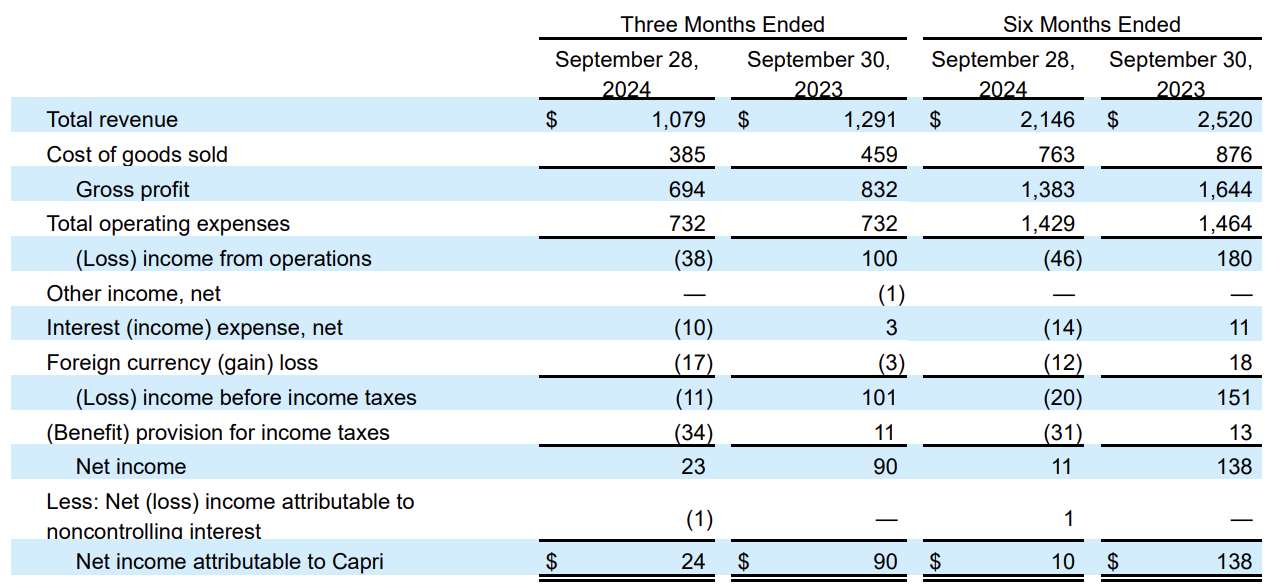

Eastern Time, after the close of trading on November 7, American luxury group Capri Holdings Ltd. (hereinafter referred to as “Capri”) announced its financial results for the second quarter of fiscal year 2025, ending September 28, 2024. Total sales revenue was $1.08 billion, reflecting a 16.4% decline compared to last year at both reported and constant currency rates. Due to weak global demand for fashion luxury goods, the company’s retail channel sales decreased slightly year-over-year, while its wholesale business saw a double-digit year-on-year decline as global demand softened.

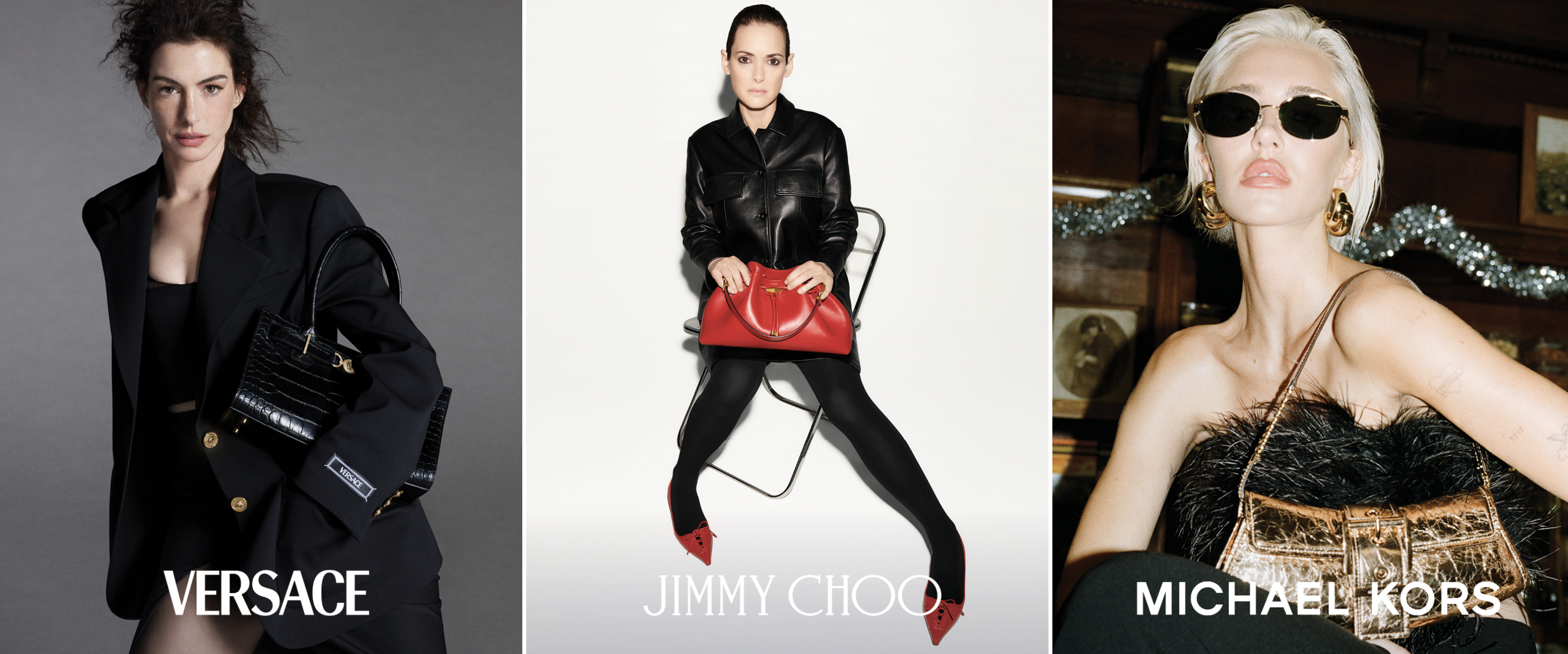

By brand, Jimmy Choo performed the best, with a year-on-year sales revenue increase of 6.1% last quarter; Versace performed the worst, with a 28.2% year-on-year drop; Michael Kors saw a global sales revenue decline of 16% year-on-year, with the Asian region posting a 43% drop.

John D. Idol, Chairman and CEO of Capri, stated, “Overall, we were disappointed with our second quarter results as performance continued to be impacted by softening demand globally for fashion luxury goods. Despite the challenging global retail environment, we remain focused on executing our strategic initiatives to deliver long-term sustainable growth across all three of our luxury houses.”

Idol continued, “Versace, Jimmy Choo and Michael Kors continued to resonate with consumers as evidenced by the 10.9 million new consumers added across our databases, representing 13% growth versus last year. This reflects the strong brand equity and enduring value of our three iconic houses.”

Idol concluded, “In August 2023 Capri Holdings announced that we entered into a definitive agreement to be acquired by Tapestry. The District Court recently granted the FTC’s motion for a preliminary injunction to enjoin the transaction pending the FTC’s in-house administrative proceeding. We are disappointed with the decision, and consistent with our obligations under the merger agreement, Tapestry and Capri have jointly filed a notice of appeal.”

The day following the financial report release, as of the close on November 8, Capri’s stock price dropped 6.7% from the previous trading day to $20.52 per share, with a current market capitalization of approximately $2.351 billion.

As of September 28, key financial data for Capri Holdings’ second quarter of fiscal year 2025 are as follows:

- By Brand:

Versace:

- Retail channel sales declined by more than 10% year-on-year, with wholesale revenue down by double digits year-on-year. Regionally, sales in the Americas dropped 33%, EMEA (Europe, Middle East, and Africa) declined by 28%, and Asia decreased by 20% year-on-year.

- Versace’s global database added 1.1 million new customers, a 16% increase from last year.

Jimmy Choo:

- Retail channel sales saw a low single-digit year-on-year decline, while wholesale revenue rose by double digits. Regionally, sales in the Americas dropped 8%, EMEA rose 25%, and Asia decreased by 8% year-on-year.

- Jimmy Choo’s global database added 700,000 new customers, a 13% increase from last year.

Michael Kors:

- Retail channel sales decreased by mid-single digits year-on-year, with wholesale revenue down by double digits. By region, sales in the Americas dropped 12%, EMEA declined 15%, and Asia decreased by 43% year-on-year.

- Michael Kors added 9 million new customers to its global database, a 12% increase from last year.

| Source: Official Financial Report

| Image Credit: Official Website

| Editor: LeZhi