On June 11, Viva Goods Company (HK: 00933, formerly known as Viva China Holdings), controlled by the Li Ning family, announced that its wholly-owned subsidiary, Futuang Global Limited, has agreed to establish a joint venture with Hong Kong investment company LionRock HK (LionRock Capital). The joint venture, owned 50% each by Futuang and LionRock Capital, will have the licensing rights to the intellectual property of Swedish outdoor sportswear and equipment manufacturer Haglöfs AB, to operate sales and marketing of Haglöfs brand products in Greater China.

In December 2023, Japanese sports giant Asics announced that it had sold Haglöfs AB to LionRock Capital.

Founded in 2011, LionRock Capital currently manages over HKD 9 billion in assets, focusing on investments in the consumer sector, with offices in Hong Kong, Shenzhen, and Zurich. Founding partner Jiang Jiaqiang serves as co-CEO, CFO, and one of the executive directors. Mr. Li Ning is the non-executive chairman of LionRock Capital, and Li-Ning Company is a limited partner in LionRock Capital Partners Fund.

Established in 2009 and headquartered in Hong Kong, Viva Goods is the largest shareholder of Li-Ning Company Limited (stock code: HK: 02331) with a stake of approximately 10.3% by the end of 2023. The actual controllers of Viva Goods are the famous Chinese athlete and entrepreneur Li Ning and his family members, holding about 68.9% of the shares by the end of 2023, with Li Ning serving as chairman and CEO. Notably, in June 2023, Viva Goods transferred its listing from GEM to the main board of the Hong Kong Stock Exchange, with a current market value of about HKD 6.7 billion.

Viva Goods aims to become an outstanding international brand operator. The group currently owns British footwear brand Clarks, well-known casual wear brands in China and Hong Kong Bossini and bossini.X, luxury casual brand LNG, and Italian luxury leather goods brand TESTONI. Its business spans Europe, the United States, Greater China, Japan, South Korea, and Southeast Asia. In 2023, the company’s revenue surged by 62.6% year-on-year to HKD 11.2 billion, with Clarks contributing the major revenue share (increasing from 79.1% to 86%) and Bossini following (increasing from 2.7% to 5.4%).

It is noteworthy that in March 2021, LionRock Capital acquired a 51% stake in the British traditional footwear brand Clarks for GBP 100 million. In May 2022, Viva Goods announced that it would co-hold the 51% stake in Clarks with LionRock Capital, achieved by investing in a target company (LionRock Capital Partners QiLe Limited). Viva Goods invested GBP 54 million for a 51% stake in LionRock Capital Partners QiLe Limited. In November 2022, Viva Goods announced its intention to invest GBP 110 million to acquire the remaining 49% stake in LionRock Capital Partners QiLe Limited.

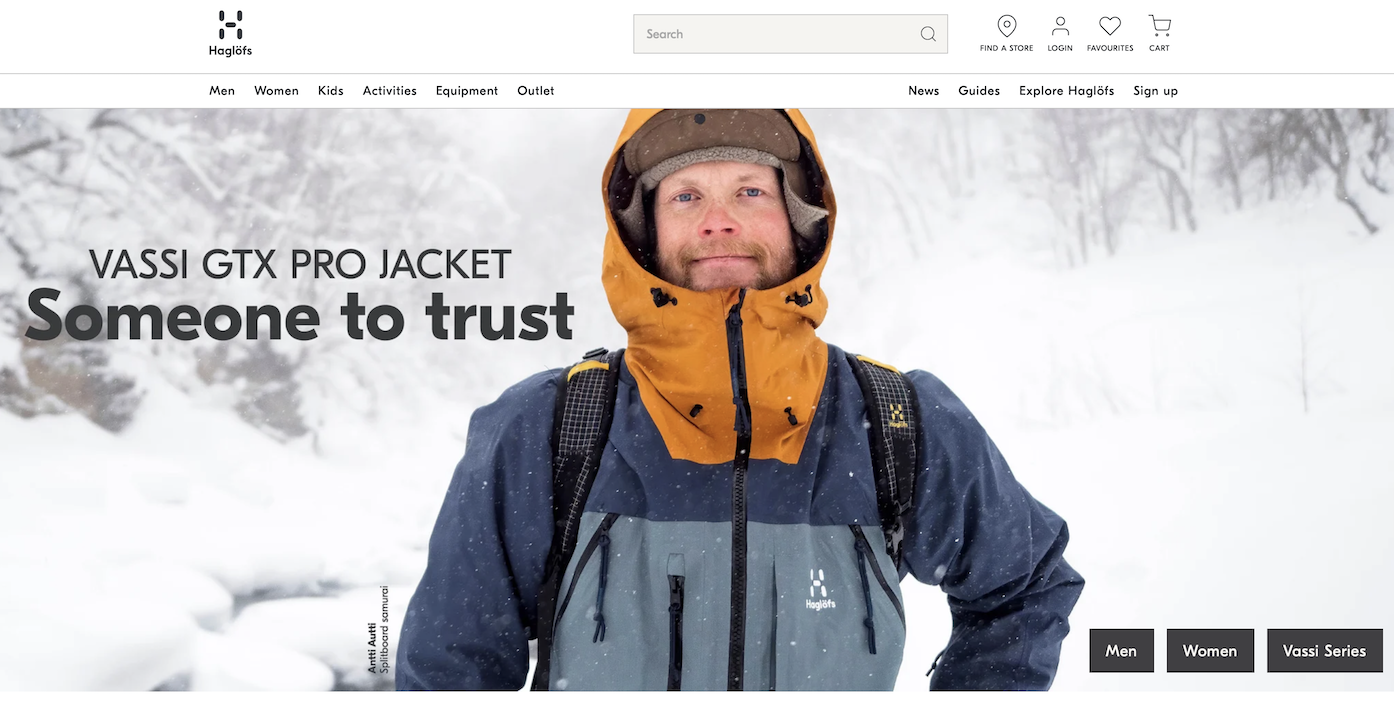

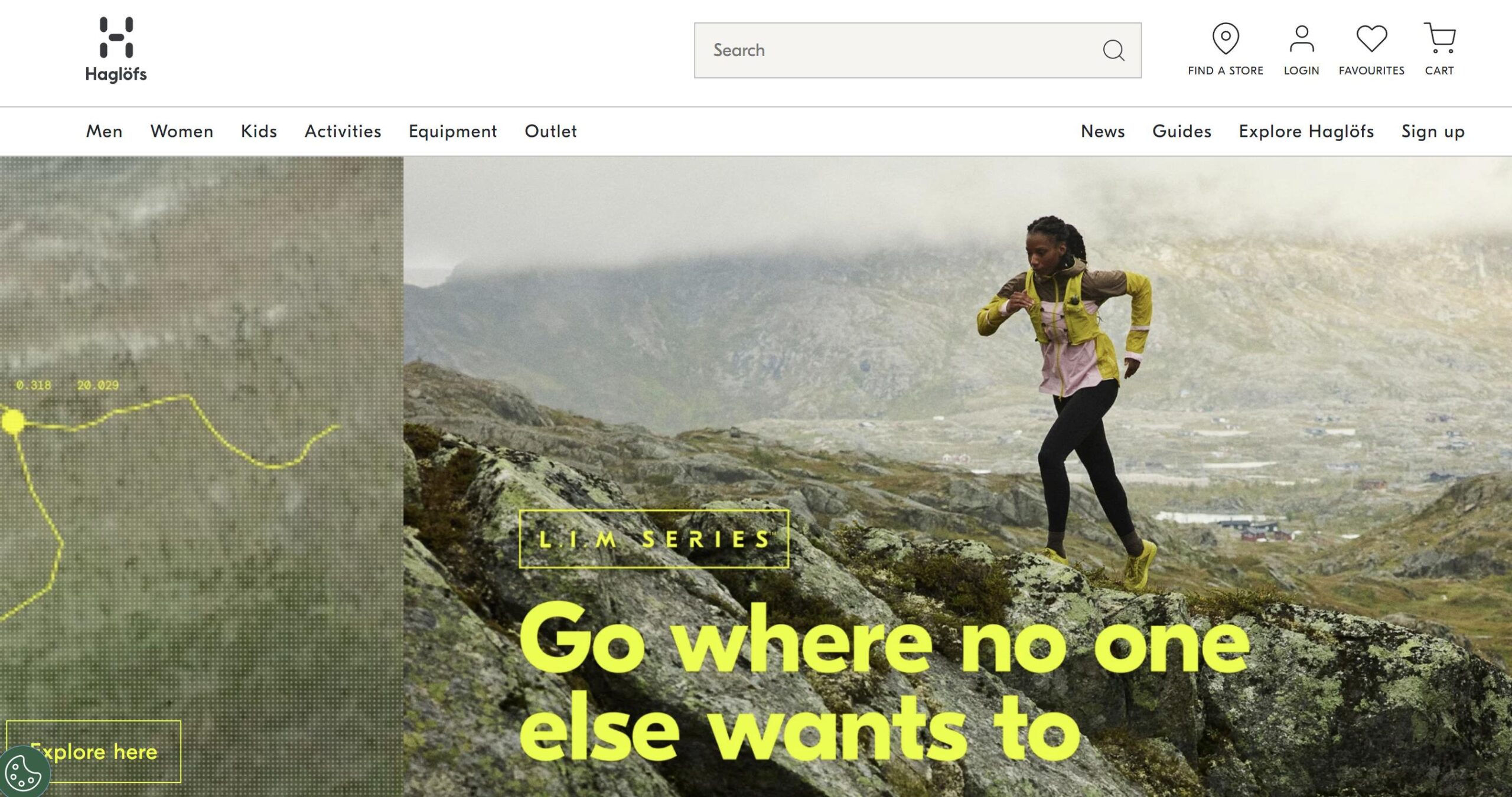

Viva Goods stated that Haglöfs is a highly regarded international outdoor equipment and apparel brand, particularly well-known in the Nordic region. This collaboration is expected to create synergy with the group’s existing brands, enhance Haglöfs’ brand awareness in Greater China, and thereby expand the group’s revenue sources, bringing better returns for the company’s shareholders.

“The establishment of the joint venture provides Viva Goods with a good investment opportunity, enriching the group’s brand portfolio, which will include fast fashion brands, high-end footwear brands, fashion and luxury footwear brands, and outdoor equipment and apparel brands,” added Viva Goods.

| Source: Official announcement, Luxe.Co historical reports

| Image Credit: Brand official website

| Editor: LeZhi