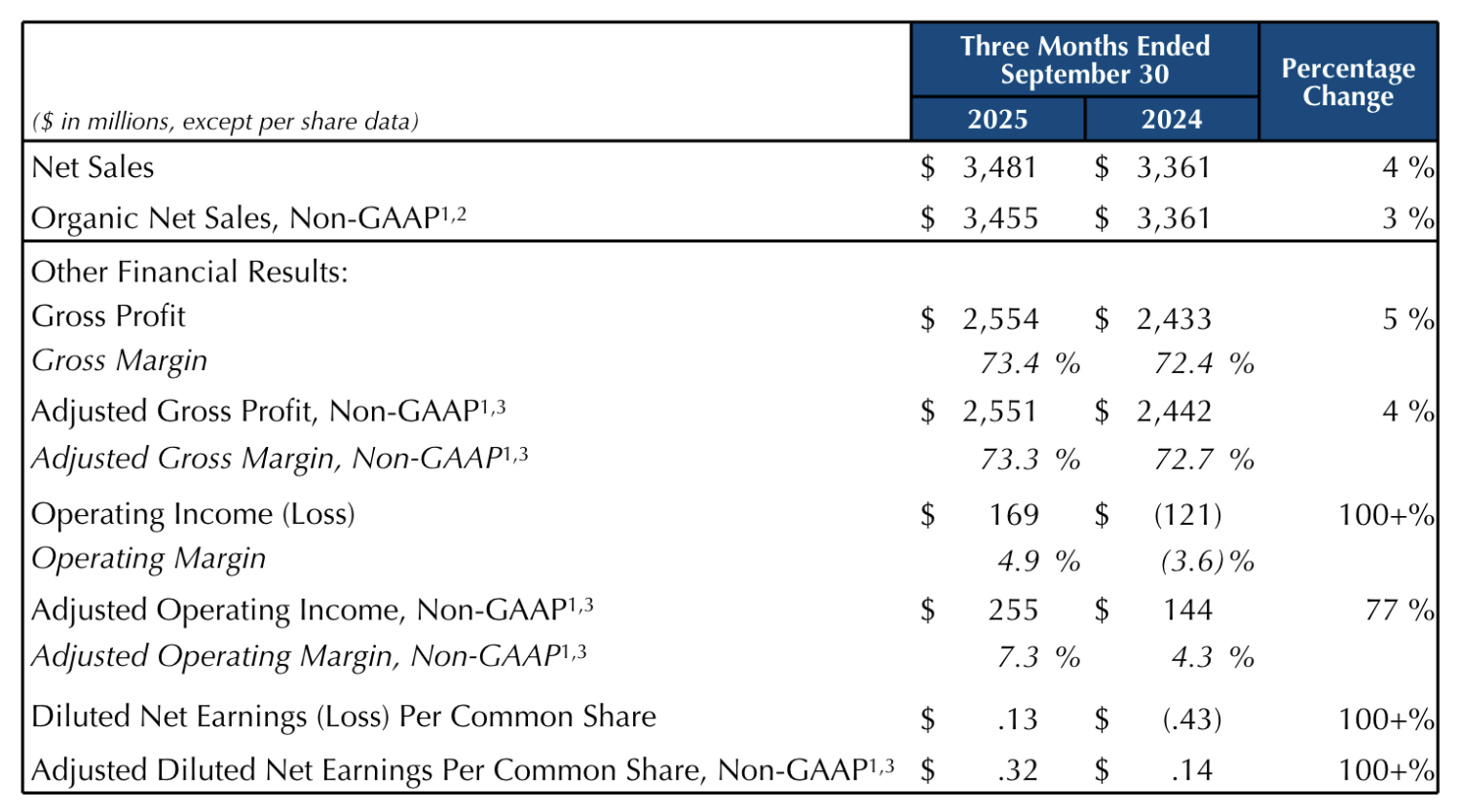

Before the U.S. market opened on October 30 (ET), American beauty giant Estée Lauder Companies Inc. announced its financial results for the first quarter of fiscal year 2026, ended September 30, 2025: benefiting from double-digit growth in the fragrance category and low single-digit growth in skincare, net sales rose 4% year-over-year to USD 3.48 billion (on an organic basis: +3%). Both operating profit and net profit returned to positive territory, reaching USD 169 million and USD 47 million, respectively.

Stéphane de La Faverie, President and Chief Executive Officer of Estée Lauder Companies, stated, “We had a strong start to fiscal 2026 as we execute on our Beauty Reimagined strategy—returning to

organic sales growth, gaining prestige beauty share in a few key strategic areas of focus, and improving

profitability. Encouragingly, we are building momentum across the organization from the significant

operational changes we have executed to-date to be faster and more agile. These results reinforce the confidence we have in our fiscal 2026 outlook—a pivotal year—as we restore organic sales growth and expand our operating margin for the first time in four years.“

In the Chinese Mainland market, net sales increased 9% year-over-year, with market share gains across all categories. Notable performances came from La Mer, Le Labo, and TOM FORD. Both online and offline channels delivered strong results.

“In the China market (according to internal company estimates), we outperformed the overall market in luxury beauty, with retail sales posting double-digit growth. Seven of our brands achieved double-digit growth this quarter, with Le Labo approaching triple-digit growth. Remarkably, we gained market share in luxury beauty in five of the past six quarters,” said Stéphane de La Faverie.

As of September 30, 2025, Estée Lauder Companies’ financial results for the first quarter of fiscal year 2026 are as follows:

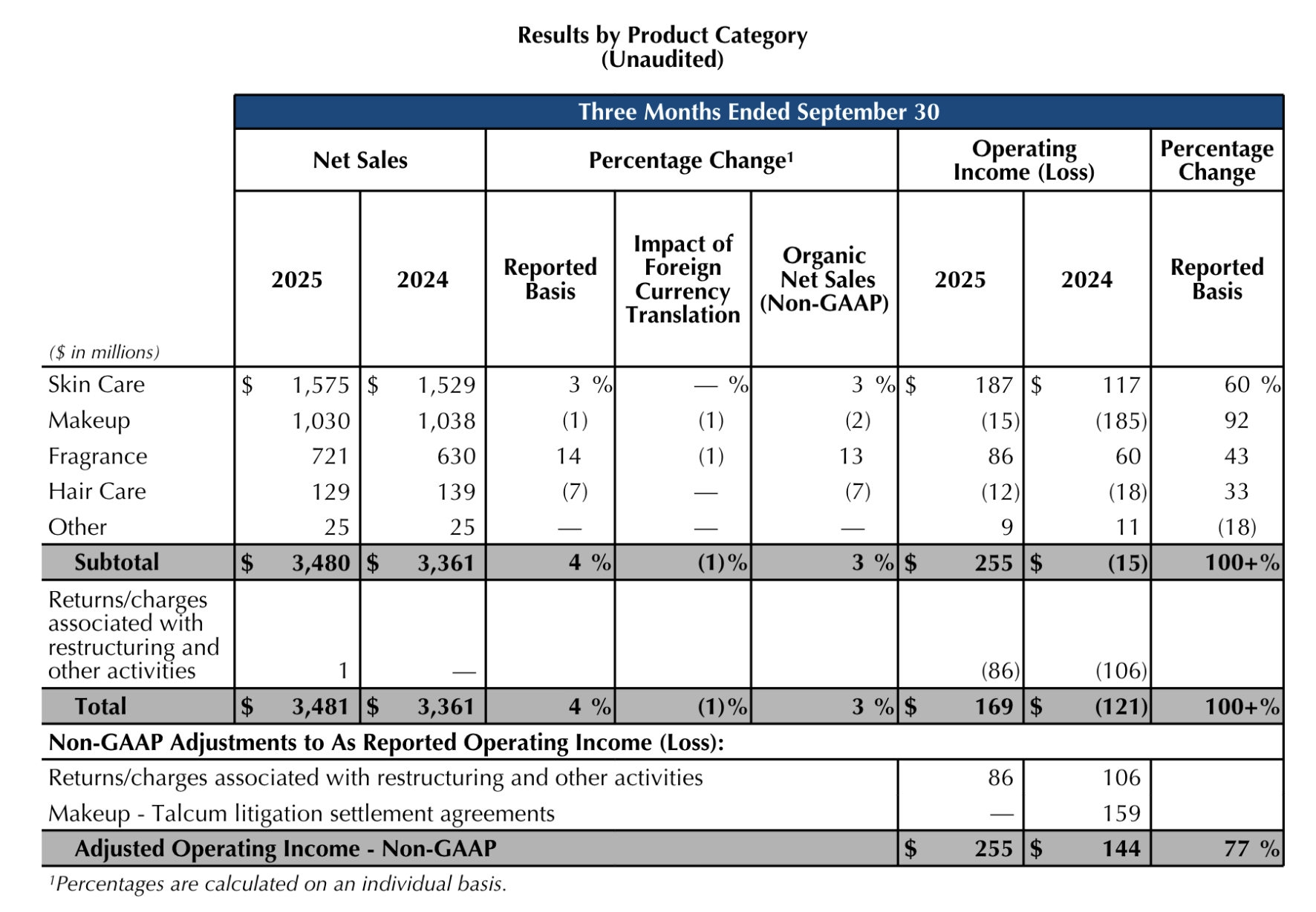

By Category

— Skincare

On an organic basis, net sales grew 3% year-over-year, primarily driven by growth in the La Mer and Estée Lauder brands.

The growth of both brands was mainly attributed to improved sales in the company’s Asia travel retail business. This improvement was supported by a low base in the same period last year (when the retail environment was challenged by low conversion rates) and inventory optimization efforts the company implemented in the previous year.

Estée Lauder’s sales growth was further supported by innovation across three major product lines: Revitalizing Supreme+, Re-Nutriv, and Advanced Night Repair.

Skincare operating profit also increased, mainly due to the rise in net sales and net benefits from the company’s Profit Recovery and Growth Plan (PRGP), which effectively reduced non-consumer-facing expenses.

— Makeup

On an organic basis, net sales declined 2% year-over-year, primarily impacted by the performance of the Bobbi Brown brand.

The decline was due in part to an unfavorable comparison against the high volume of new product shipments in the same period last year, and a decline in the eye makeup category—largely driven by the company’s strategic reduction in the number of palettes.

Makeup operating profit improved, primarily due to the absence of a one-time USD 159 million charge in the prior-year period related to the talc litigation settlement, which created a favorable year-over-year comparison.

Further improvement was supported by the implementation of the PRGP plan (which reduced non-consumer-facing expenses) and lower sales costs due to fewer promotional activities.

These positive impacts were partially offset by increased consumer-facing investments, including marketing and promotional expenses related to new product launches.

— Fragrance

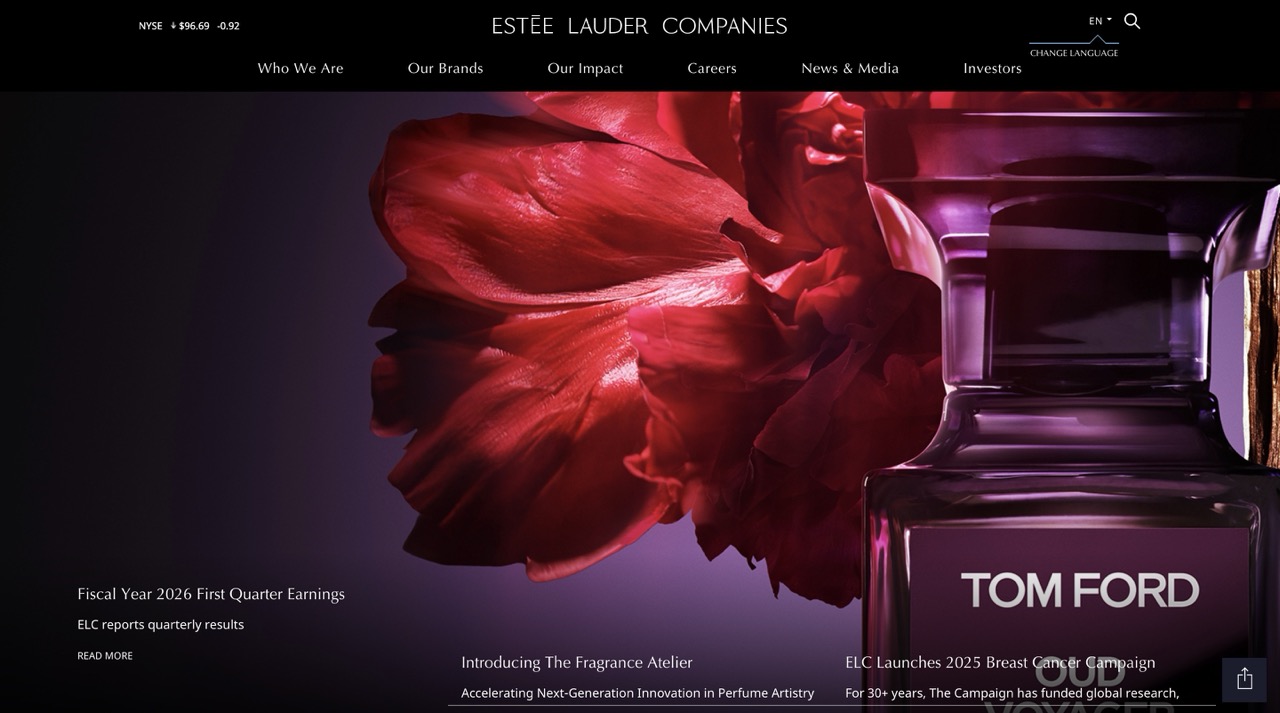

On an organic basis, net sales grew 13% year-over-year, primarily driven by the company’s Luxury Brands, which achieved high single-digit to strong double-digit growth across all regions. Specific brand highlights include:

-

Le Labo: Growth was fueled by the Classic Collection and City Exclusives, with standout performances from Another 13, Santal 33, and the Tokyo-exclusive Gaiac 10. The brand also expanded its consumer reach through targeted expansion.

-

TOM FORD: Growth was driven by innovative launches such as Oud Voyager and Black Orchid Reserve, which created a halo effect that boosted existing product sales. The brand also benefited from expanded target consumer coverage.

-

Jo Malone London: Growth came primarily from the cologne category. Wood Sage & Sea Salt remained a bestseller, while seasonal sales were boosted by limited editions like Ginger Biscuit and Raspberry Ripple. Expanded consumer reach also contributed to performance.

Operating profit increased, mainly due to higher gross margin, partially offset by increased consumer-facing investments, including channel expansion and optimization, key activations, and promotional support.

— Haircare

On an organic basis, net sales declined 7% year-over-year, primarily impacted by the Aveda brand.

The decline was due to strategic initiatives aimed at improving the brand’s long-term performance, including a planned reduction in online promotional activities and the exit of underperforming stores (including some directly operated stores). Continued weakness in the salon channel also contributed.

These negative factors outweighed certain positive developments, such as Aveda’s launch on Amazon’s Premium Beauty storefront in the U.S. in Q4 of fiscal 2025, and incremental sales from the launch of the Miraculous Oil.

Haircare operating performance improved, benefiting from net gains under the PRGP (Profit Recovery and Growth Plan), which reduced non-consumer-facing expenses, along with strict cost management. However, this was partially offset by the decline in sales.

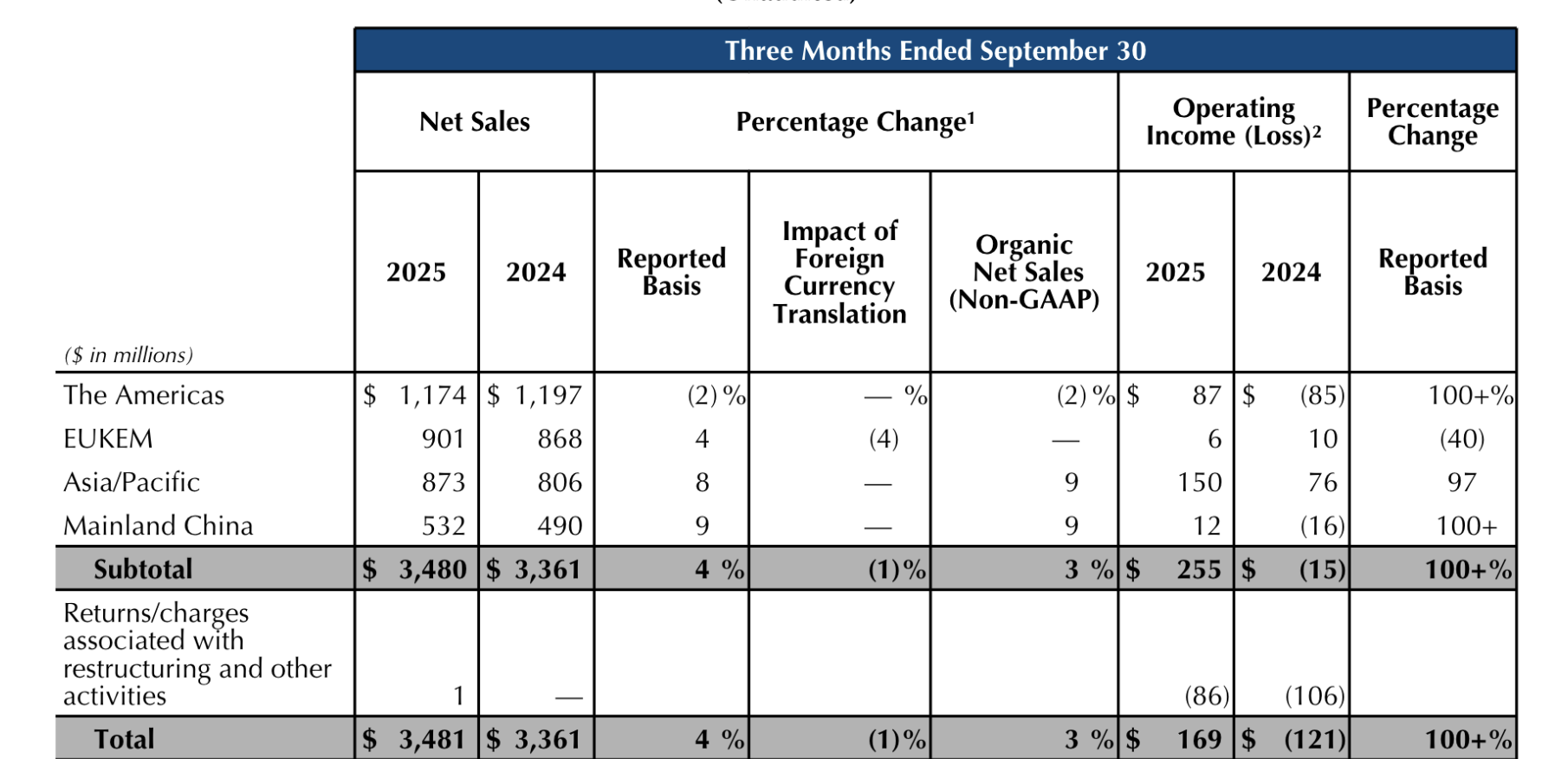

By Region

Growth in the Asia-Pacific region was mainly driven by the Chinese Mainland (+9%) and the Asia travel retail business. Specific factors included:

-

Growth in Asia travel retail net sales, which was aided by a low base in the prior-year period—when the retail environment faced challenges such as declining conversion rates—and by the company’s previous efforts to optimize channel inventory.

-

Growth in travel retail sales in the Europe, Middle East, and Africa (EMEA) region, driven by fragrances and supported by strategic activations and expanded targeted consumer outreach for TOM FORD, Jo Malone London, and KILIAN PARIS.

In the Chinese Mainland, market share increased across all categories, with standout performances from La Mer, Le Labo, and TOM FORD. Both online and offline channels delivered strong results.

Growth in the Chinese Mainland was supported by a dual engine of innovative and existing products, targeted expansion in consumer reach, and focused marketing campaigns that fueled online growth. The increase in sales, along with the benefits from the Profit Recovery and Growth Plan, contributed to higher operating income in the China market.

This growth was partially offset by a low single-digit decline in North America, primarily due to ongoing challenges in the department store channel. These included store closures stemming from retailer bankruptcies, weaker performance among certain retailers, and persistently elevated inventory levels for some brands throughout the quarter.

These headwinds offset the positive impact from higher shipments through the company’s Amazon Premium Beauty storefronts in the U.S. and Canada, where brand expansion on the platform continued.

Outlook for Fiscal 2026

The company reaffirmed its full-year outlook for fiscal 2026:

-

Net sales on an organic basis are expected to be flat to up 3%;

-

Adjusted operating margin is projected to range between 9.4% and 9.9%.

Chief Financial Officer Akhil Shrivastava stated, “While the Chinese Mainland has not yet fully recovered from historic lows, we are seeing signs of improved consumer confidence. Our global travel retail business is gaining momentum in Western markets, driven by consumer-facing investments and channel expansion. However, the Eastern markets continue to face temporary challenges, which are affecting retail sales. Given the high base in China and global travel retail last year, we expect these challenges to have a more pronounced impact in the second half. Despite the expected variables, we are encouraged by our strong start to the year and our return to growth.”

Note: Estée Lauder’s Profit Recovery and Growth Plan (PRGP) is designed to further transform the company’s operating model to support the resumption of sales growth in fiscal 2026, rebuild a strong double-digit adjusted operating margin over the next few years, and mitigate the impact of external volatility. The company expects the PRGP initiatives to be largely completed in fiscal 2027, with most of the expected operational benefits realized that year.

|Source: Official financial report, official press release

|Image Credit: Estée Lauder official website

|Editor: LeZhi