The Italian luxury group Salvatore Ferragamo announced its preliminary financial results for the fiscal year ending December 31, 2023: the group’s total revenue decreased by 7.6% year-on-year to 1.16 billion euros (an 8.1% decrease at constant exchange rates). Net sales decreased by 11.1% year-on-year to 1.12 billion euros (an 8.4% decrease at constant exchange rates).

Despite a year-on-year decline in sales in the Asia-Pacific region, including Greater China, the fourth quarter saw a positive trend in sales, with wholesale revenue in Greater China growing and retail channel sales achieving double-digit growth.

*The group’s total revenue includes net sales, licensing and services, rental income from investment properties, and the impact of cash flow hedging.

Marco Gobbetti, CEO and General Manager of the group, commented, “2023 has been a year of very intense work in which we made significant progress in our transition. We progressively increased the share of our new products in the stores, enhancing communication in terms of social media response and engagement, and editorials.”

“We have strengthened the platform in terms of brand identity, product and communication. We have been infusing heat into the brand and, especially at the end of the year, started to see some pleasing signals from new products. We also worked on optimizing the network and on the new store concept, that will be revealed in the Milan Women store, reopening in February for the Fashion Show. This is another fundamental step in the implementation of our strategy.”

On January 22, Ferragamo appointed Pierre La Tour as Chief Financial Officer, effective March 18. Pierre La Tour is an experienced executive who has worked in international finance. Ferragamo stated that “due to the special powers and tasks assigned to Pierre La Tour in administration, finance, control, and investor relations,” the board will equip him with a manager responsible for strategic duties.

The day after the financial report was released, as of the close of January 26, the stock price of the Ferragamo Group rose by 7.6% to 11.74 euros/share, with a current market value of about 1.97 billion euros.

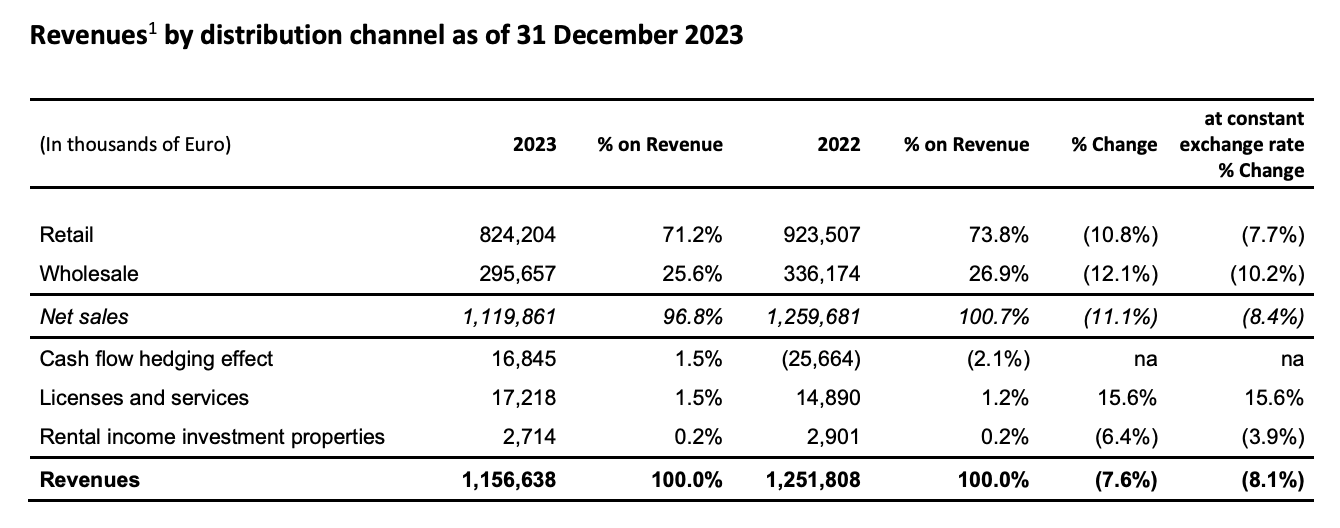

As of December 31, the performance of Ferragamo’s various channels in the 2023 fiscal year is as follows:

- The decline in the retail channel was mainly due to a generally weak market in the last few months of 2023, with the most affected being “discounted products.”

- The decline in the wholesale channel was mainly due to the group’s plan to optimize its third-party sales network.

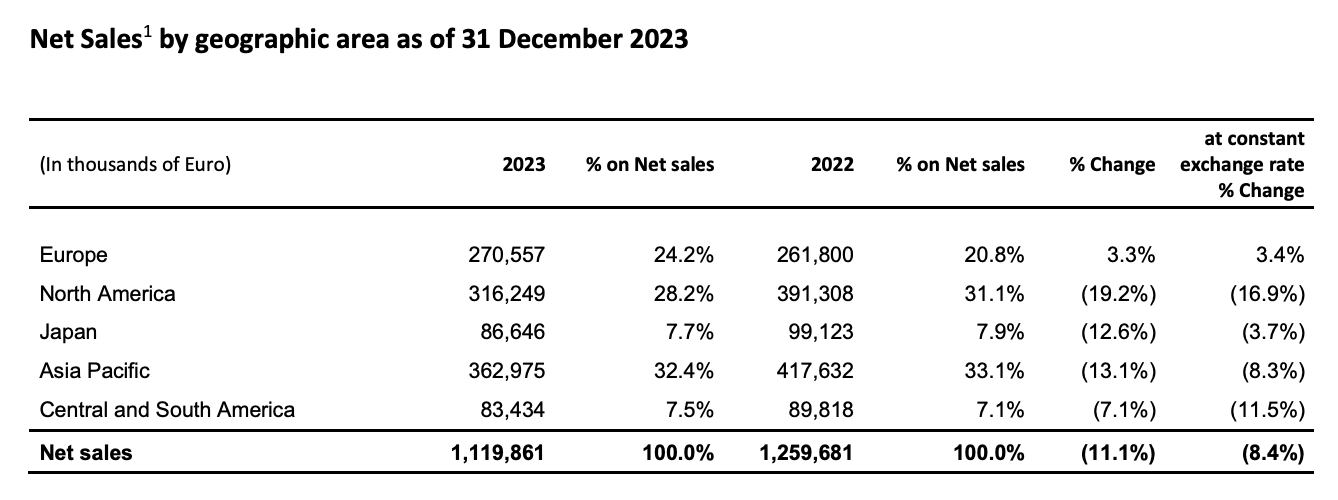

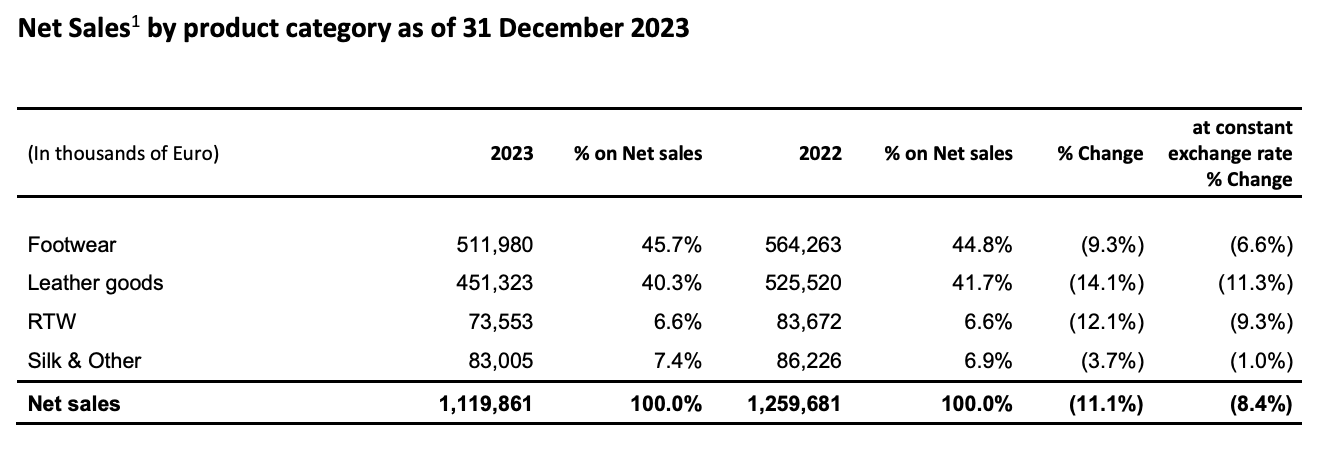

The net sales performance by region and category is as follows:

——By region:

Although sales in the Asia-Pacific region declined year-on-year, the fourth quarter showed a positive trend, with wholesale revenue in Greater China growing and retail channel sales achieving double-digit growth.

——By category

| Source: Official financial report

| Image Credit: Group’s official website

丨Reporter:Zhang Yang

| Editor: LeZhi