In the first ten months of this year, Luxe.CO Intelligence tracked and analyzed 3,128 business activities from 464 sports and outdoor brands, with 164 updates from Amer Sports‘ brands, making it the leading foreign sports and outdoor group by coverage.

In February, Amer Sports was listed on the New York Stock Exchange, marking the largest U.S. IPO since September 2023. In May, Arc’teryx opened its flagship museum on Nanjing West Road in Shanghai, further solidifying its leadership in the Chinese high-end outdoor market. Alongside Arc’teryx, other brands under Amer Sports, such as Salomon and Wilson, are also rapidly gaining momentum.

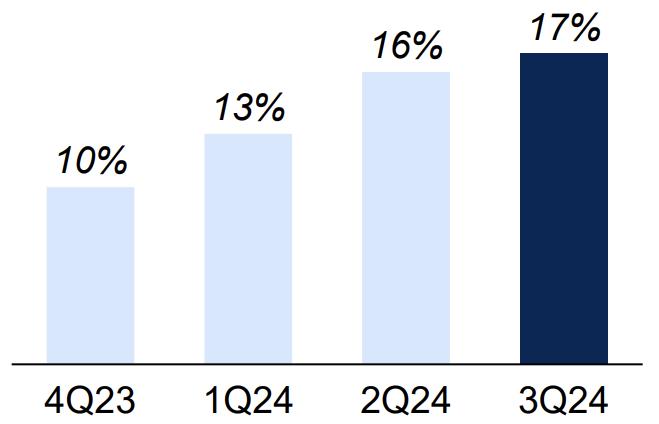

Under the leadership of these three major brands, Amer Sports’ third-quarter revenue reached $1.354 billion, representing a 17% year-on-year increase on both reported and constant-currency bases. Despite a generally sluggish global market for mid-to-high-end brands, Amer Sports achieved accelerated growth for the fourth consecutive quarter.

The Greater China market delivered standout performance, with revenue rising 56% year-on-year to $313 million, making it the best-performing region for four consecutive quarters. This robust performance underscores the growing maturity of China’s sports and outdoor market, often described as entering a “golden era.”

Chart: Amer Sports’ Year-on-Year Quarterly Revenue Growth Over the Past Year

Amer Sports attributes its success to a commitment to precise brand positioning. CEO James Zheng emphasized, “Our brands remain professional and niche-focused.”

This article, based on the latest financial reports and analyst calls, explores how Amer Sports tailors proactive and flexible strategies for its niche sports and outdoor brands, leveraging Greater China’s strong momentum to drive global growth. The group is expanding brand influence, deepening channel presence, and strengthening both professionalism and innovation, enhancing overall competitiveness and brand desirability.

Leading Brands Drive Growth as Pricing Power Boosts High-Quality Development

Since 2018, Amer Sports has focused on transforming its business by concentrating on core brands and streamlining its product portfolio. The company now operates three divisions with ten brands: the Technical Apparel division, with Arc’teryx as the core; the Outdoor Performance division, led by Salomon; and the Ball & Racquet Sports division, anchored by Wilson.

Arc’teryx entered the Chinese Mainland market in the early 2000s. After more than 20 years of development, it has become a highly recognized and extremely loyal high-end outdoor brand among Chinese consumers.

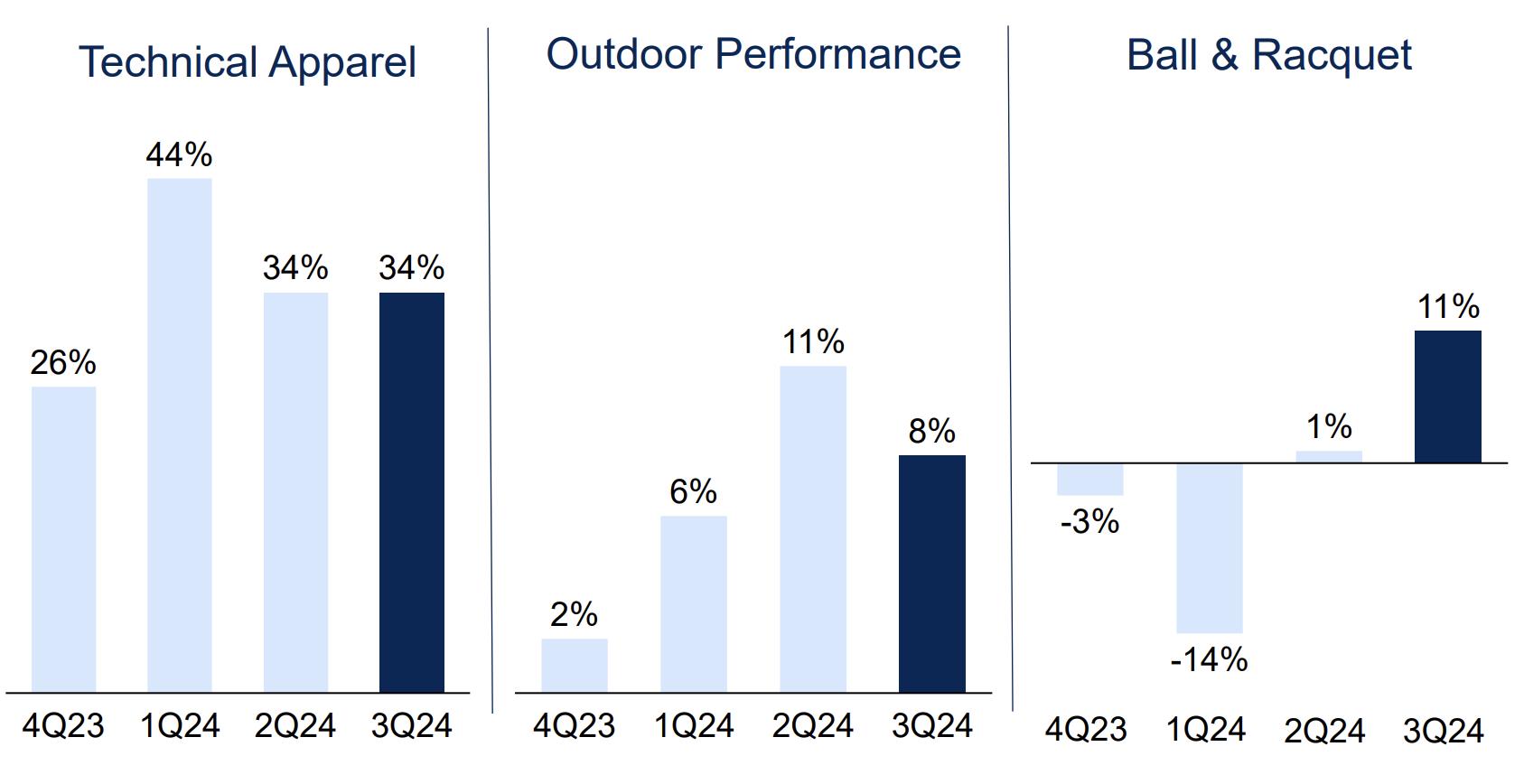

In the third quarter, the Technical Apparel division recorded a 34% year-on-year revenue growth, reaching $520 million USD. Over the past four quarters, the division’s revenue grew by 26%, 44%, 34%, and 34%, consistently leading the group’s growth. Arc’teryx remains the group’s largest and fastest-growing brand.

The Outdoor Performance division, led by Salomon, achieved 8% year-on-year growth in the third quarter, reaching $534 million USD. Amer Sports expects this division to reach an annual revenue of $1.8 billion USD in 2024, making it a key pillar of the group’s overall performance.

The Ball & Racquet Sports division showed significant acceleration in growth, with revenue increasing 11% year-on-year in the third quarter to $300 million USD, compared to a mere 1% growth in the previous quarter. Wilson, a century-old brand in the tennis world, is entering its prime. During the Paris Olympics, Chinese tennis player Zheng Qinwen used a Wilson racket to win a gold medal, resulting in a 20-fold surge in racket sales on the same day, marking a milestone for Wilson in the Chinese Mainland market.

Chart: Year-on-Year Revenue Growth/Decline for Amer Sports’ Three Divisions Over the Past Year (Four Quarters)

In 2020, Arc’teryx opened its then-largest flagship store, Alpha Center, on Shanghai’s high-end Huaihai Road, directly across from Hermès. In May 2023, Arc’teryx launched a 2,400-square-meter flagship museum on Nanjing West Road in Shanghai, the brand’s largest experiential store globally.

These milestones underscore that Arc’teryx is positioning itself as a luxury brand, which has further reinforced Salomon and Wilson’s confidence in pursuing high-end strategies.

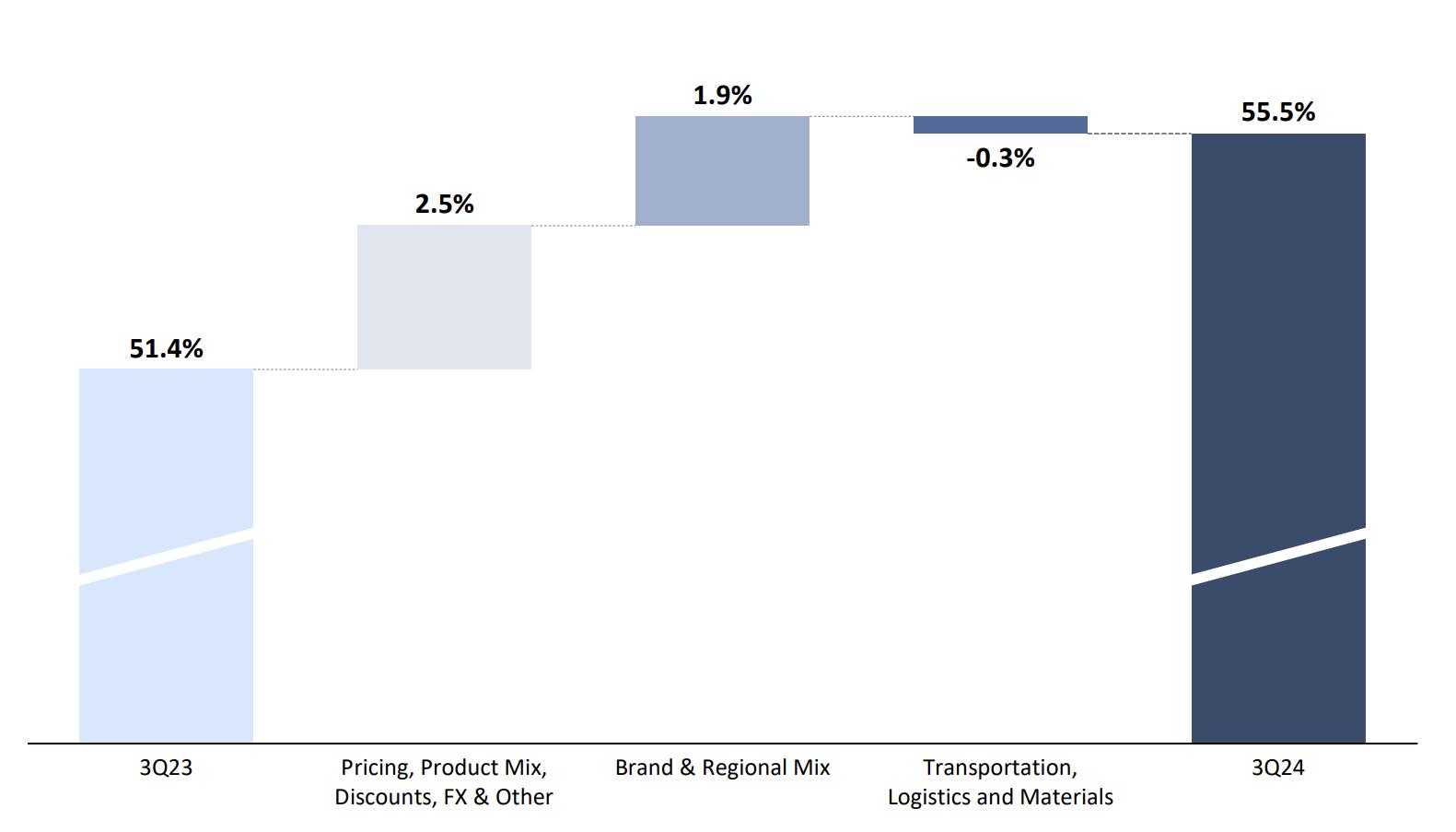

According to the financial report, Amer Sports’ adjusted gross margin for the third quarter increased by 410 basis points to 55.5%. The company further detailed the breakdown of the gross margin improvement: “pricing power, product mix, discounts, foreign exchange, and other factors” contributed 250 basis points, while “brand and regional mix” added 190 basis points.

The improvement in gross margin reflects the strengthened pricing power and continued product upgrades across the group’s brands.

Chart: Changes in Amer Sports’ Gross Margin in the Third Quarter

China Leading Global Growth with Deeper Channel Expansion

Amer Sports’ sustained high growth is closely tied to the outstanding performance of the Chinese Mainland market. Over the past four quarters, the Greater China region’s revenue growth accelerated sequentially, with year-on-year increases of 45%, 51%, 54%, and 56%, contributing 23.1% of the group’s revenue in Q3 2024, a significant rise from 8.3% in 2020.

James Zheng, CEO of Amer Sports, noted, “Today’s consumers, particularly those in the Chinese market and especially within our niche sectors, are still looking for new experiences. We are fortunate that the sports niche in China remains vibrant. We estimate the Chinese sports industry will achieve high single-digit growth this year, with the outdoor segment growing faster than the industry average.”

He added, “We see more and more consumers, especially in first- and second-tier cities, viewing sports and outdoor activities as an integral part of their lifestyle. Their engagement has exceeded our expectations. This is an excellent moment for us.”

In first- and second-tier cities, Amer Sports has been aggressively expanding its direct-to-consumer (DTC) channels. In the third quarter, DTC revenue maintained a strong 41% year-on-year growth, outpacing the group’s overall performance. The DTC segment’s share of total revenue nearly doubled, rising from 21.7% in 2020 to 40.4% in the first three quarters of 2024.

According to Luxe.CO’s observations, Amer Sports’ brands are expanding their retail networks by opening flagship stores, first stores, and concept stores across various city tiers. This strategy integrates premium sports and outdoor experiences into the lives of urban consumers.

For Arc’teryx, which has been deeply rooted in the Chinese Mainland market for years, its retail upgrades are evident. From the Shanghai Alpha Center to the Arc’teryx Museum, and now with new flagship stores in Beijing Financial Street, Jinan Hang Lung, and Wuhan SKP, the brand has established a clear and strong trajectory of retail transformation.

Compared to Arc’teryx’s larger flagship stores, Salomon, a rising “new star” in the Chinese market, has adopted a different approach by opening smaller, scalable ‘standard stores’ to reach more consumers. This year, Salomon has launched stores in cities such as Changzhou, Luoyang, Harbin, Urumqi, Fuzhou, and Kunming. These stores deliver four times the per-square-meter sales efficiency compared to the industry average.

Wilson has also been actively addressing market gaps by opening its first stores in cities such as Qingdao, Nanning, Xiamen, Suzhou, Nanjing, Wenzhou, Jinan, Taiyuan, Xuzhou, and Changsha. Gordon Devin, President of Wilson Sportswear, revealed in an exclusive interview with Luxe.CO that 24 new Wilson stores (including direct and franchised outlets) have opened in China this year, with many more in the pipeline.

Wilson has also been innovating with localized concepts. In September, the brand opened its “Bamboo Pavilion” urban concept store in Chengdu Taikoo Li, blending Sichuan culture with the style of an American tennis club. To mark the opening, the store launched a Chengdu-exclusive tennis racket featuring ink-brush bamboo designs on both the racket and the tennis bag.

Another Amer Sports brand, Peak Performance, brought its Nordic aesthetic to Shanghai’s Jing’an Kerry Centre, a prime location on Nanjing West Road. In September, the brand debuted its first PP Club concept store in China, showcasing exclusive new products, including limited-edition designs specific to the Chinese market.

Continuous Product Innovation Propels “Niche Professional Brands” to Broader Recognition

James Zheng, CEO of Amer Sports, remarked that the Chinese Mainland consumer market is undergoing a survival-of-the-fittest process. In this environment, some brands stand out while others lag behind. He emphasized, “Although our brands are relatively niche, their exceptional professionalism, quality, and continuous technological innovation have earned widespread recognition in the Chinese Mainland market.”

The latest financial report, along with insights from Luxe.CO Intelligence, confirms this perspective. Luxe.CO observes that Amer Sports’ strategic investment in product innovation is a key driver behind its niche professional brands achieving high-quality growth and broader market appeal in the Chinese Mainland.

Arc’teryx

James Zheng stated, “Product innovation is the core DNA of Arc’teryx.”

Arc’teryx’s iconic hard-shell jackets have become one of its best-performing product categories in recent years. Notably, the Alpha SV jacket, now in its seventh iteration, exemplifies the brand’s core value of evolution—achieving continuous breakthroughs in technology and performance through years of refinement.

In August, Arc’teryx’s Advanced Concepts Team collaborated with SKIP R&D to launch the world’s first wearable exoskeleton softshell pants, MO/GO™, specifically designed for outdoor sports. This groundbreaking innovation was named one of the “Best Inventions of 2024” by TIME magazine.

“We believe this technology has the potential to significantly and meaningfully improve accessibility to outdoor activities, regardless of physical ability,” Zheng commented.

Beyond its traditional core categories, Arc’teryx has found new growth drivers in footwear and women’s apparel:

Since the launch of its first independently designed footwear collection, Arc’teryx has continued to expand its footwear offerings, achieving strong double-digit growth across all channels and regions in the third quarter. Notably, the Kragg hiking boots and the newly introduced Kopec trekking shoes delivered standout performances.

Women’s outdoor apparel, including jackets and footwear, also exhibited strong double-digit growth, accounting for nearly one-quarter of the third-quarter sales. Breakthrough products such as the Clarkia climbing pants performed exceptionally well, further driving growth in this category.

Salomon

In China, Salomon has pioneered a new product category called “outdoor fashion,” which has gained popularity, especially among younger consumers.

However, trail running and consistent product innovation remain the brand’s core DNA. Salomon has launched a series of hit products, from the XA PRO 3D/XT-QUEST to the XT-6, which became highly sought-after last year, and this year’s new Speedcross 3 trail running shoes.

Salomon’s Chief Product Officer Guillaume Meyzenq was recently promoted to President and CEO, signaling the brand’s continued focus on product innovation.

James Zheng commented, “This brand, born in the mountains, holds a unique position in the global sports shoe market with its technical performance and aesthetic design. However, its market share remains relatively low, offering significant growth potential, especially as consumers today are more open to exploring new sports footwear than ever before.”

Wilson

With a vision of becoming the “world’s leading tennis brand”, Wilson has dedicated over 110 years to professional sports equipment, particularly in the racquet and ball sports segment. The brand is favored by numerous top athletes, including tennis legend Roger Federer.

In August, Federer and Wilson collaborated to launch the new RF01 racquet series. Designed and tested by Federer himself, this series aims to deliver outstanding performance for the next generation of players.

Conclusion

Luxe.CO believes that Amer Sports’ remarkable growth, especially its sustained strong performance in the Chinese Mainland market, stems from its precise understanding of personalized brand positioning, deep insights into the high-level needs of sports and outdoor consumers, and differentiated, forward-looking strategies tailored to its diverse brand portfolio.

Through carefully curated market strategies and marketing campaigns, Amer Sports has successfully established Arc’teryx, Salomon, and Wilson as distinct, high-end leaders in their respective segments in the minds of Chinese consumers. These efforts have deepened and expanded their market shares within niche categories.

Beyond its three flagship brands, Amer Sports’ ambitions extend further. The group’s other brands are also gathering momentum, ready to unleash unprecedented energy and creativity to drive a new wave of growth in both global and Chinese markets.

| Sources: Amer Sports Financial Report, Amer Sports Analyst Meetings

| Image Credit: Amer Sports Financial Report, Provided by Amer Sports

| Editor: LeZhi