From May to June 2024, Luxe.CO Intelligence recorded 485 significant updates from 210 high-end beauty and fragrance brands/companies. We have selected the Top 10 exemplary cases worth industry reference and provided exclusive reviews. (Note: Sorted alphabetically by brand, not ranked in any order)

1) Dior Beauty (LVMH Group) opens its largest global spa at Hamad International Airport, Qatar.

Case Insights:

The booming global health and wellness market has made brands more aware of the commercial opportunities during consumers’ travels.

Hamad International Airport was named the World’s Best Airport in 2024. In the first quarter of 2024, Hamad International Airport set a new record with over 13 million passengers, a 27.6% increase compared to the same period last year. High-end travel retail spaces like Hamad International Airport have become a battleground for premium beauty brands, emphasizing larger store sizes and exclusive services and experiences.

The Dior Beauty Spa at Hamad International Airport holds threefold significance: it is Dior’s first airport spa, the largest Dior spa globally, and the world’s first spa with a barbershop. Over the past two months, Dior Beauty has been expanding its spa experience business in global travel destinations, such as ASPEN in the U.S. and the Seine River in Paris.

Besides Dior Beauty, large beauty enterprises like Clarins are continuously deepening their spa and wellness business through collaborations with hotels or even acquiring hotels.

2) Florasis, a Chinese makeup brand, announces a collaboration with DFS to open its first European counter at La Samaritaine in France this September.

Case Insights:

Florasis entering La Samaritaine is the latest case of Chinese beauty brands expanding overseas.

According to data from the General Administration of Customs of the Chinese Mainland, the export value of Chinese beauty and personal care products has grown significantly over the past three years, reaching $4.852 billion in 2021 and $5.625 billion in 2022, with year-on-year increases of 14.4% and 16%, respectively. The total export value in 2023 was $6.51 billion, up 16.7% year-on-year.

It’s noteworthy that this process has evolved from quantitative to qualitative changes. Domestic brands such as Perfect Diary, Florasis, and Judydoll have been exploring overseas markets, initially attracting new customer groups with “cost-performance” and “aesthetics,” and now focusing more on selecting suitable local partners and exporting brand cultural values. The overseas journey of domestic brands is maturing.

3) Fendi (LVMH Group) launches its first high-end fragrance series, sold exclusively in brand stores.

Case Insights:

In recent years, luxury brands such as Hermès, Prada, and CELINE have ventured into the beauty and fragrance category to leverage their brand IP assets and appeal to younger consumers.

In the past, most luxury brands would license their beauty business to third parties like L’Oréal, Coty, Puig, Shiseido, and Interparfums. Recently, many luxury companies have been bringing their beauty product lines in-house: in 2023, Kering and Richemont announced the establishment of internal beauty fragrance departments, seeking to gradually self-manage their brands’ beauty businesses.

Fendi is the latest example of a luxury brand launching beauty fragrance products in-house. According to the brand, this series was created in collaboration with perfumers Anne Flipo, Fanny Bal, and Quentin Bisch, alongside creative directors Kim Jones, and family members Silvia Venturini Fendi and Delfina Delettrez Fendi.

This move not only strengthens Fendi’s luxury universe but also confirms the continued deepening of LVMH’s commitment to the beauty and fragrance category.

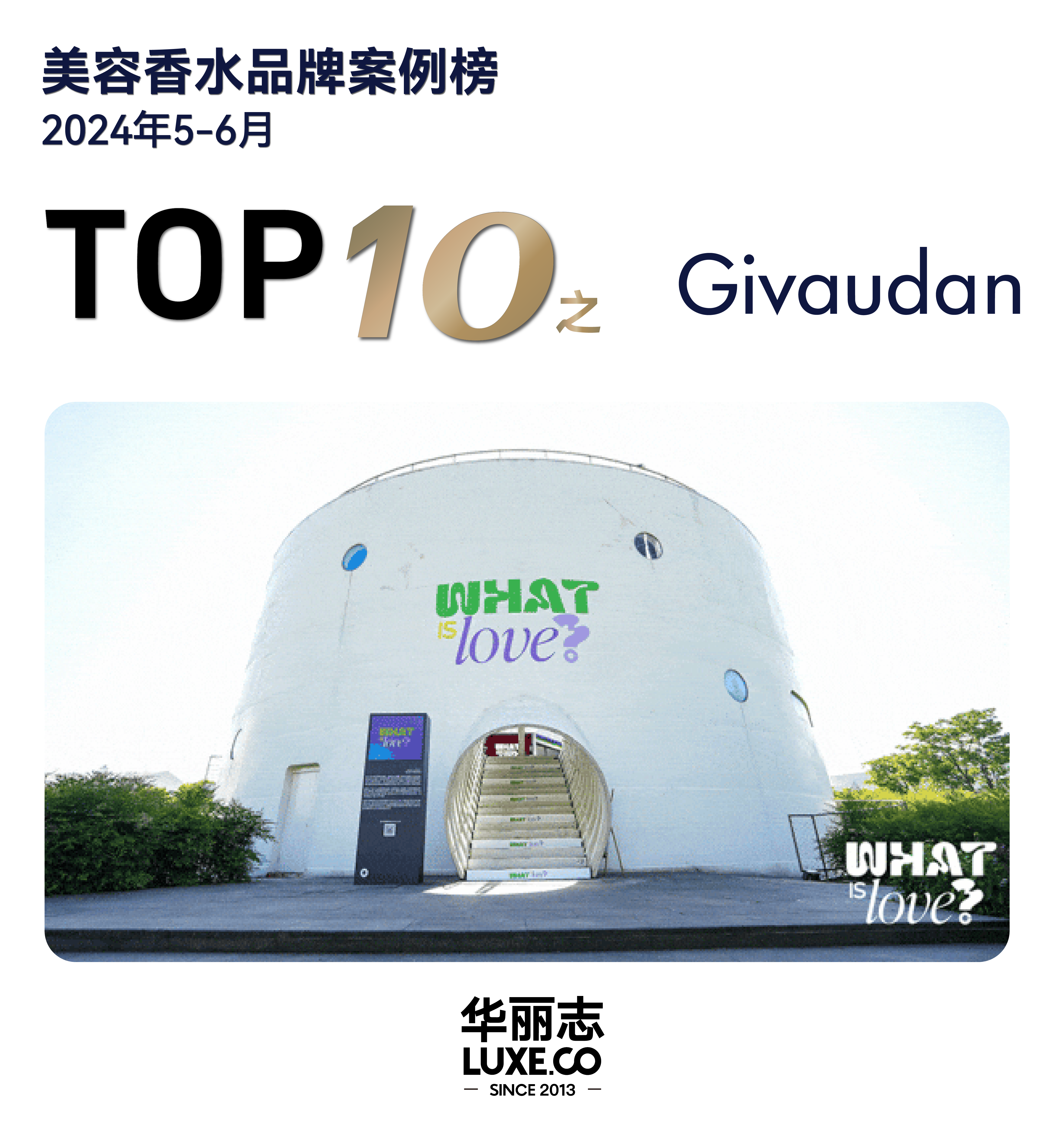

4) Swiss fragrance and flavor giant Givaudan hosts the “WHAT IS LOVE?” global touring perfume art exhibition in Shanghai.

Case Insights:

Large-scale global exhibitions are no longer exclusive to brands; upstream industry chain companies are also increasingly investing in brand building.

As a major global fragrance and flavor producer, Givaudan supplies beauty and fragrance brands and brings extensive and in-depth consumer insights to the global beauty industry. “WHAT IS LOVE?” is a creative event targeting Gen Z consumers, presented through exhibitions in Paris, New York, Dubai, and Shanghai, aiming to express this group’s understanding of love and attraction.

Besides this tour, Givaudan recently held the “Leonardo da Vinci and Perfume Exhibition of the Renaissance” at Château du Clos Lucé in France, showcasing 28 perfumes created by Givaudan perfumers. Such exhibitions foster direct dialogue with end consumers, promoting transparency and communication across the entire fragrance industry chain.

5) French luxury brand Hermès redesigns the packaging of its Le Bain Hermès personal care series, introducing refillable glass bottles and refills.

Case Insights:

Hermès’ packaging upgrade for the Le Bain Hermès series elevates the “sustainability” trend in the high-end beauty industry to a new level.

From Chanel Beauty using camellia seed shells for cream jar caps to Prada Beauty adopting refillable perfume packaging, now Hermès’ packaging upgrade for its bathing fragrance series, every move by luxury companies in sustainable packaging for beauty products has garnered significant industry attention. This will drive comprehensive upgrades in sustainable packaging across materials, technology, aesthetics, and marketing, ultimately benefiting consumers and the entire industry ecosystem.

6) Lancôme (L’Oréal Group) opens a dining space, Café de la Rose Lancôme, at its flagship store on the Champs-Élysées in Paris.

Case Insights:

Coffee and culinary culture have become new touchpoints for fashion and beauty brands to reach younger consumers, and the French heritage brand Lancôme is no exception.

Opened in 2019, Lancôme’s flagship store on the Champs-Élysées is a renowned beauty landmark in Paris. In line with the Paris Olympics, Lancôme collaborated with Nina Métayer, named the World’s Best Pastry Chef in 2023 and 2024, to create the “café,” inspired by the brand’s iconic “rose” DNA. This initiative stimulates consumers’ sensory exploration of taste and perfectly embodies Lancôme’s values of happiness and sharing.

7) The 110-year-old Spanish beauty and fragrance group Puig officially listed its shares for trading, marking the largest IPO in Europe so far this year.

Case Insights:

Puig’s listing is significant on multiple fronts: it is Spain’s first publicly traded fashion and beauty company, recording the largest IPO in Europe this year and Spain’s largest IPO in the past decade.

Founded by Antonio Puig in 1914, Puig is a family-owned enterprise specializing in cosmetics and perfumes, currently led by third-generation family member Marc Puig. Post-IPO, the Puig family maintains its status as the major shareholder, holding 71.7% of the shares, and retains a majority voting power (92.5%) on the board.

As Marc Puig mentioned at the IPO launch, “Our goal is for our family to continue supporting this project, ensuring family businesses not only achieve short-term results but also succeed in the long term.” The IPO has become a solution for family businesses like Puig to alleviate the pressures of “intergenerational succession.”

Recent acquisitions, including Belgian designer brand Dries Van Noten, British makeup artist brand Charlotte Tilbury, and German high-end skincare brand Dr. Barbara Sturm, have fueled Puig’s “strong growth” and “revenue diversification.” Industry experts believe that the IPO will enhance its financial strength.

8) Sephora (LVMH Group) successfully launches FENTY BEAUTY BY RIHANNA in the Chinese Mainland, covering 320 stores nationwide.

Case Insights:

Facing challenges from local multi-channel beauty retailers, Sephora adopts niche/exclusive brands as a unique differentiation strategy for its global platform.

Regarding the FENTY BEAUTY brand, with founder Rihanna’s immense popularity (over 150 million fans globally) and backed by LVMH’s beauty incubator Kendo’s robust product development capabilities, the potential to expand in global markets, including the Chinese Mainland, is undeniable.

From Sephora’s brand strategy perspective, in recent years, Sephora China has introduced several popular niche brands, such as Drunk Elephant (a clean beauty skincare brand under Shiseido), Grown Alchemist (an Australian natural skincare brand under the L’Occitane Group), and Marc Jacobs (a high-end fragrance brand under Coty), mainly through exclusive collaborations.

In the Chinese market, where opportunities and uncertainties coexist, overseas brands urgently need strong high-end beauty platforms to quickly gain market foothold. Thus, choosing the right partner is crucial.

9) SkinCeuticals (L’Oréal Group) opens its global flagship SKINLAB store in Shenzhen’s Qianhai MixC.

Case Insights:

According to L’Oréal Group’s official website, SkinCeuticals is positioned as the world’s first professional skincare brand originating from the U.S. In 2012, SkinCeuticals pioneered the “integrated skincare” concept, combining “scientific skincare solutions,” “advanced home care,” and “professional beauty projects.”

The SKINLAB store in Uniwalk Qianhai, covering about 700 square meters with a two-story structure, integrates retail and professional project services, marking another milestone for its “integrated skincare” concept, aiming to provide customers with a one-stop professional aesthetic experience.

L’Oréal’s first-quarter performance report shows that the dermatological beauty division, which includes SkinCeuticals, maintained strong momentum, growing 1.6 times faster than the market. This reflects the robust demand for the rapidly developing dermatological and medical beauty sub-sectors.

Given the expanding domestic professional medical beauty market, SkinCeuticals’ “integrated skincare” and its SKINLAB are leading new trends and market opportunities.

10) Perfect Diary’s parent company Yatsen opens a global innovation and R&D center in Shanghai.

Case Insights:

Yatsen places research and development as the core strategy for future growth and product differentiation, continuously increasing R&D investment. According to Yatsen’s 2023 annual report, the group’s annual R&D expenditure was RMB 110 million, with the R&D expense ratio rising from 2.4% in 2021 to 3.3%. The company has applied for 203 patents globally, including 91 invention patents and 57 granted invention patents.

The Shanghai global innovation and R&D center, with an initial investment exceeding RMB 80 million and covering 4,000 square meters, marks the further expansion of Yatsen’s “technology pathway.” It will work alongside the Toulouse R&D center in France and the Guangzhou R&D center.

In addition to Yatsen, other Chinese beauty companies have also increased their global R&D investments in recent years. For instance, the emerging skincare brand Simpcare established China’s first Asian sensitive skin functional skincare joint research center, and Yunnan Baiyao launched its first anti-aging serum specifically developed for Oriental skin on its 18th anniversary.

丨Image Credit: Luxe.CO production, official websites, and official press releases of each brand.

丨Editor: LeZhi