Next year, Giorgio Armani, the Italian fashion designer, will turn 90. He remains the sole owner of his namesake luxury brand to this day. Armani’s succession plan has been a subject of much interest due to his lack of children. Recent revelations about the Armani Group’s inheritance plan have reignited discussions on how luxury family businesses can transition smoothly.

Each luxury brand’s founding family prides itself on long-termism and independence. However, for those without direct descendants or whose descendants are unwilling or unable to take over, ensuring a smooth transition of control and management as the older generation ages is a pressing and challenging task.

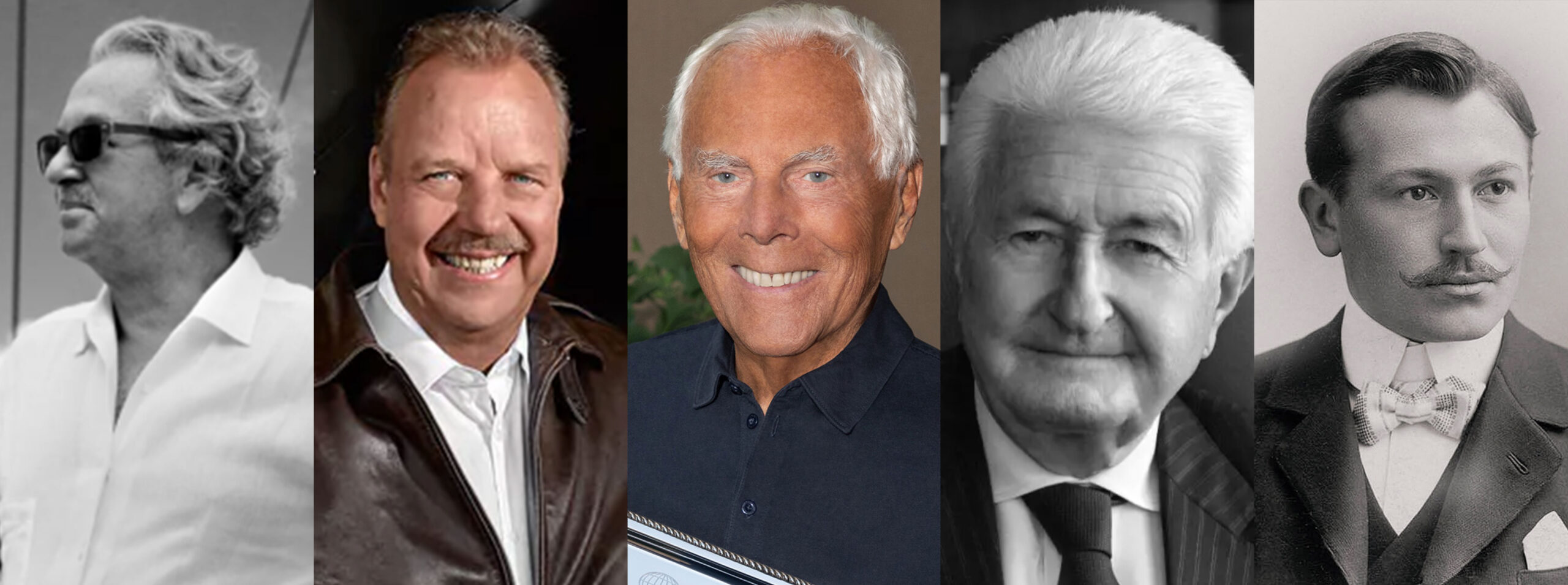

Not just Armani, but many luxury brands have faced this issue. Luxeplace.com analyzes the experiences of Rolex, Bucherer, Loro Piana, and Rimowa, outlining three approaches:

1. Establishing foundations to extend the founder’s personal influence.

2. Entrusting long-term partners for mutual benefit.

3. Joining multi-brand groups to transition to contemporary management styles.

Entrusting to Long-Term Partners for Mutual Benefit and Success

Jörg G. Bucherer, the third-generation heir of the world’s largest watch retailer Bucherer, passed away in November at the age of 87. Without direct descendants, he chose to entrust the 135-year-old family business to long-term partner Rolex three months before his death. The transaction price was not disclosed.

Jörg G. Bucherer

Bucherer’s 99-year-long close collaboration with Rolex began during the era of Rolex’s founder. Since 1924, Bucherer has been an official retailer for Rolex. The familial ties between the senior members of Bucherer and Rolex have been crucial to the company’s expansion into Austria in the 1980s and Germany a decade later. Jörg Bucherer was considered the last person to have known and worked with Hans Wilsdorf.

Bucherer, with over 100 sales points globally, retails 53 Rolex and 48 Tudor (a Rolex subsidiary) outlets. Investment firms and multi-brand luxury groups had shown strong interest in Bucherer, but the decisive factor for this transaction was the long-standing stable cooperation between the two Swiss family businesses.

Rolex stated in an official press release that the acquisition ensures Bucherer’s future development while maintaining its independence. Bucherer will retain its name and continue to operate independently, with its management team unchanged. The high-end watch brand CARL F. BUCHERER will also be integrated into the Rolex Group. Furthermore, Jörg G. Bucherer’s inheritance will be incorporated into the Hans Wilsdorf Foundation.

Rolex’s acquisition of Bucherer, without a direct heir, is seen as a protective measure to keep Bucherer operating within familiar parameters and continue as part of a Swiss family. For Rolex, this acquisition paves the way for direct consumer sales in its boutiques.

This is Rolex’s first major acquisition since its establishment in 1905. Known for maintaining exclusivity, this transaction marks a significant strategic shift for Rolex. The industry eagerly awaits how it will shape the future of both companies, including the development of the CARL F. BUCHERER brand founded in 2001.

Joining a Multi-Brand Group, Transitioning to Contemporary Management

German luxury luggage brand Rimowa and Italian luxury cashmere brand Loro Piana were sold by their heirs to French luxury giant LVMH Group.

Under modern multi-brand luxury groups, these historically rich brands not only continue their legacy but also receive new vitality. Although founding family members initially retained positions, they gradually relinquished control as the companies embarked on new chapters.

In 2016, LVMH acquired 80% of Rimowa for €640 million from Dieter Morszeck, the grandson of the founder.

Dieter Morszeck

Concurrently, Dieter Morszeck established the RIMOWA Dieter Morszeck Foundation, donating a significant portion of the sale proceeds to support scientific research, public health, education, and humanitarian aid in Germany and internationally. For instance, in 2018, the foundation provided approximately €30 million to the German Cancer Research Center (DKFZ).

Dieter Morszeck, an aviation enthusiast and pilot, invested over $30 million in Junkers Aircraft the year before selling Rimowa. His investment in aviation progressed rapidly, announcing the sale to LVMH just two weeks after introducing the modern Junkers F13 model.

During his tenure at Rimowa, Dieter Morszeck led significant R&D work, designing the first waterproof metal suitcase in 1976 and pioneering the durable, temperature-resistant, lightweight polycarbonate suitcase in 2000, now a standard in luggage manufacturing.

Following the completion of the transaction with LVMH Group, Dieter Morszeck served as co-CEO of Rimowa alongside Alexandre Arnault, LVMH Group’s second son. However, both have since stepped down from their positions.

Under the umbrella of LVMH Group, Rimowa has accelerated its reforms, including developing a new visual identity, launching eyewear products, and orchestrating a series of eye-catching cross-brand collaborations with popular brands like Off-White, Supreme, luxury brand Fendi, and Danish high-end audio and video brand Bang & Olufsen.

In 2013, the sixth-generation heirs of the Loro Piana founding family, brothers Sergio Loro Piana and Pier Luigi Loro Piana, sold 80% of their company’s shares to LVMH Group for 2 billion euros.

After the acquisition, Antoine Arnault, the eldest son of the LVMH Group, became Chairman of the Board of Loro Piana, while the Loro Piana brothers assumed the roles of Vice Presidents and Board Members.

Less than half a month after the transaction was completed, the elder brother Sergio Loro Piana, who had been long ill, passed away at the age of 65, leaving behind a wife and three children.

In 2017, LVMH acquired an additional 5% of Loro Piana, reducing the Loro Piana family’s share to 15%.

Since joining LVMH, Pier Luigi Loro Piana has continued to serve as Vice President and Board Member. He is an enthusiastic sailor and in recent years has devoted more energy to water sports such as yachting and motor boating. Loro Piana was also the official sponsor of this year’s IMA Maxi European Championship, a major sailing event.

Pier Luigi Loro Piana. Photo from Loro Piana

During their joint leadership of Loro Piana, brothers Sergio and Pier Luigi spearheaded the development of high-quality fabrics, including cashmere, extra-fine wools, and Tasmanian fabrics. They also diversified the business, launching the brand’s first ready-to-wear collection and establishing luxury goods and home interior departments.

In an exclusive interview with The Washington Post, Antoine Arnault recalled that the only firm “advice” Sergio Loro Piana had for LVMH at the time of the deal was not to hire celebrity designers.

Although LVMH did not appoint a star creative director, the group has positioned Loro Piana in the spotlight in other ways, steering it towards a younger direction, including expanding product categories and collaborating with Japanese streetwear icon Hiroshi Fujiwara to launch a capsule collection.

| Image Credit: Official websites of the respective companies/brands

丨Reporter: Jin Daixi

| Editor: Zhu Ruoyu