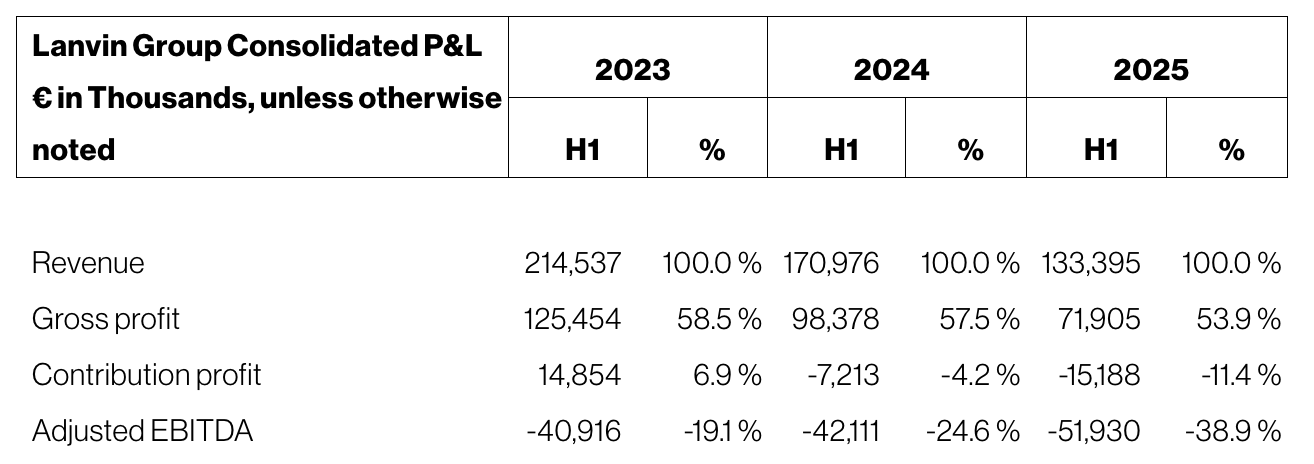

On August 29, global fashion and luxury group Lanvin Group (NYSE: LANV) released its unaudited financial results for the first half of 2025: revenue fell 22% year-on-year to €133 million (approximately USD 144.4 million), gross profit was €72 million (approximately USD 78.2 million), and adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) loss widened to €52 million (approximately USD 56.5 million). Sales across all brands in the Greater China market declined by double digits.

Lanvin Group stated that despite ongoing industry pressures, signs of recovery emerged in the second quarter, driven by stringent cost control and improved operational efficiency.

The Group anticipates continued challenges in the market environment in the second half of 2025, but remains firmly committed to enhancing cost efficiency and making strategic investments in its brands.

As of market close on August 29, Lanvin Group’s share price rose 0.48% from the previous trading day to USD 2.09 per share, with a latest market capitalization of USD 263 million. Over the past 12 months, its stock has gained 14.84%.

The Group is currently advancing several strategic initiatives, including optimizing its retail network layout, improving operational efficiency, upgrading its product matrix, launching high-impact marketing campaigns, and deepening partnerships with wholesale distributors. These initiatives have already shown initial results and are expected to yield more significant outcomes in the second half. The Lanvin and Sergio Rossi brands will leverage the momentum brought by newly appointed creative directors to accelerate transformation, while St. John, Wolford, and Caruso will continue to refine their channel strategies and expand their presence in core markets.

Zhen Huang, Chairman of Lanvin Group, stated: “Despite a challenging luxury market in the first half, we remained disciplined in cost management and strategic streamlining, responsive to market dynamics, and steadfast in our commitment to unlocking the long-term potential of our brands. With new creative leadership and continued investment in product innovation, we are well positioned to capture opportunities as the market environment improves.”

Andy Lew, Executive President of Lanvin Group, said: “In the first half, our focus was on operational discipline and laying the foundation for future growth. With fresh creative direction across our houses, supported by targeted marketing and refined channel strategies, we expect to build brand momentum and increase consumer engagement in the second half. We remain agile and execution-focused as we strengthen brand desirability and prepare for recovery.”

In January 2025, Andy Lew, then CEO of St. John, was appointed Executive President of Lanvin Group. In his new role, he is leading the establishment of a second headquarters in Europe to enhance operational efficiency and strengthen global management capabilities. At the brand level, core management teams have also been reinforced, including:

-

Appointment of a new Deputy CEO for Wolford

-

New positions at St. John: Chief Commercial Officer, Chief Merchandising Officer, and Chief Operating Officer, preparing the brand for its next stage of growth

Lanvin Group noted that performance in the first half of the fiscal year was primarily impacted by sustained weakness in the global luxury market, strategic adjustments to the DTC (Direct-to-Consumer) channel, cautious consumer sentiment in the Chinese Mainland, and weaker wholesale demand in the EMEA region. By channel, DTC revenue declined 23% and wholesale revenue dropped 22%, reflecting both more cautious buying strategies by retailers and slowing foot traffic in key luxury markets.

In the second quarter, brand performance showed improvement: Lanvin and Sergio Rossi both recorded strong quarter-over-quarter rebounds in retail and e-commerce, indicating a recovery in consumer interest. Wolford saw a notable improvement in gross margin due to inventory control and cost-saving measures, continuing its recovery from last year’s logistics disruptions. St. John maintained steady growth momentum throughout the period.

The gross margin for H1 2025 was 54%, down from 58% in the same period of 2024. The decline was mainly due to the transitional phase in creative direction, clearance of past-season inventory, underutilized production capacity, and product mix adjustments. Although all brands took active measures to improve sell-through and manage inventory levels, the broader industry headwinds had a more significant impact.

The Group stated: “Despite the decline in Group revenue, gross profit margin compressed by only 364 bps, reflecting the impact of swift, company-wide cost optimization measures. Since H1 2023, G&A expenses have been reduced by 35% at St. John, 27% at Wolford, and 25% at Sergio Rossi. The retail network optimization program launched in 2024 continues to advance, delivering tangible efficiencies and strengthening the Group’s operational foundation.”

The decline in adjusted EBITDA was primarily due to a reduction in gross profit; however, stringent cost management effectively limited further losses. At the same time, the Group continued to invest in the creative domain, including new collection designs, fabric development, prototyping, and sample production for Lanvin and Sergio Rossi. These forward-looking investments, combined with ongoing cost controls, have reinforced brand value and competitiveness, laying a solid foundation for gaining market share and improving profitability when the market environment improves.

By Brand:

Lanvin

In the first half of 2025, Lanvin was in a strategic transition period, with revenue declining 42% year-on-year to €27.93 million (approximately USD 30.3 million).

The performance shift was mainly due to two factors: wholesale clients in the EMEA (Europe, Middle East, and Africa) region delaying orders in anticipation of Peter Copping’s debut collection, and a general atmosphere of caution across the industry. Notably, retail performance in the EMEA market remained resilient, retail operations in the Asia-Pacific region progressed steadily in line with strategic adjustments, and North American e-commerce achieved a strong rebound following the successful launch of its marketplace model.

By region, revenue in the EMEA market declined 47.2% year-on-year to €12.22 million (approximately USD 13.2 million); revenue in North America decreased 28.2% to €8.61 million (approximately USD 9.3 million); sales in the Greater China market fell 60.3% to €3.78 million (approximately USD 4.1 million); and revenue in other markets dropped 7.9% to €3.32 million (approximately USD 3.6 million).

By channel, DTC revenue fell 34.2% to €15.84 million (approximately USD 17.2 million), and wholesale revenue declined 61.8% to €17.64 million (approximately USD 19.2 million).

The gross margin narrowed by 366 basis points, mainly due to product mix adjustments, market challenges, and ongoing retail network optimization. Despite the revenue decline, marginal returns reflected the effectiveness of strict cost control, while the brand continued to allocate resources to the development of Peter Copping’s upcoming collection.

Looking ahead to the second half, Lanvin will launch a comprehensive marketing campaign around Peter Copping’s highly anticipated debut collection, revamp in-store visual merchandising, and host targeted client engagement events to drive foot traffic. Operational efficiency gains will be reinvested into flagship store image upgrades and strategic collaborations across digital channels.

Wolford

Revenue in the first half declined 23% year-on-year to €32.99 million (approximately USD 35.8 million), primarily due to lingering effects from last year’s logistics partner transition.

By channel, wholesale revenue grew strongly by 14% through deepened partnerships, while the trend in DTC reflected a structured optimization of the retail network.

By region, EMEA revenue dropped 19.9% year-on-year to €21.18 million (approximately USD 23 million); North America fell 31.3% to €8.76 million (approximately USD 9.5 million); sales in the Greater China market declined 13.6% to €2.83 million (approximately USD 3.1 million); and revenue in other markets rose 83.3% to €220,000 (approximately USD 238,800).

By channel, DTC revenue dropped 35.1% year-on-year to €21.94 million (approximately USD 23.8 million), while wholesale revenue increased 14% to €9.95 million (approximately USD 10.8 million).

Gross margin was affected by underutilized production capacity and targeted inventory clearance. Management expenses fell 18% year-on-year, demonstrating Wolford’s firm commitment to operational discipline.

In the second half, under the leadership of newly appointed Deputy CEO Marco Pozzo, Wolford will launch a large-scale brand promotion campaign as part of its 75th anniversary celebration. The focus will be on optimizing the product structure, highlighting core items, and advancing supply chain transformation. The brand will also actively explore growth opportunities in high-potential markets such as the Middle East and Asia-Pacific.

Sergio Rossi

Revenue in the first half of the year fell 25% year-on-year to €15.31 million (approximately USD 16.6 million), primarily due to customers postponing purchases in anticipation of the debut collection by Paul Andrew, set to launch in the second half.

By region, EMEA revenue declined 25% to €7.15 million (approximately USD 7.8 million); North America plummeted 80.1% to €56,000 (approximately USD 60,800); sales in the Greater China market dropped 34.5% to €2.73 million (approximately USD 2.9 million); and revenue in other markets declined 16.3% to €5.37 million (approximately USD 5.8 million).

By channel, DTC revenue declined 21.3% year-on-year to €11.01 million (approximately USD 11.9 million), while wholesale revenue dropped 33% to €4.31 million (approximately USD 4.7 million).

Gross margin narrowed by 9%, primarily due to product mix adjustments and lower capacity utilization. In the second quarter of 2025, the brand showed early signs of recovery, with retail sales rising 17% quarter-on-quarter and e-commerce increasing 10%, reflecting the effectiveness of its channel optimization efforts. Although declining revenue led to narrower marginal profitability, effective cost control helped offset some of the negative impact.

Looking ahead to the second half, Sergio Rossi will accelerate wholesale expansion through new partnerships, continue enhancing operational efficiency, and revamp its brand image with the launch of Paul Andrew’s debut collection. The brand will also deepen its strategic presence in core markets.

St. John

In the first half of 2025, St. John delivered stable performance amid a challenging luxury market environment, with revenue remaining largely flat year-on-year at approximately €39.65 million (approximately USD 43 million).

Revenue in the North American market grew by 4% year-on-year, highlighting the brand’s competitive strength in its core market. Wholesale revenue increased 11%, driven by strategic partnerships with key accounts.

By region, revenue in the EMEA market declined 41.1% year-on-year to €176,000 (approximately USD 191,000); North America grew 3.8% to €38.74 million (approximately USD 42.1 million); sales in the Greater China market dropped 70.9% to €653,000 (approximately USD 710,000); and revenue in other markets decreased 26.9% to €870,000 (approximately USD 946,000).

By channel, DTC revenue fell 3.6% year-on-year to €31.01 million (approximately USD 33.7 million), while wholesale revenue grew 11% to €8.56 million (approximately USD 9.3 million).

The brand maintained a high gross margin of 69%, supported by stable full-price sell-through rates and the contribution of its wholesale model in partnership with premium department store Nordstrom. Marginal return remained steady at 11%.

In the second half of 2025, St. John will continue optimizing its core channels to improve conversion rates, leverage newly onboarded talent to drive e-commerce growth, refine product design and merchandising operations, and enhance its supplier ecosystem.

Caruso

In the first half, Caruso recorded an 11% year-on-year revenue decline to €19.73 million (approximately USD 21.4 million). The overall contraction was due to the ongoing adjustment phase in the luxury market, coupled with changes in delivery schedules and production shifts, which temporarily impacted its third-party OEM business. In contrast, its proprietary brand business maintained a positive growth trajectory, supported by strong demand for its ready-to-wear collections.

By region, revenue in the EMEA market dropped 10.5% year-on-year to €15.04 million (approximately USD 16.3 million); North America grew 7.2% to €2.15 million (approximately USD 2.3 million); sales in the Greater China market fell 66.7% to €6,000 (approximately USD 6,500); and revenue in other markets declined 52.5% to €436,000 (approximately USD 474,000).

By channel, DTC revenue was €63,000 (approximately USD 68,500), while wholesale revenue declined 10.9% year-on-year to €17.56 million (approximately USD 19 million).

Despite the challenging market conditions, Caruso maintained a solid gross margin of 29%, with only a slight decline in marginal returns.

In the second half of 2025, Caruso plans to collaborate with the newly appointed creative directors of several OEM client brands to support the relaunch of their product lines. The brand will also expand its wholesale business in high-growth markets, while continuing to optimize its cost structure and enhance operational efficiency.

About Lanvin Group

Lanvin Group is a global fashion and luxury group. Its portfolio includes Lanvin, the oldest operating French couture house; Wolford, the Austrian luxury skinwear brand; Sergio Rossi, the Italian luxury footwear label; St. John Knits, the iconic American knitwear brand; and Caruso, a leading Italian high-end menswear manufacturer. The Group was listed on the New York Stock Exchange in December 2022.

|Source: Official Financial Report

|Image Credit: Group’s Official Social Media Accounts

|Editor: LeZhi