Before the market opened on August 19 local time, Finnish sportswear group Amer Sports, owner of brands such as Arc’teryx, Salomon, and Wilson, announced key financial data for the second quarter of 2025. Revenue rose 23% year-over-year to $1.236 billion, and the company successfully returned to profitability with a net income of $18 million, compared to a net loss of $4 million in the same period last year.

Among the highlights, the Chinese Mainland stood out, with revenue surging 42% year-over-year to $410 million, accounting for 33% of total revenue. Among core brands, the Outdoor Performance Apparel segment, which includes Arc’teryx, recorded a 23% year-over-year revenue increase to $509 million.

Amer Sports’ global CEO James Zheng stated:

“Amer Sports’ strong momentum continued in the second quarter, as our unique portfolio of premium technical brands continues to create white space and take share in sports and outdoor markets around the world. We remain confident in our ability to manage through higher tariffs and other near-term macro uncertainties, while also ensuring that we develop each of our unique brands for high quality, long duration growth. The recent Salomon footwear acceleration, Arc’teryx’s continued momentum, and steady results from our equipment franchises position us well for another strong performance in 2025 and beyond.”

CFO Andrew Page added:

“Although the tariff impact to our Ball & Racquet segment will be slightly higher than expected, given the mitigation strategies already underway across brands, we continue to expect the impact to our consolidated results to be negligible this year.“

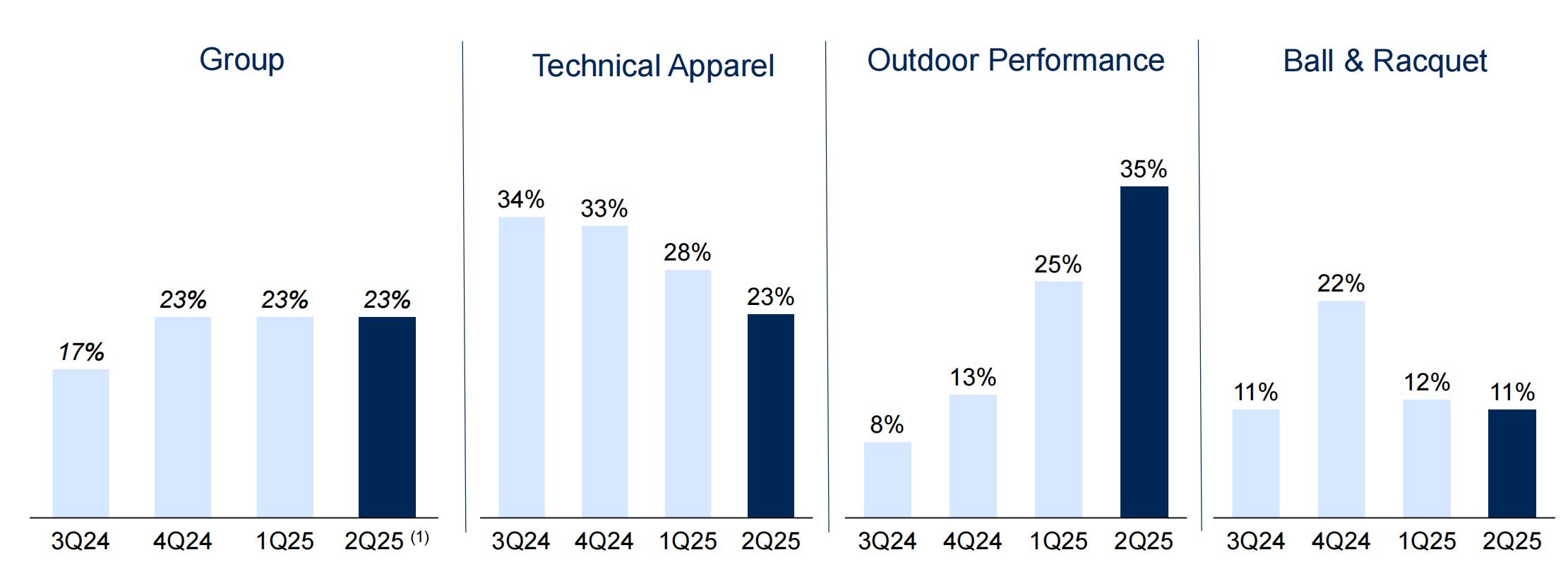

Performance by Business Segment

Outdoor Performance Apparel (led by Arc’teryx):

Revenue rose 23% YoY to $509 million. Arc’teryx delivered strong results across regions, channels, and categories. Its omnichannel revenue, including self-operated retail stores and e-commerce, grew 15% YoY. Key highlights during the reporting period include:

-

Retail Network Optimization: The brand continued to focus on improving store quality and sales per square foot, with a net addition of 7 stores in Q2. In the Chinese Mainland, Arc’teryx opened its first-ever Departure Store at the Beijing Peninsula Hotel, showcasing the brand’s image at the highest level. Rather than expanding blindly, the brand will prioritize retail network optimization. Despite expected net store closures in the Chinese Mainland this year, the number of self-operated stores will continue to grow steadily.

-

Category Growth: Footwear remained the fastest-growing category, outpacing overall brand growth. The women’s segment also maintained strong momentum, with double-digit growth across all regions. Products like the Clarkia functional pants, designed specifically for women, sold out quickly.

Mountain Outdoor Apparel and Equipment (led by Salomon):

Revenue surged 35% YoY to $414 million. Salomon’s footwear business continues to accelerate, with both outdoor lifestyle and performance lines showing strong momentum and acting as primary growth drivers. Key highlights during the reporting period include:

-

Product Innovation: New trail running models like the Aeroglide 3 and GRVL series received positive feedback from consumers and retailers. The iconic X Ultra 5 hiking shoe was also upgraded and relaunched.

-

Market Expansion: Salomon’s growth accelerated across all regions. Its DTC model is the core growth engine in Asia. In Q2, Salomon added 16 stores in the Chinese Mainland, bringing the total to 234. In the Asia-Pacific region, 10 new stores were added in South Korea and Japan. In August, the brand opened a high-profile “Salomon Xiaobailou·Fujun” flagship store on Anfu Road in Shanghai.

Balls and Racquet Sports (led by Wilson):

Revenue grew 11% YoY to $314 million. The Wilson Tennis 360 strategy continues to drive both revenue and margin growth. Professional tennis racquets remained popular, with the newly launched RF Classic Series performing particularly well. Highlights include:

-

Apparel and Footwear Growth: The segment continued strong momentum, with revenue doubling YoY in Q2. The Intrigue women’s tennis shoe was named Best Tennis Shoe of the Year by Women’s Health magazine.

-

Chinese Market: Performance was strong, with plans to open approximately 50 new Wilson Tennis 360 stores this year.

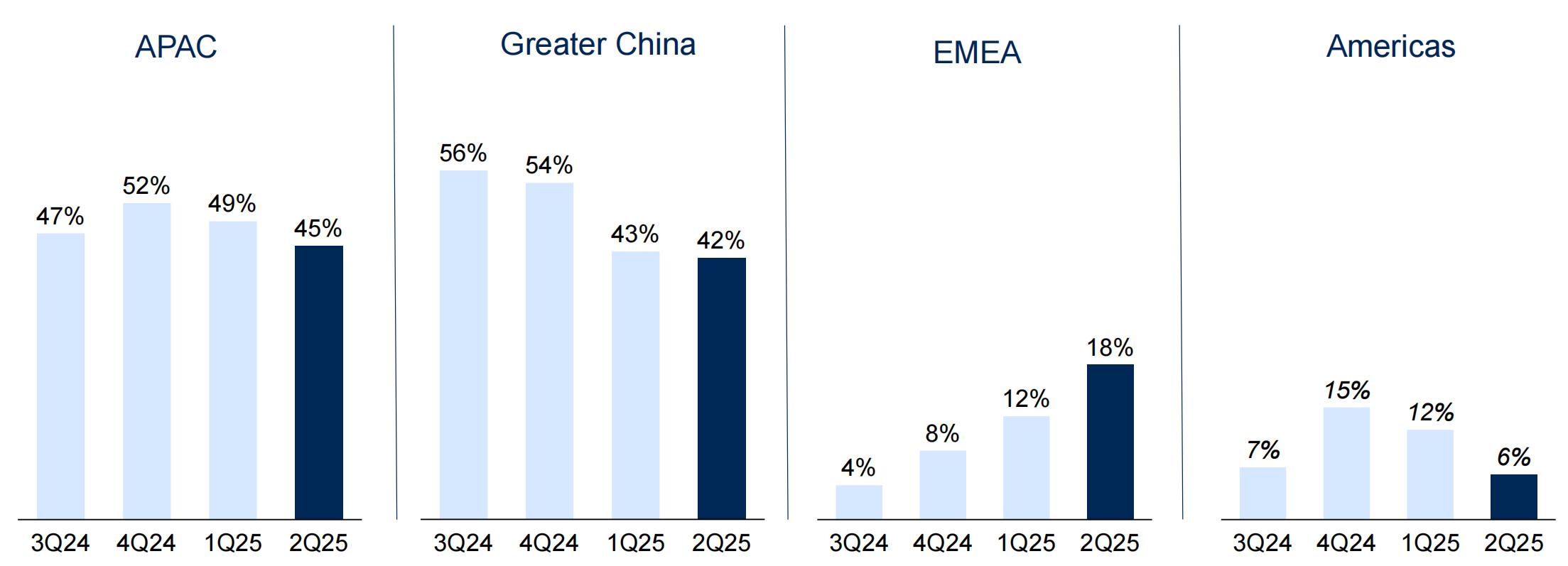

Regional Performance

All regions achieved growth, with the Chinese Mainland and Asia Pacific continuing to lead:

-

Chinese Mainland:

Revenue reached $410 million, up 42% YoY. Since Q1 2023, the region has consistently recorded over 40% YoY revenue growth. -

Asia Pacific (excluding the Chinese Mainland):

Revenue was $155 million, up 45% YoY, maintaining high-speed growth. -

EMEA (Europe, Middle East, and Africa):

Revenue hit $276 million, up 18% YoY, showing a significant acceleration. -

Americas:

Revenue reached $395 million, up 6% YoY.

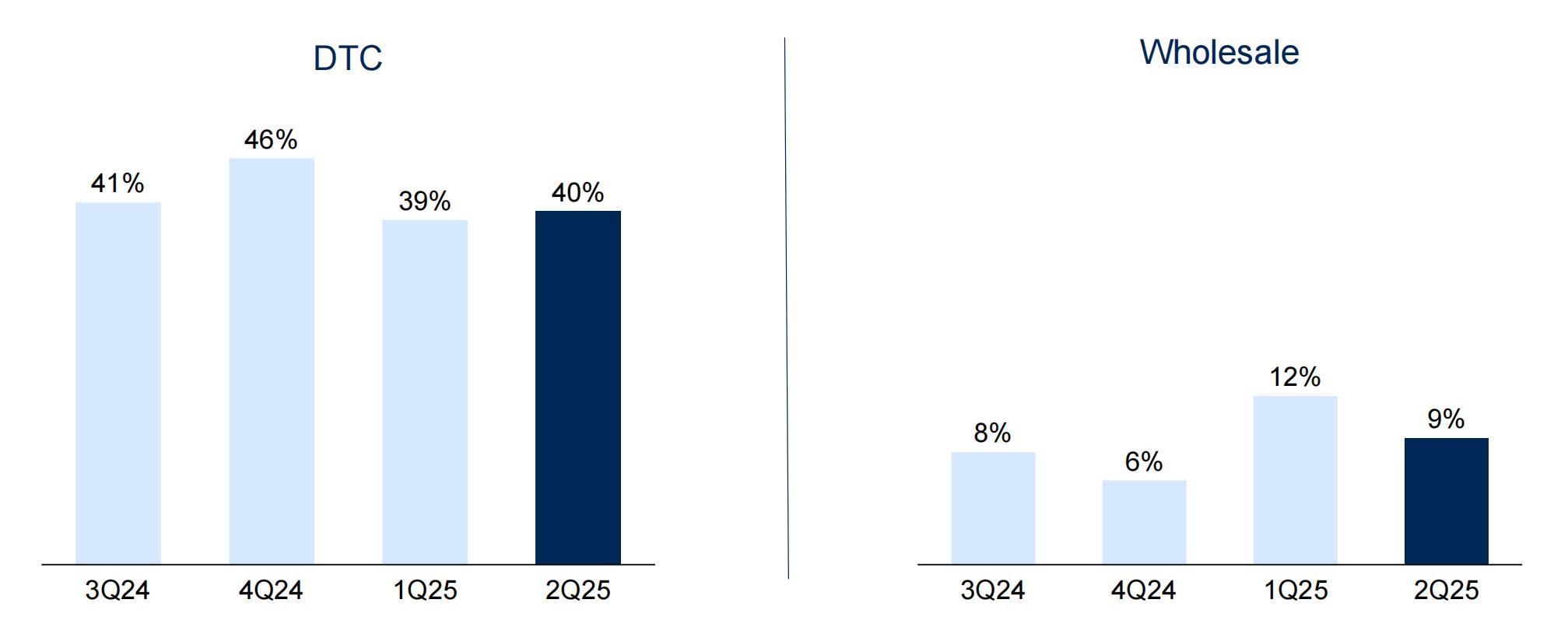

Channel Performance

Both direct-to-consumer (DTC) and wholesale channels delivered steady growth:

-

DTC Channel:

Continued to be the group’s main growth driver, with Q2 revenue up 40% YoY to $641 million. As of the end of the quarter, Amer Sports operated 546 self-owned stores worldwide, a 40% YoY increase. -

Wholesale Channel:

Revenue increased 9% YoY to $595 million.

Updated Full-Year 2025 Outlook

Based on the strong first-half performance and sustained momentum, Amer Sports has raised its full-year 2025 guidance:

-

Revenue Growth: 20–21%

-

Gross Margin: ~57.5%

-

Operating Margin: 11.8–12.2%

-

Fully Diluted EPS: $0.77–$0.82

Amer Sports also provided guidance for Q3, expecting revenue to grow approximately 20% YoY and operating margin to be in the range of 12.0–13.0%.

As of August 19, the company’s stock price declined 4.69% from the previous day to $35.74 per share, with a total market capitalization of approximately $19.8 billion. Year-to-date, the stock has risen 28%.

| Source: Official earnings release and earnings call

| Image Credit: Official earnings release, company and brand websites

| Editor: LeZhi