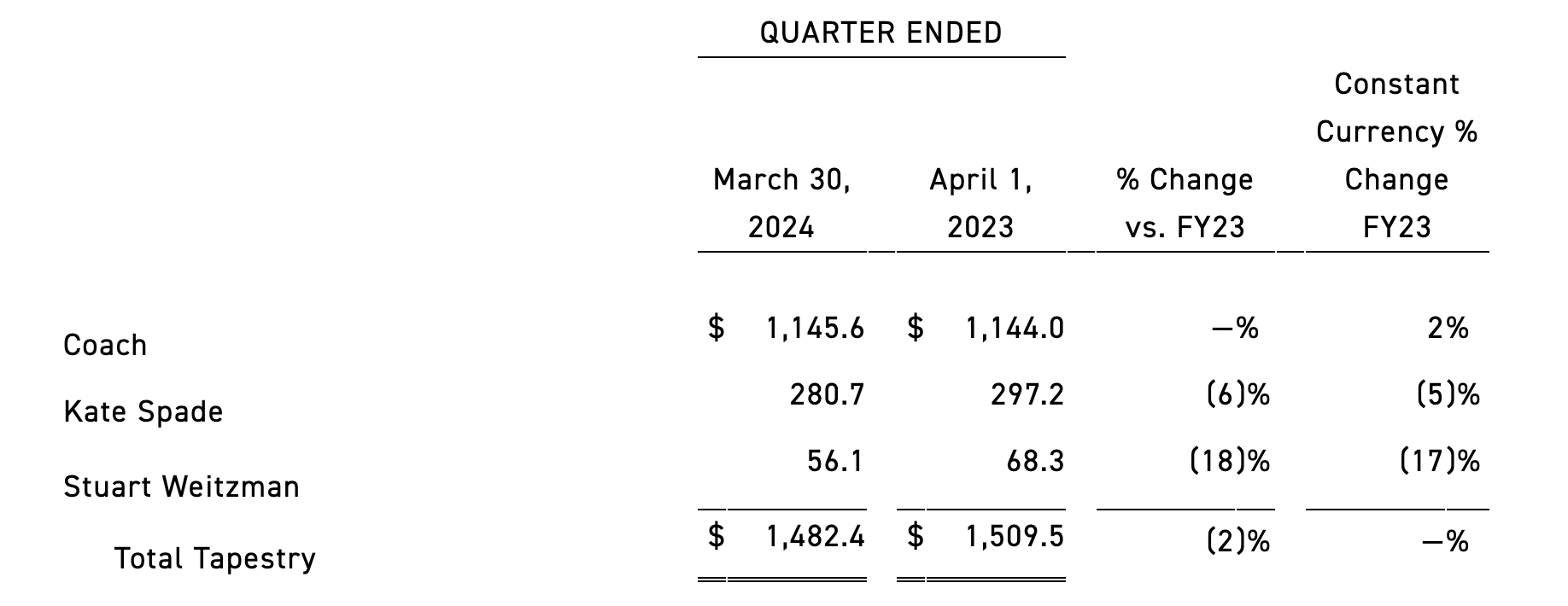

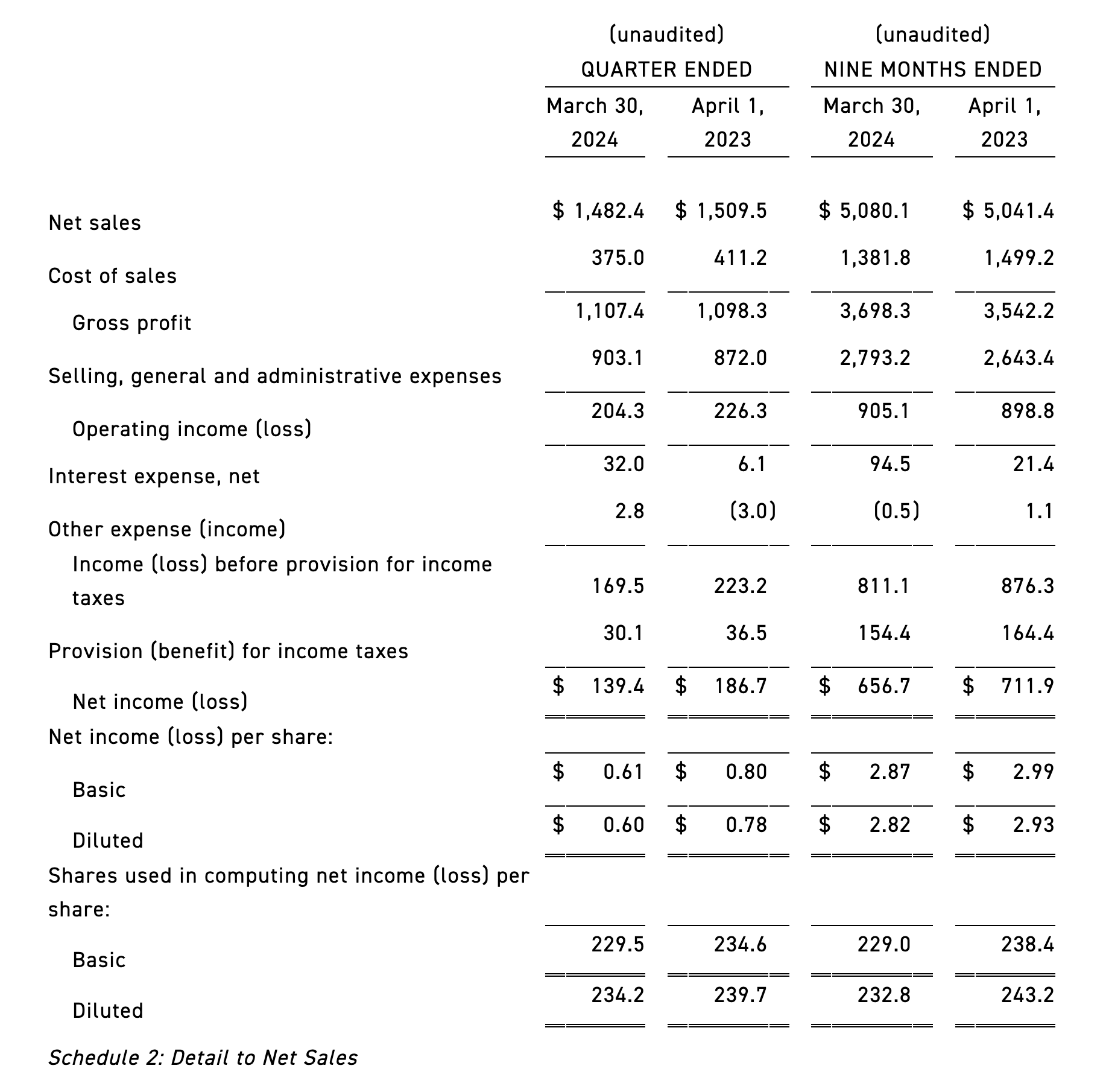

Ahead of the market opening on May 9, Tapestry, Inc. (NYSE: TPR), the American luxury fashion holding company owning brands such as Coach, Kate Spade, and Stuart Weitzman, released its financial results for the third quarter of the fiscal year 2024, ending March 30, 2024. Total sales reached $1.48 billion, down from $1.51 billion the previous year, marking a 2% decrease both on a reported basis and at constant exchange rates. Adjusted for a roughly 160 basis point unfavorable foreign exchange impact, sales were essentially flat compared to the previous year.

By the close of trading on May 9, Tapestry’s stock price had risen 3.57% to $40.37 per share, with a cumulative 12-month increase of 8.7% and a current market capitalization of approximately $9.3 billion.

Tapestry’s CEO, Joanne Crevoiserat, commented on the quarter’s performance, stating: “Our third quarter earnings results outperformed expectations, reflecting our unwavering commitment to disciplined brand building and operational excellence. Our talented global teams continued to advance our long-term initiatives, fueling innovation and consumer connections, while successfully harnessing the power of our customer engagement platform to navigate the dynamic backdrop with focus and agility. Moving forward, we are confident in our vision for the future and the significant runway to drive sustainable growth and shareholder value.”

Key strategic developments during the third quarter included:

Building enduring consumer relationships:

- Deepening brand-consumer interactions, acquiring approximately 1.2 million new customers in North America alone, over half of whom are Gen Z and Millennial consumers.

Achieving global growth:

- Direct sales declined during the quarter, but this was offset by growth in wholesale driven by international markets;

- Sales increased by 3% year-over-year at constant exchange rates internationally, with Europe growing 19%, other Asian markets 15%, and Japan 2%; China’s sales decreased by 2%, in line with expectations; North America saw a 3% decline amid challenging consumer markets;

- Adjusted diluted earnings per share exceeded expectations by approximately $0.15, benefiting from excellent operational performance and a favorable expense timing shift in the fourth quarter (about $0.06); the term “favorable expense timing shift” refers to the discrepancy between actual and expected payment times within the financial period, which positively impacted the financial performance of this period.

- Year-to-date, the company has seen strong growth in business activity cash flow and free cash flow, surpassing $900 million, higher than the previous year, continually advancing the company’s strategic growth agenda.

Providing rich omnichannel experiences:

- Launching immersive retail experiences and new concepts globally, enhancing visibility and customer penetration among younger demographics;

- Maintaining robust digital business, with revenues more than three times pre-pandemic levels, accounting for over 25% of total sales.

Driving fashion innovation and creating superior products:

- Offering a diverse and unique range of products, with COACH brand seeing notable growth, driving up the average price of handbag products;

- Benefiting from reduced freight costs, favorable foreign exchange conditions, and outstanding operational performance, gross margin improved by 190 basis points;

- Maintaining strict inventory control, with a significant focus on inventory management, year-end inventory levels decreased by 12% compared to the previous year.

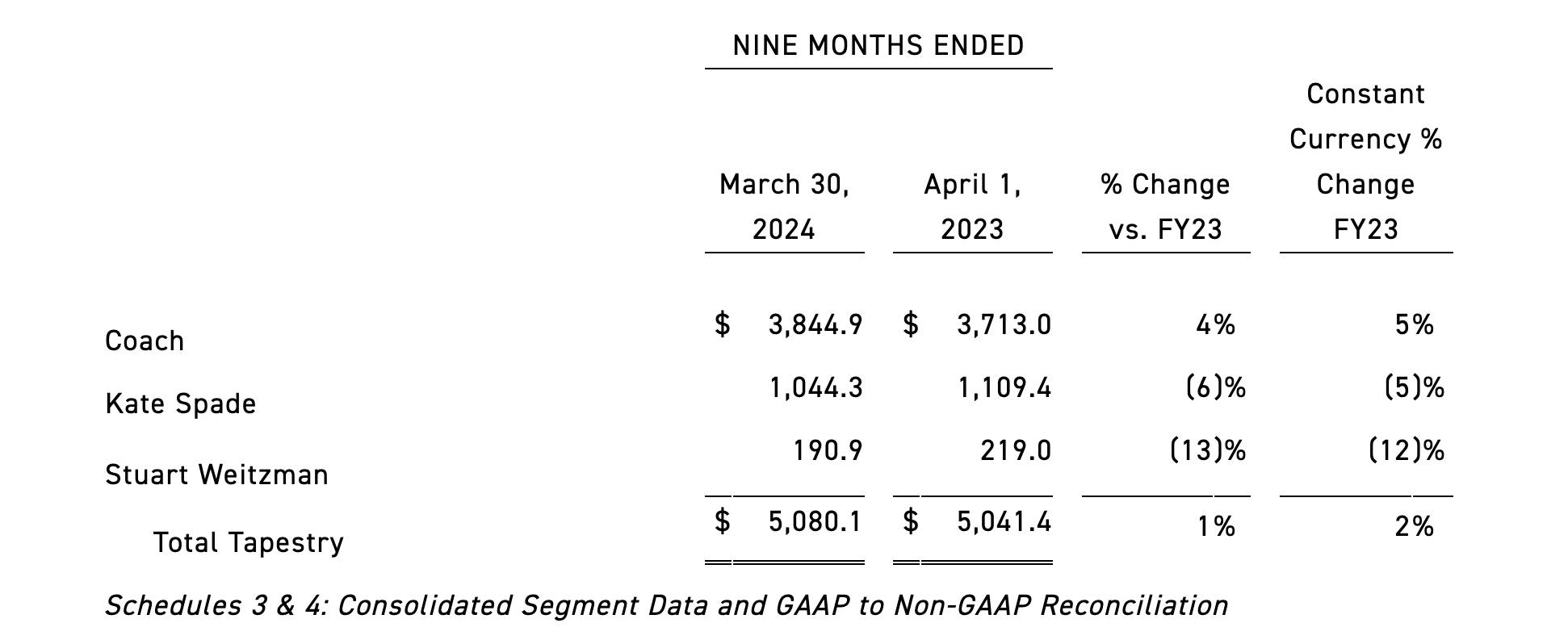

By brand:

Tapestry also stated in its financial report that on April 22, the Federal Trade Commission (FTC) filed a lawsuit to block the proposed acquisition of Capri Holdings Limited.

On August 10 last year, Tapestry Group announced the final agreement to acquire Capri Holdings Limited, the parent company of brands such as Versace, Jimmy Choo, and Michael Kors. The group stated that this transaction will:

- Expand the brand portfolio’s coverage and diversification across consumer segments, geographical locations, and product categories, tapping into the global luxury market valued at over $200 billion and growing;

- Fully leverage Tapestry Group’s consumer interaction platforms to enhance direct sales opportunities;

- Achieve significant cost synergies of over $200 million within three years after completing the transaction;

- Generate highly diversified, strong, and stable cash flows to invest in merged entity’s brands, talent, and business, while supporting rapid debt repayment to achieve a total leverage ratio below 2.5 times debt/adjusted EBITDA within 24 months post-transaction.

- Continue to advance the company’s goal-oriented and people-centric development processes;

- Create pathways to enhance shareholder total returns, including achieving high double-digit growth in adjusted diluted earnings per share and delivering attractive investment returns.

Regarding the obstruction by the Federal Trade Commission (FTC), Tapestry Group expressed that the group firmly believes the acquisition will bring significant benefits to the merged company, benefiting global consumers, employees, partners, and shareholders. This reflects the group’s consumer-centric approach, brand-building prowess, and standard operational achievements, speeding up the group’s strategic and financial growth agendas. The group is confident about the acquisition and will actively address the lawsuit, aiming to complete the transaction within 2024.

Previously, on April 15, this merger had already received approval from regulatory bodies in the European Union and Japan. This merger will consolidate Tapestry with Capri’s array of luxury brands to create the world’s fourth-largest luxury giant. According to Wells Fargo analysts, the merged entity will hold approximately 5.1% of the global luxury market share.

Looking ahead to the fiscal year 2024, the group expects: Total revenue to exceed $6.6 billion, roughly flat compared to the previous year on a reported basis, and to grow by 1% on a constant exchange rate basis; diluted earnings per share are projected to be between $4.20 and $4.25, representing an 8% to 9% increase from the previous year. Free cash flow is expected to be around $1.1 billion, excluding transaction-related costs.

Attached: Key Financial Data for the Third Quarter of Fiscal Year 2024 for Tapestry Group

| Source: Tapestry Group official website, official press releases, and official financial reports

| Image Credit: Tapestry Group official website

| Editor: Wang Jiaqi