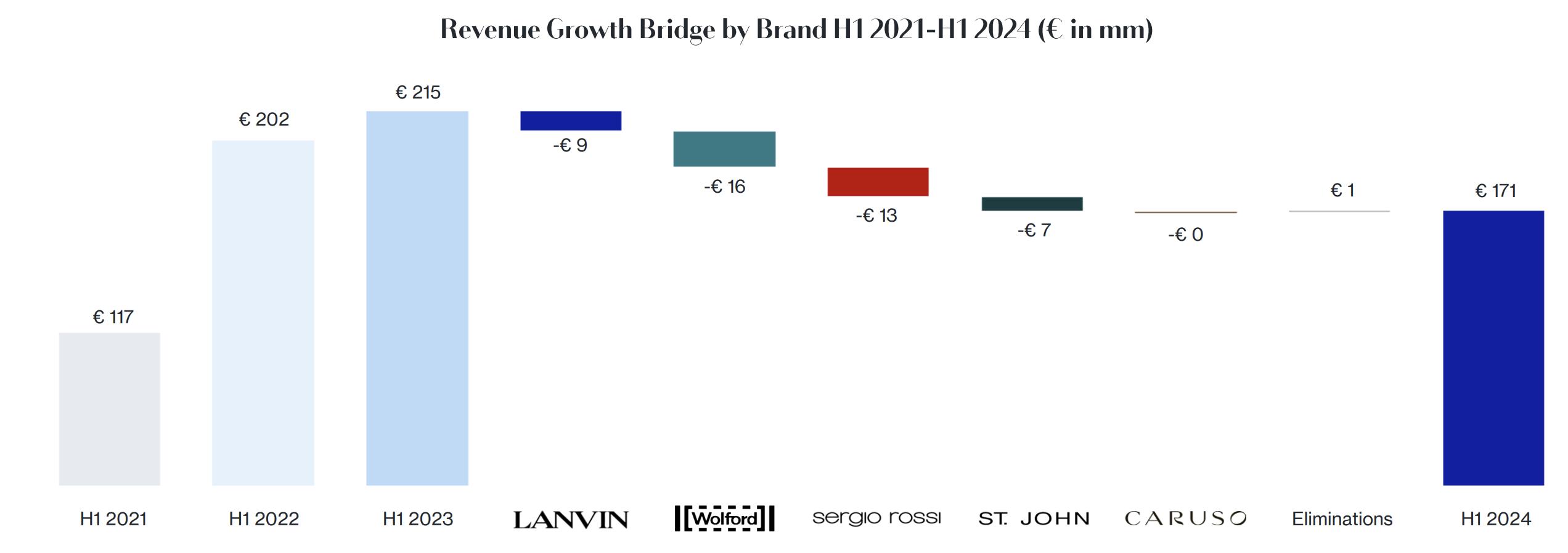

On August 26, local New York time, before the market opened, global fashion luxury group Lanvin Group (NYSE: LANV) released its H1 2024 financial report: the group achieved a revenue of €171 million, a 20% decrease compared to the same period in 2023. The group’s adjusted EBITDA fell by 3% compared to the same period last year, resulting in a loss of €42.11 million. Lanvin Group’s portfolio includes brands such as Lanvin, Wolford, Sergio Rossi, St. John, and Caruso.

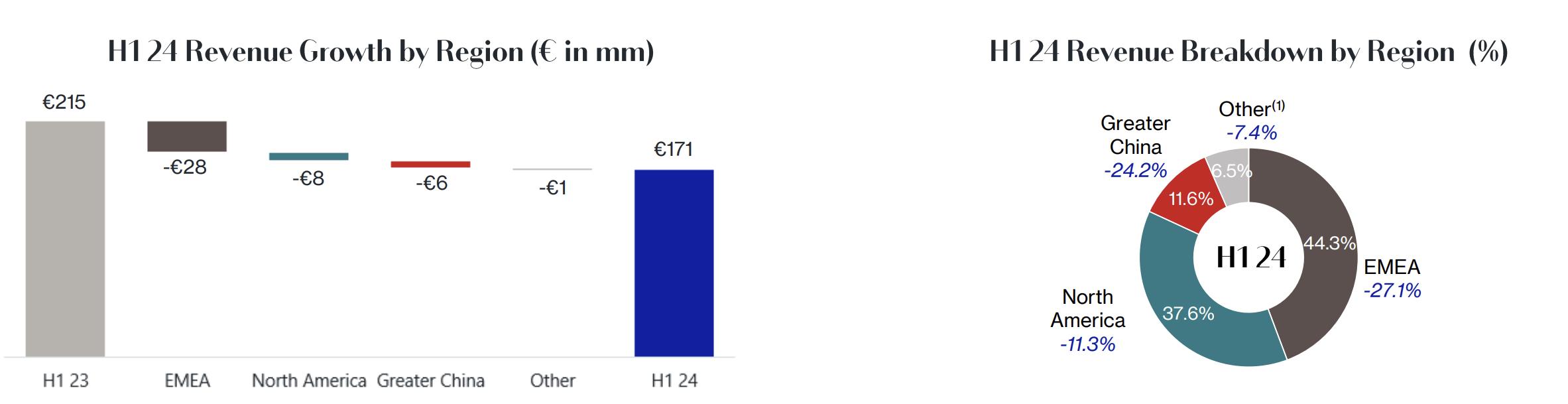

The group stated that the global luxury market is sluggish, with significant revenue impacts in the EMEA (Europe, Middle East, and Africa) region and the Greater China region. However, the Lanvin brand achieved a strong 9% growth in the Asia-Pacific region outside the Greater China region.

Additionally, the group demonstrated robust operational fundamentals and strong cost control capabilities through proactive strategic adjustments, achieving a gross profit of nearly €100 million in the first half, with a gross margin maintained at 57.5%, only a one-percentage-point decline from the same period last year. Benefiting from increased sell-through rates at full price and strategic inventory management, gross margins for Lanvin, St. John, and Caruso saw significant growth.

As of the close on August 26, the group’s stock price rose 10.43% from the previous day to $1.8 per share, with a total market capitalization of approximately $200 million.

Zhen Huang, Chairman of Lanvin Group, stated that “We faced a tumultuous market in the first half of 2024. While we anticipate this will continue for the near-term, we remain committed to the long-term growth of our Group and our path to profitability.”

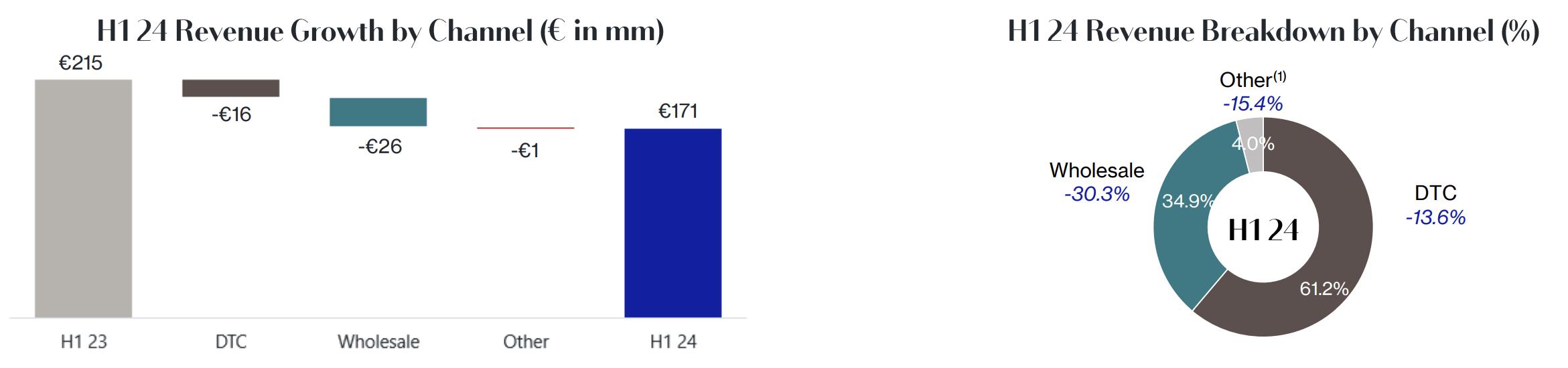

Eric Chan, CEO of Lanvin Group, noted that “Struggles in the wholesale channel compounded the issues of a softening global luxury market, in the first half of 2024. We spent much of the first half committed to our marketing plan, but also prioritized rationalizing our cost base to fit the current market environment. Furthermore, we are committed to our product strategy and investing in product development, which is why we are excited to have the new creative leaders who have joined our family. While we will be proactive in our approach to the near-term slowdown, we remain resolute in investing in our brands to forge our path forward, and to capitalize on our momentum as the markets improve.”

Recently, the management teams of several brands under the group have been refreshed:

- In June 2024, Lanvin announced that Peter Copping would join as Creative Director in the second half of the year.

- In June 2024, Wolford appointed Regis Rimbert as its new CEO.

- In July 2024, Sergio Rossi appointed Paul Andrew as Creative Director.

From left to right: Regis Rimbert, Peter Copping, Paul Andrew

—— Brand Overview:

Lanvin: Revenue declined by 15% year-on-year to €48.27 million, primarily due to global luxury consumption weakness and challenges in the wholesale market.

Offline retail channels (including boutiques and outlets) declined by only 3%, with overall direct-to-consumer channels down 10% and wholesale channels down 23%.

Globally, the EMEA region saw the largest decline of 21%, mainly due to a drop in wholesale business in Europe; North America and the Asia-Pacific region both saw a 9% decline, with the Greater China region down 14%. However, the Asia-Pacific region outside the Greater China region achieved a 9% positive growth.

The brand looks forward to driving further development and strengthening its market influence with the introduction of the first collection by new Creative Director Mr. Copping in 2025.

- Wolford: Revenue fell by 28% year-on-year to €42.59 million, primarily due to delays in integration with a new logistics supplier impacting shipments. Additionally, challenges in the European wholesale market affected revenue.

At the channel level, direct-to-consumer channels declined by 14%, and wholesale channels by 53%. Regionally, the EMEA region saw the largest decline at 34%, North America declined by 10%, and the Asia-Pacific region declined by 24%, with the Greater China region down 20%.

In the first half, Wolford appointed Regis Rimbert as CEO. With extensive experience in the luxury fashion sector, Rimbert will drive a series of reform initiatives in the second half to implement a sustainable development model, optimize the supply chain and distribution network, and focus on brand positioning and marketing to improve customer experience.

- Sergio Rossi: Revenue declined by 38% year-on-year to €20.40 million, primarily due to continued weakness in the wholesale market and a strategic reduction in third-party contract manufacturing.

The brand’s revenue in its largest market, the EMEA region, declined by 49%, and the Asia-Pacific region by 22%, with the Greater China region down 34%. Overall, direct-to-consumer channels fell by 17%, and e-commerce channels by 2%, with wholesale revenue, including third-party contract manufacturing, down 60%.

In the second half of 2024, the brand will drive cost efficiency through multiple initiatives and supply chain reforms. Additionally, Sergio Rossi will continue to optimize its retail network and expense management. The brand plans to launch a new promotional campaign under the leadership of new Creative Director Paul Andrew, highlighting the brand’s heritage and its iconic footwear styles.

- St. John: Revenue declined by 14% year-on-year to €39.98 million.

The decline was relatively even across sales channels, with direct-to-consumer channels (including e-commerce) down 15% and wholesale channels down 13%. Due to overall market weakness, its largest market, North America, declined by 10%, while the Asia-Pacific region (which accounts for less than 10% of revenue) declined by 46%.

In the second half of 2024, the brand will continue to drive the development of its core product lines and further optimize its retail network and operational costs.

- Caruso: Despite a challenging global luxury and wholesale market environment, Caruso’s revenue in the first half was down only 1% compared to the same period last year.

Caruso’s third-party contract manufacturing business was slightly weak, but its proprietary brand business grew by 21%, with particularly strong sales performance in ready-to-wear and custom products.

In the second half of 2024, the brand will continue to expand its third-party contract manufacturing business through customer development.

—— Regional Overview:

—— Channel Overview:

Looking ahead to 2024, the group expects the second half of 2024 to remain challenging and will continue to take proactive measures in cost control and operational efficiency improvement. Lanvin and Sergio Rossi plan to further enhance market promotion, with the addition of Peter Copping and Paul Andrew laying the groundwork for new product creativity in 2025. The group will continue to drive healthy revenue growth through marketing activities, enhance brand influence, and strategically expand its store network.

About Lanvin Group

Lanvin Group is a global fashion luxury group with a portfolio that includes the oldest surviving French luxury couture house, Lanvin, Austrian luxury skinwear brand Wolford, Italian luxury footwear brand Sergio Rossi, American classic knitwear brand St. John Knits, and Italian high-end menswear manufacturer Caruso. The group was listed on the New York Stock Exchange in December 2022.

|Source: Official Financial Report

|Image Credit: Lanvin Group Official Website, Official Announcements

|Editor: LeZhi