On June 24, after the market closed, L’Occitane International (HK:973), a French skincare group listed on the Hong Kong Stock Exchange, released its FY2024 annual results for the year ending March 31. The group’s total sales exceeded the €2.5 billion milestone, reaching €2.54 billion, a year-on-year increase of 19.1% (24.1% at constant exchange rates), driven by the robust performance of Sol de Janeiro and steady growth of L’OCCITANE en Provence, particularly due to continued stable growth in the Chinese Mainland market.

Operating profit for the period decreased by 2.5% to €233 million (FY2023: €239 million), with an operating profit margin of 9.2%. This decline was mainly due to increased marketing investments in strategic markets and channels for major brands. Excluding special items such as impairments and profit/loss from associates, operating profit for FY2024 reached €308 million, with an operating profit margin of 12.1%.

In terms of individual markets, the Chinese Mainland emerged as the second-largest market, achieving a strong growth of 19.3% at constant exchange rates, accounting for 12.9% of the group’s sales, and becoming a key growth engine for the group:

- L’OCCITANE en Provence: Double-digit growth in the Chinese Mainland market.

- ELEMIS: High double-digit growth in the Chinese Mainland market.

- Sol de Janeiro, ELEMIS, and L’OCCITANE en Provence: Excellent performance in new online store channels on Douyin, driving a 25.2% growth in online sales at constant exchange rates.

As of March 31, the total number of retail locations increased by 266 from 2,774 at the end of the previous fiscal year to 3,040, with the total number of self-operated stores increasing by 1 to 1,362. The breakdown of self-operated store numbers and changes by brand are: L’OCCITANE en Provence (1,221; -15), L’OCCITANE au Brésil (75; +10), Melvita (32; -3), Erborian (2; unchanged), ELEMIS (24; unchanged), and Dr. Vranjes Firenze (9; +9).

In January 2024, L’Occitane Group announced the acquisition of the Italian luxury home fragrance brand Dr. Vranjes Firenze from the British private equity fund Bluegem Capital Partner (for details, see Luxe.CO’s report: L’Occitane Group Acquires Italian Luxury Home Fragrance Brand Dr. Vranjes, Valuation May Reach €150 Million).

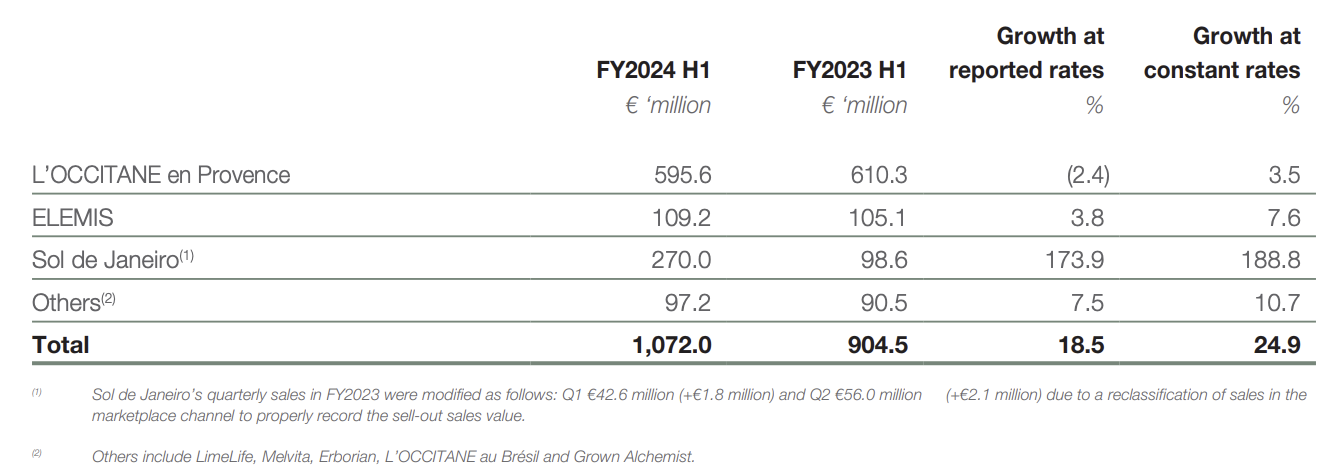

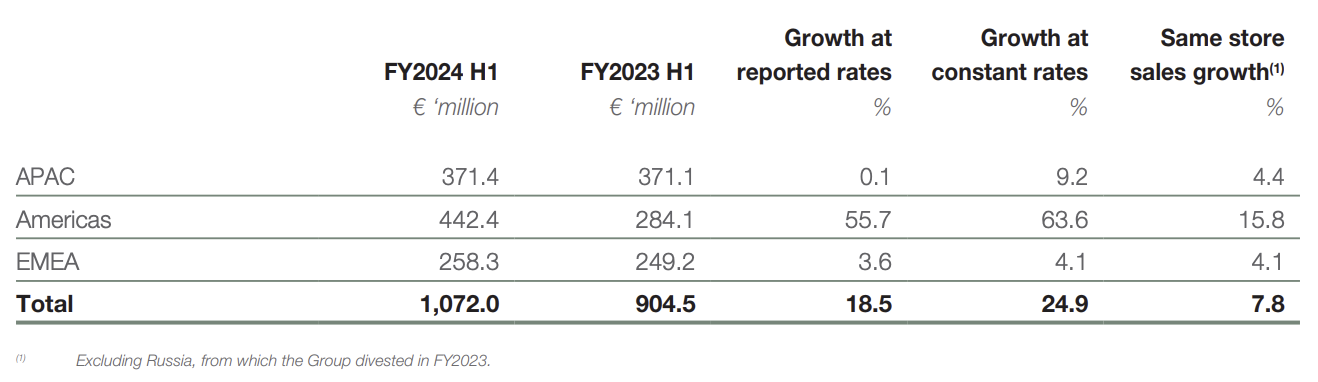

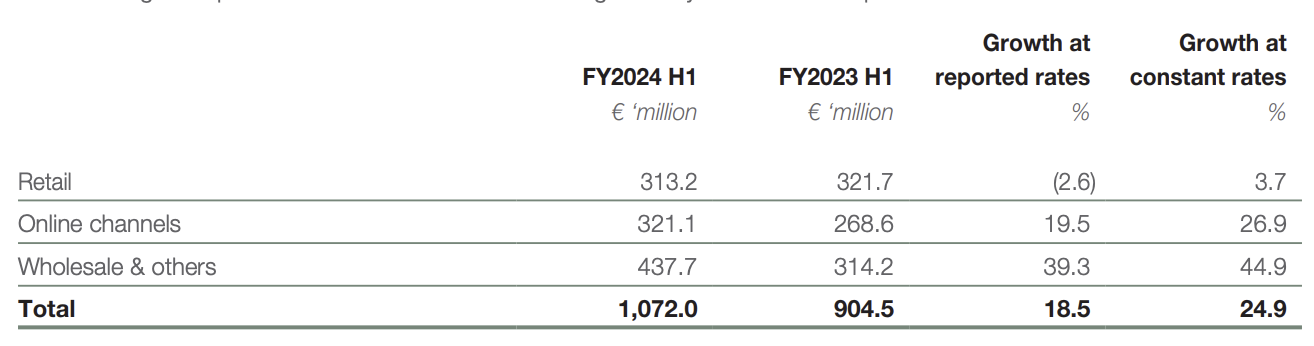

The following data is at constant exchange rates.

By Brand

- L’OCCITANE en Provence: Sales increased by 2.7% year-on-year, mainly driven by double-digit sales growth in the Chinese Mainland. All channels in the Chinese Mainland achieved double-digit sales growth in FY2024, primarily due to additional marketing investments attracting new online store traffic and the launch of a new online store channel on Douyin. The brand’s flexible product strategy targeting high-value body moisturizing products increased the average order value, offsetting the decline in offline foot traffic.

- ELEMIS: Sales increased slightly by 1.3%. Sales growth in the UK market in the fourth quarter of FY2024 slowed compared to double-digit growth in the third quarter. Excluding the marine channel, sales in the US market increased by 15.7% year-on-year, driven primarily by double-digit growth in online channels. Sales in the Chinese Mainland achieved high double-digit growth, mainly due to accelerated marketing investments in social media channels and successful marketing activities such as the Rose Campaign in the fourth quarter of FY2024.

- Sol de Janeiro: Maintained its sales momentum with a year-on-year increase of 167.1%. Growth was mainly driven by the successful launch of new products, continued strategic expansion of distribution (including entry into key US multi-brand partners), and excellent performance in wholesale channels.

- Other Brands: Erborian and L’OCCITANE au Brésil performed particularly well, with year-on-year growth of 35.5% and 37.2%, respectively. Melvita’s performance continued to improve quarter by quarter, achieving single-digit sales growth for the entire fiscal year. LimeLife performed poorly, continuing to underperform with a significant decline.

By Region

The group’s regional sales mix changed slightly compared to last year, with the Americas becoming the largest region, accounting for 43.0% of sales and surpassing €1 billion in FY2024. The Asia-Pacific region was the second largest, accounting for 34.8% of sales, while Europe, the Middle East, and Africa accounted for the remaining 22.2%.

The US remained the largest single market, accounting for 38.0% of the group’s sales, with a strong year-on-year growth of 10.8%, mainly due to Sol de Janeiro’s triple-digit sales growth in the US. The second-largest market was the Chinese Mainland, accounting for 12.9% of the group’s sales, followed by the UK at 7.7%.

- The Americas: The fastest-growing region, achieving a 63.0% increase in sales, mainly benefiting from the accelerated growth of Sol de Janeiro.

- Asia-Pacific: Achieved a significant growth of 6.3%, primarily driven by the strong 19.3% growth in the Chinese Mainland market.

- Europe, the Middle East, and Africa: Saw a year-on-year growth of 4.0%, mainly due to the outstanding performance of Erborian and Sol de Janeiro. Excluding Russia, the region grew by 6.0% at constant exchange rates.

By Channel

- Wholesale and Others: Led the growth with a year-on-year increase of 45.7%. Wholesale chains, international distribution, and travel retail all experienced strong growth. This channel accounted for 39.8% of the group’s sales, slightly up from 33.5% in FY2023, mainly due to the higher wholesale sales mix of Sol de Janeiro.

- Online Channels: Increased by 25.2% year-on-year, mainly driven by the strong performance of Sol de Janeiro and ELEMIS, and L’OCCITANE en Provence’s launch on Douyin in the Chinese Mainland.

- Retail: Stable growth of 3.0%, mainly contributed by the Chinese Mainland.

Looking ahead, the group stated that it is preparing for future growth and geographic expansion, having completed leadership restructuring. In April 2024, former Managing Director Laurent Marteau succeeded André Joseph Hoffmann as the group’s CEO, while Hoffmann will remain as Executive Director and Board Member. Additionally, since June 2023, Samuel Antunes has been promoted to Chief Financial Officer, bringing extensive corporate finance experience to the group since joining in 2010.

For the new fiscal year, the group remains cautiously optimistic. However, it will continue to increase investments in marketing, store renovations, IT infrastructure, and talent acquisition, which are expected to continue impacting its profit margins in the coming months and years. As new international and local brands join the market, competition in the global skincare and cosmetics industry continues to intensify. Investments to consolidate the existing strengths of all its brands remain necessary, with each brand requiring strategies tailored to its specific geographic locations to develop or maintain its market position.

Regarding privatization, the group stated that in April 2024, the Board received a proposal from L’Occitane Groupe S.A. (the offeror, the company’s controlling shareholder ultimately controlled by its chairman Reinold Geiger) to acquire all the company’s issued and outstanding shares not owned by the offeror. The aim is to delist the company from the Hong Kong Stock Exchange and fully privatize the group. This proposal is driven by the offeror’s vision to accelerate the group’s transformation and growth. By transitioning to a private enterprise, the group will gain greater strategic investment autonomy and more effectively implement strategies.

| Sources: Official Financial Report

| Image Sources: Official Financial Report, Official Website

| Editor: LeZhi