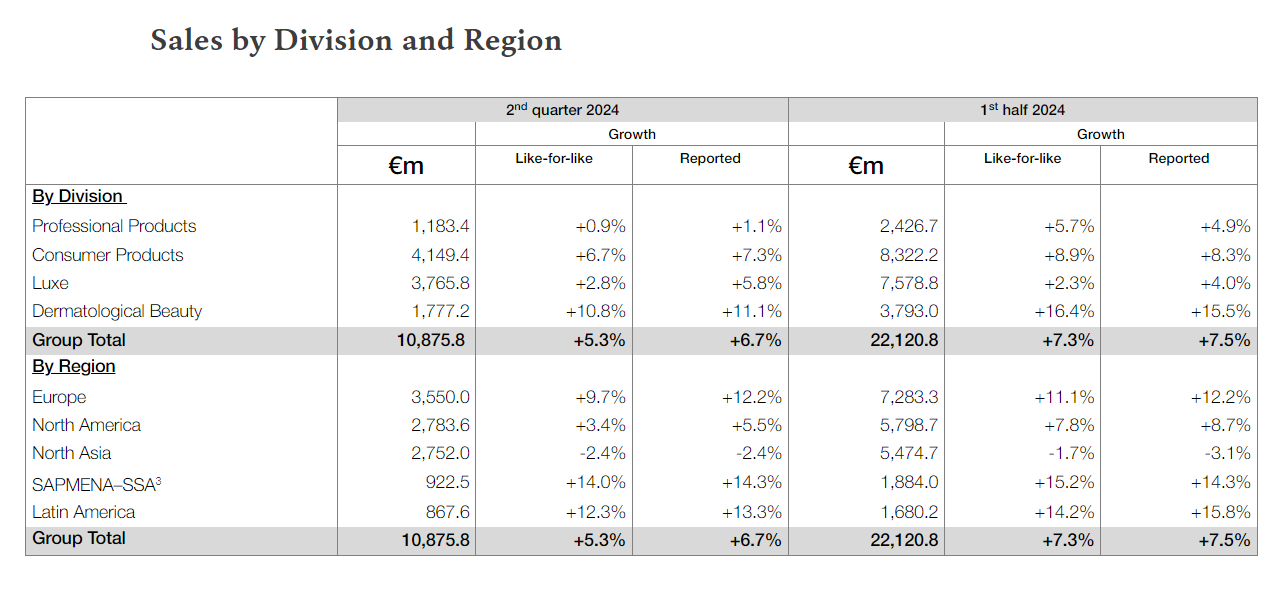

On July 30, French beauty giant L’Oréal Group released its financial data for the first half of fiscal year 2024, ending June 30. The group continued to perform excellently in the active global beauty market, with sales reaching €22.12 billion, up 7.3% year-over-year and 7.5% at constant exchange rates. Operating profit margin was 20.8%, an increase of 10 basis points, and net profit grew by 8.8% to €3.65 billion.

By department, all four major divisions achieved growth, driven by the Dermatological Beauty and Mass Cosmetics divisions. The High-end Cosmetics division accelerated growth for two consecutive quarters. Regionally, Europe and emerging markets achieved double-digit growth, while the North American market maintained a balanced growth pace throughout the first half of the year.

As of the close of trading on July 30, L’Oréal Group’s stock price fell 0.08% from the previous day to €392.3 per share, a cumulative decline of 7.3% over the past 12 months, with the latest market value at €208.6 billion.

L’Oréal Group CEO Nicolas Hieronimus commented: “In the first half, we delivered strong growth of +7.3%, well-balanced between value and volume and strengthened our global leadership in a beauty market that remains dynamic.

Our continued strong momentum in emerging markets, Europe and North America allowed us to more than offset the depressed beauty market in mainland China and the unfavourable comparative in Travel Retail. In this context, I am particularly pleased to see the acceleration of L’Oréal Luxe, the dynamism of Consumer Products and the continued share gains of Dermatological Beauty and Professional Products.

The combination of our powerful R&I and unique marketing creativity allowed us to offer consumers groundbreaking innovations. The consistent increase of our A&P spend to support these innovations and our 37 international brands allowed us to, once again, outpace the global beauty market.

In an environment that continues to be marked by economic and geopolitical tensions, we remain optimistic about the outlook for the beauty market and confident that our innovation power and the robustness of our multi-polar model will allow us to keep outperforming it and to achieve another year of growth in sales and profit.”

In line with the authorization approved by the annual shareholders’ meeting on April 23, the Board of Directors decided to formulate a share repurchase plan in the second half of 2024, with a repurchase amount of up to €500 million and a maximum of 2 million shares to be repurchased. The repurchased shares will be canceled.

Focusing on the North Asia region, which includes the Chinese Mainland, Hong Kong, Taiwan, South Korea, and Japan, the business environment in the Chinese market remains challenging.

Due to the high comparison base in the same period last year and the continued low consumer confidence, the overall beauty market in the Chinese Mainland experienced negative growth in the second quarter; in the first half, L’Oréal Group achieved low single-digit growth and expanded market share in the Chinese Mainland, mainly thanks to the record performance of the Dermatological Beauty division, Professional Hair Products, and High-end Cosmetics divisions.

Although travel retail still impacted growth in the first half, its momentum has continuously improved. Japan maintained double-digit growth, benefiting from the recovery of the tourism industry.

By department, the growth of the Dermatological Beauty division was driven by the contributions of all brands, and the Professional Hair Products division benefited from the continued success of Kérastase. The Mass Cosmetics division achieved low single-digit growth, driven by L’Oréal Paris and Maybelline New York. The High-end Cosmetics division was affected by the sluggish Chinese Mainland and travel retail markets but performed well in other parts of the region; high-end luxury brands performed best.

| Source: Official Press Release, Yahoo Finance

| Image Credit: L’Oréal Official Website

| Editor: LeZhi