On July 30th, Hang Lung Properties Limited (HK: 00101) announced its interim results for 2024: revenue increased by 17% year-on-year to HKD 6.114 billion, with property sales revenue at HKD 1.228 billion (2023: none). Due to three major factors—weak luxury consumption in the Chinese Mainland, a slowdown in the Hong Kong retail and office markets, and the depreciation of the RMB against the HKD—property leasing income decreased by 7% year-on-year to HKD 4.886 billion (2023: HKD 5.237 billion).

In terms of profitability, overall operating profit fell by 10% year-on-year to HKD 3.43 billion, and net profit attributable to shareholders decreased by 22% year-on-year to HKD 1.735 billion, mainly due to the decline in leasing operating profit and increased financial expenses.

The group stated that after a strong rebound in the Chinese Mainland in the first half of 2023, market momentum weakened, and conditions slowed in 2024, with luxury retail consumption remaining sluggish. As a result, the group’s overall leasing income and tenant sales in the first half of the year decreased by 3% and 13%, respectively, in RMB terms.

Hang Lung Properties Chairman Chan Man Bok said at the results briefing that after several years of record growth in the Mainland luxury market, the past 12 months have seen a significant increase in outbound travel, particularly to Japan (where the depreciation of the yen has made local luxury goods about 30% cheaper than in the Mainland), along with weakened consumer confidence in the Mainland, causing the domestic luxury market to return to previous levels.

“Despite the normalization of luxury consumption in Shanghai, it is fortunate that more than half of our tenant sales revenue in other cities’ malls comes from similar categories,” Adriel Chan said. He expressed confidence that “our business will perform well” once market confidence recovers.

Following the results announcement, the group’s stock price fell by 11.74% to HKD 5.64 per share, with a total market value of approximately HKD 27 billion.

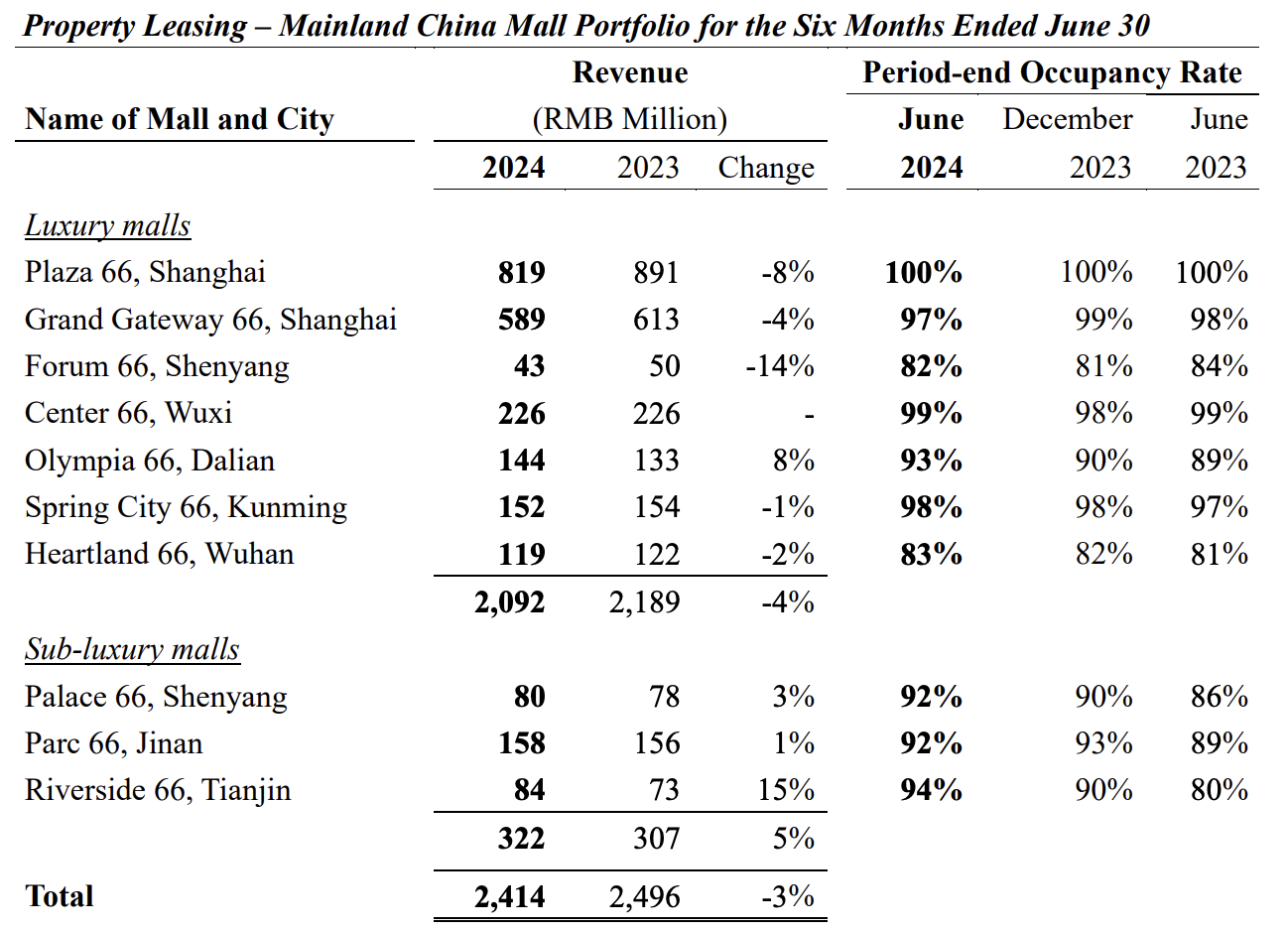

The financial report disclosed the operating conditions of ten high-end and sub-high-end malls in the Mainland, as follows:

Shanghai Plaza 66: Rental Income and Sales Down by 8% and 23% Year-on-Year, Occupancy Rate Maintained at 100%

The decline is mainly due to more cautious luxury spending by customers with slightly weaker purchasing power, who tend to seek better deals while traveling overseas. Top-tier customers continue to favor the mall’s exclusive and luxurious offerings. The group continues to leverage the “Heng Lung Club” membership program to strengthen connections with loyal customers and attract new members, thereby consolidating its market position. In April, the group collaborated with several international luxury brands to host the “Spring Wonderland” spring celebration, offering a unique shopping experience for customers.

Shanghai Grand Gateway 66: Rental Income and Sales Down by 4% and 14% Year-on-Year, Occupancy Rate Maintained at a High Level of 97%

As the sister mall of Plaza 66, Grand Gateway 66 offers a wider variety of fashion and lifestyle choices. During the Chinese New Year and other holidays, the mall hosts various marketing activities to strengthen customer engagement. The group organized the exclusive “Cupid’s Summer Solstice” event, attracting a large number of visitors and becoming a hot topic on social media.

Shenyang Forum 66: Rental Income and Sales Down by 14% and 20% Year-on-Year, Occupancy Rate at 82%

The mall continues to co-host marketing activities with Palace 66, leveraging synergies to enhance the customer experience.

Wuxi Center 66: Stable Rental Income and Sales, Occupancy Rate at 99%

With the addition of several top-tier luxury brands at the end of 2023, the mall’s leading position in the luxury market has been further solidified.

Dalian Olympia 66: Rental Income and Sales Up by 8% and 2% Year-on-Year, Occupancy Rate Increased by 4 Percentage Points to 93%

Since transforming into a regional high-end retail landmark, the mall has attracted more high-end brands, especially beauty brands. The group has also enhanced the variety of retail offerings, including dining, sportswear, fashion apparel, and accessories, enriching the one-stop shopping experience. A series of effective marketing activities, such as the “Floral Dream Journey” event in April, further boosted consumer sentiment.

Kunming Spring City 66: Rental Income and Sales Down by 1% and 6% Year-on-Year, Occupancy Rate Maintained at 98%

Affected by a decline in local consumption, the group launched several well-received activities, such as the “Sweet Cool Love” 520 festival in May, to strengthen connections with consumers and stimulate foot traffic. As the mall enters its fifth year since opening, base rent and management fees have increased.

Wuhan Heartland 66: Rental Income and Sales Down by 2% and 15% Year-on-Year, Occupancy Rate at 83%

In April, the mall celebrated its third anniversary with a series of sales-driven promotional activities to encourage consumption and drive foot traffic. The exclusive “Heng Lung Club” VIP lounge, The Lounge, was officially opened in May, providing members with a superior shopping experience.

Shenyang Palace 66: Rental Income and Sales Up by 3% and 2% Year-on-Year, Occupancy Rate Increased by 6 Percentage Points to 92%

The mall hosted a series of attractive marketing activities, including Chinese New Year promotions and musical performances. The group continues to diversify its brand mix to expand its target audience. The group also plans to renovate the food court, further enhancing the mall’s dining options to cater to different tastes and boost foot traffic.

Jinan Parc 66: Rental Income Up by 1% Year-on-Year, Occupancy Rate Increased by 3 Percentage Points to 92%

With the completion of the first phase of the asset optimization plan, several beauty retailers and brands have opened exclusive stores here. The remaining phases of the asset optimization plan are expected to be completed between the end of 2024 and early 2025, further enhancing the mall’s attractiveness and long-term profitability.

Tianjin Riverside 66: Rental Income and Sales Up by 15% and 9% Year-on-Year, Occupancy Rate Increased by 14 Percentage Points to 94%

The mall adopted intensive marketing campaigns and co-hosted several events with local government, including a New Year’s Eve countdown event, an April-themed Begonia wall, and a Youth Art Festival in May. The mall also introduced community-building facilities such as a jewelry garden and a children’s play area, attracting more visitors to different areas, driving foot traffic and sales.

About Hang Lung Properties

Hang Lung Group Limited is one of the most established listed companies in Hong Kong, with over fifty years of experience in the property development market. Through its subsidiary Hang Lung Properties Limited, the group develops, owns, and manages world-class commercial complexes in major cities across the Chinese Mainland. It is renowned as one of Hong Kong’s leading property developers.

In addition to its diversified real estate business in Hong Kong, Hang Lung Properties began developing, owning, and managing several commercial complexes in major cities across the Chinese Mainland in the 1990s. These currently include Plaza 66 in Shanghai, Grand Gateway 66 in Shanghai, Forum 66 in Shenyang, Palace 66 in Shenyang, Parc 66 in Jinan, Center 66 in Wuxi, Riverside 66 in Tianjin, Olympia 66 in Dalian, Spring City 66 in Kunming, and Heartland 66 in Wuhan.

| Source: Company Announcement

| Image Credit: Company Website

| Editor: LeZhi