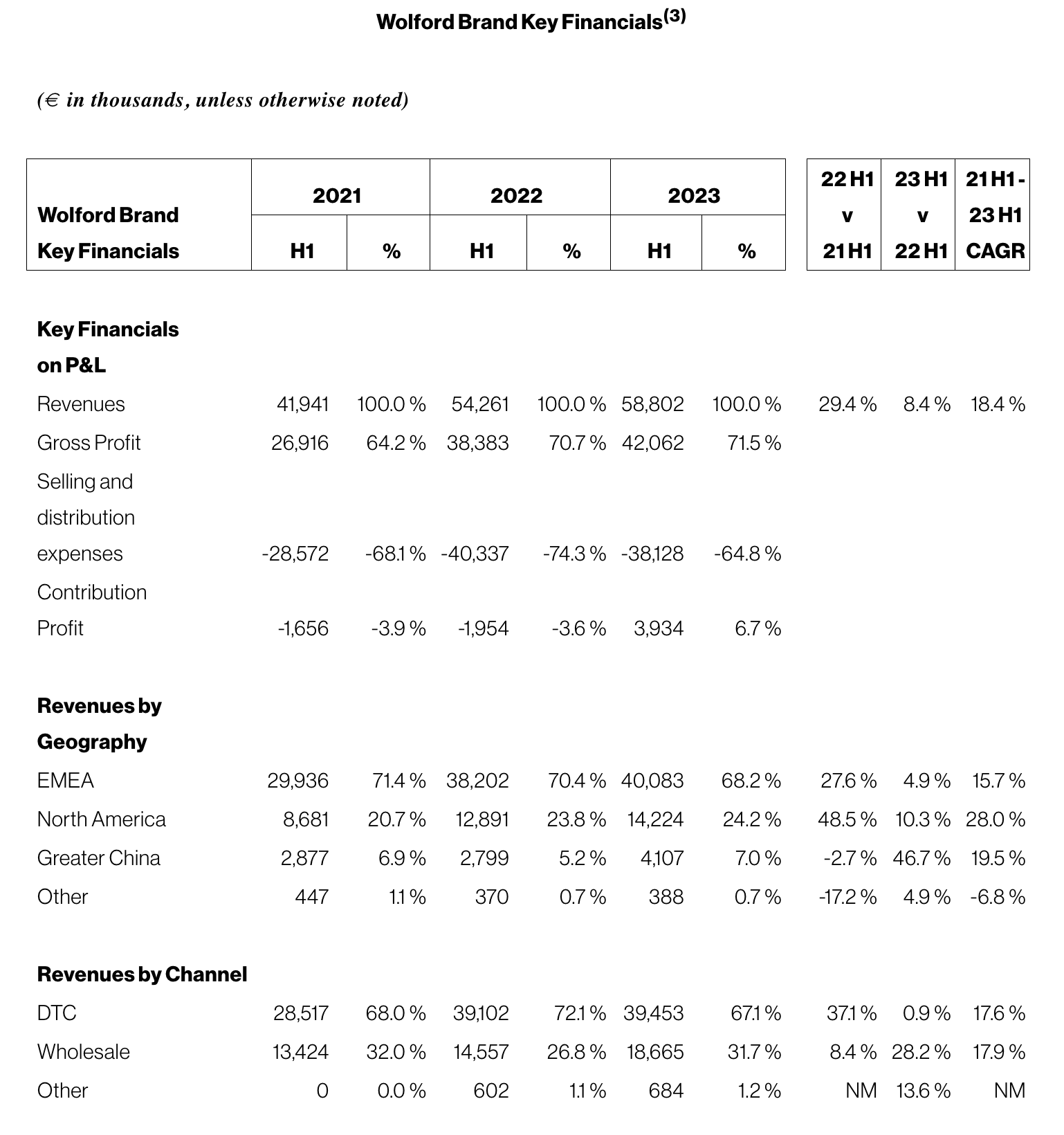

—— Wolford

Wolford’s revenue increased from 54.26 million euros in the first half of 2022 to 58.80 million euros in the first half of 2023, representing an increase of 8.4%. The Greater China region saw growth of 46.7%, the North American market grew by 10.3%, and the EMEA region increased by 4.9%. Wholesale channel revenue (including newly expanded distributor regions) increased by 28.2%, driven primarily by price adjustments and organic growth of the brand.

Wolford’s gross profit margin increased from 70.7% in the same period of the previous year to 71.5%. Thanks to increased income, higher gross profit, and better management of operating costs, Wolford’s marginal income turned from a loss to a profit in the first half of the year, increasing from a loss of 1.95 million euros in the first half of 2022 to a profit of 3.93 million euros in the first half of 2023, and the marginal income rate increased from -3.6% to 6.7%.

Wolford’s growth in the first half of the year was driven by various initiatives, including the outstanding performance of The W activewear collection, the collaboration with Italian fashion brand N°21, and the impactful advertising campaign featuring legendary singer and fashion icon Grace Jones, who has inspired generations of women with her confident and bold performances. We anticipate that Wolford’s continued product innovation and releases will remain a major driving force for the brand’s growth in the second half of the year.

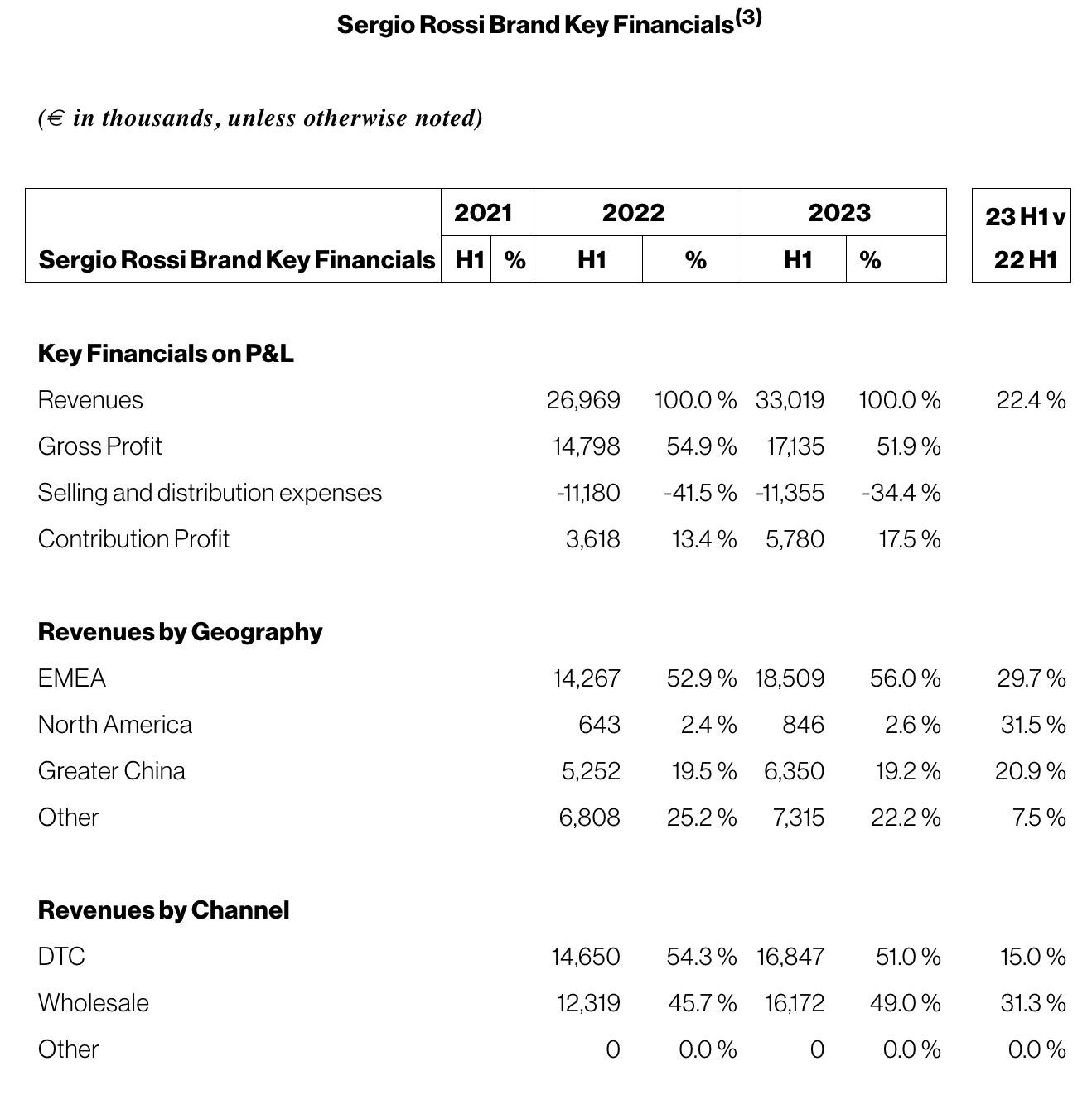

—— Sergio Rossi

Sergio Rossi’s brand revenue increased from 26.97 million euros in the first half of 2022 to 33.02 million euros in the first half of 2023, representing a growth of 22.4%. The EMEA market grew by 29.7%, the North American market by 31.5%, and the key Greater China market grew by 20.9%. Sergio Rossi’s collaborations, such as the joint collection with New York’s cutting-edge fashion brand AREA, elevated the brand’s profile, and the special collaboration with Japanese artist Mari Katayama, who has walked with prosthetics since the age of nine, creatively combined the brand’s craftsmanship with the special needs of individuals, earning widespread acclaim for the brand.

Sergio Rossi’s gross profit margin decreased from 54.9% in the same period of the previous year to 51.9%. This was primarily due to a substantial 31.3% growth in revenue from the wholesale channel in the first half of the year, while DTC channel revenue grew by 15.0%. The revenue growth from the wholesale channel was mainly driven by third-party manufacturing orders (the brand categorizes this business as wholesale revenue). The marginal income rate increased from 13.4% to 17.5%, benefiting from the operating leverage optimization brought by revenue growth.

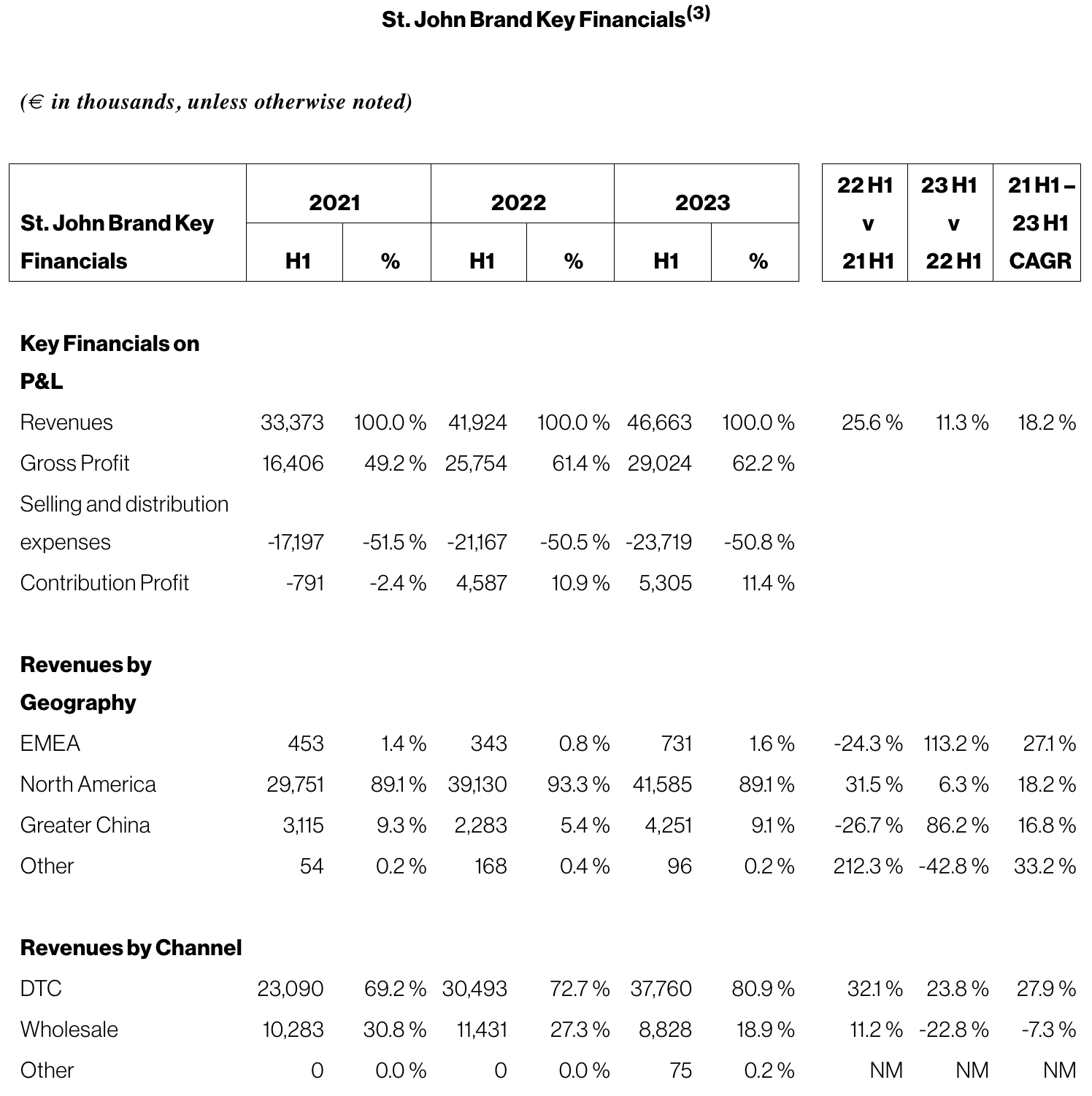

—— St. John

St. John’s brand revenue increased from 41.92 million euros in the first half of 2022 to 46.67 million euros in the first half of 2023, a growth of 11.3%. Gross profit increased from 25.75 million euros to 29.02 million euros, and the gross profit margin increased from 61.4% to 62.2%. The marginal income increased by about 720,000 euros year-on-year, and the marginal profit rate increased by 50 basis points. The Foundation series launched last fall, intended to be a must-have staple in every woman’s daily wardrobe, has become an important growth driver for the brand, especially after celebrity stylist Karla Welch joined as a creative consultant. The #OwnYourPower campaign initiated in collaboration with American screenwriter and producer Shonda Rhimes paid tribute to extraordinary women who have achieved remarkable careers, resonating with St. John’s female clientele.

The brand expects to complete operational cost optimization as planned in the second half of the year, including supply chain upgrades. The transformation from production-driven to brand-driven has stabilized St. John’s business, and the brand will accelerate growth and further improve profitability through enhanced brand marketing.

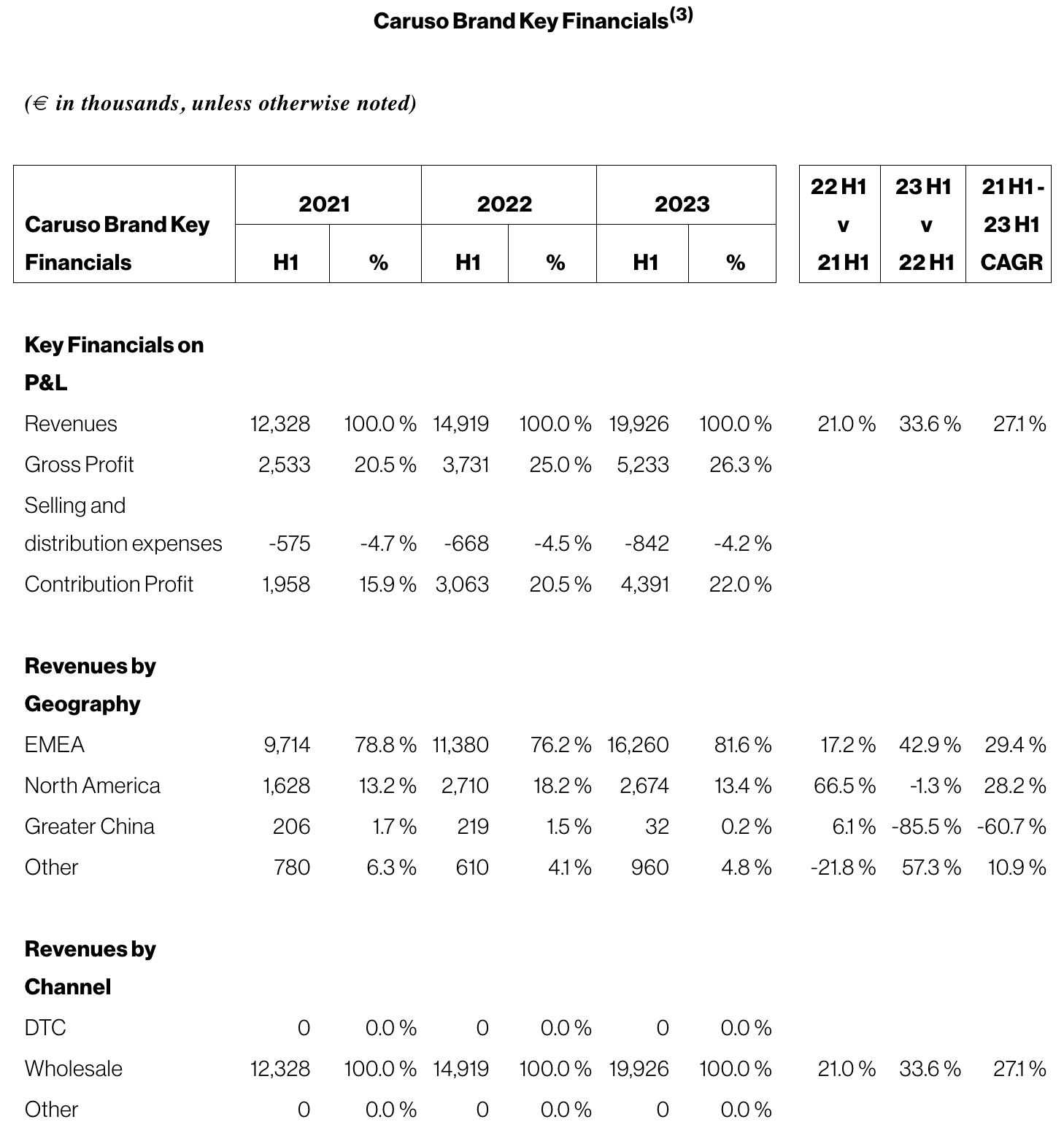

—— Caruso

Caruso’s brand revenue increased by 33.6% from 14.92 million euros in the first half of 2022 to 19.93 million euros in the first half of 2023. This growth was driven by strong year-on-year growth in its factory OEM business and positive feedback from the market regarding Caruso’s own-brand products. Gross profit increased from 3.73 million euros to 5.23 million euros, and the gross profit margin increased from 25.0% to 26.3%. The marginal income increased from 3.06 million euros to 4.39 million euros, and the marginal income rate increased from 20.5% to 22.0%. Caruso plans to continue to improve its profitability by expanding its customer base for new brands while deepening existing customer relationships to enhance its profitability through economies of scale continuously.

Note: Marginal income is defined as gross profit minus sales and marketing expenses. It is an important indicator used by the group’s management to measure marginal profitability and analyze the effectiveness of brand operational improvements.

Outlook for 2023

Despite ongoing macroeconomic challenges, the group expects to maintain growth momentum, optimize operational efficiency, and continue to improve profitability in the second half of the year. With exciting marketing initiatives, collaborations, and the launch of new product series, the group anticipates strong performance in the second half of 2023.

The group will continue to focus on revenue growth. As operating costs stabilize and store optimization work progresses, the group expects to steadily increase profitability and achieve positive EBITDA as planned by 2024.

Other Key Financial Data

About Lanvin Group

Lanvin Group is a global fashion and luxury conglomerate with brands including Lanvin, the oldest active French high fashion house, Austrian luxury skinwear brand Wolford, Italian luxury footwear brand Sergio Rossi, American classic knitwear brand St. John Knits, and Italian high-end menswear manufacturer Caruso. The company went public on the New York Stock Exchange in December 2022.

| Source: Lanvin Group’s Financial Report

| Image Credit: Lanvin Group’s Official Website, Lanvin Group’s Financial Report

| Editor: LeZhi