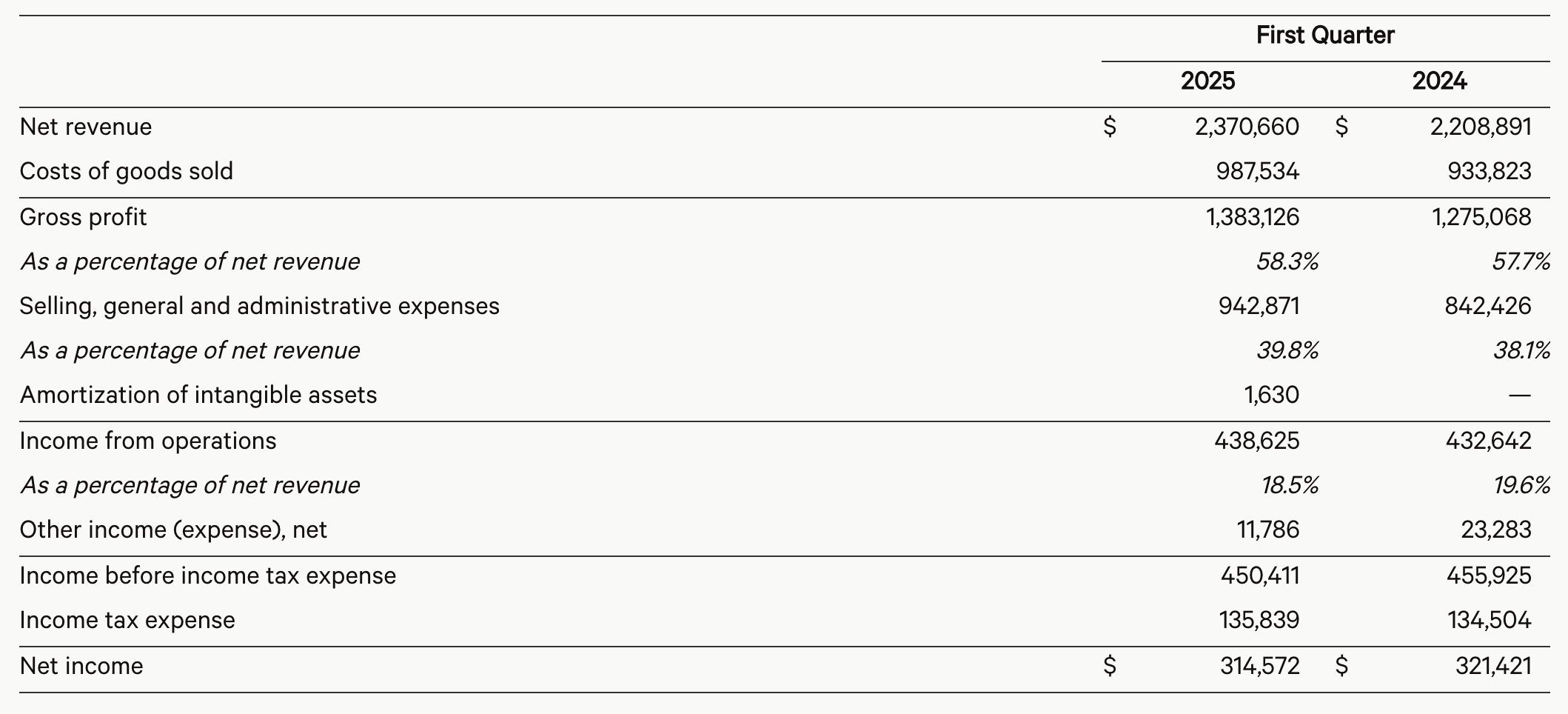

After the market closed on June 5 (ET), Lululemon Athletica Inc. (Nasdaq: LULU), the Vancouver-based Canadian activewear and yoga apparel company, released its financial results for the first quarter of fiscal year 2025, ending May 4. Net revenue in the Chinese Mainland increased 21% year-over-year (22% in constant currency), contributing to a 7% rise in total company net revenue to $2.4 billion (8% in constant currency).

In terms of profitability, gross profit increased 8% year-over-year to $1.4 billion, with the gross margin rising 60 basis points to 58.3%. Operating income edged up 1.4% to $439 million, while net income dipped slightly by 2.1% to $315 million.

Lululemon CEO Calvin McDonald stated, “In the first quarter, we achieved growth across channels, categories, and markets, including the U.S., reflecting the continued strength and agility of our business model. Additionally, guests responded well to the product innovations, newness, and brand activations we delivered around the world. As we navigate the dynamic macroenvironment, we intend to leverage our strong financial position and competitive advantages to play offense, while we continue to invest in the growth opportunities in front of us.”

Lululemon CFO Meghan Frank commented, “We delivered first quarter revenue growth at the high end of our guidance and are pleased with the start to our second quarter. Looking ahead, we remain focused on our strategy and continue to operate with discipline as we drive the business forward. We are grateful to our teams around the world who are enabling us to deliver these consistent results.”

During the earnings call, Calvin McDonald emphasized, “Looking back at the first quarter, we continued to see strong double-digit growth in the Chinese Mainland and other international markets. These strong results reflect our versatile, performance-driven product portfolio and deeper connections with guests through brand and community engagement. There remains significant room for growth in market share and brand awareness. We continue to see healthy new guest acquisition, and existing guests remain engaged and enthusiastic about both our core categories and new product launches.”

Speaking on product innovation, McDonald noted, “Product is at the core of our success across all markets, delivering innovative and unique solutions for various athletic and lifestyle occasions. In Q1, our women’s category performed strongly, with the Define collection continuing to gain traction globally, and our new Daydrift™ collection receiving a positive response. In the men’s category, the Zeroed In and ShowZero™ collections also performed well.

On brand campaigns, McDonald said, “Our teams continue to create unique and impactful brand and community initiatives to engage guests, raise brand awareness, and support product launches. This summer, to celebrate the 10th anniversary of Align™, we launched a global campaign, which included the largest yoga community event since our entry into China, held in Beijing with over 5,000 participants. This event, along with other brand initiatives in Q1, highlights our dual focus: building local guest connections through community while leveraging media and our ambassador network to support product and brand growth.”

As of May 4, key financial metrics for Q1 FY2025 included:

The increase in gross margin was primarily driven by a 110-basis-point improvement in product margins, which included:

-

A 130-basis-point benefit from lower product costs, higher average unit retail prices, and reduced inventory damage and discounting, partially offset by higher freight costs;

-

And an approximately 20-basis-point negative impact from foreign exchange rates.

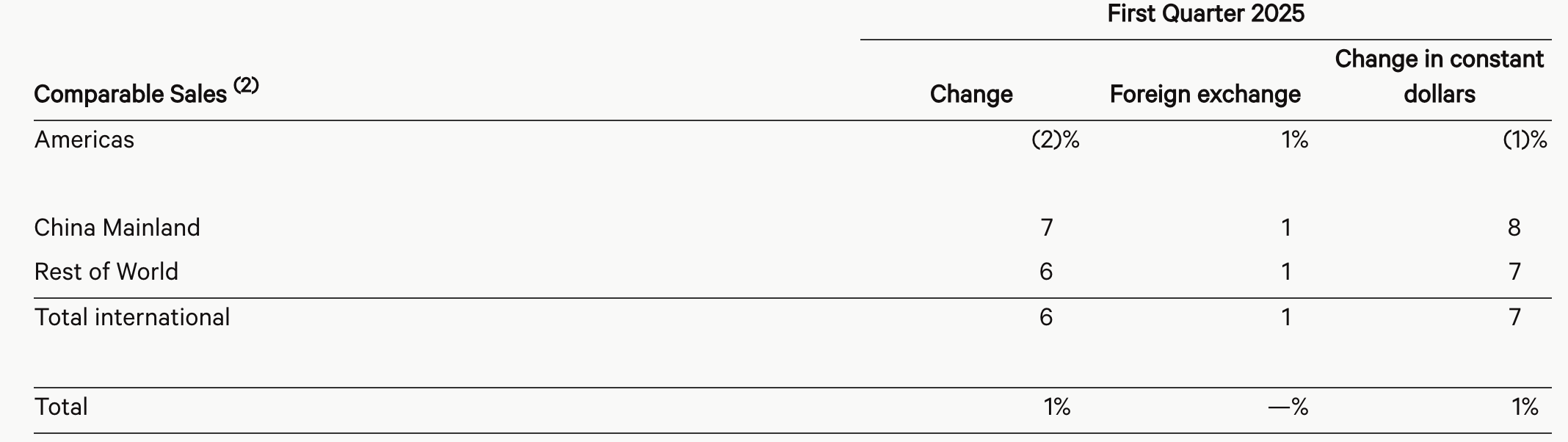

By Region:

-

Americas: Net revenue increased 3% year-over-year to $1.7 billion (4% in constant currency), accounting for 71% of total revenue; comparable sales declined 2%, or 1% in constant currency.

-

Chinese Mainland: Net revenue rose 21% year-over-year to $368.1 million [approximately USD 368.1 million] (22% in constant currency), accounting for 16% of total revenue; comparable sales increased 7%, or 8% in constant currency.

-

Other International Markets: Net revenue increased 16% year-over-year to $328 million (17% in constant currency), accounting for 14% of total revenue; comparable sales rose 6%, or 7% in constant currency.

Outlook wise, Lululemon expects net revenue for the second quarter to be in the range of $2.535 billion to $2.56 billion, representing year-over-year growth of approximately 7% to 8%. Diluted earnings per share are expected to be between $2.85 and $2.90.

As for Lululemon’s forecast for FY2025, net revenue in the range of $11.15 billion to $11.3 billion, representing growth of approximately 5% to 7%, or 7% to 8% excluding the 53rd week in fiscal 2025. Full-year diluted earnings per share are expected to be between $14.58 and $14.78.

|Source: Official Financial Report

|Image Credit: Official Website

|Editor: Wang Jiaqi