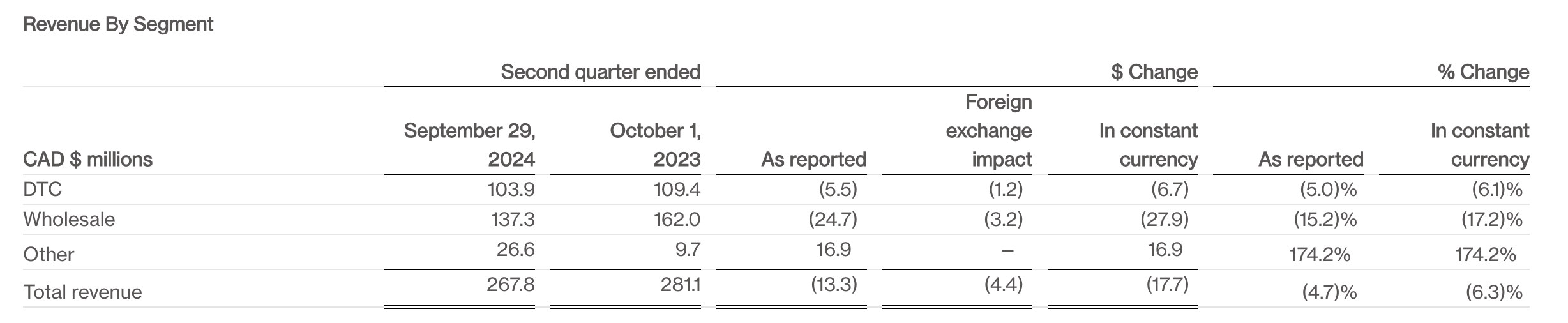

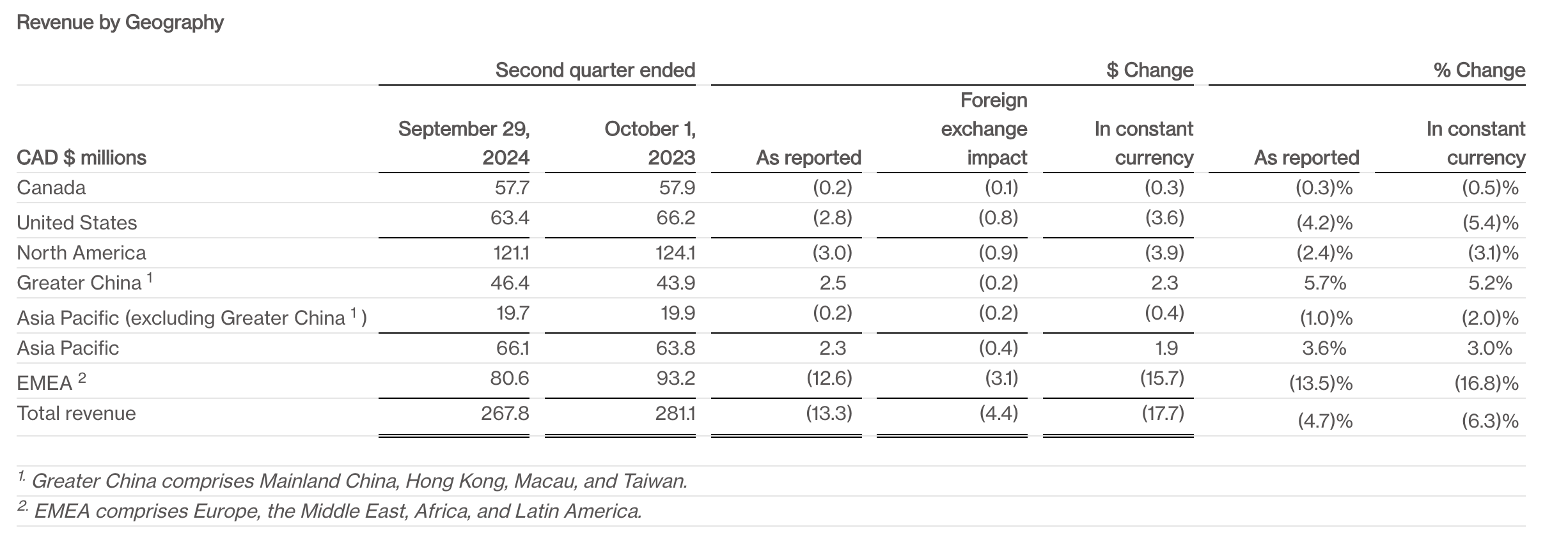

On November 7, high-end functional apparel brand Canada Goose released its second-quarter financial report for fiscal 2025, ending September 29, 2024. The brand saw sustained growth in sales across the Greater China and Asia-Pacific regions, with global results surpassing expectations.

During the quarter, sales in Greater China grew 5.7% year-on-year, with additional growth observed during the Golden Week holiday. The brand launched its official live streaming on Douyin, yielding impressive results that bolstered its e-commerce business. Canada Goose stated that Douyin is an effective platform to tell the brand’s story and interact with consumers on product style and functionality. Early performance on Douyin has been strong, contributing significantly to Asia-Pacific e-commerce revenue. Driven by the Greater China market and tourism retail, sales in the Asia-Pacific region rose 3.6% year-on-year.

The brand opened two new standalone stores in key markets during the quarter, one in Montreal, Canada, and another in Wuhan, China. Additionally, it upgraded two temporary stores, including the pop-up at Shanghai’s Taikoo Hui, to standalone stores. Its flagship store in Tokyo’s Ginza district reopened after a major renovation. As of the end of the second quarter of fiscal 2025, Canada Goose operated a total of 72 standalone stores.

Image Above: Canada Goose store at Wuhan SKP

“Our second quarter performance reflected steady progress across our operating priorities, as we navigated an increasingly challenging macro environment that affected consumer sentiment,” said Dani Reiss, Chairman and CEO of Canada Goose. “We remain focused on delivering an outstanding customer experience in our DTC channel and increasing desirability for our versatile collection through focused marketing and improved distribution. We believe we are well positioned for the upcoming holiday season and are excited to bring the first capsule collection from our Creative Director, Haider Ackermann, to market at the end of November. We are confident that our plan will improve our overall business performance as we continue build a strong foundation for sustainable, long-term profitable growth.”

CFO Neil Bowden stated in a post-earnings call that, in October, despite some consumer pressure in markets like the Chinese Mainland, EMEA, the United States, and Canada, certain stores showed positive comparable sales trends. The Chinese Mainland market performed well in October, contributing to organic growth in DTC comparable sales.

Dani Reiss added, “While China faces some macroeconomic challenges, we remain confident in this market and hopeful that stimulus policies will have a positive long-term effect. We genuinely feel that Chinese consumers, whether at our stores in Canada, the U.S., Europe, or especially the Chinese Mainland, resonate strongly with our brand. Positive momentum was observed during the recent National Day Golden Week and the Double Eleven shopping event, and we hope to see this trend continue. We are optimistic that Chinese consumers will continue to support Canada Goose.”

Image Above: Canada Goose Fall/Winter Collection

The following is a breakdown of Canada Goose’s Q2 fiscal 2025 performance:

In fiscal 2025, Canada Goose continued focusing on three core areas: brand and product development, premium retail execution, and internal operations, achieving substantial progress.

— Premium Retail Execution

- Ensuring staffing and training excellence across its global DTC network to optimize product displays and meet consumer demand.

- These initiatives improved conversion rates in EMEA and are being rolled out in North America and APAC.

— Brand and Product Development

- Strategic decisions in the second quarter aimed at long-term brand development, including concentrating marketing expenditures in Q3 and Q4 of fiscal 2025 to fully support the holiday launch of Haider Ackermann’s debut capsule collection. The quarter also saw optimization in product launch timing and refined brand storytelling to captivate customers, with the DTC channel prioritizing the upcoming Haider Ackermann capsule collection.

- The Fall/Winter collection received positive reviews, with October sales seeing a substantial rise over Q2, and the anticipated launch of an eyewear collaboration with Marchon Eyewear slated for spring 2025.

- Social media and community outreach expanded, with global omnichannel followers growing over 30% year-on-year.

— Internal Operations

- Investing in technology and design talent, with a focus on building a Paris-based design studio team.

- Inventory turnover improved by 13% year-on-year.

Image Above: Canada Goose Fall/Winter Collection

|Source: Official financial report, earnings call

|Image Credit: Provided by the brand

|Editor: LeZhi