In July 2023, during the semi-annual conference call, Jean-Jacques Guiony, the CFO of LVMH Group, emphasized, “For the top two brands under the group, Louis Vuitton and Dior, there are three main priorities: desirability, desirability, and desirability. Our strategy remains unchanged; all our efforts are dedicated to enhancing the brands’ appeal.”

Louis Vuitton, with sales exceeding 20 billion euros in 2022, and Dior, with an estimated fashion sales of 8.8 billion euros in 2022, stand as LVMH’s premier luxury brands. Despite a consistent overarching strategic goal, their specific brand development initiatives showcase both differences and similarities.

Insights are derived from the Luxe.CO Intelligence’s annual luxury brand series reports, “Louis Vuitton in 2023” and “Dior in 2023,” which were recently published.

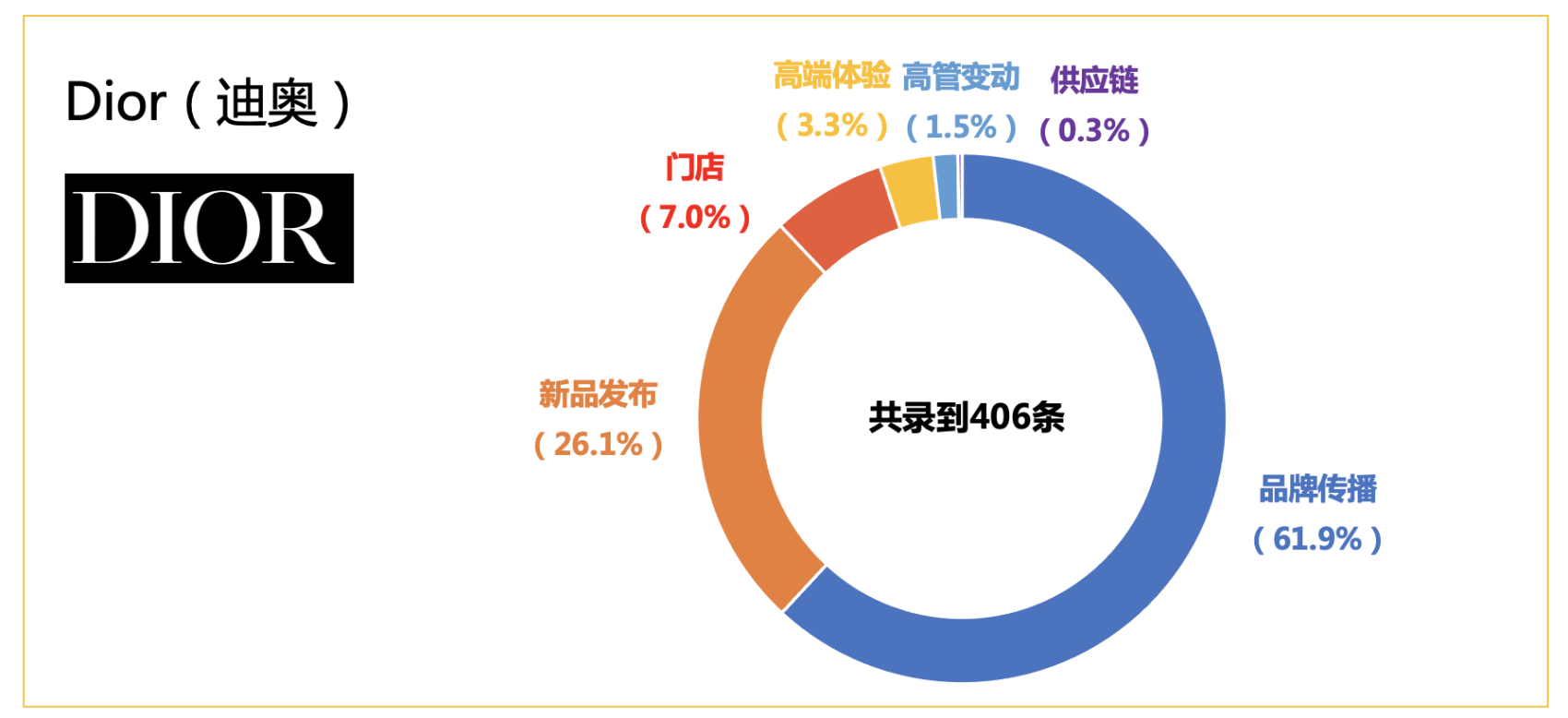

Based on comprehensive coverage and real-time updates on brand public activities from Tong.Luxe.CO and long-term systematic research on the luxury industry by Luxe.CO Intelligence, these reports have included a total of 693 major brand activities (incomplete count) for Louis Vuitton and Dior from January 1, 2023, to December 31, 2023. These activities span across five main areas: retail stores, product innovation, brand communication, supply chain, and human resources.

Compared to Louis Vuitton, Dior had a more intense year with a total of 406 activities, 41.5% higher than Louis Vuitton’s 287:

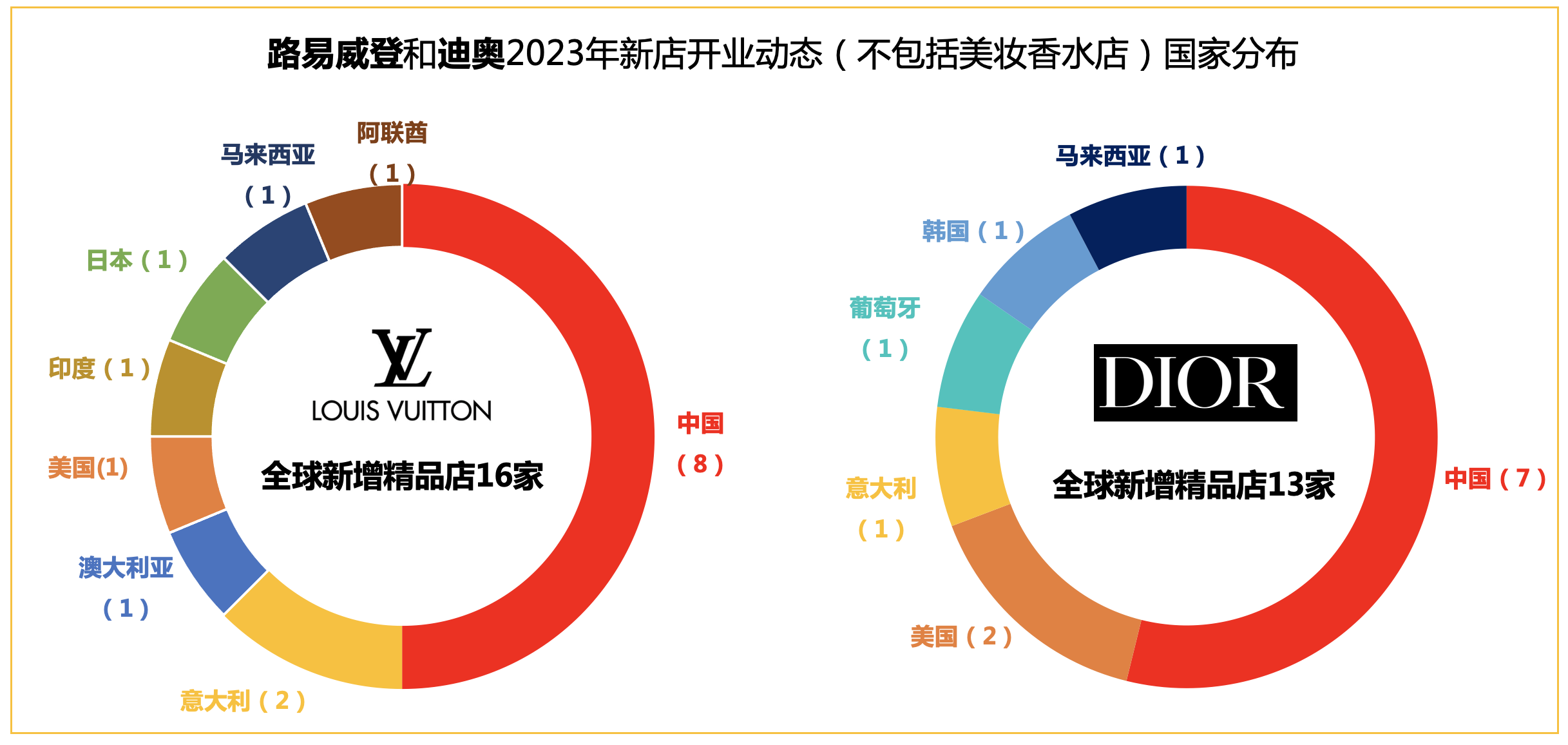

In terms of new store openings (excluding beauty business), Louis Vuitton had slightly more new stores (16) compared to Dior (13) over the past year.

- Geographically, both brands prioritized China significantly: the number of new stores each opened in China accounted for over 50% of their global expansions—Louis Vuitton with 8 and Dior with 7, representing 50% and 53% of their total new stores, respectively.

- Even though Luxe.CO Intelligence does not have the exact figures, it’s observed that both brands have opened comparatively larger stores in China. This is in line with Jean-Jacques Guiony, LVMH Group’s CFO, stating in January 2024 that, due to a substantial increase in domestic purchases, Louis Vuitton and Dior are considering opening larger stores in China.

- Outside of China, the distribution of Louis Vuitton‘s new stores was more balanced across countries—with one each in Australia, the United States, India, Japan, Malaysia, and the UAE, and two in Italy; Dior, on the other hand, opened two new stores in the United States and one each in Malaysia, South Korea, Portugal, and Italy. It’s evident that besides China and the United States, Malaysia and Italy were also common focal points for both Louis Vuitton and Dior last year.

In terms of new products:

- Dior’s two main divisions—Haute Couture (fashion new products accounting for 22.1%) and Perfumes & Cosmetics (new product dynamics accounting for 30.8%)—stood strong, with beauty products being the most frequently updated (23.1%), followed by fashion (22.1%), then bags (9.6%), fragrances (7.7%), and home (6.7%).

- Louis Vuitton, known for its leather goods and fashion, had the most new fashion items (22%), followed by bags (16%), jewelry (13%), and watches (11%).

- Both Louis Vuitton and Dior made strides in the baby and children market, with new product dynamics accounting for 4% and 5.8%, respectively. Louis Vuitton launched its first baby collection in March 2023, while Baby Dior relaunched its fragrance and personal care product line in October 2023.

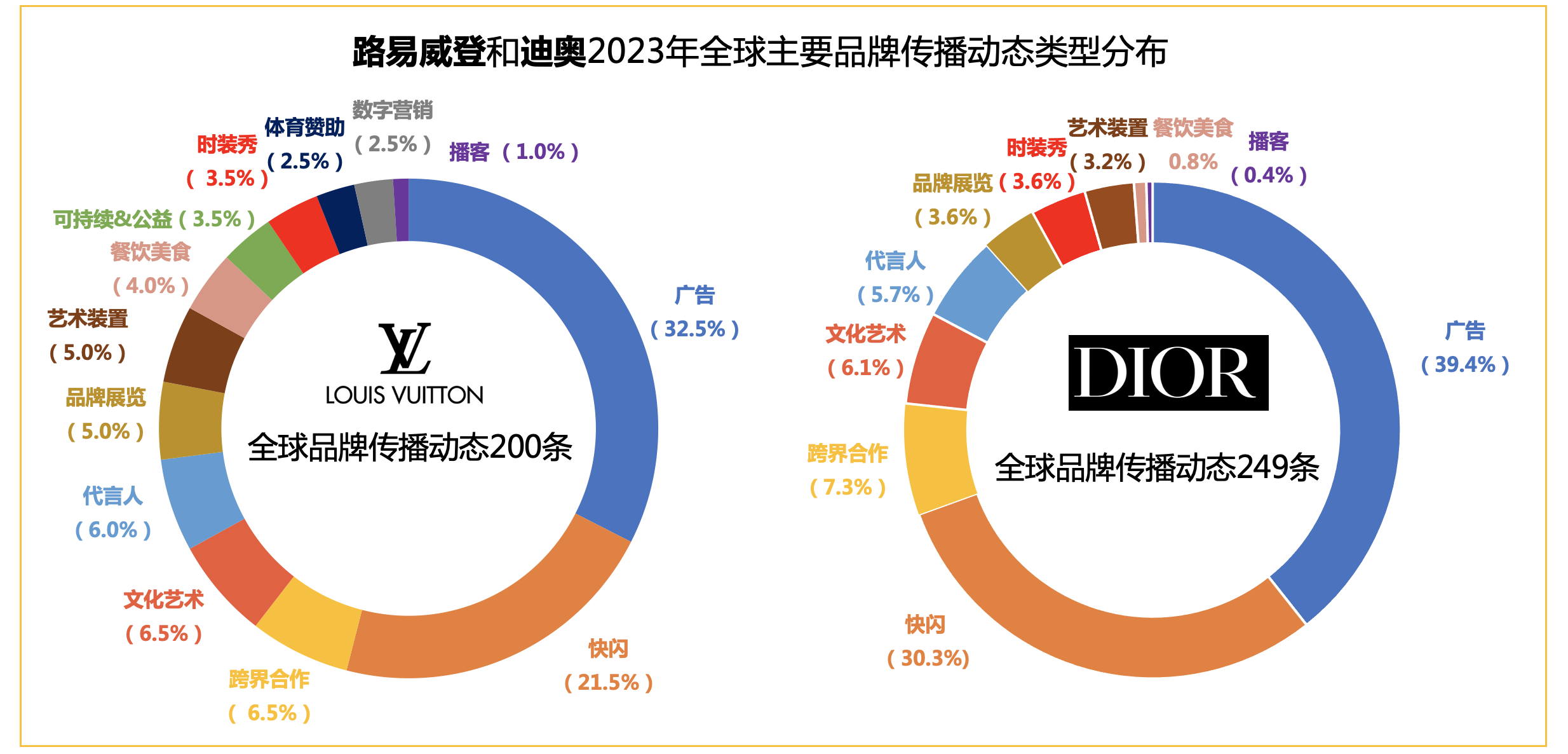

In brand communication, Dior had more global brand activities (249), 24.5% higher than Louis Vuitton (200). Here is a gist:

- The top five types of brand communication activities for both Louis Vuitton and Dior were the same: advertising, pop-up events, cross-collaboration, cultural arts, and spokespersons.

- In terms of officially announcing brand spokespersons (including brand ambassadors), the frequency of both brands was roughly equal—Louis Vuitton at 6%, and Dior at 5.7%.

- However, Dior placed a significantly higher emphasis on “advertising” (39.4%) and “pop-up” events (30.3%) compared to Louis Vuitton (advertising at 32.5% and pop-ups at 21.5%).

- Louis Vuitton valued “gastronomy events” more, with such activities making up 4% of its communication dynamics, in contrast to Dior’s 0.8%.

- The variety of brand communication activities was richer for Louis Vuitton, which notably led in “sports sponsorships,” “digital marketing” (including launching digital collectibles, joining social media platforms like Discord, setting up interactive AR games for products online), and “sustainability & philanthropy” activities.

In executive team changes, both Louis Vuitton and Dior saw leadership changes at the beginning of 2023:

- Pietro Beccari, former President and CEO of Christian Dior Couture, became the CEO of Louis Vuitton.

- Delphine Arnault, former Vice President of Products at Louis Vuitton and eldest daughter of LVMH Chairman Bernard Arnault, took over as CEO of Christian Dior Couture.

LVMH’s top brands seem to favor “exchanging executives”:

In December 2023, Olivier Sastre, Senior VP of Human Resources at Louis Vuitton, moved to Christian Dior Couture as Senior VP of Human Resources, leading sustainability efforts. Emmanuelle Favre-Ray, former Senior VP of Human Resources at Christian Dior Couture, took over the corresponding role at Louis Vuitton, leading the sustainability department.

For more information and to access the full “Louis Vuitton in 2023” report: Click here. (available only to Luxeplace subscribers)

For more information and to access the full “Dior in 2023” report: Click here. (available only to Luxeplace subscribers)

About Luxe.CO Intelligence

Luxe.CO Intelligence has been deeply involved in the fashion and luxury sectors for a long time. Leveraging our continuously expanding industry network, data intelligence, and knowledge system, we are committed to providing professional, innovative, and forward-looking consulting services to brands and companies in China and overseas. Our areas of focus include brand revitalization and upgrade strategies, brand content and communication strategies, niche industry positioning and opportunity analysis, and strategies for entering the Chinese market.

View all reports published by Luxe.CO Intelligence: https://luxe.co/page/hlzk

In the past six months, other brand research reports released by Luxe.CO Intelligence include:

“Gucci in 2023”

“Prada in 2023”

“Chanel in 2023”

“Hermès in 2023”

“Tiffany & Co. in China”

…

Email: lci@luxe.co