Hang Lung Properties Limited (HK: 00101) and Hang Lung Group Limited (HK: 00010) announced their performance for the first half of 2023, ending on June 30. Due to the depreciation of the Renminbi and the absence of property sales revenue (comprised entirely of property rental income), Hang Lung Properties’ total income decreased by 1% year-on-year to HKD 5.237 billion, while Hang Lung Group’s total income fell by 1% to HKD 5.525 billion.

However, Hang Lung Properties saw a 3% increase in operating profit, reaching HKD 3.824 billion, and a significant 22.9% YoY growth in net profit attributable to shareholders, amounting to HKD 2.394 billion.

As of the closing on July 31, Hang Lung Properties’ stock price rose by 1% to HKD 12.1 per share, with a total market value of HKD 54.4 billion.

Chairman of Hang Lung Group and Hang Lung Properties, Ronnie C. Chan, stated, “In the past six months, our mainland rental income (measured in Renminbi) reached an all-time high. We are committed to enhancing operational efficiency and maximizing the productivity of each project. Additionally, we have a series of ongoing projects, including Westlake 66, as well as some hotel and residential developments in mainland China. Our team is tirelessly working to create more value for shareholders.”

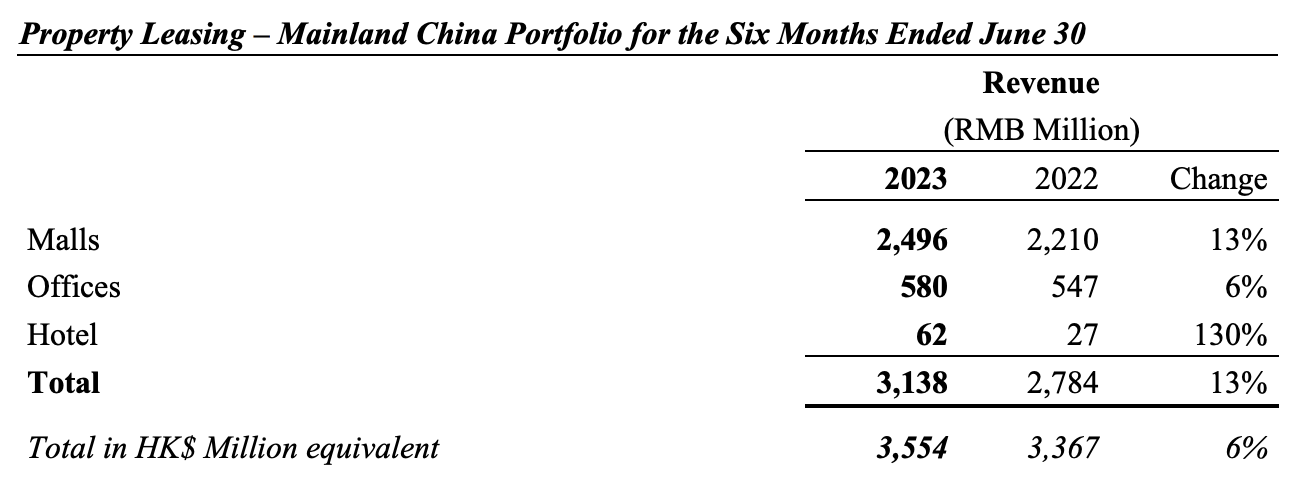

During the reporting period, Hang Lung Properties’ overall mainland rental income and operating profit increased by 13% and 17%, respectively. The shopping mall business rebounded with a 13% overall revenue growth. The high-end office portfolio maintained steady growth, achieving a 6% increase primarily driven by higher rental rates in office buildings completed in recent years in Kunming and Wuhan. The hotel operations also benefited from the relaxation of travel restrictions, with revenues more than doubling compared to the same period last year.

The report also revealed updates on Westlake 66, an upscale commercial complex featuring a shopping center, five Grade-A office towers, and the luxury Hangzhou Mandarin Oriental Hotel. The project is progressing well and is expected to be completed in stages starting from 2024. The Hangzhou Mandarin Oriental Hotel is projected to open by the end of 2025, offering over 190 luxury rooms and suites.

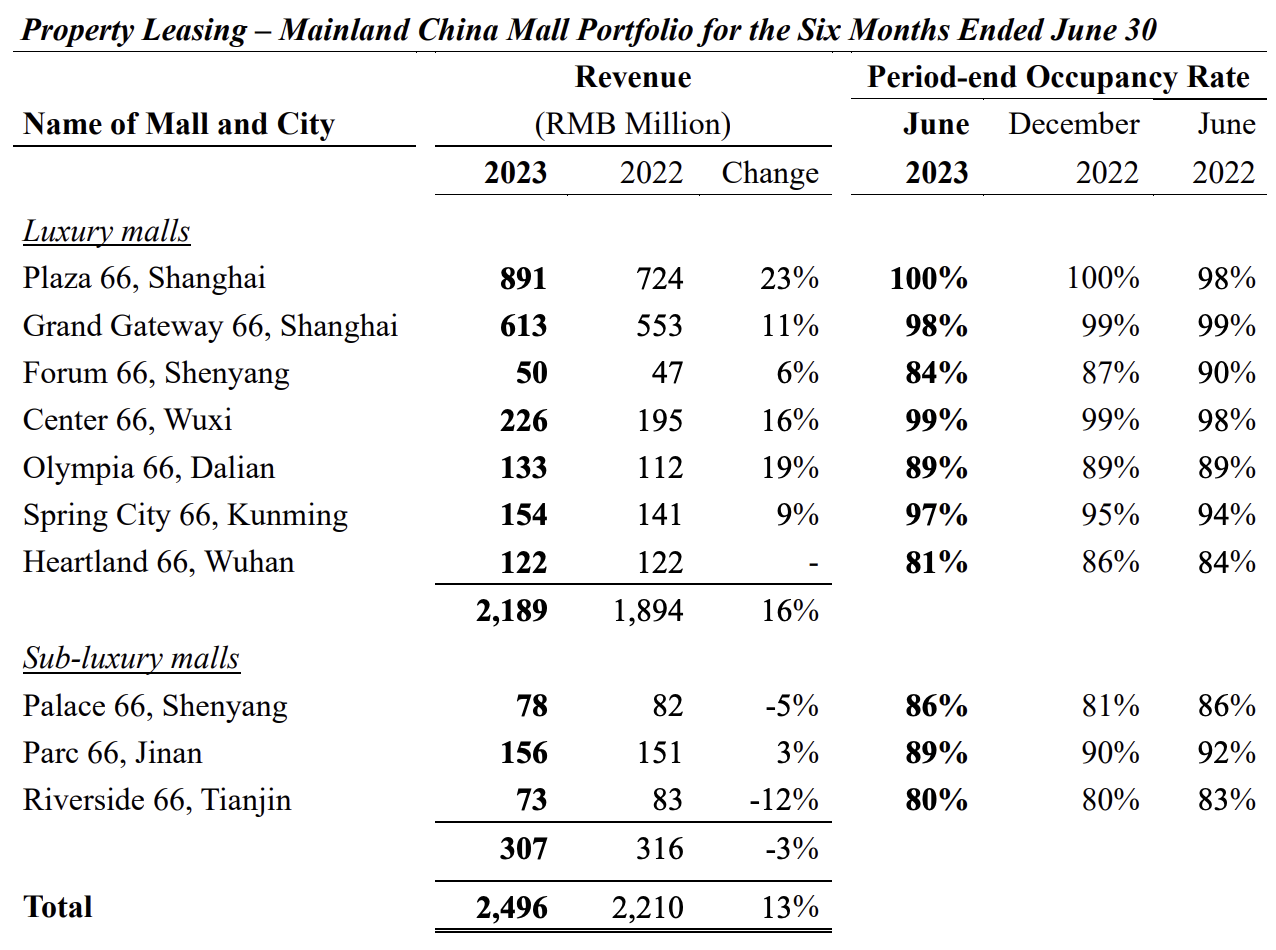

The financial report provided operational details for ten high-end and upper-mid-scale shopping malls in mainland China:

- Plaza 66, Shanghai: Sales increased by 101% year-on-year.

To boost sales growth and capitalize on the recovering consumer demand, Plaza 66 actively launched various membership programs and innovative marketing initiatives, such as the “Game of Wonder” event held in April this year.

The mall’s performance is encouraging, especially during the Chinese New Year and Valentine’s Day when tenant sales exceeded those of 2022. As of the end of June, the mall maintains full occupancy with all spaces leased out.

- Grand Gateway 66, Shanghai: Sales rose by 68% year-on-year.

During the Chinese New Year and Valentine’s Day holidays, the business performance at Grand Gateway 66 surpassed the levels of 2022. The mall hosted an exclusive promotional event for the Chinese version of the musical “Phantom of the Opera,” attracting a constant flow of visitors and gaining widespread traction on social media. As of the end of June, the occupancy rate remains high at 98%.

- Forum 66, Shenyang: Sales increased by 16% year-on-year.

Forum 66 in Shenyang collaborated with merchants to launch a series of market-oriented marketing activities targeting specific customer groups. This included joint events with the Shenyang Conrad Hotel and Forum 66, leveraging synergies to provide an improved customer experience. As of the end of June, the occupancy rate reached 84%.

- Center 66, Wuxi: Sales grew by 24% year-on-year.

Center 66 in Wuxi partnered with merchants to create an exclusive and desirable shopping experience that gained popularity among customers, successfully consolidating the mall’s leading position. The occupancy rate remains high at 99%.

- Olympia 66, Dalian: Sales increased by 26% year-on-year.

In April, Dalian Olympia 66 held the “Colorful Dalian, Colorful World” celebration event, which continuously boosted consumer spending and foot traffic. As of the end of June, the occupancy rate remained stable.

- Spring City 66, Kunming: Sales grew by 8% year-on-year.

Entering its fourth year of operation, Kunming Spring City 66 continued to experience growth in its basic rental rates, maintaining an increasing occupancy rate of 97% as of the end of June.

- Heartland 66, Wuhan: Sales rose by 25% year-on-year.

Wuhan Heartland 66 is restructuring its tenant mix to enhance its competitiveness, leading to a decrease in the end-of-period occupancy rate to 81%. Despite the decline in occupancy, the mall’s revenue remains at the level of 2022, with a 25% increase in tenant sales. To celebrate its second anniversary, the mall invited Cirque du Soleil to Wuhan for its first performance in March and collaborated with merchants.

Additionally, three sub-high-end shopping malls, Palace 66, Shenyang, Parc 66, Jinan, and Riverside 66, Tianjin, recorded sales growth of 40%, 31%, and 40%, respectively.

About Hang Lung Group and Hang Lung Properties:

Hang Lung Group Limited is one of Hong Kong’s most experienced listed companies with over 50 years of experience in property development. Through its subsidiary, Hang Lung Properties Limited, it constructs, holds, and manages world-class commercial complexes in major cities in mainland China, making it one of the top property developers in Hong Kong.

Apart from its diversified property business in Hong Kong, Hang Lung Properties built, holds, and manages several commercial complexes in mainland China during the 1990s. These include Plaza 66, Shanghai, Grand Gateway 66, Shanghai, Forum 66, Shenyang, Center 66, Wuxi, Olympia 66, Dalian, Spring City 66, Kunming, Heartland 66, Wuhan, Palace 66 Shenyang, Parc 66, Jinan, and Riverside 66, Tianjin.

*Note: At time of writing, 1 HKD = 0.13 USD

| Source: Company Interim Results

| Image Credit: Company Website

| Editor: Wang Jiaqi