On January 22nd, Finnish local time, Amer Sports, a Finnish sporting goods group under Anta Group, announced on its official website that it had been approved for listing on the New York Stock Exchange with the stock code “AS”. The company has submitted an updated F-1 form (prospectus for non-U.S. domestic companies) to the U.S. Securities and Exchange Commission.

*On January 4th this year, Amer Sports submitted a preliminary F-1 form.

In this IPO, Amer Sports plans to issue 100 million ordinary shares, with a price range of $16 to $18 per share. The underwriters also have an over-allotment option for an additional 15 million ordinary shares. Based on this, Amer Sports is valued between $7.7 billion and $8.7 billion.

Moreover, according to the updated prospectus, three cornerstone investors of Amer Sports – Anta Sports, Anamered Investments, and Tencent – have expressed their intention to purchase ordinary shares at the IPO price: Anta and Anamered Investments plan to subscribe for a total amount not exceeding $220 million each, while Tencent plans to subscribe for up to $70 million.

*Anamered Investments is an investment company founded by Chip Wilson, the founder of the Canadian yoga sportswear brand Lululemon.

In the latest prospectus and roadshow documents, Amer Sports disclosed its preliminary performance for 2023, long-term targets, major institutional investors’ shareholdings, and more detailed data. In this article, Luxeplace.com will provide a detailed interpretation of the following four sets of data:

1. Amer Sports’ 2023 revenue exceeds $4.35 billion, a year-on-year increase of about 23%.

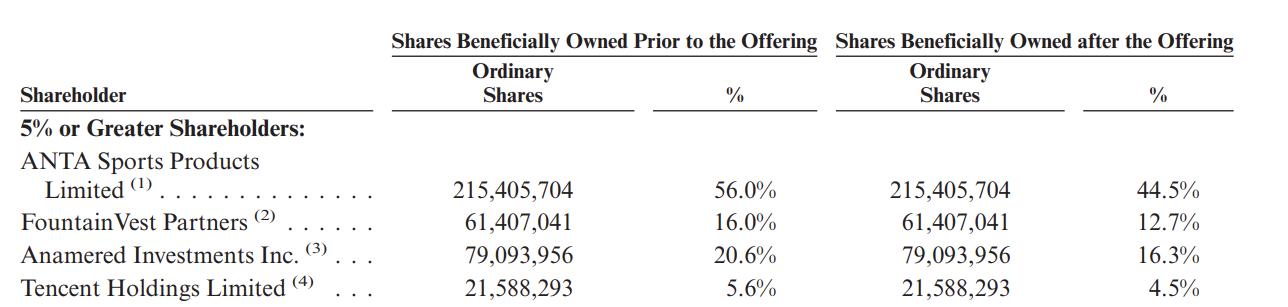

2. Anta Sports currently holds 56% of the shares, becoming the largest shareholder, while Tencent holds 5.6%.

3. Four out of the “Five €1 Billion Strategies” have been achieved two years ahead of schedule.

4. The sales per square meter of Arc’teryx’s self-operated retail stores in the Greater China region exceed $2,000, double that of North America.

Amer Sports’ 2023 Revenue Exceeds $4.35 Billion, a Year-On-Year Increase of About 23%

In the prospectus, Amer Sports disclosed its preliminary financial data for 2023:

- Revenue: Expected to be between $4.35 billion and $4.36 billion, a year-on-year increase of 22.7% to 23.0%.

- Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Expected to be between $597 million and $607 million, a year-on-year increase of 31.8% to 34.0%.

- Net loss: Expected to be between $204 million and $234 million, with a reduction in losses of 7.4% to 19.3%.

The roadshow document updated the financial data for the past 12 months as of September 2023: Revenue of $4.3 billion and adjusted EBITDA of $613 million.

According to the roadshow document, Amer Sports presented the group’s long-term growth targets:

- Revenue: Achieve a low to mid double-digit annual compound growth rate.

- Gross margin: Improve by 300 basis points.

- Adjusted EBITDA: Achieve mid to high double-digit growth.

Anta Sports Currently Holds 56%, Becoming the Largest Shareholder, While Tencent Holds 5.6%

In December 2018, Anta Sports, along with FountainVest SPV, Anamered Investments, and Tencent SPV, formed a consortium and made a cash offer to acquire all the issued shares of Amer Sports, with a total purchase price of approximately €4.6 billion. The acquisition was completed in March 2019, with Anta Sports and other consortium members owning all the issued share capital of Amer Sports through AS Holding.

After the transaction, Anta Sports held 58%, while FountainVest SPV and Anamered Investments each held 21%, and Tencent participated through FountainVest SPV.

The updated prospectus also revealed the latest shareholding data:

- Anta Sports: Currently holds 56%, expected to hold 44.5% after the IPO, becoming the largest shareholder of Amer Sports.

- Private equity firm FountainVest Partners: Currently holds 16.0%, expected to hold 12.7% after the IPO.

- Anamered Investments: Currently holds 20.6%, expected to hold 16.3% after the IPO.

- Tencent: Currently holds 5.6%, expected to hold 4.5% after the IPO.

The “Five €1 Billion Strategies” Have Achieved Four Items Two Years Ahead of Schedule

After the acquisition of Amer Sports, Anta Sports and the new board of Amer Sports restructured the company’s business and formulated the “Five €1 Billion Strategies” – by 2025, to build the Arc’teryx, Salomon, and Wilson brands into “€1 billion” brands respectively; and to achieve €1 billion in revenue each in the Greater China region and direct sales model.

According to the roadshow document: In the 12 months ending September 2023, the revenues of Arc’teryx, Salomon, Wilson, and direct sales channels were approximately $1.3 billion, $1.3 billion, $1.1 billion, and $1.4 billion respectively. Calculated at the current exchange rate, these four items have already achieved the 2-year target ahead of schedule.

In the 12 months ending September 2023, the revenue in the Greater China region was about $800 million (about $200 million in 2020).

Among the five tasks, the Greater China region grew the fastest: from 2020 to 2022, the revenue compound annual growth rate was 60.9%, and the revenue in the first three quarters of 2023 increased by 67.6% year-on-year. It is highly likely to achieve the €1 billion target in 2023.

The Sales per Square Meter of Arc’Teryx’s Self-Operated Retail Stores in the Greater China Region Exceed $2,000, Double That of North America

In October 2005, Amer Sports acquired the Salomon division of adidas for €485 million, classifying Arc’teryx and Salomon under the outdoor clothing and footwear department, with Arc’teryx mainly focusing on clothing products and Salomon on footwear products. (The above classification was before and including 2018; Amer Sports’ prospectus has made adjustments, as shown in the figure below)

The rapid growth of Amer Sports in the Greater China region is closely related to Arc’teryx. In the first three quarters of 2023, Arc’teryx’s revenue increased by 61.8% year-on-year, with the Greater China region contributing 48% of the group’s revenue, making it the undisputed largest market. Additionally, Arc’teryx’s loyalty program in the Greater China region has more than 1.7 million members, compared to just 14,000 in 2018.

According to the roadshow document, self-operated retail stores have become a key factor in the rapid growth of Arc’teryx in the Greater China region:

- In terms of quantity: There are 42 self-operated retail stores in the Greater China region, ranking first among the main markets (41 in North America, 16 in Asia-Pacific, and 4 in Europe, the Middle East, and Africa).

- In terms of sales per square meter: In the 12 months ending September 2023, the sales per square meter of self-operated retail stores exceeded $2,000, reaching $2,051, double that of North America ($1,061). This figure was $1,251 in 2021.

| Source: Amer Sports prospectus and roadshow documents

| Image Credit: Amer Sports official website

| Reporter: Wang Jiaqi

| Editor: LeZhi