On the morning of March 26, China Resources Land Ltd (HK:01109), a real estate company under China Resources Group, announced its 2023 annual performance, revealing the operational situation and performance of some shopping centers, particularly MixC. The performance announcement meeting also included the disclosure of China Resources Land’s shopping center opening plan for the next four years, from 2024 to 2027.

In 2023, China Resources Land’s total revenue increased by 21.3% year-on-year to 251.14 billion RMB, with net profit attributable to the parent increasing by 11.7% year-on-year to 31.37 billion RMB.

As a result of this performance, the group’s share price rose by 2.26% to 24.85 HKD per share at the close of March 26, bringing its total market value to 177.2 billion HKD.

China Resources Land includes four major businesses: development and sales, operational real estate, light asset management, and ecosystem component businesses. Among them, the operational real estate business, centered around shopping centers, achieved a revenue of 22.23 billion RMB in 2023, up 30.6% year-on-year, ranking second only to the development and sales business (212.08 billion RMB) and higher than both the light asset management (10.64 billion RMB) and ecosystem component businesses (6.19 billion RMB). The operational real estate business saw the fastest year-on-year growth rate, surpassing the development and sales business (20.4%), light asset management business (27.7%), and ecosystem component business (11.6%).

Furthermore, the operational real estate business contributed 28.3% of the group’s core net profit (net profit after deducting the appraisal increase of investment properties), while the contributions from the development and sales, light asset management, and ecosystem component businesses were 65.6%, 3.5%, and 2.6%, respectively.

In terms of the operational real estate business, which includes shopping centers, office buildings, and hotels. Shopping centers, in particular, achieved a rental income of 17.9 billion RMB in 2023, up 29.7% year-on-year, significantly higher than office buildings (2.06 billion RMB) and hotels (2.32 billion RMB). The overall occupancy rate was 96.5%, up 0.3 percentage points year-on-year, with gross profit margin and operating profit margin rising to recent highs of 76% and 58.5%, respectively.

At the performance announcement meeting, China Resources Land disclosed more detailed data about its shopping centers:

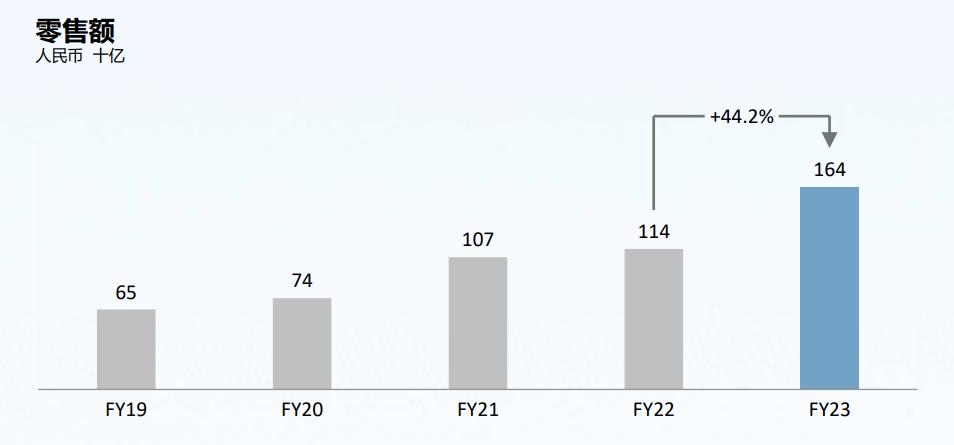

- In 2023, its 76 operating shopping centers achieved a retail turnover of 163.87 billion RMB, up 44.2% year-on-year.

- 61 shopping centers ranked in the top three in retail turnover in their local areas.

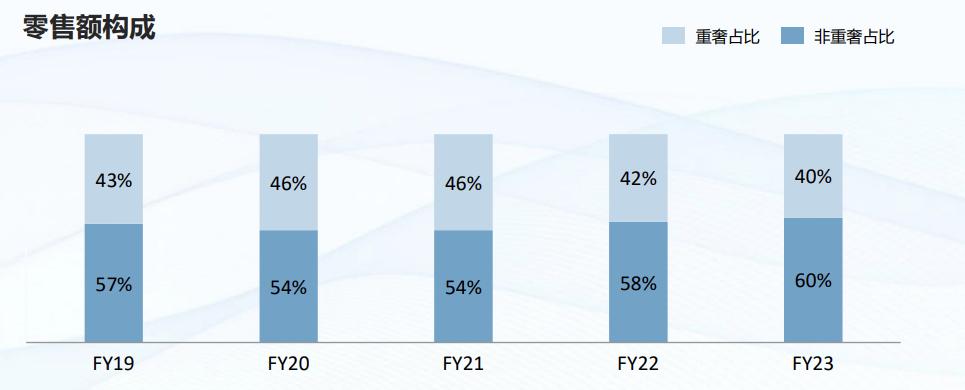

- In 2023, the group’s shopping centers outperformed the market, with both high-end luxury and non-high-end luxury shopping centers showing strong performance, with year-on-year increases of 36.5% and 49.7%, respectively, and same-store rebounds of 24.3% and 36.1%. The retail share of high-end luxury and non-high-end luxury remained at 40:60.

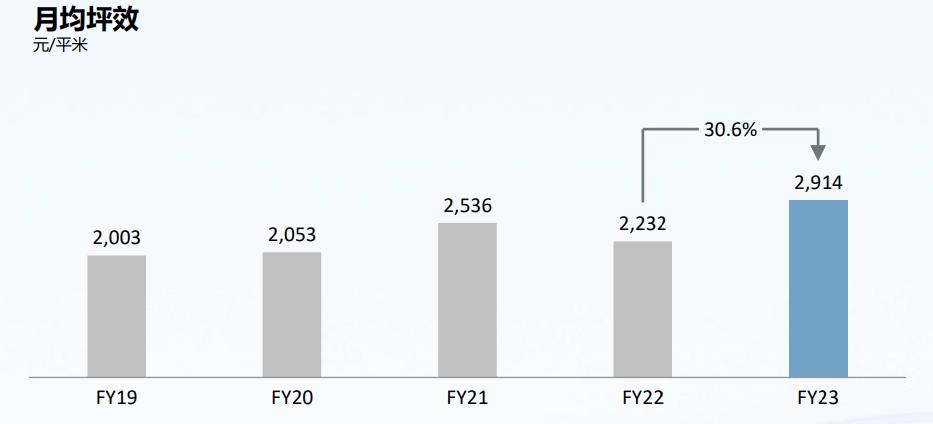

- In 2023, the group’s shopping centers welcomed over 960 million visitors, with average daily foot traffic per venue up 35.4% year-on-year, driving retail growth through the release of consumption potential. The number of members increased by 36% year-on-year to 46.25 million, with average monthly sales per square meter up 30.6% year-on-year to 2914 RMB/sqm.

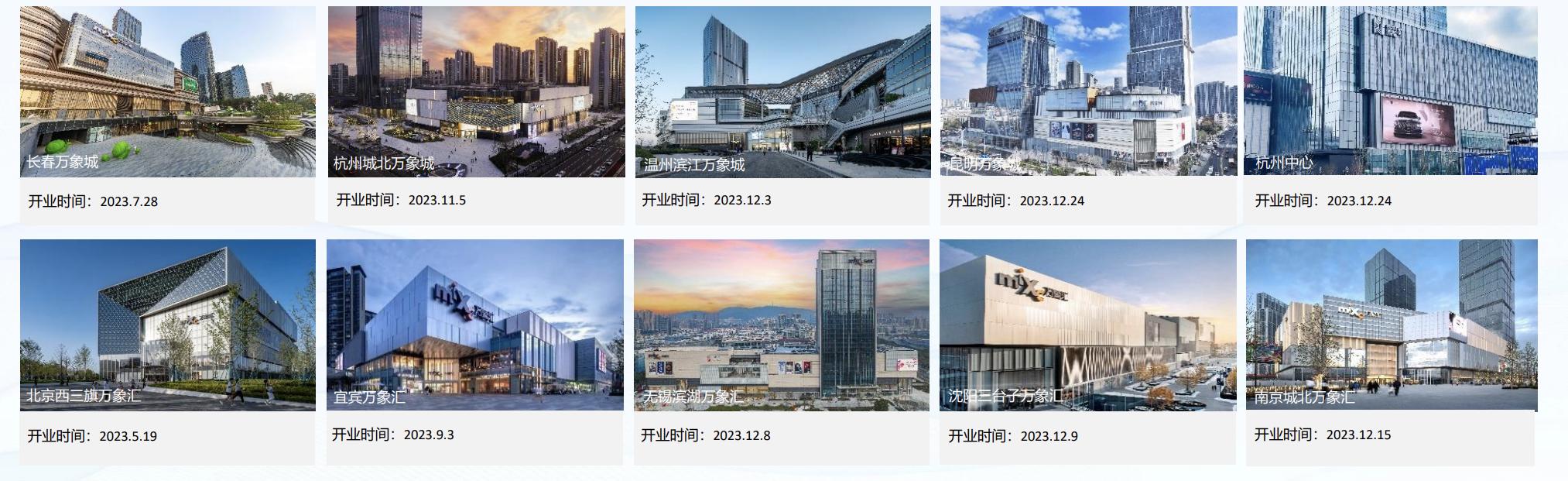

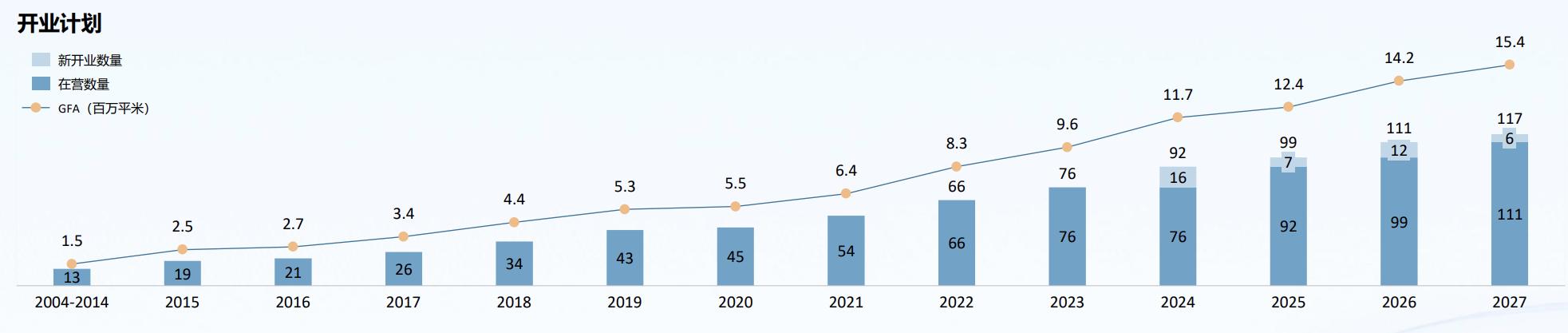

- Throughout the year, 10 shopping centers and 1 phased project were opened as scheduled, increasing the number of high-end luxury shopping centers to 12. The retail turnover and rental contributions of newly opened shopping centers accounted for 2.0% each, with an average occupancy rate of 96.2%.

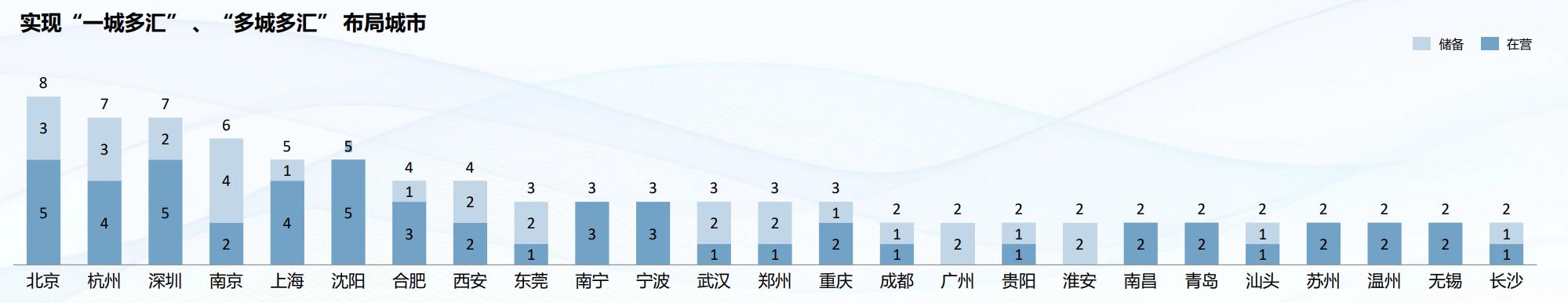

- The group stated that it will strengthen its focus on key cities, continue to concentrate on first- and second-tier cities and provincial capitals, implement the “multi-center in one city” and “multi-center in multiple cities” layout strategies, and increase its retail market share in key cities. As of the end of 2023, the group operated 76 shopping centers, with 25 cities having two or more shopping centers.

- In 2024, the group plans to open about 16 new shopping centers in Beijing, Shenzhen, Nanjing, Xi’an, Changsha, Zhengzhou, and other places. By the end of 2027, the number of operating shopping centers is expected to increase to 117.

Appendix: China Resources Land’s Shopping Center Opening Plan for 2024-2027

| Source: Official financial report

| Photo Credit: Official financial report

丨Reporter:Wang Jiaqi

| Editor: LeZhi